The word of the week is re-rating. Both Wells Fargo and Morgan Stanley have suggested that, notwithstanding this year’s 50%+ return in midstream energy infrastructure, further upside is possible. They posit that a re-rating of the sector would not be unreasonable given the strong fundamentals.

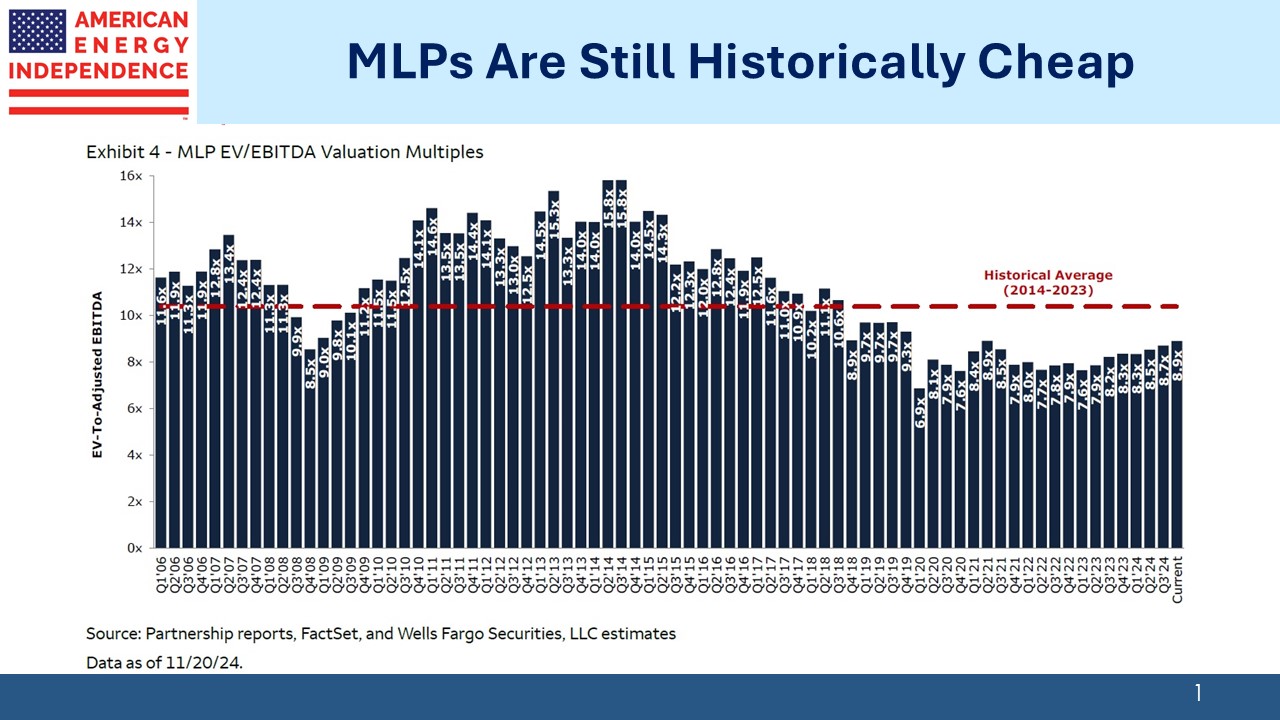

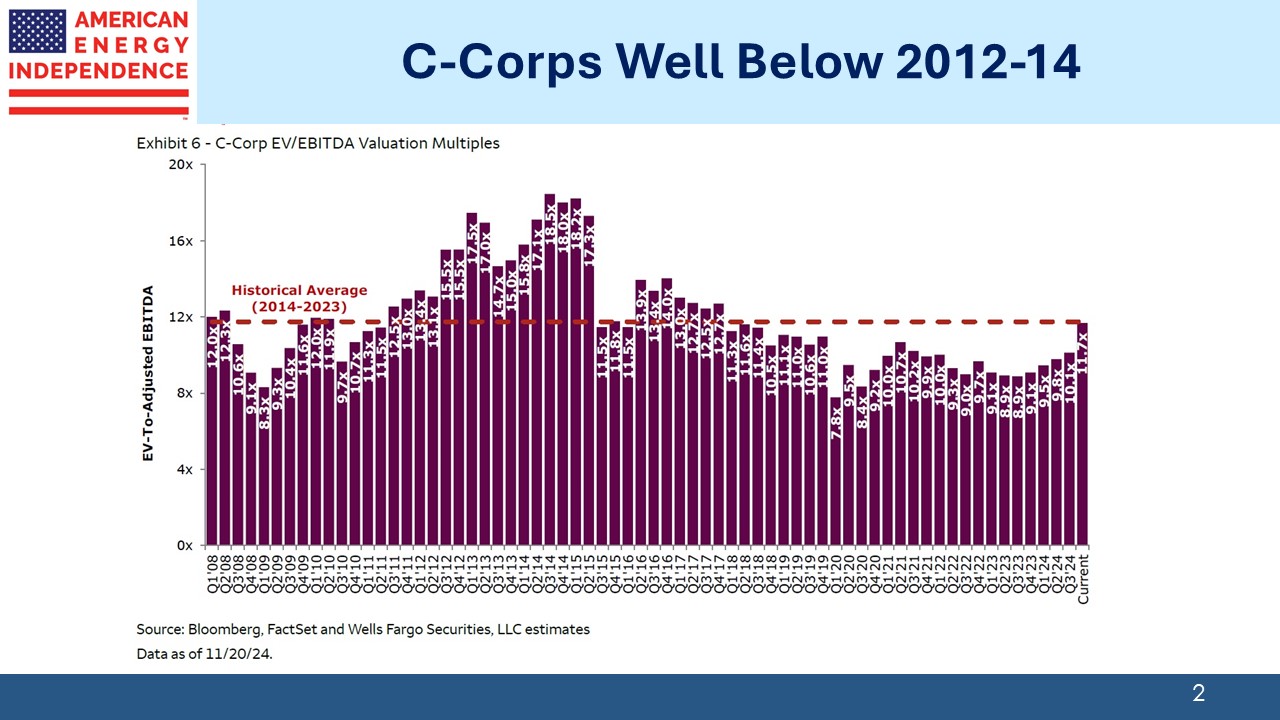

Enterprise Value/EBITDA (EV/EBITDA) is a widely used valuation metric, although my partner Henry correctly points out that this is less useful when leverage varies throughout a sector. By this measure though, MLPs remain below their ten-year average while c-corps, representing roughly two thirds of the investible universe, are at their ten-year average.

