Methanol catches the interest from global shipping

The methanol markets are entering into an exciting period of growth in the years ahead. The lower carbon impact of methanol from more efficient bunkering infrastructure compared to more traditional fuels such as LNG has seen strong interest from the global shipping markets. Many shipping and trading firms with large fleets have either submitted plans to retrofit existing fleets to be able to run methanol or alternatively ordering new vessels. At the end of August 2023, Maersk, one of the largest shipping companies successfully refuelled a ship in both Rotterdam and Singapore and has placed an order for another 24 methanol powered ships.1 Cargill is also making similar moves as the market continues to explore lower carbon solutions for transport.2

Futures markets expand on broader methanol demand

Traditionally, methanol was largely used as a base material in the acrylic plastics, synthetic fibres for clothing, adhesives, paint, and plywood sectors. However, in recent years the number of sectors that use methanol has increased and it has been discovered as an effective biofuel as well as for fuel for shipping.

Traders have turned to the futures markets to manage the associated price risk on the underlying spot markets where prices remain volatile. The European Methanol T2 FOB Rotterdam futures contract is the most liquid futures contract alongside the China CFR China Specific Origins futures contract. Both contracts reference spot market prices as provided by ICIS, a price reporting agency in the sector.

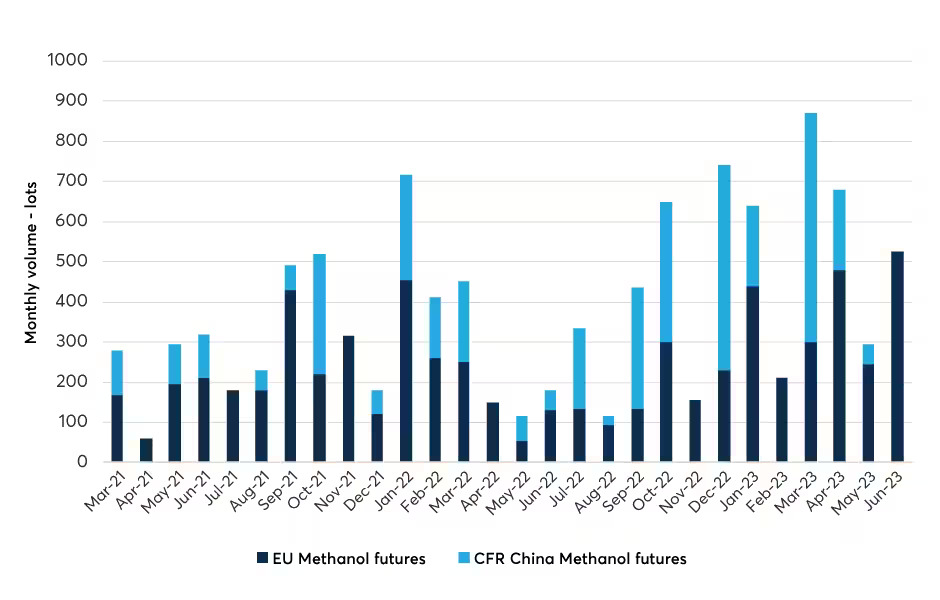

Volumes have risen to over 3,200 lots or 320,000 tons in the first six months or 2023 compared to just over 2,000 lots or 200,000 tons in the first six months of 2022.

Chart 1: Methanol futures volumes leapfrog 2022 levels

Source: CME Group data

Open interest is another key metric to assess the health of a futures market. CME Group data shows the level of open positions along the forward curve is increasing. Typically, a high level of open interest shows a high degree of adoption by the market as a valid price risk management tool and the contract’s relevance to participants with physical price exposure to the underlying commodity. As of end June 2023, total open interest in the European Methanol futures market was 900 contracts, the highest level since July 2021.

The Asian methanol markets began trading in March 2021 following interest from commercial market participants to manage price risk around a growing volume of imports into North China.3 markets began trading in March 2021 following interest from commercial market participants to manage price risk around a growing volume of imports into North China. The development of a North China market has enabled commercial clients to manage any associated price risk between the European and Asian markets. Asia-based firms are also able to manage risk linked to the growing volumes of methanol imports into the region.

