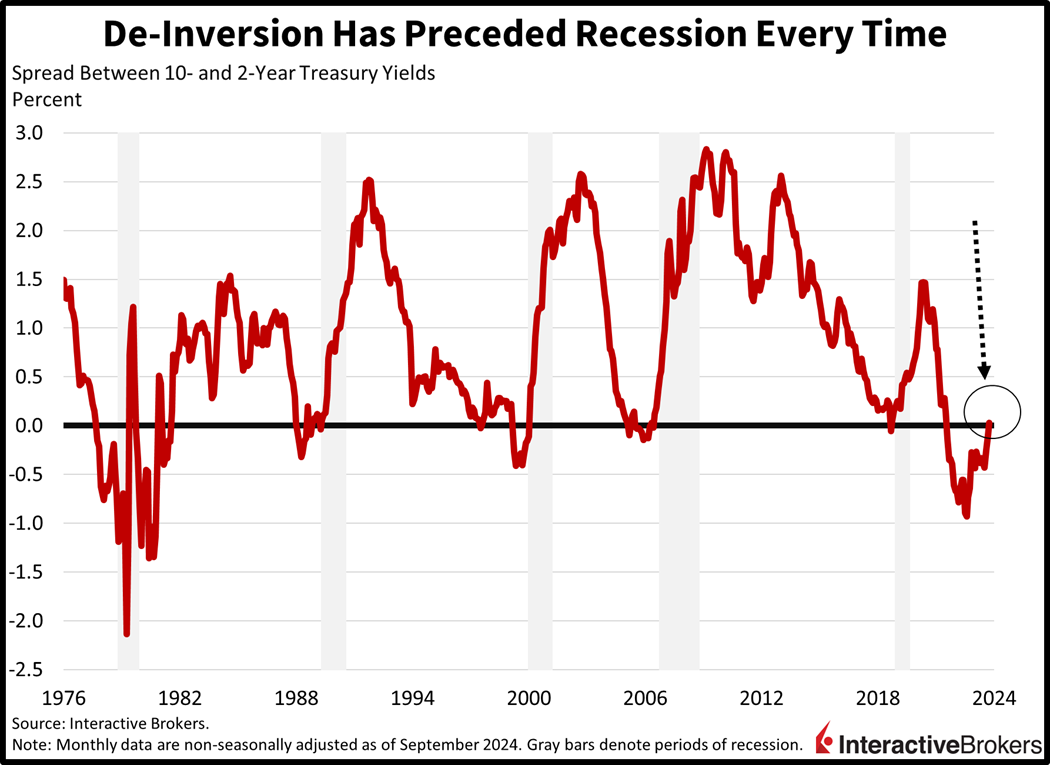

Markets are tumbling as recession fears mount following this morning’s weaker-than-expected Jobs Report. While stocks are selling off, we are witnessing a sustained de-inversion of the yield curve that we warned about in yesterday’s commentary. Indeed, a positive spread across the 2- and 10-year Treasury maturities following a long period of a negative difference has historically preceded economic downturns. Investors are responding by unloading almost everything, but they are scooping up downside insurance via index put derivatives and volatility call options as well as fixed-income instruments and homebuilder shares that are likely to benefit from lighter borrowing costs amidst undersupplied conditions.

