By Ryan Gorman, CFA, CMT, BFA

1/ The King as Far as Weighting is Concerned, MSFT

2/ The Long-Term Leader, AAPL

3/ The New Kid on the Block, NVDA

4/ Not a Leader, but Certainly Interesting, BA

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

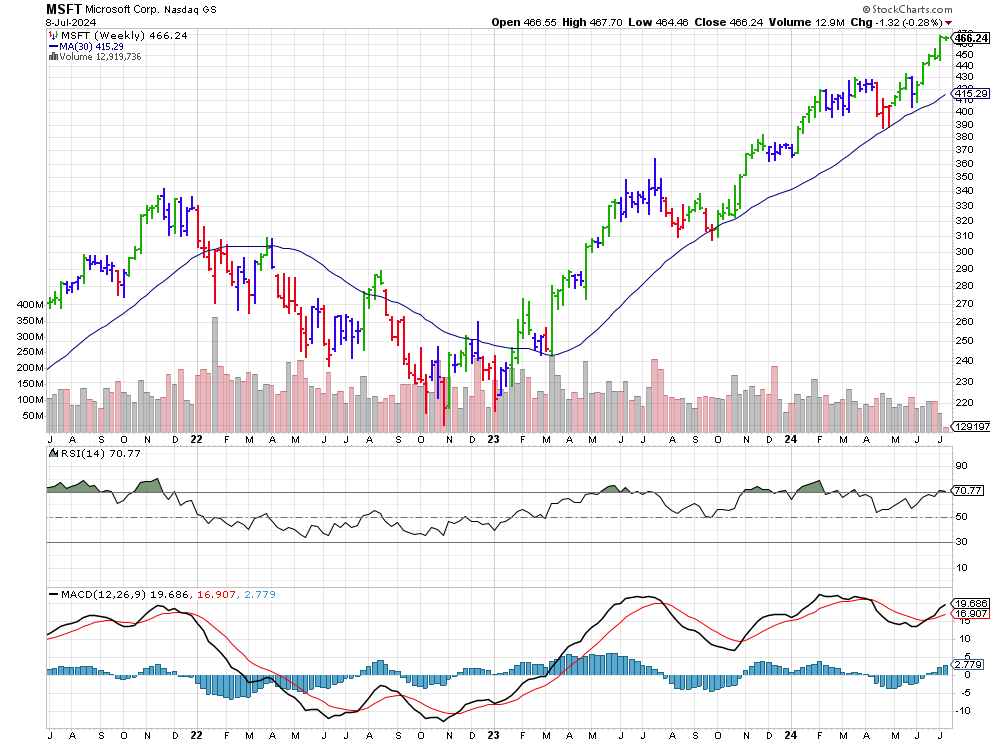

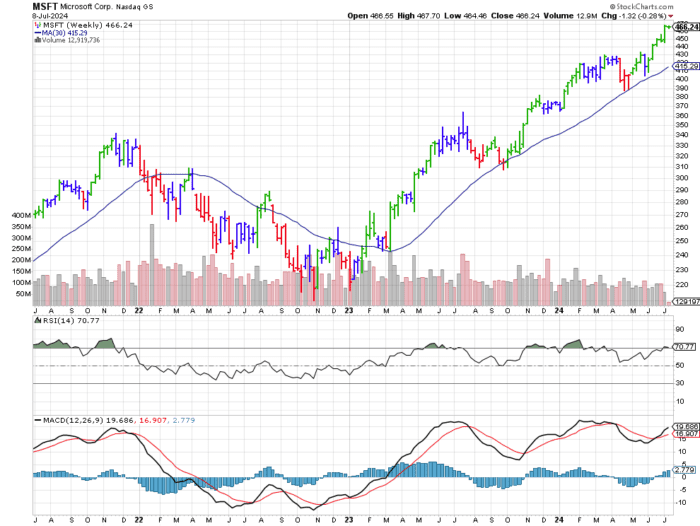

The King as Far as Weighting is Concerned, MSFT

I am interested in the top stocks by index weighting for a few reasons. The first is, they have been the clear leaders for some time. As such, their strength had a large bearing on how the indexes perform.

According to Morningstar’s report on SPY’s portfolio, the biggest weight goes to Microsoft. This giant makes up 7.41% of the index.

Courtesy of StockCharts.com

This chart strikes the closest resemblance to our weekly S&P chart of yesterday. A clear strong uptrend. Momentum as measured by RSI is diverging. The elder bars are green year the start to the week was a slow one.

There is a decent distance to the 30-week moving average. On the one hand, a correction in this stock would weigh on the index. Further, with so much money in ETF’s, a lot of selling of the ETF could weigh on the stock.

