By Ryan Gorman, CFA, CMT, BFA

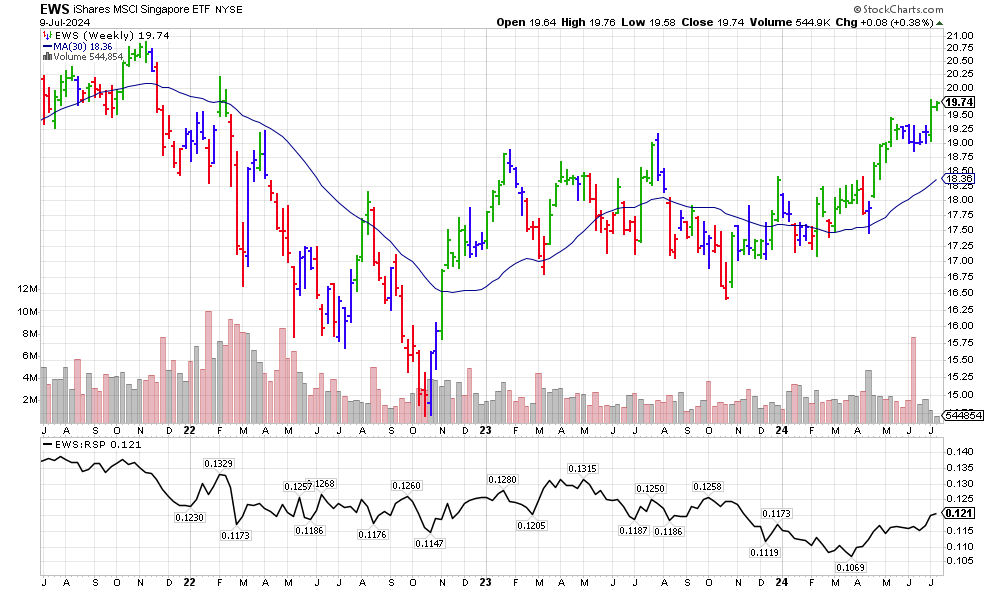

1/ First Stop, Singapore

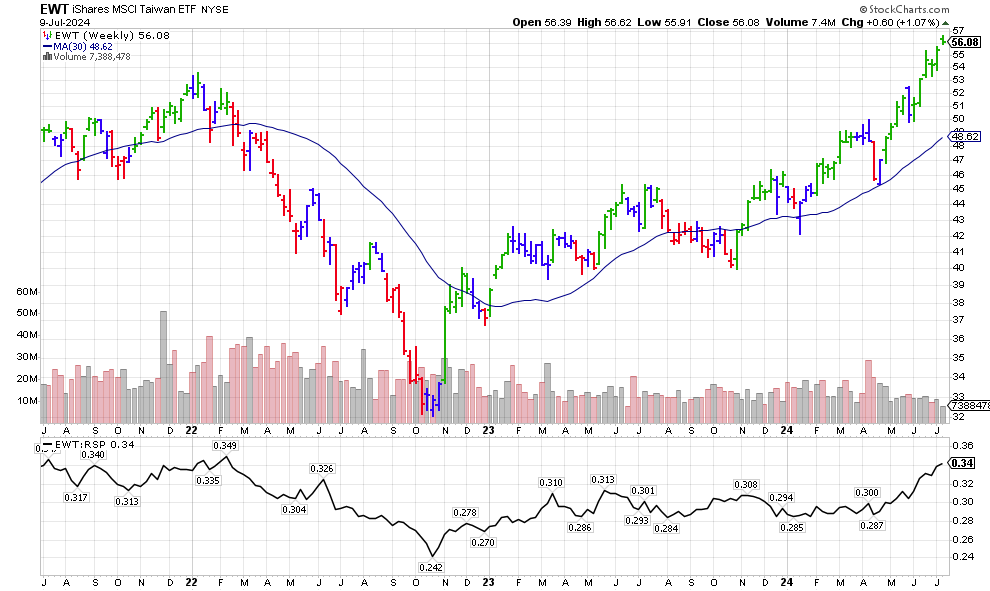

2/ Taiwan Strength

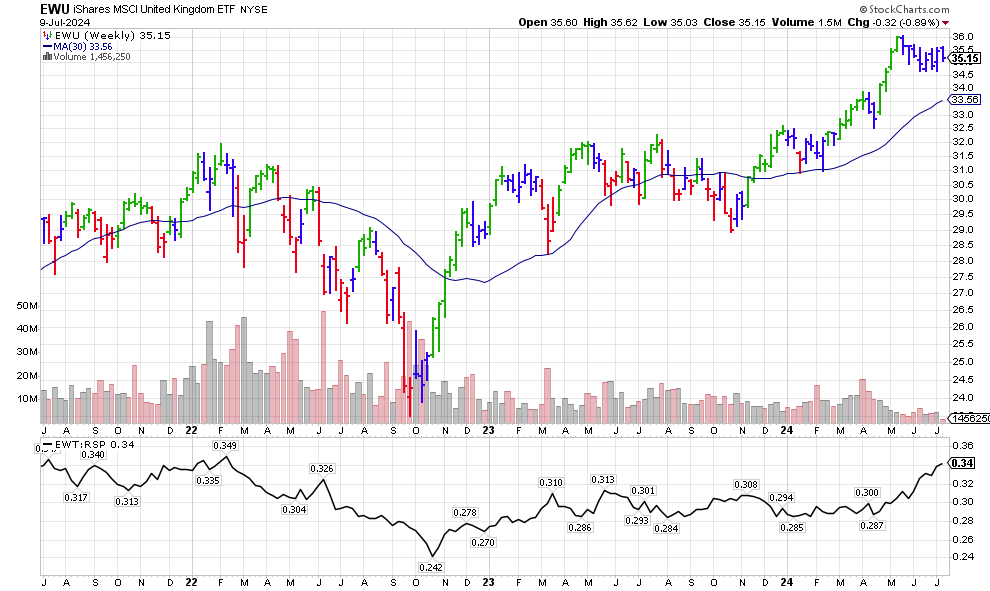

3/ Jolly England, Resting After a Breakout

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

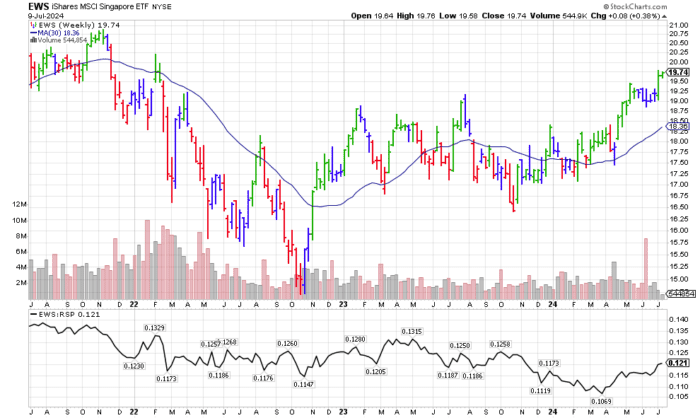

First Stop, Singapore

For much of my career, foreign markets have been viewed as “cheap” from a valuation standpoint. Yet their returns have been about a 5th of the large cap U.S. stocks over the last decade.

The best way I have learned to avoid value traps is relative strength. When cheap things trend, the odds are on your side!

Courtesy of StockCharts.com

You may be seeing some similarities in my charts if you have followed along this week. Getting a few consistent tools that work is a great way to speed up your analysis time.

Here we see new highs, a green elder bar and an up sloping 30 week moving average. We can also see a relative strength breakout. I decided to look at relative strength vs the equal weight S&P etf to better facilitate a more diversified portfolio.

2/

Taiwan Strength

Taiwan looks great. This should not be as much a surprise as the country has some very important companies in the semiconductor industry.

Courtesy of StockCharts.com

While the elder bar is green and the 30 week is nicely sloping up, this may be a good one to add to the watch list. The distance to the moving average is pretty big and so far this week has shown a gap up and so far is in the lower part of the range.

3/

Jolly England, Resting After a Breakout

The United Kingdom has been in the news recently with their election. Price has broken out and is in a nice relative strength uptrend to the equal weight S&P.

Courtesy of StockCharts.com

Elder bars are blue as it consolidates. This is a good pullback and worth watching. A breakdown of this range and the bars turning red would be a good sign to avoid it. If the bars turn green however and the break comes to the upside it could refresh the rally.

—

Originally posted 10th July 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.