Michael Normyle – Nasdaq’s US Economist joins IBKR’s Andrew Wilkinson and Jeff Praissman to discuss wage growth versus inflation and the different measurements used to measure them.

Contact Information:

Email: [email protected]

Web: www.nasdaq.com

Note: Any performance figures mentioned in this podcast are as of the date of recording (June 20, 2023).

Summary – IBKR Podcasts Ep. 92

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Jeff Praissman

Hi everyone, welcome to IBKR Podcasts. I’m your host, Jeff Praissman along with Andrew Wilkinson and today we’re going to discuss labor cost and relationship between labor cost and inflation, and which drives the other. It’s my pleasure to welcome back to our IBKR Podcast studio, Michael Normyle, Nasdaq US Economist. Welcome Back, Michael.

Michael Normyle

Thanks for having me.

Jeff Praissman

It’s our pleasure. Before we get started, I just wanted to say a quick note to our listeners: Please rate and review our podcast, we appreciate the feedback. Michael, in our most recent podcast “Prices Up, Spending Power Down” we discussed the Consumer Price Index or the CPI. Many people have heard of the CPI but maybe not, as many have heard of the Personal Consumption Expenditure Price Index, or PCE. Could you explain to our listeners what the PCE is and how it differs from the CPI?

Michael Normyle

Sure. So first off, one way that they’re similar is that they’re both measures of consumer prices. But you know, even though the CPI is kind of what grabs most of the media headlines, PCE is actually what the Fed uses for its 2% inflation target. And so, one of the main differences is that CPI looks only at urban consumers, while PCE considers urban and rural consumers as well as expenditures made on behalf of those consumers by third parties, so you can think something like healthcare insurance providers making payments on your behalf. And so, because of that, the weights are different within those two measures of inflation. And so, for housing, for PCE, it’s actually about half the weight that it is in CPI, whereas healthcare’s weight in PCE is about double that for CPI. So, you get kind of differences, particularly for the weighting and so that’s why you might get different readings if you look at CPI and PCE together. They’ll move more or less together, but sometimes the magnitudes are a bit different.

Andrew Wilkinson

Michael, tell us what are non-housing services? I think we refer to those as NHS, non-housing services. Why are they such an important component to the overall inflation measure?

Michael Normyle

Basically, they’re kind of exactly what they sound like, right? Non-housing services are any services aside from housing costs. So that’s something like getting a haircut or seeing a doctor or going to a lawyer. And so, if you think about, like, when you visit a lawyer, part of their fee, it’s office rents, for example but it’s mostly going to be the wages for that lawyer. And that’s true for kind of non-housing services more generally and so it’s such an important component of overall inflation for a couple of reasons. 1st, it’s the weight, it’s about 30% of inflation so it’s a big chunk of overall inflation and 2nd it’s sticky because wages are something that don’t tend to adjust too quickly. So that’s why it’s kind of a hot topic in inflation lately.

Jeff Praissman

And to kind of drill down into the main focus of this podcast, what part do labor cost and wages, play in inflation, and what effect do they have on companies?

Michael Normyle

Well, so labor costs and wages certainly play a role in inflation. You know, when you get a haircut wages help determine the final price you pay, and it’s also part of a pricing decision from the corporate side because they have to decide how much of wage growth they can pass on to consumers via higher prices. So, if they lack pricing power they might have to absorb higher wage costs by shrinking their margins rather than raising prices too much and potentially losing business. But if they do have pricing power, then you could potentially pass on those wage costs and then some, expanding the businesses margin.

Andrew Wilkinson

So, Michael, what’s the trend been in recent years? Are there some more interesting dynamics? Does it matter how much you earn? Have wages gone up for lower, middle or higher income earners over the years? Which industries have most benefited from wage increases over the recent years and which ones have been lagging behind?

Michael Normyle

The pandemic has definitely been one of the more dramatic periods for wage growth in recent decades because it basically completely changed working patterns with the rise of remote work and then on top of that, you had a lot of people changing careers. And there was the so-called great resignation with lots of people choosing to leave jobs that didn’t align with what they wanted anymore. And then you also had a bunch of people retiring early, so that created an issue with the labor supply during the pandemic and that led to very high wage growth. And if you look at the job site, Indeed they have a wage series that splits it into low, middle and high wage jobs. And so, wage growth was definitely strongest for the low wage jobs and that has a lot to do with people leaving those industries like restaurants, for example. Or, you know, if you remember earlier on in the pandemic, people on the low end of the wage spectrum were making more money from their enhanced unemployment benefits that they did from working. So that kind of created a scenario where restaurant owners or retail store owners had to increase wages to attract those workers back. And so, wage growth for low wage workers peaked over 12% year-over-year growth around the start of last year but it’s fallen down to about 5 1/2% now and wage growth was high, but not quite as high for middle and high wage jobs. For them, the growth peaked around 8 or 9% and it’s down to about 5 or 6% now. But if you compare that to the pre-pandemic years, they all tend to be in the 2 to 4% range. So, they’re still high relative to where they were pre-pandemic even after having come off their highs over the last year. And in terms of industries that have seen the biggest gains, it’s really those where the shortages were most acute, so leisure and hospitality, transportation, warehousing and then it lagged in the more higher wage areas like information or tech in some professional business services as well.