2/

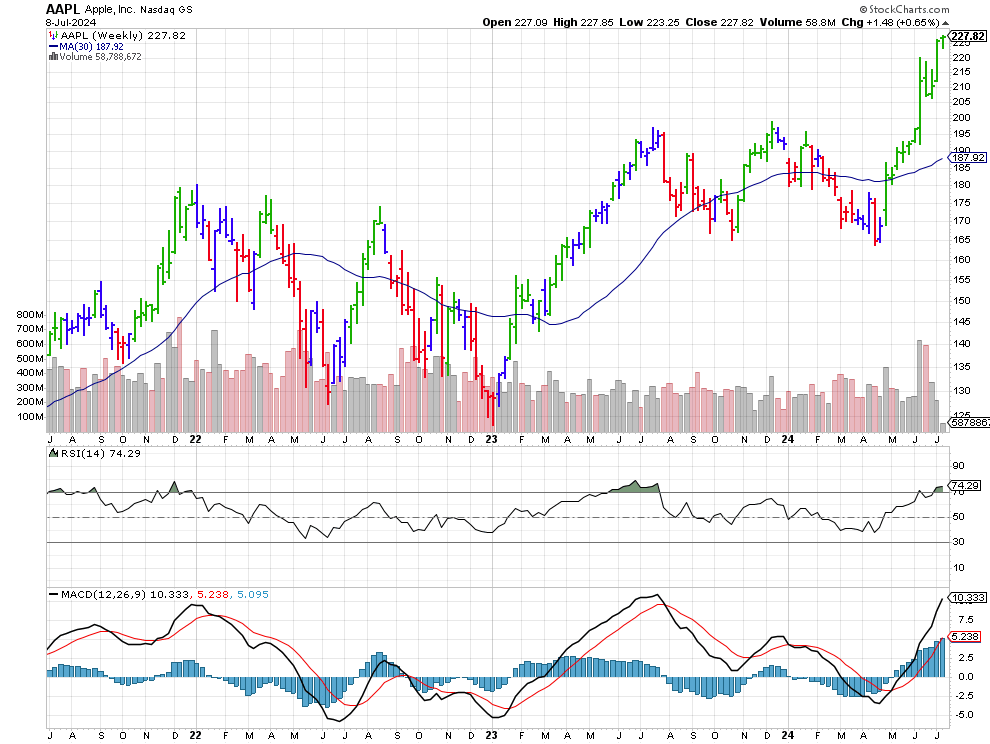

The Long-Term Leader, AAPL

Apple is a long-time leader and maintains a spot as one of the largest companies in the world. This stock was largely dormant for most of the year, until the recent developers conference kicked it into gear.

Courtesy of StockCharts.com

Here again, there is a large distance to the now rising 30 week moving average. The MACD is far from stalling and the elder bars are green. It has moved a great distance in a short time but looks good overall. The previous range was from about $165 to $195. It remained in that range for almost a year. One trading tip is to take that range and add it to the breakout point to reach a first target. $30 is the price range, added to $195 and $225 would be the target. It has hit this, perhaps it triggers a rest for now.