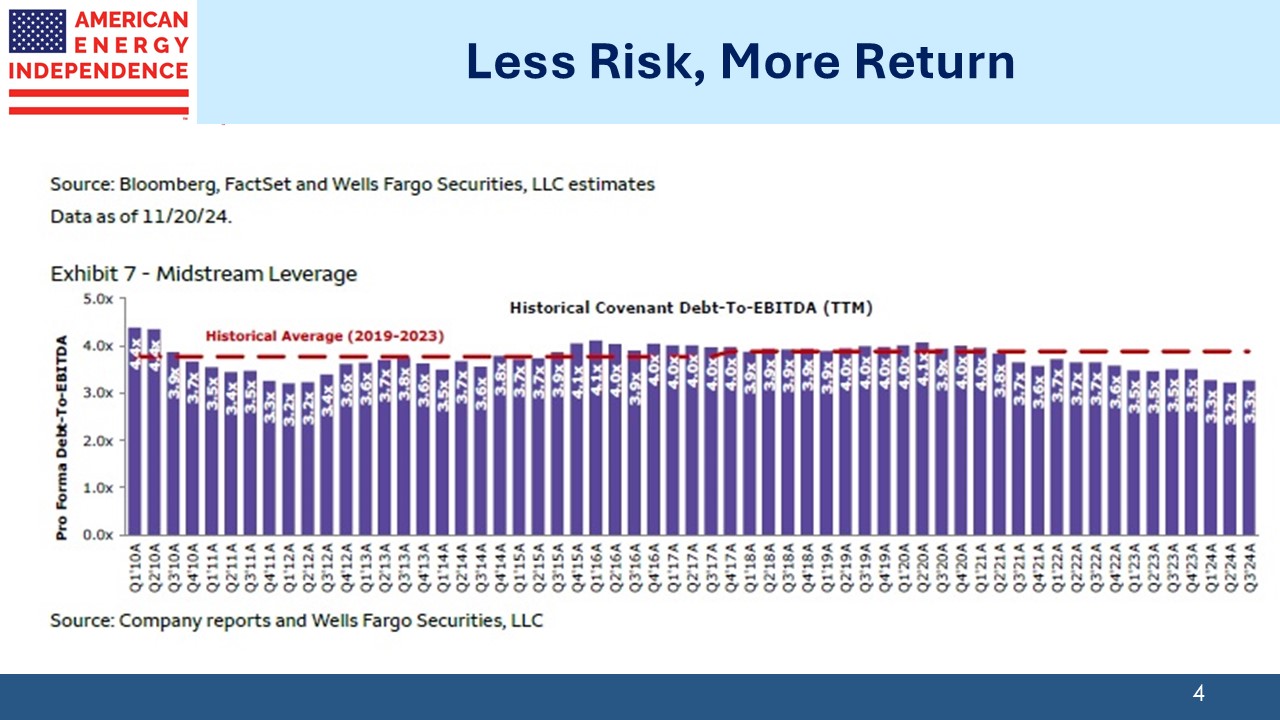

Reasons why fair value might exceed the average include the sharp increase in gas demand for data centers and the secular drop in leverage, which is 3.0-3.5X (Debt:EBITDA) versus 4.0X and higher a decade ago.