Forward markets become more liquid

Commercial firms using the European Methanol futures market have traded at various points along the forward curve. Trading volumes have been executed as far out as 17 months ahead from the spot month. Volumes in the month six to eight forward contracts have increased from 475 contracts in 2022 to a total of 525 contracts over the eight months year-to-date (YTD) in August 2023. Trading volumes YTD 2023 have already surpassed 2022 volumes with traders looking to manage price risk further out along the forward curve. Trading volumes reached around 20% of the total volume in the M6-M8 contracts in 2022 and YTD 2023 compared to around 10% in 2021.

Higher forward liquidity is a sign of a healthy futures market as it shows that market participants believe the contract reflects the fair value of the underlying commodity over the longer term.

Chart 2: Trading activity along the forward curve

Source: CME Group data – YTD August 2023

Shipping targets 50% emission reduction

The International Maritime Organisation (IMO) has a target to cut greenhouse gas emissions by half by 2050 compared with 2008 levels. It is very likely that a wider range of fuels will have to be used and methanol is well placed to displace some of the more traditional bunker fuels such as marine gasoil or even liquefied natural gas (LNG). Den Norske Veritas (DNV) data shows the number of methanol fuelled ships in operation as of July 2023 reached 27 with a further 177 vessels on order to be operational by the middle of this decade.

Rotterdam, the biggest bunkering port in Europe, supplied 1,500 tons of methanol in 2022, an increase from the 250 tons sold in 2021.1 Further volumes are expected in the second half of 2023 as the commercial operations scale up further.

The Oxford Institute of Energy Studies estimates that the global shipping fleet is responsible for approximately 0.9 gigatons (GT) of carbon emissions or 2.9% of total carbon emissions.5 At the same time, the European Union included emissions from shipping into the Emissions Trading Scheme from 2022, a move which is expected to see greater numbers of shipping clients trading emissions-based futures contracts. The fuels that power the industry are also set for change with alternative products such as ammonia and bio-based methanol coming more into focus.

Chart 3: Methanol fuelled vessel orderbook reaches record level

Source: DNV

Supply demand fundamentals keep methanol prices volatile

An increase in methanol demand has led to greater volatility in the underlying price, in part due to the limitations on global supplies. CME Group data shows that the 30-day historical annualized volatility in the front-month listed European futures contract has traded between 10% and 90% since 2021. The volatility in methanol has exceeded other products such as marine gasoil, another shipping bunker fuel alternative.

Chart 4: Volatility in methanol remains high

Source: CME Group data

It is widely accepted that methanol has a role to play in the transition to a lower carbon alternative for the shipping markets compared to some of the more traditional bunker fuel alternatives. The higher demand for methanol in the coming years could create higher volatility in the market and the futures may represent an option for the market to manage any likely price risk exposure.

To ensure net zero commitments further low carbon alternatives made from renewables or biofuels are likely to emerge in the coming years. Costs are also expected to decline as more technologies are scaled up to meet growing demand.

References

- https://www.reuters.com/sustainability/maersks-methanol-ship-makes-maiden-refuelling-rotterdam-2023-08-29/

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/shipping/061623-interview-cargill-kickstarts-maritime-decarbonization-with-biofuels-methanol

- https://www.cmegroup.com/markets/energy/petrochemicals/methanol-cfr-china-specific-origin-icis.contractSpecs.html

- Port of Rotterdam statistics – 2021 and 2022

- OIES – Role of hydrogen in energy transition (May 2021)

—

Originally Posted October 18, 2023 – Methanol catches the interest of global shipping

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: CME Group

© [2023] CME Group Inc. All rights reserved. This information is reproduced by permission of CME Group Inc. and its affiliates under license. CME Group Inc. and its affiliates accept no liability or responsibility for the information contained herein, including but not limited to the currency, accuracy and/or completeness of this information, and delays, interruptions, errors or omissions. This information is an unofficial copy and may not reflect the official and accurate version. For the definitive and up-to-date version of any of this information, please see cmegroup.com.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

So what are Methonal equities and optionable stocks.

Hello, to view all available securities for trading on our platforms, please visit http://spr.ly/IBKR_ProductsExchanges