The labor market is slowly loosening, but it’s still tight, resulting in ongoing headaches for employers and reinforcing the likelihood of inflation remaining too strong. Even though the Bureau of Labor Statistics (BLS) this morning reported that the number of hired individuals moderated in June, unemployment is extremely low and the ratio of unfilled positions to the number of unemployed workers is still substantially above pre-pandemic levels, illustrating that demand for workers is likely to remain top of mind for the Federal Reserve. Amidst conflicting data, however, investors were relieved that today’s labor figures from the government weren’t as hot as yesterday’s ADP numbers. This morning’s softer data served to aid sentiment at the margin, pulling short-term bond yields lower while longer-term inflation expectations remained lofty, resulting in bear-steepening activity across the yield curve.

Just one day after ADP reported that new hires surged in June, BLS data this morning shows that employers added only 209,000 workers last month, below the analyst consensus estimate of 225,000 and the 306,000 new hires in May. During the first six months of this year, payrolls grew by an average of 278,000 a month and last year by a monthly average of 399,000 per month. The numbers show a much more modest increase in new hires than reported by ADP, which signaled that 497,000 employees were added in June, blowing past the analyst expectation of 228,000 and the 267,000 hires in May. Indeed, ISM’s PMI for services released yesterday also reflected a rapid acceleration in job growth, from a 49.2 index level in May to 53.1 in June.

For June, the following categories led job creation, according to the BLS:

- Health Care and social assistance, which added 65,000 employees. Social assistance led the segment with 24,000 hires while hospitals added 15,000 new workers.

- Government, with 60,000 hires of which the largest growth occurred among local governments.

- Construction added 23,000 jobs, as a high need for housing inventory and record onshoring activity in the U.S drive the sector’s recovery. