1/ One Chart to Rule’m All

2/ AMD Doesn’t Look Great

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

One Chart to Rule’m All

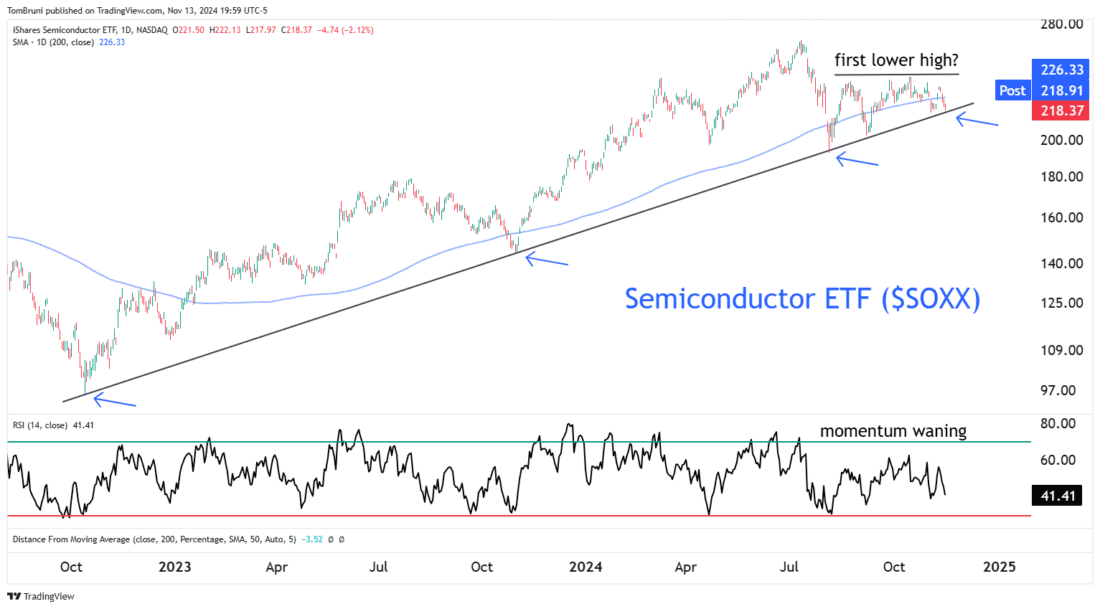

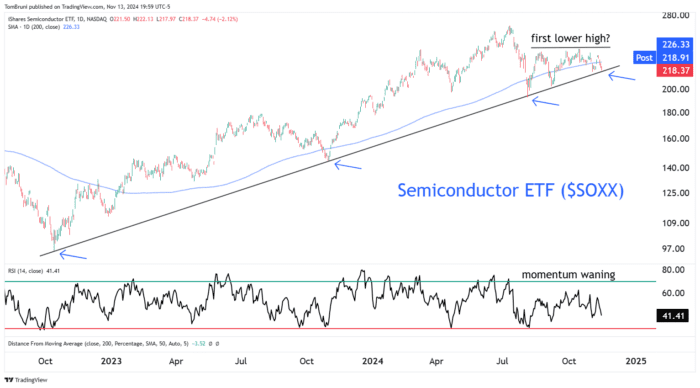

We’re going to keep things simple in this issue, focusing on what’s arguably the most important sector chart in the world.

Below is a chart of the iShares Semiconductor ETF ($SOXX), which had been a major leader in the market throughout 2023 and into mid-2024, but has faded in strength recently.

The chart shows prices sitting below their 200-day moving average and trendline from its October 2022 lows. On top of that, momentum recently failed to reach overbought territory since July, showing a lack of commitment from buyers. If prices were to break below their uptrend line, that could signal a clear trend break and confirm the first “lower high” of a potential downtrend.

This sector is particularly in focus because its largest holding (and world’s largest company), Nvidia ($NVDA), is reporting earnings next Wednesday after the bell. Shares are sitting at all-time highs, but expectations for its results have never been higher, given shares have rallied over 1200% in two years.

The company’s results and subsequent stock reaction will set the tone for a semiconductor sector that clearly needs a catalyst to keep its long-term upward momentum going. If you want in on the action, we’re hosting an “Nvidia Day” event on Stocktwits that culminates with our community listening to the conference call live on Stocktwits.

2/

AMD Doesn’t Look Great

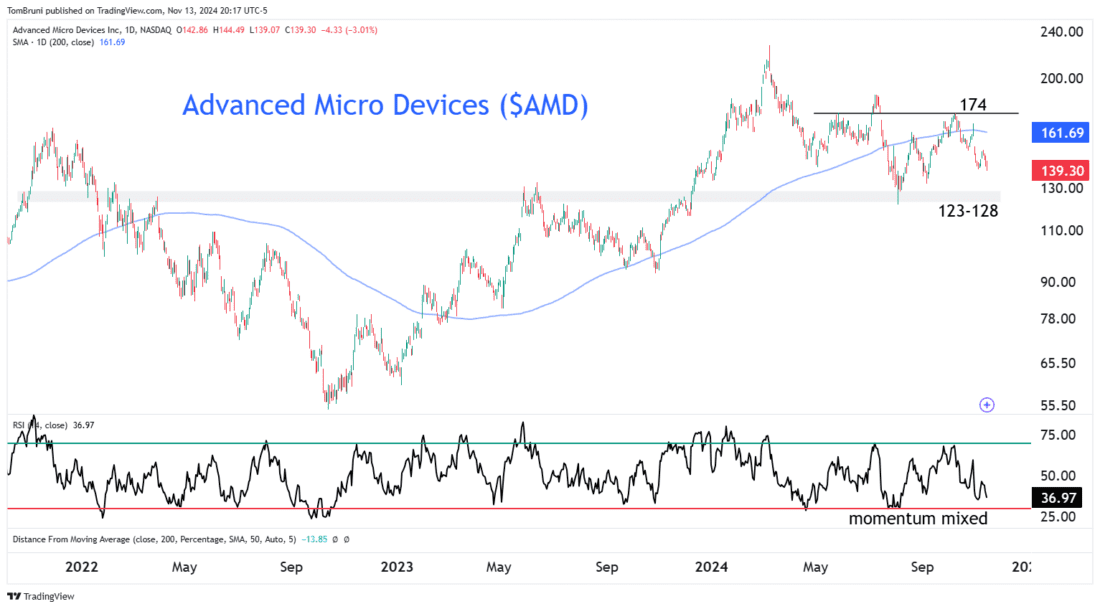

Since we’re talking about waning momentum in the semiconductor sector, we should talk about Advanced Micro Devices ($AMD), which recently announced a 4% workforce cut as it “right sizes” headcount to focus on its core priorities.

The stock hit new all-time highs in March and has been trending sideways in a wide range ever since. With momentum showing mixed signals and prices sitting comfortably below a downward-sloping 200-day moving average, this is a sideways trend at best…and a downtrend at worst. As the third largest weighting in the $SOXX semiconductor ETF, traders and investors are watching this closely to see how it develops.

—

Originally posted 14th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.