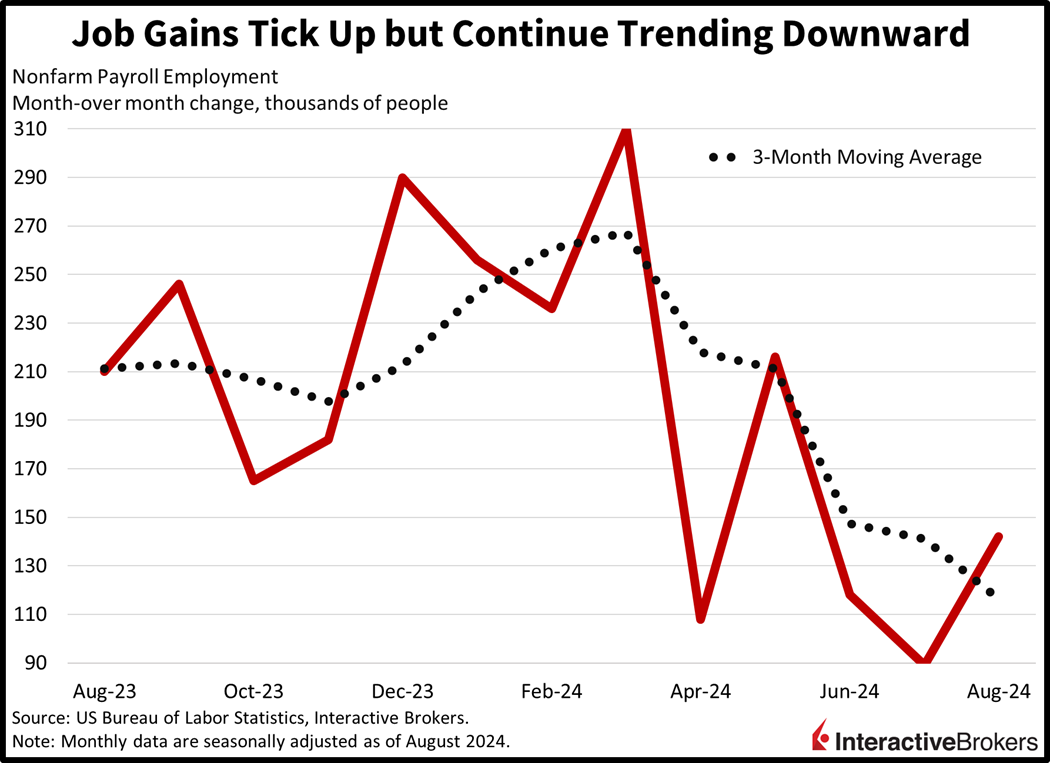

Job Creation Trends South

In further evidence of a decelerating labor market, today’s nonfarm payrolls posted a sizable downside miss amidst non-cyclical leadership. The US economy added 142,000 jobs last month, above July’s downwardly revised 89,000 and the median estimate of 164,000. Nearly half of the total was created by two non-economically sensitive categories: private education and health services, which added 47,000 positions, and the government sector, which posted a 24,000 increase in headcounts. The leisure and hospitality category, which expanded by 46,000 folks, had the second-largest total growth. Other sectors that advanced and the number of added employees were as follows:

- Construction, 34,000

- Financial activities, 11,000

- Professional and business services, 8,000

- Transportation and warehousing, 7,900

- Wholesale trade, 4,900

- Other services, 1,000

Manufacturing, with a 24,000 decline, had the largest number of lost jobs, followed by retail trade, information and utilities, which recorded declines of 11,100, 7,000 and 200, respectively. Payrolls for mining and logging had no change.

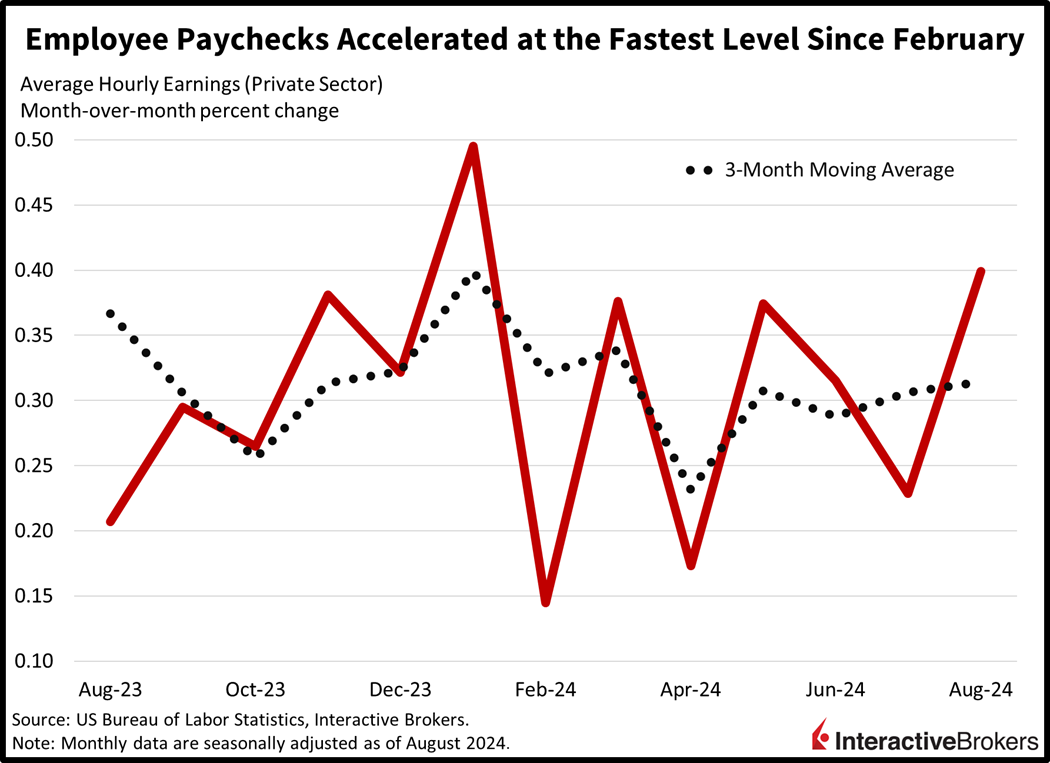

It’s Not All Bad

Looking under the hood, there were some positive signs at the margins. Joblessness declined, wage pressures picked up and the labor force expanded. The unemployment rate ticked down 10 basis points (bps) to 4.2% even as 120,000 new folks entered the labor force. Average hourly earnings accelerated to 0.4% month over month (m/m) and 3.8% year over year (y/y), exceeding forecasts by 10 bps on both fronts and July’s 0.2% and 3.6%.