Jeff Praissman

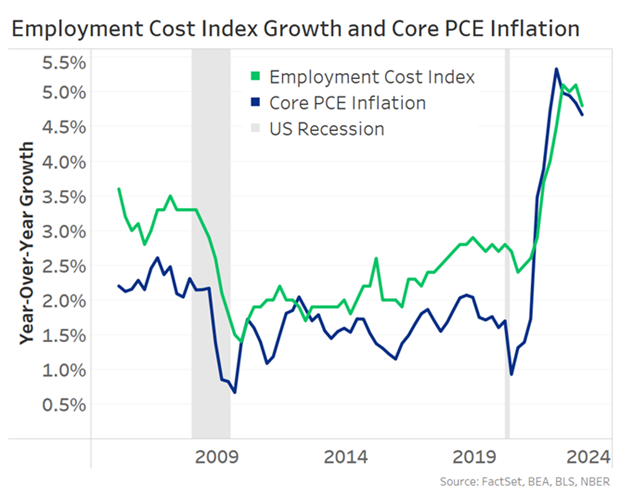

You’ve provided us with the chart, which for our listeners, we’re going to include in the study notes, and it shows the year-over-year growth in the Employment Cost Index or ECI against the year-over-year core PCE inflation wages increase. Could you explain to our listeners what the ECI is and what it contributes to the PCE?

Michael Normyle

Sure. So the ECI, it’s mostly important because it’s what the Fed likes to look at as a measure of wages and that’s because it’s mix adjusted. So that means that it accounts for the composition of the labor force: how many people are in high wage jobs or middle-income jobs, or low wage jobs. Average hourly earnings, on the other hand, which is another popular measure of wages, it’s not mix adjusted. It’s just aggregate pay divided by aggregate hours and that matters because if you look at average hourly earnings growth during the pandemic, it jumped when low wage workers were laid off from restaurants and retail stores. But that was simply a function of higher paying industries being less impacted and not that those people made more money, necessarily. So, on top of accounting for the labor mix, the ECI, it’s also a broader measure of labor costs that takes into account things like benefits and bonuses that average hourly earnings wouldn’t capture. And ECI isn’t explicitly part of PCE but since wages play a role in many parts of inflation, it measures some of the same things as PCE. And so that’s why they, you know, actually move together for the most part. And there was a recent study from the San Francisco Federal Reserve that showed surprise changes in the PCE, meaning those that weren’t accounted for by changes in the economy or inflation have relatively little pass through to inflation, but to the extent that it does, it shows up at that non housing services that we spoke about earlier. So, in the pandemic period, the model in the paper showed that ECI only had about 0.1 percentage points to current core PCE inflation.

Andrew Wilkinson

Michael, when it comes to looking at labor costs, are their advantages of using the ECI over other measures?

Michael Normyle

Well, I think the big advantage is it’s more comprehensive and then also because it’s mix adjusted, it won’t be distorted like I mentioned earlier was the case with average hourly earnings with changing composition of the labor force.

Jeff Praissman

And if your companies can pass on labor costs to consumers through higher product cost or to the investor through maybe lower margins in stock performance, what are the short and long term effects, higher labor costs have on inflation? In other words, how much do labor costs drive inflation.

Michael Normyle

Well, I think when inflation is high, in particular, you hear a lot of concern about a wage price spiral and that means that if wage growth is rising, people have more disposable income. And so, there’s increased demand for goods and services, which causes inflation, and that might require workers to demand higher wages. And so, you can get at this kind of vicious cycle of rising wages causing rising inflation causing rising wages. But the empirical evidence suggests that it’s more wage growth following inflation, so workers want their wages to rise to catch up with inflation. And if wage growth is chasing inflation, then that lag should kind of allow inflation to slow, preventing that vicious cycle from catching on. So, wage growth, it’s definitely a factor in inflation, but it’s not necessarily the driver of it that it’s made out to be sometimes.

Andrew Wilkinson

So Michael, the labor costs affect inflation through supply or through demand?

Michael Normyle

Well, so that same San Francisco Fed paper that we discussed earlier looked at the same question and found that it’s almost exclusively through the supply channel. So that means businesses passing on labor costs through higher prices.

Jeff Praissman

And if research points to wages not having much impact on inflation, what are some reasons the Fed is so concerned with wages then?

Michael Normyle

Well, despite the work in this paper we’ve discussed, I think concern about wage price spirals is a relatively powerful force and economics and media. That’s why the Fed has been concerned about inflation and expectations remaining anchored. And that means where people expect inflation to be in five or ten years, even if inflation itself hasn’t been that high. So that means that they’re concerned about these expectations not moving up because that could kind of set up a situation where we have that inflation becoming “entrenched.” And so, since those inflation expectations informed consumer behavior and also whether they might push for a raise, for example. So, by constraining inflation expectations, that should keep wage growth from spiraling out of control, but more immediately, wage growth is still a factor in inflation, and it’s high relative to pre pandemic levels like we spoke about earlier and it’s slow to adjust. So that’s something that the Fed doesn’t want to see increasing again because that would make it harder for them to get back to their 2% target.

Andrew Wilkinson

I’d like to thank our guest, Michael Normyle, Chief US Economist at the Nasdaq for joining us today at IBKR Podcasts. And for more from Michael and Nasdaq, please go to our website under Education to view previous Nasdaq webinars as well as our previous podcasts. Thank you, Michael.

Michael Normyle

Thanks so much. Thanks for having me.

Andrew Wilkinson

I also want to remind everybody that you can find all of our podcasts on the website IBKR.com under Education, scroll down to IBKR Podcasts or from YouTube, Spotify, Apple Music, Amazon Music, PodBean, Google Podcasts, and Audible. Thanks for listening, I’m Andrew Wilkinson.

Jeff Praissman

And I’m Jeff Praissman and we’re with Interactive Brokers. Thank you.

Andrew Wilkinson

Thanks everybody.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.