Key News

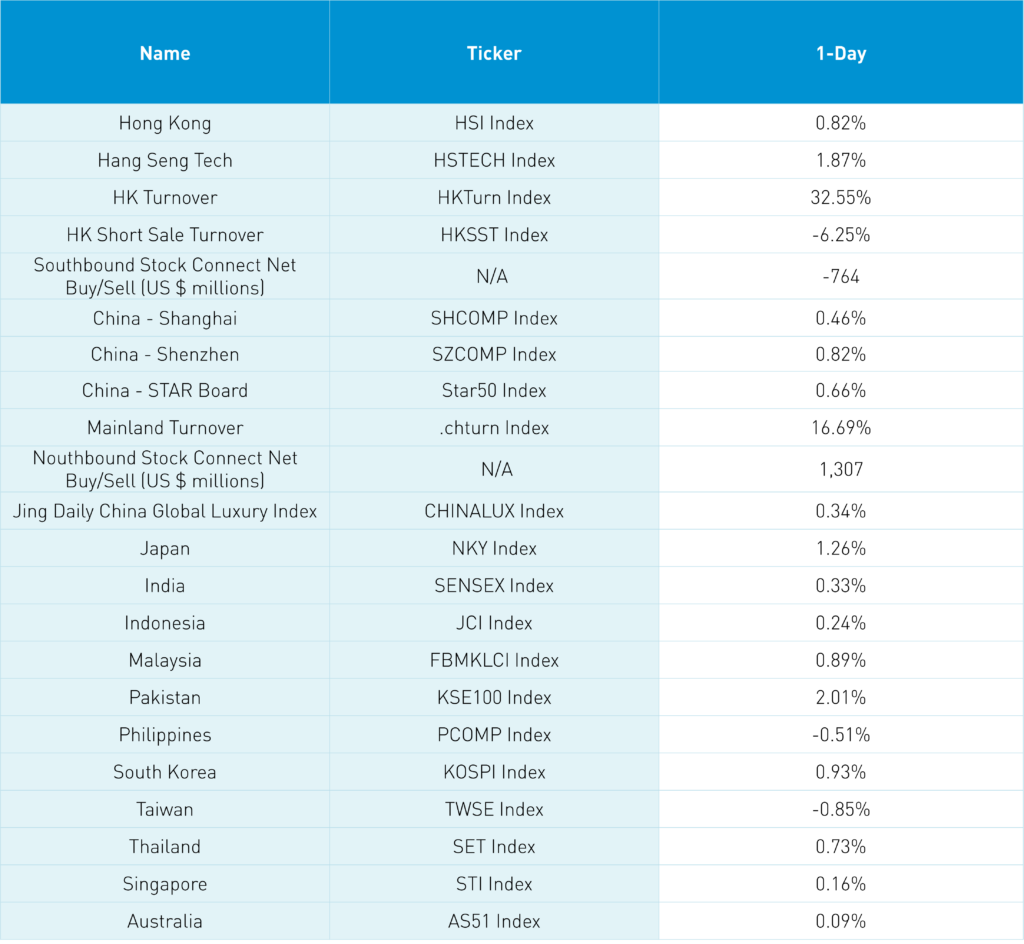

Asian equities ended a positive July on a high note, except for Taiwan and the Philippines.

Hong Kong and Mainland China both ripped higher at the open though curtailed gains over the course of the trading day. Volumes were very high as Hong Kong stocks traded at 122% of the 1-year average volume, and Mainland China traded 124% of the 1-year average. Mainland China volume exceeded RMB 1 trillion for the first time since July 3rd, Southbound Stock Connect volume was more than 2X the recent average, and Northbound Stock Connect volumes were at MSCI rebalance day levels.