Canada’s Unemployment Climbs Above Forecasts

North of the border, Canada’s employment figures were also bifurcated. In fact, jobs expanded by 22,100 in August, missing expectations of 23,700 but recovering from July’s loss of 2,800. Driving the monthly gain was growth in part-time work, with the segment adding 65,700 while full-time jobs declined by 43,600. The unemployment rate increased to 6.6%, exceeding the anticipated 6.5% and the previous month’s 6.4%.

Outlook for AI Sales Falls Short of Investors’ Exuberance

Artificial Intelligence (AI) helped grow sales at Broadcom and DocuSign. However, guidance from the companies failed to match investors’ strong optimism regarding the technology’s potential for accelerating earnings and revenue growth.

Broadcom (AVGO) reported revenue and earnings for its fiscal third quarter ended July 31 that exceeded analyst consensus estimates with total sales climbing 47% y/y, but its outlook for the current quarter fell short of investors’ expectations regarding AI powering strong growth for the manufacturer of specialty chips and networking equipment. Broadcom’s share price fell 7% in last night’s extended trading after the company said it expects to generate $14 billion in revenue this quarter, missing the analyst consensus forecast of $14.04 billion. The revenue guidance includes sales from AI optimized chips being revised upward to $12 billion.

DocuSign (DOCU) reported earnings and revenue that surpassed analyst expectations, explaining that its AI-enabled product, Intelligent Agreement Management (IAM) helped generate new sales. For the recent quarter, revenue climbed 7% y/y, but the company’s earnings guidance disappointed investors even though it was a tad higher than expectations. Shares of DocuSign fell approximately 6% in after-market trading. IAM uses AI to make finalizing agreement documents quicker while also transforming agreement data into insights. DocuSign CEO Allan Thygesen, in a conference call with investors, said IAM is experiencing higher customer win rates, larger average deal sizes and shortened periods for closing deals.

Equities Set for Worst Week in a Year

Stocks are on track for their worst week in a year as investors begin to question the feasibility of 2025 earnings estimates. All major equity indices are tanking with the Nasdaq Composite, Russell 2000, S&P 500 and Dow Jones Industrial benchmarks lower by 2.3%, 1.9%, 1.5% and 0.9%. Sectoral breadth is awful with every segment losing on the session. The laggards are comprised of technology, consumer discretionary and communication services, which are down 2.6%, 1.8% and 1.5%. The homebuilder sub-sector is up 0.4% though. Rates are plunging with the 2- and 10-year Treasury maturities changing hands at 3.66% and 3.68% in bull steepening fashion, 9 and 6 bps lighter on the session. The dollar is near the flatline as the US currency appreciates versus the euro, pound sterling and Aussie and Canadian dollars but depreciates relative to the franc, yen and yuan. Commodities are getting pounded, with crude oil, lumber, copper, silver and gold down 2%, 1.4%, 1.1%, 0.7% and 0.1%. WTI crude is trading at $67.90 per barrel on demand concerns as Riyadh enacts discounts on exports sent to Asia.

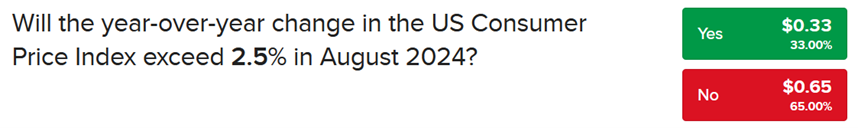

Markets Still Anticipate 25

Despite the cooling employment market, rate watchers are still penciling a 25-bp reduction from the Fed on September 18. While figures so far this month haven’t been weak enough to warrant a 50, next week’s consumer and wholesale inflation data may move the needle further. The November meeting is a different story though, ladies and gentlemen: Fed fanatics are expecting a 50-bp trim as economists and traders alike see the data getting worse before it gets better. Meanwhile, IBKR Forecast traders are investing, speculating and hedging in our Fed Funds and Consumer Price Index (CPI) instruments amidst a volatile and turbulent landscape. I’m seeing an attractive opportunity in the over, or Yes, contract, which is priced at just $0.33 for a CPI figure exceeding 2.5%. My projection is in-line with the consensus this time at 2.6%, providing what I consider to be favorable odds for a triple.

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

thanks for this

We hope that you continue to enjoy Traders’ Insight!