By: Global X CIO Team

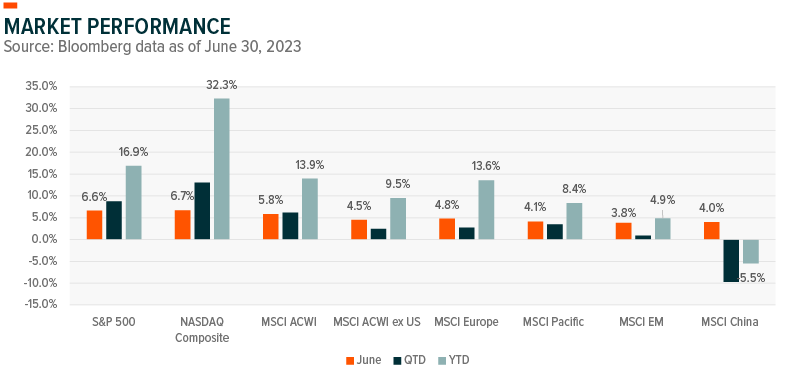

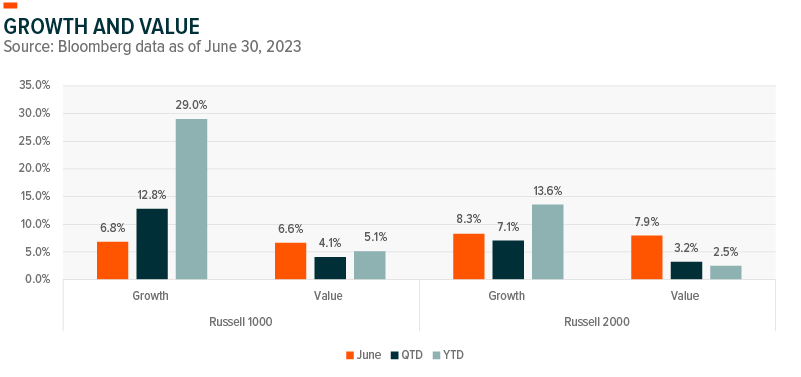

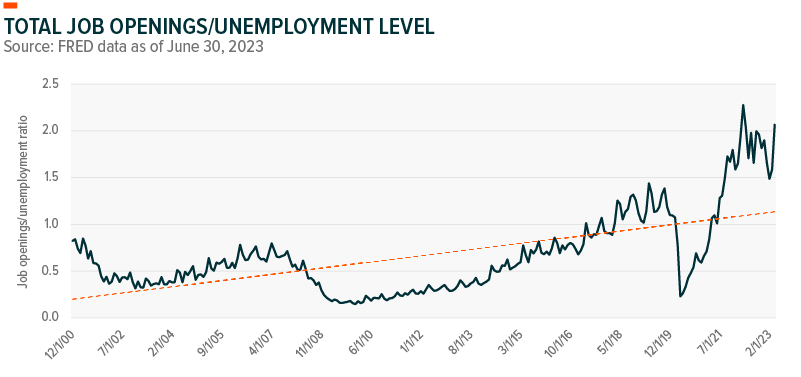

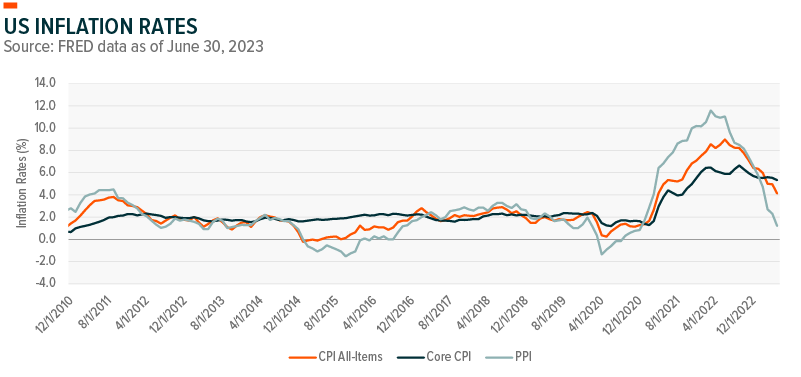

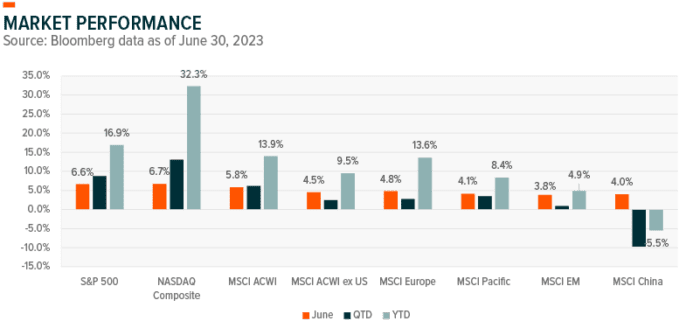

The S&P 500 and Nasdaq extended their winning streaks for the fourth consecutive month in June rising 6.6% and 6.7%, respectively. Market breadth improved with all S&P 500 GICS sectors rising. Cyclical sectors like Consumer Discretionary, Industrials, and Materials led, while defensives lagged. The upward revision to Q1 GDP, resilient consumer spending, and softer than expected headline inflation reduced recession fears. Earnings expectations also improved going into 2H 2023 fueled by efficiency initiatives surrounding AI. Despite the Federal Reserve’s hawkish pause in June, their updated dot plot and projection materials maintained an upward bias through signaling potentially two more rate hikes this year. Expectations for a potentially higher terminal rate predominantly impacted durations between 1 and 10 years, weighing on segments of the fixed income market.

Globally, returns were weaker, albeit positive, with both Europe and China underperforming the broader MSCI ACWI index. Manufacturing activity contracted more than expected in both regions. Individually, Europe has more progress to make in its fight with inflation, while China’s post-lockdown rebound was weaker than expected.

Click here to download Global X’s Market Snapshot.

FOOTNOTES

All data sourced from Bloomberg as of June 30, 2023.

—

Originally Posted July 5, 2023 – Market Snapshot – July 2023

Investing involves risk, including the possible loss of principal.

Index returns are for illustrative purposes only and do not represent actual fund performance. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index. Past performance does not guarantee future results.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Global X Management Company LLC serves as an advisor to the Global X Funds.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.