Learn about Algo Trading Strategies with Part I.

How to Learn Algorithmic Trading?

To learn algorithmic trading, you can follow these key steps:

1. Build the skills and knowledge needed for algorithmic trading such as:

- Quantitative Analysis skills: Develop skills in statistics, time-series analysis, and using tools like Python, Matlab and R. Focus on problem-solving and data analysis.

- Financial Markets Knowledge: Gain an understanding of trading instruments, strategies, arbitrage opportunities, and risk management.

- Programming Skills: Learn programming languages essential for algorithmic trading, with Python being particularly important. Practice coding and understand how to implement trading strategies.

2. Choose Learning Resources:

Books: You can begin with the free books such as:

- “Algorithmic Trading: A Rough & Ready Guide” by Vivek Krishnamoorthy and Ashutosh Dave

- “Machine Learning in Trading: Step by step implementation of Machine Learning models” by Ishan Shah and Rekhit Pachanekar

- “Neural Networks & Deep Learning” by Michael A. Nielsen

- “Python Basics: With Illustrations From The Financial Markets” by Vivek Krishnamoorthy, Jay Parmar and Mario Pisa Peña

Recommended read:

Free Resources to Learn Algorithmic Trading | A Compiled List

- Other Free Resources: Utilise YouTube videos, and podcasts to supplement your learning.

- Online Courses and Certifications: Enroll in algorithmic trading course like the Executive Programme in Algorithmic Trading (EPAT) offered by QuantInsti. Explore other platforms like Coursera and Udacity for specialised courses.

For a more in-depth understanding, consider taking algorithmic trading courses that offer comprehensive training and hands-on experience in the field.

3. Hands-On Experience:

- Backtesting: Test your strategies using historical data to evaluate their potential effectiveness.

- Paper Trading: Use virtual money to refine your strategies and understand market dynamics.

- Practical Implementation: Once comfortable, apply your strategies in live trading environments. Seek internships or work with firms to gain real-world experience.

4. Advanced Learning and Continuous Improvement: Stay updated with industry trends and continuously refine your skills while getting started with algorithmic trading. Join professional networks and communities to learn from experienced practitioners.

Let us now see the workflow of algorithmic trading next.

The workflow of Algorithmic Trading

Coming to the “Understanding of the Workflow”, it is a concept that explains how each trade gets placed using algorithms behind the scenes.

Historically, manual trading used to be prevalent, in which, the trader was required to gather the data manually and place the order telephonically for the execution of the trade. That would involve a lot of time and effort and hence, not make much of returns since not much of trading could take place.

Now with Algorithmic trading coming into existence, the entire process of gathering market data till placement of the order for execution of trade has become automated.

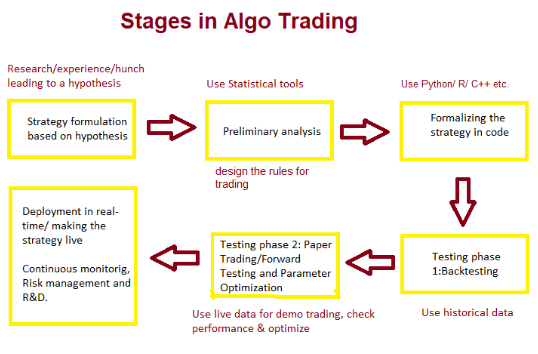

Coming to how a quantitative analyst goes about implementing algorithmic trade, here is a simplified diagram:

The image above shows how a quant implements algorithmic trade.

In the first step, you will need to do research or get some experience leading to a hypothesis. That is how your strategy formulation will be based on the hypothesis you set.

Then in the second step, with the help of preliminary analysis and usage of statistical tools, the rules are designed for trading.

In the third step, the strategy is formalised in coded language using one of the languages namely, Python/R/C++. This is done for the system/computerised trading platform to understand the strategy in a language that is understandable to it.

Now, in the fourth step, Testing phase 1 is done through backtesting, in which historical price information is taken into consideration. In this, the strategy is tested using historical data to understand how well the logic would have worked if you used this in the past. This way, the performance of the strategy is tested. Also, depending on the results you get the opportunity to optimise the strategy and its parameters.

Then, the fifth step is Testing phase 2 in which the testing of strategy happens in the real environment. In this, you do not need to invest actual money but it still provides you with a very accurate and precise result. Hence, with this, one can expect to get the results which may also come about in the actual environment. The only drawback is that it is a time-consuming activity but you can do this by using the feature provided by the broker. Alternatively, you can also develop your framework to test the game.

