Uninformed long-term investors provide an easy target for short-term traders, and they often unscrupulously take advantage of them. But ETF investors with long investment time horizons can mitigate some of the front-running costs if they take transactional costs into account to calculate whether it is economically optimal to participate in these “market games” (exchange and broker fees + classical opportunity costs of actively participating in strategy execution). Today, we will turn our attention to the paper “ETF Rebalancing, Hedge Fund Trades, and Capital Market” from Wang, Yao, and Yelekenova to better understand complex relationship between ETFs (their investors) and hedge funds.

ETFS, Hedge Funds, and Their Relationships

ETFs are prevalent investment vehicles, having especially staggering popularity amongst retail investors. We can imagine an ETF as a basket that holds similar stocks (be it from the same industry/sector, of roughly the same market capitalization, special theme, country, …). There are even leveraged, inverse, commodity, and cryptocurrency ones. Some were to go so far that they have called them the second-best invention since mutual funds. Hedge funds (HFs) are professionals, traders, and investors, whose “daily bread” (job occupation, simply) is often in making arbitrage trades to capture a significant profit from market inefficiencies, anomalies, and discrepancies.

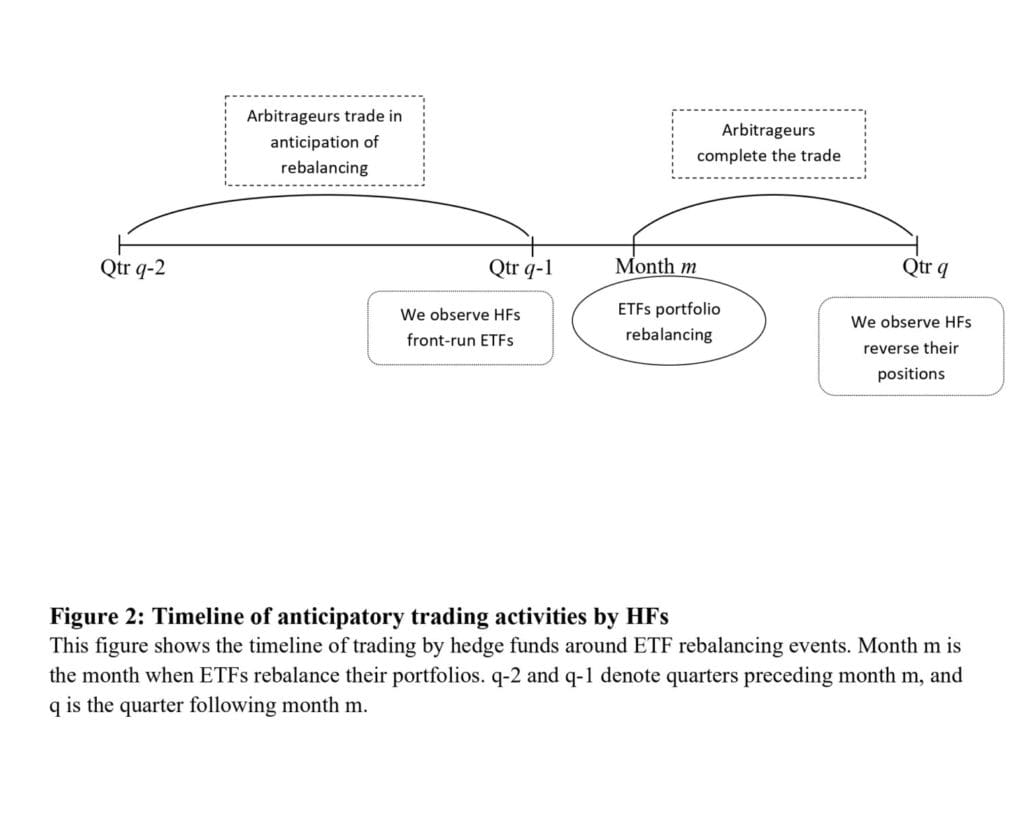

And what do those two main actors of our today’s post have in common? Amongst many, here comes the main point that explains our main topic today: HFs’ arbitrage trades may move stock prices primarily before ETF rebalancing. You can see schematics of how HFs position themselves before ETFs rebalance takes place from the following figure:

In anticipation, HFs accumulate stakes in stocks they assume rebalance entities will buy from them for higher prices. They may also sell short stocks, expecting the number of shares held will drastically decrease in a particular ETF.