3/

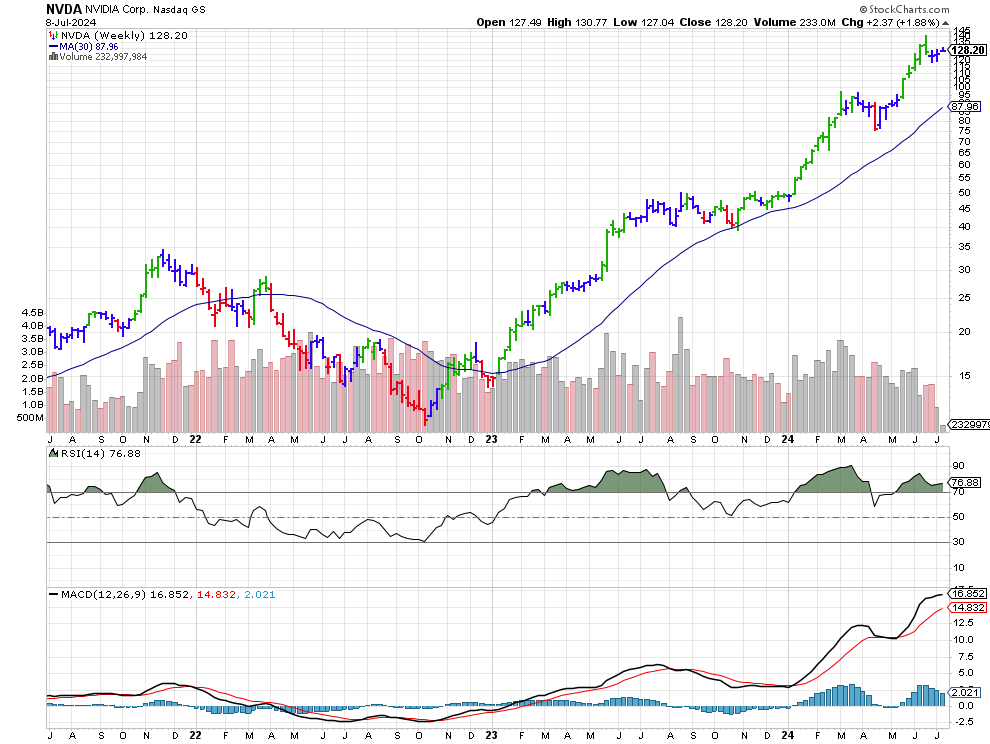

The New Kid on the Block, NVDA

NVDA is the new kid on the block. Blasting to massive highs and joining the $3 trillion market cap club. The stock is up 154% this year and contributes around half the index’s returns.

We can see a pullback has begun, of the major leaders it is the furthest away from its all-time high. Near term, the price has gone up again this week, but the elder bar is blue. This is a sign of indecision.

Courtesy of StockCharts.com

The 30-week moving average is under $100, which was the last major breakout point as well as a round number. It is possible this area is tested again, though the moving average would still be sloping up and indicating the uptrend was intact.

4/

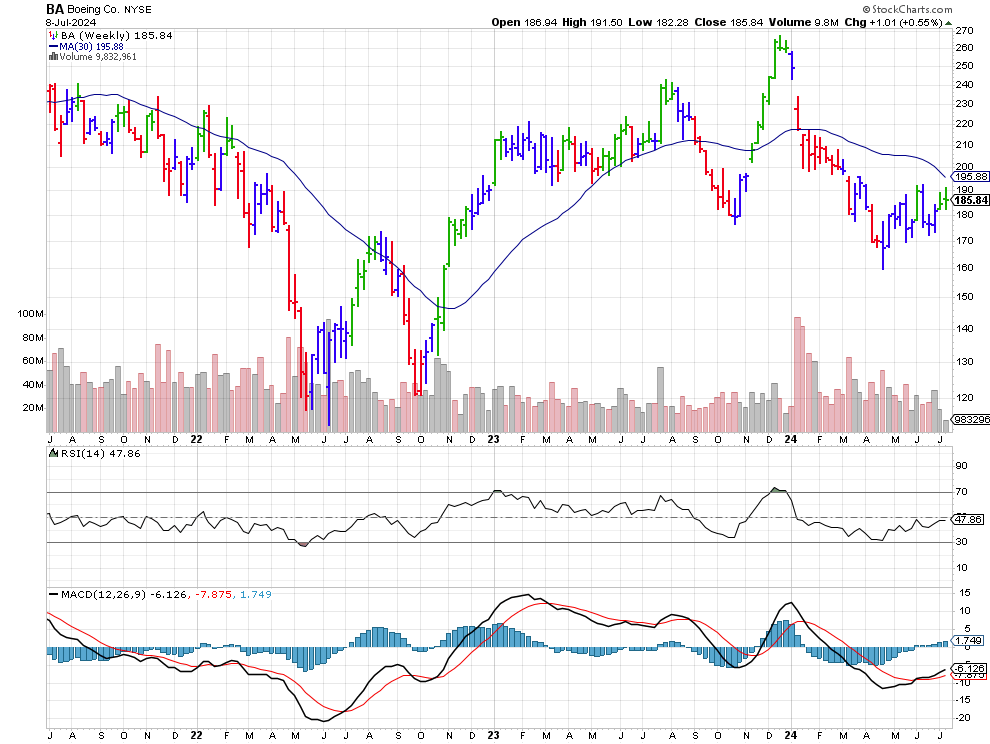

Not a Leader, but Certainly Interesting, BA

Boeing has not, indeed, been a winner. In fact, it has hardly gone anywhere in 3 years!

I wanted to include it as an interesting bonus chart however, because the news is constantly bad. Yet, since April, the stock has been trending higher, putting in higher lows. In fact, just yesterday, they pleaded guilty to 2 felony’s and though it was well off the high of the day, it was positive. Also, the elder bar is green, though the price has not really moved up. This has the potential to be bullish foreshadowing. Could be too aggressive below a declining 30 week moving average, but it seems the tides may be turning for this name!

Courtesy of StockCharts.com

—-

Originally posted 9th July 2024

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

I can’t understand why Taiwan Semiconductor has not climbed to the top in value since it has a virtual monopoly. Everybody in the world uses their chips. They have incredible financial fundamentals & they are drowning in money. It’s a phenomenal business.

I don’t understand why anybody would want to invest in BA. I’m regularly reading about another one of their disasters. They don’t have acceptable fundamentals. I think their management is incompetent. It’s almost like they are being sabotaged.