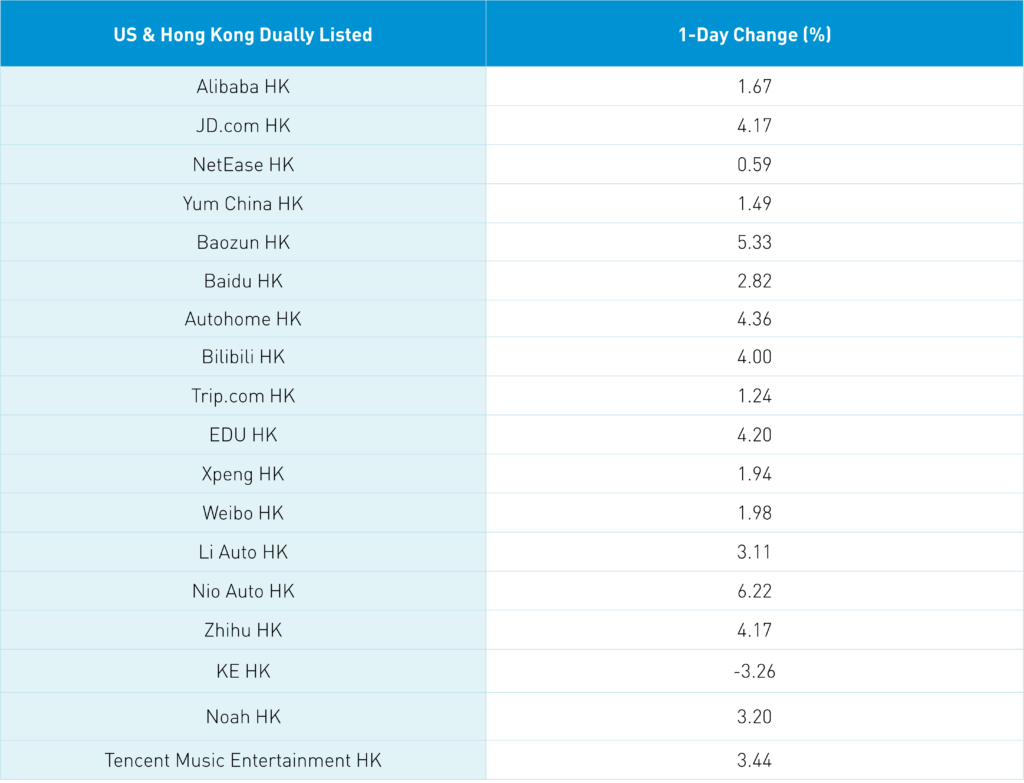

Last Friday’s release that a coordinated policy response focused on domestic consumption with an emphasis on autos and home appliances drove those sectors and related stocks higher. The State Council and National Development and Reform Commission held a press conference overnight, at which they released twenty measures “in order to deeply implement the strategy of expanding domestic demand”. The measures outlined areas of “bulk consumption” beyond the three included initially. The release also included mentions of “expanding service consumption” with a focus on restaurants and domestic tourism, “promoting rural consumption”, “expanding new consumption,” including digital. This bullet point explains the strong performance of Hong Kong-listed internet stocks as the government will “promote the development of digital consumption norms such as s e-commerce, live broadcast economy, and online entertainment.”