The sixth step involves deployment in the real environment, which requires multiple facets to be managed, which are generally not considered in backtesting.

Functionally, the following aspects are required to be managed:

- Order management

- Risk Management

- Money/Fund Management

- Diversification of assets

- Portfolio management

- User Management

- Slippages

Technically, the following aspects are required to be managed:

- Establish a Connection with the broker API.

- Passing the buy/sell orders using the broker connection

- Establish a Connection with the data API (if the data vendor is different from the broker)

- Accessing the real-time and historical data using a data API connection

Visit QuantInsti to watch the video on using Python trading bots to backtest a trading strategy.

Next, let us check out how to build your algorithmic trading desk.

How to build your own Algorithmic Trading Business or Desk?

For setting up your algorithmic trading desk, you will need a few things in place and here is a list of the same.

Operational considerations

- Registering company – Choose the appropriate legal structure and register with relevant authorities to obtain licenses and permits.

- Capital requirements – Determine the initial funding needed to cover trading activities, infrastructure, and operational costs.

- Trading paradigm – Decide between high-frequency trading, algorithmic trading, or other strategies based on your objectives and market conditions.

- Access to market – Establish connections with exchanges and brokers to facilitate trading and data acquisition.

- Infrastructure requirements – Set up reliable hardware and software systems, including servers, networking equipment, and databases.

- Algorithmic trading platform – Select or develop a platform capable of executing algorithms, managing orders, and integrating with market data feeds.

- Backtesting – Use historical data to test and refine trading algorithms before deploying them in live markets.

Additional tools

- Risk management software – Implement tools to monitor and control exposure, manage risk limits, and ensure compliance with risk policies.

- Order management systems (OMS) – Utilise OMS to manage and execute orders, track trading activity, and integrate with trading algorithms.

Team structure and roles

- Quantitative analysts and developers – Develop and implement trading algorithms and models using advanced mathematical and programming skills.

- Risk analysts and managers – Monitor risk exposure, analyse potential threats, and develop strategies to mitigate financial and operational risks.

- IT support and infrastructure specialists – Manage and maintain technology systems, ensuring reliability, performance, and security of trading infrastructure.

Now we will see some advantages of algorithmic trading.

Advantages of algorithmic trading

Here are some of the advantages of algorithmic trading.

- Speed and Efficiency: Algorithms can process data faster than humans and generate trading signals before human traders can react.

- 24/7 Trading: Can operate around the clock, including during off-hours in the current location when market is open across different time zones.

- Consistency: Follows predefined strategies without emotional influence, leading to more consistent trading decisions.

- Backtesting: Allows thorough testing of strategies against historical data to refine and improve performance before live deployment.

Recommended read:

How much salary does a quant earn?

Let us move to the disadvantages of algorithmic trading now.

Disadvantages of algorithmic trading

Below you can see the disadvantages of algorithmic trading.

- Market Impact: Algorithmic trading algorithms can contribute to market volatility and exacerbate market crashes.

- Regulatory Risks: Subject to evolving regulations, which can create compliance challenges and potential legal risks.

- Over-Reliance on Models: May lead to poor performance if algorithms are based on flawed models or assumptions, particularly in unpredictable market conditions.

Recommended read:

Now we will see the recent developments and potential future trends surrounding algorithmic trading.

Recent developments and potential future trends in algorithmic trading

In India, around 50-55% of trades are currently executed through algo trading, and this figure is expected to grow by 15% in the coming years.

Robo-advisory services utilise algorithms to deliver financial advice and handle portfolio management with little to no human input, making financial planning more affordable and efficient for a wider range of clients. The global robo-advisory market is projected to grow to $41.07 billion by 2027. ⁽⁵⁾

The influence of AI algorithmic trading on the stock market is expected to increase. Software developers are likely to create more advanced and faster algorithms capable of analysing larger datasets. These systems will improve at detecting intricate patterns, swiftly adapting to market changes, and adjusting trading strategies in real-time. This trend may lead to AI trading becoming a dominant force in financial markets, potentially consolidating power among a few firms with the most advanced technology. ⁽⁶⁾

Conclusion

The algorithmic trading business is sure to offer you an advanced system of trading. With the apt knowledge, regular compliances and regulations, an algorithmic trading platform is the fastest choice amongst traders.

In case you are also interested in developing lifelong skills that will always assist you in improving your trading strategies. In this algo trading course, you will be trained in statistics & econometrics, programming, machine learning, and quantitative trading strategies and methods, so you are proficient in every skill necessary to excel in quantitative & algorithmic trading. Learn more about the EPAT course now!

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.