“HFs, as strategic traders, may see an opportunity to engage in arbitrage trading through buying stocks prior to ETF buying and profiting by selling afterwards. For example, if a rules-based ETF follows an S&P 500 momentum index, HFs can anticipate upcoming portfolio rebalancing and front-run ETFs by buying stocks that are to be included in the index or to be increased in position and (short) selling stocks that are to be excluded or to be decreased in position. Once ETFs complete their rebalancing, HFs can complete their trade and profit from exacerbated prices by reversing their positions.”

ETFs perform their portfolio rebalancing on a semi-annual, quarterly, or even monthly basis. And undoubtedly, ETF rebalancing activities play an essential role in explaining future stock return patterns in addition to the previously documented nonfundamental shock imposed by ETF flows, which impose non-fundamental demand on underlying securities.

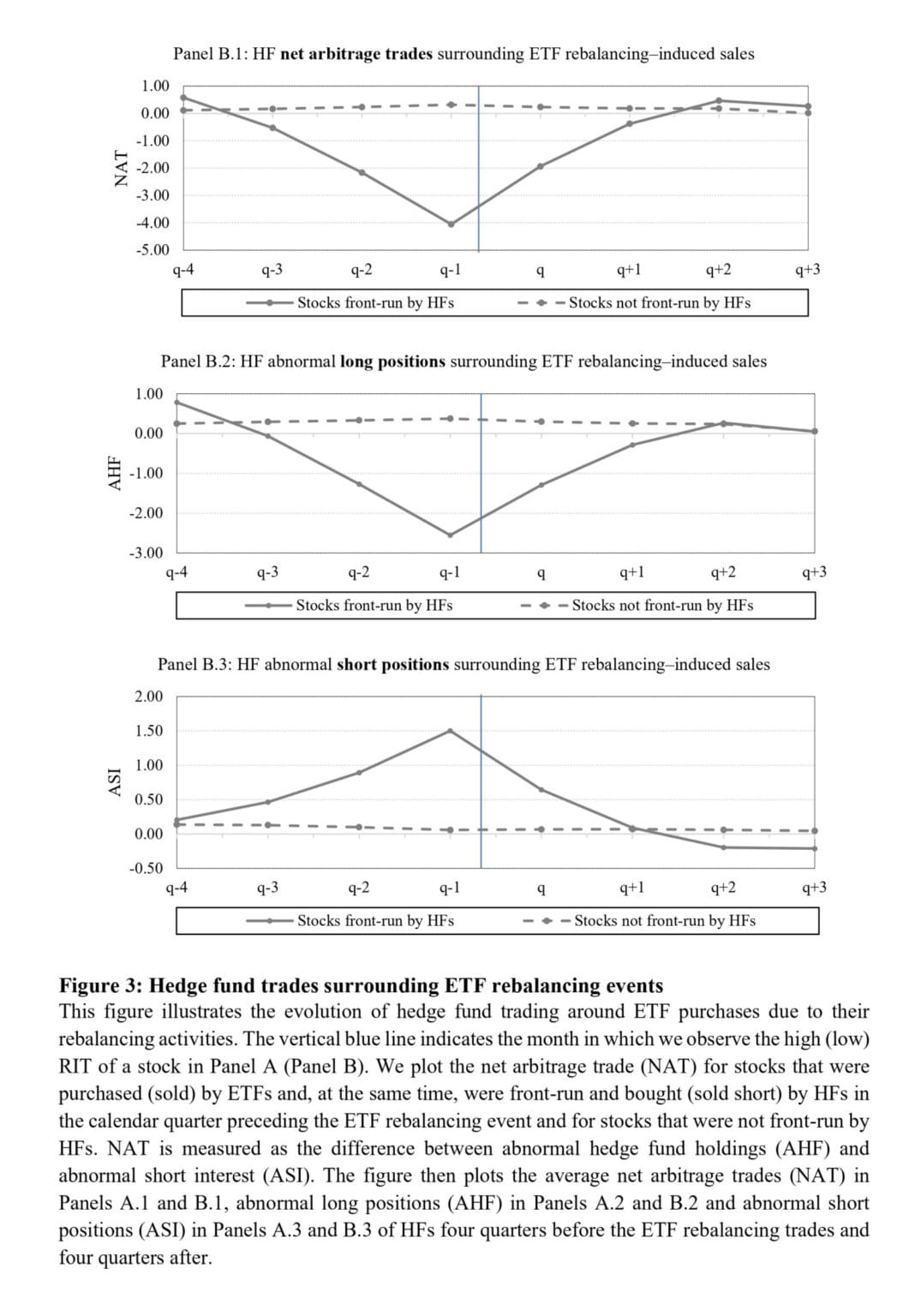

Furthermore, and more importantly, there is a significant negative relation between ETF rebalancing activities and future stock returns. The relation is most pronounced for rules-based ETFs, where rebalancing activities happen more frequently due to the nature of the underlying indices. And following figure depicts the whole process a bit more schematically:

And what’s the impact on the performance of ETFs?

“Individual stocks subject to HF front-running activities experience an increase in returns prior to ETF rebalancing events. This creates a scenario in which ETFs may be forced to rebalance at inflated prices, leaving ETF investors with higher costs. Stocks that are subject to rebalancing by ETFs that are not part of IMF (index mutual funds) rebalancing experience, on the other hand, a more severe decrease in future stock returns.

The difference between ETFs and IMFs lies in the fact that ETFs do not have the managerial discretion to execute rebalancing before or after the actual dates of index rebalancing, while IMFs can choose to avoid delegation costs and rebalance at a more convenient date.”

There are several interesting applications of these effects around ETF rebalancing trades on the capital markets. We examine two applicable of them for us: either replicating of accused front-running strategy of HFs as short-term trader, or tactically buying or selling assets you wish as long-term investor.

Arbitrage Trades, Their Detailed Impact on Stock Returns, and How You Can Profit

There are strong arguments that support the thesis that ETF flows predict price reversal of underlying stocks’ within 40 days period. If you wish to accquire data about them, it opens you to whole new range of trading opportunities for your repeitorare. If you mostly have capital for trading, you can use the most probable opportunities and set risk paremeters correctly. Willing reader will find comprehensive details in 2.3 ETF rebalancing trades and 3. ETF rebalancing trades sections.

Second option is suitable for more of long-term investor approach. If you have significant portion of stocks or ETFs, it would be favourable for you to liquidate it just after the front-running to capture sweet premium, which can be then reinvested in your next investment decision.

