With income tax rates ranging from zero to a staggering 13.3%, the state you call home can significantly impact your financial health.

High earners, especially those residing in high-income-tax states like California and New York, are always on the lookout for investment opportunities that offer tax advantages.

Enter tax-free municipal bonds, or munis, a financial instrument that not only provides a steady income but also comes with the added benefit of being exempt from federal, and often state, taxes.

The Tax Landscape In The U.S.

First, let’s take a quick look at the state income tax landscape in the U.S.

In states with progressive tax systems, such as California, New York and Hawaii, the tax rate increases as your income rises. California leads the pack with a top rate of 13.3%, followed by Hawaii at 11% and New York at 10.9%. High earners in these states are subject to the nation’s highest tax rates, which can substantially reduce their take-home pay.

Local income taxes are not included. New Hampshire taxes apply to interest and dividends income only. Washington applies to capital gains income of high-earners. Source: Tax Foundation, U.S. Global Investors

On the other end of the spectrum are states with flat tax rates, like North Carolina and Illinois, where everyone pays the same percentage of their income in taxes. These systems are simpler but can be less equitable, as the rate remains the same whether you earn $50,000 or $500,000.

There are currently eight states with no income tax at all: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. While this can result in higher take-home pay, it’s worth noting that these states may have other forms of taxation, such as higher property or sales taxes, to compensate. (In Texas, for instance, property owners pay an average tax rate of 1.8%, according to Rocket Mortgage. By comparison, Hawaiians pay an average 0.28% on their property.)

Some states have unique tax structures. Interestingly, people in New Hampshire pay taxes only on dividends and interest income. Others like Iowa and Oklahoma offer exceptionally low starting tax rates, which gradually increase as income rises.

Why Tax-Free Municipal Bonds?

As many of you know, municipal bonds are debt securities issued by state and local governments to finance public projects, from schools to sewer systems. They offer a steady income stream, usually semi-annual interest payments, until the bond matures.

The most compelling feature of munis is their tax-free status. Let’s say you live in California and fall into the highest tax bracket. Investing in munis essentially increases your take-home pay since you’re not losing a chunk of your earnings to taxes.

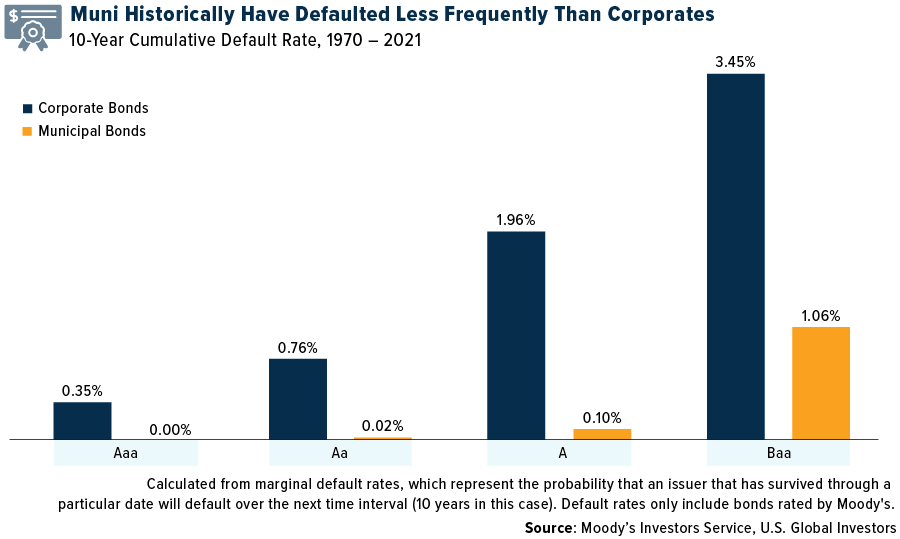

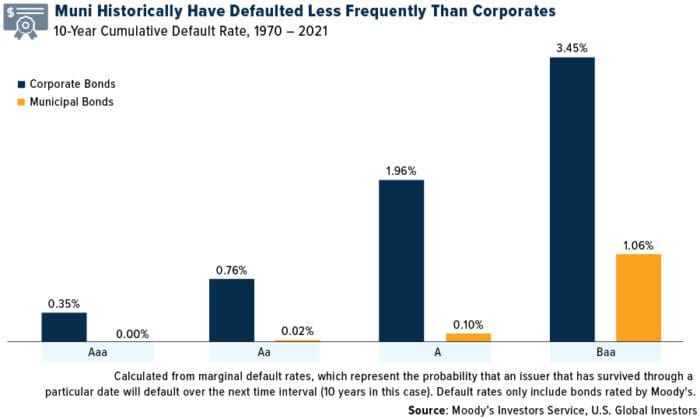

Munis are also generally considered lower risk compared to other investment options like stocks, potentially making them more attractive to conservative investors with a shorter investment horizon. And compared to corporate bonds, munis have historically defaulted far less frequently. Over the past 50 years, defaults among Aaa- and Aa-rated munis have been virtually non-existent, while corporates have seen a number of failures. The likelihood of default increases as credit ratings decline.

—

Originally Posted September 7, 2023 – The Allure Of Tax-Free Municipal Bonds

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

A bond’s credit quality is determined by private independent rating agencies such as Standard & Poor’s, Moody’s and Fitch. Credit quality designations range from high (AAA to AA) to medium (A to BBB) to low (BB, B, CCC, CC to C).

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Investing involves risk including the possible loss of principal. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Past performance is no guarantee of future results.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.