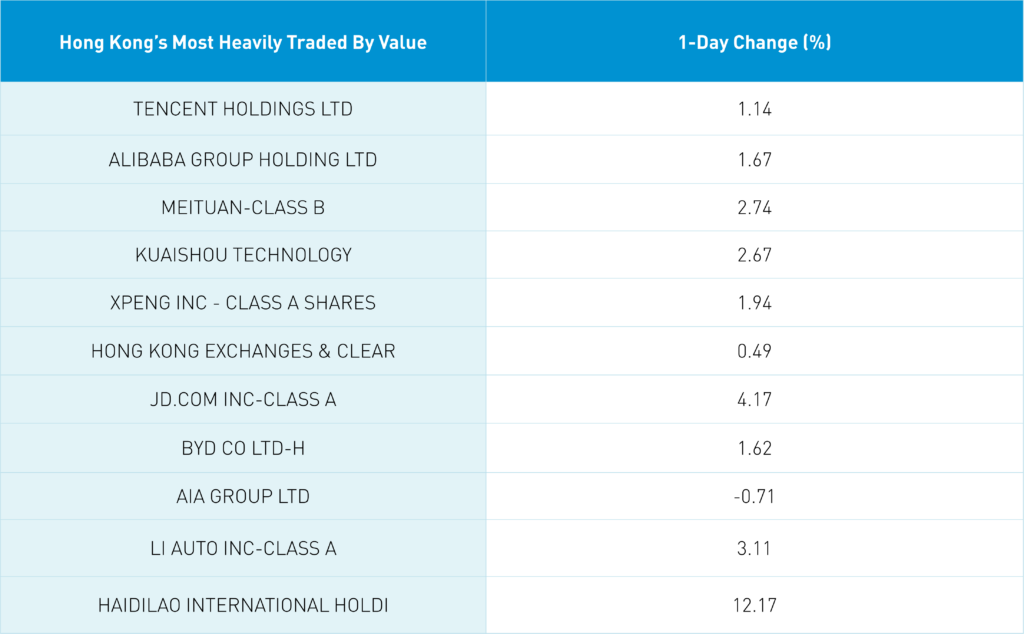

It was not surprising that Hong Kong’s most heavily traded stocks by value were Tencent, which gained +1.14%, Alibaba, which gained +1.67%, despite talk that an Ant IPO is not likely in the short term. Meanwhile, Meituan gained +2.74%, Kuaishou gained +2.67%, and Xpeng gained +1.94%. Consumer Discretionary stocks were the top-performing sector in Mainland China, including Kweichow Moutai, which was a large net buy from foreign investors via Northbound Stock Connect.

You would never know it from Western media coverage, but the July Manufacturing PMI beat expectations. Nonetheless, export orders are still weak, indicating the global economy is slowing. Business expectations increased while non-manufacturing was weak, but still expanding with a reading above 50. New orders and new export orders weakened with property’s construction as the major culprit. PMIs and business expectations are diffusion indexes, meaning that readings above 50 indicate expansion, while readings below 50 indicate contraction.

Beijing, Shenzhen, and Guangzhou announced regional property support measures. However, Hong Kong-listed real estate stocks were weak after Country Garden’s Yang Huiyan announced that she will donate $826 million worth of shares to her foundation, though promised not to sell for ten years.

Hotpot restaurant Haidilao (6862 HK) gained +12.17% after announcing first half 2023 profit would be RMB 2.2 billion, which is ahead of expectations. This is a good sign that China’s consumer is coming back online. After the close in the US, Yum China will report financial results, as Q2 earnings season picks up for ADRs.

The Hang Seng and Hang Seng Tech indexes gained +0.82% and +1.87%, respectively, on volume that increased +32.55% from Friday, which is 162% of the 1-year average. 319 stocks advanced while 183 stocks declined. Main Board short sale turnover declined -6.26% from Friday, which is 122% of the 1-year average, as 13% of turnover was short turnover. Growth outperformed value while large caps outperformed small caps. The top-performing sectors were materials, which gained +2.79%, consumer discretionary, which gained +2.2%, and utilities, which gained +1.44%. Meanwhile, real estate fell -1.14% and healthcare fell -0.33%. The top-performing subsectors were materials, autos, and retail, while telecom, real estate, and pharmaceuticals were among the worst. Southbound Stock Connect volumes were very high at more than 2X the recent average as Mainland investors sold a net -$764 million worth of Hong Kong-listed stocks and ETFs as Tencent was a large net sell, Meituan and Kuiashou were moderate net buys, and XPeng and Li Auto were small net sells.

Shanghai, Shenzhen, and the STAR Board gained +0.46%, +0.82%, and +0.66%, respectively, on volume that increased +16.69% from Friday, which is 124% of the 1-year average. 3,191 stocks advanced while 1,510 declined. Growth outperformed value while small caps outpaced large caps. The top-performing sectors were consumer discretionary, which gained +2.19%, communication services, which gained +1.94%, and industrials, which gained +1.83%. Meanwhile, healthcare fell -2.27% and energy fell -0.2%. The top-performing subsectors were autos, internet, and agriculture. Meanwhile, healthcare, telecom and biotech were among the worst. Northbound Stock Connect volumes were high as foreign investors bought a net $1.307 worth of Mainland stocks as Kweichow Moutai was a large net buy, and Ping An and China Tourism Duty Free were small net buys.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.15 versus 7.15 Friday

- CNY per EUR 7.89 versus 7.88 Friday

- Yield on 1-Day Government Bond 1.40% versus 1.33% Friday

- Yield on 10-Year Government Bond 2.66% versus 2.65% Friday

- Yield on 10-Year China Development Bank Bond 2.77% versus 2.77% Friday

- Copper Price +0.89% overnight

- Steel Price +0.21% overnight

—

Originally Posted July 31, 2023 – Markets Gain On High Volumes, Receive Further Details On Consumption Support

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Security Futures

Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, please read the Security Futures Risk Disclosure Statement. For a copy visit ibkr.com

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.