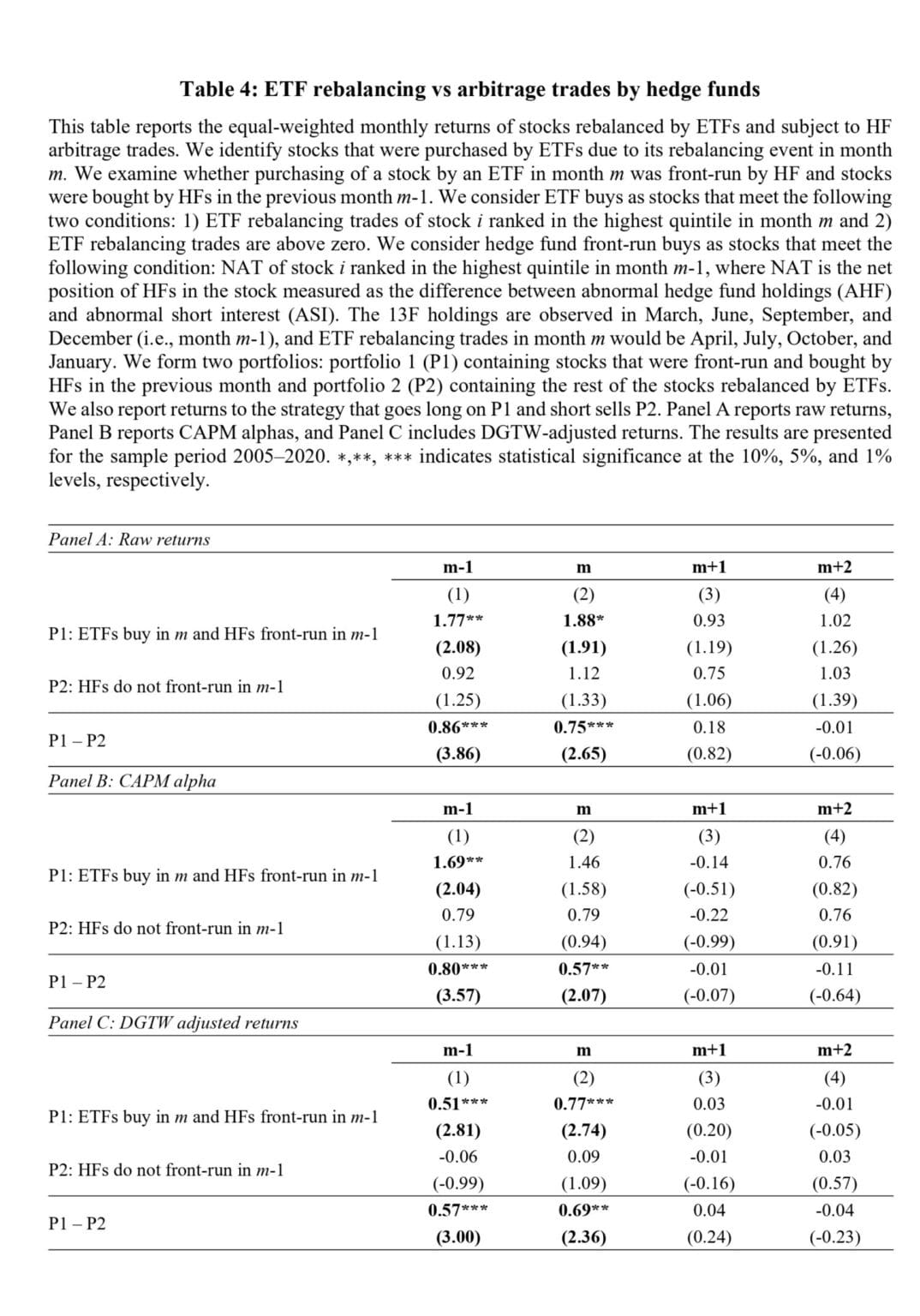

A very nice summary of monthly returns of one of several possible proposed strategies can be seen from following table:

Short Conclusion

“ETF rebalancing trades have an impact on underlying stock returns. The transparency of indices ETFs follow makes them an easy target for arbitrage traders. This, in turn, imposes huge costs on ETF investors.”

To summarize, stocks that are subject to arbitrage trading by HFs significantly outperform stocks that are not front-run by HFs by 0.86% per month before the ETF rebalancing event. What’s interesting is that this effect continues: the outperformance remains significant at 0.75% during the ETF rebalancing month, possibly because HFs may not necessarily close their arbitrage positions immediately after ETF rebalancing, and some may choose to ride on the wave (joined by momentum crowd) and close their positions gradually.

Authors: Wang, George Jiaguo and Yao, Yaqiong and Yelekenova, Adina

Title: ETF Rebalancing, Hedge Fund Trades, and Capital Market

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4324054

Abstract:

We study the interaction between ETF rebalancing and hedge fund “front-running” trades and its implications for the capital market. First, we document that ETF rebalancing has a strong negative relation with future stock returns. Second, we observe that hedge funds gradually increase (decrease) their net arbitrage positions before ETF rebalancing. Strikingly, the “front-running” stocks bought by hedge funds significantly outperform stocks not subject to hedge funds front-running by 0.86% (with a t-statistic of 3.86) before the month of ETF rebalancing. Our findings raise the question of the potential cost of ETFs rebalancing due to their embedded transparency and predictability, which creates anticipatory arbitrage trading by hedge funds.

Originally posted on Quantpedia.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Hedge Funds

Hedge Funds are highly speculative, and investors may lose their entire investment.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.