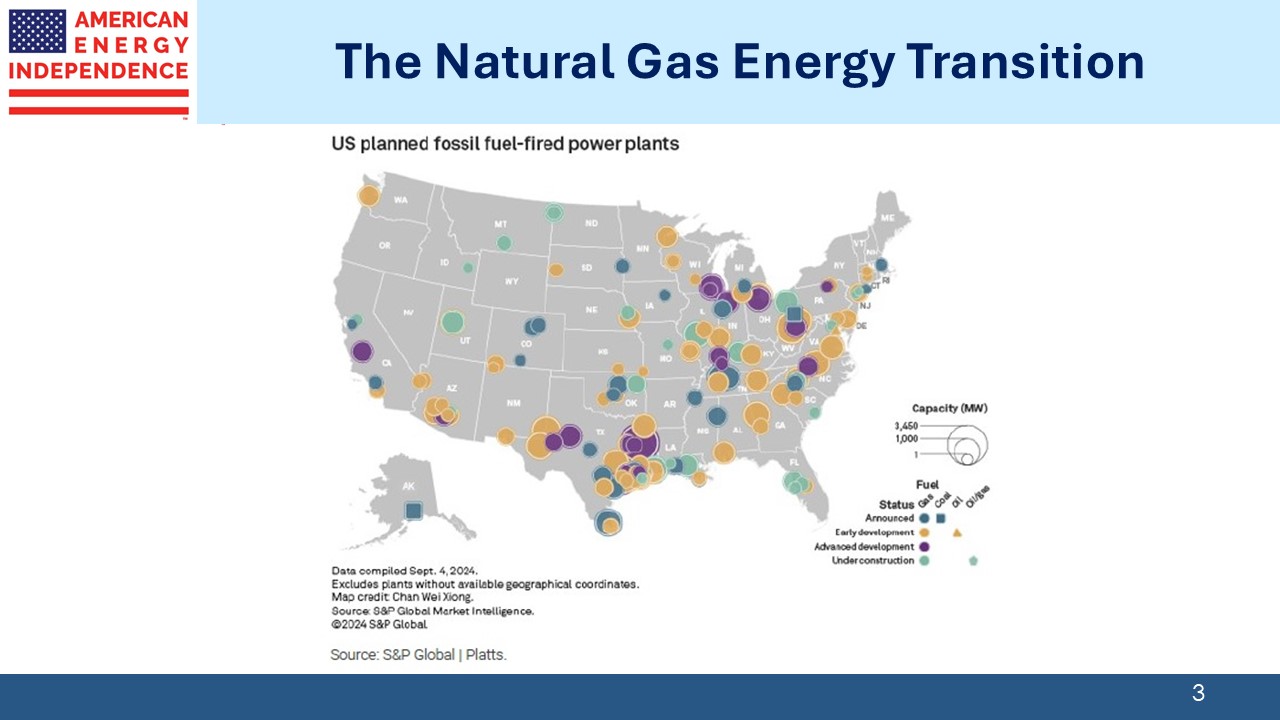

The increase in natural gas demand is real. 148 new power plants are under construction or have been announced as of September, up from 133 in April.

Entergy is building two new gas-fired power plants in Richland Parish, LA for a $5BN Meta data center in nearby Holly Ridge, LA. According to Morgan Stanley, Meta has, “expressed a need for the project to be completed quickly.”

America’s tech giants need more electricity. Nuclear can meet some of this but restarting old reactors takes years. Solar and wind, the choice of climate extremists, are weather-dependent. Natural gas, which already provides 40% of our power, is the best solution. You can still read poorly informed commentators stating that renewables are now cheaper than hydrocarbons. They’re not. The choices data centers are making clearly show that natural gas is the preferred option.

Midstream companies have also been de-risking their balance sheets. After peaking at 4.1X during the pandemic, leverage has been steadily falling. Reduced capex has helped. Few want to embark on a new greenfield pipeline project anymore. Leverage recently reached 3.2X.

Climate extremists have learned how to weaponize the court system so that interminable delays make completion uncertain and IRR less attractive. Investors like us have come to appreciate the consequent boost to free cashflows even if it’s an unintended result of efforts by the Sierra Club and their motley crew.

Hug a climate extremist and drive them to their next protest.

Some have expressed concern that the incoming administration’s energy mantra “drill baby, drill” will lead to a repeat of the poor investment performance under Trump’s first term. But there’s little evidence that another bout of over-production will depress oil prices, and sanctions on Iran will likely remove at least one million barrels per day from global markets. US natural gas prices are held down by associated gas production from Permian basin oil wells in west Texas and New Mexico. It’s unlikely any E&P company will “drill baby, drill” with reckless abandon for more gas.

Several people have asked us whether the construction of the Keystone XL pipeline will be restarted. A story on Politico said Trump was planning to reissue the permit as part of a raft of energy-related executive orders on his first day in office.

Keystone XL was an expansion of the existing Keystone pipeline intended to solve Canada’s perennial challenge of getting crude oil from Alberta to overseas markets. Because it crosses the border, the US State Department was required to issue a permit.

Back in 2010 a limited permit was granted under Obama with numerous conditions attached. By 2012 with increased sensitivity to climate opposition, Obama canceled it. Trump reinstated the permit upon taking office in 2017, and Biden duly rescinded it four years later. Canada’s TC Energy sued the Federal government for $15BN in damages once they finally threw in the towel.

Given this history, one might think there would be little appetite to start again, especially since construction takes longer than a single presidential term. TC Energy is now principally a natural gas pipeline company, having spun off its liquids business in the form of South Bow. And the Canadian federal government completed TransMountain Express at considerable taxpayer expense after buying it from Kinder Morgan (KMI). An ongoing dispute between Alberta and British Columbia led KMI to conclude that they had no place in the middle of an inter-provincial squabble.

Completed substantially over budget, TMX now moves crude oil to the pacific coast for shipment to export markets. So Canada’s need to find egress for its crude oil is not as acute as several years ago. Our betting is that the reissued Keystone XL permit will provide a welcome change of regulatory intent but won’t lead to any construction.

We just might be in a Goldilocks period for midstream, with the desire to build, baby build due to positive fundamentals tempered by continued financial discipline. Under such circumstances, re-rating doesn’t seem unreasonable.

—

Originally Posted November 27, 2024 – Midstream’s Goldilocks Phase

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.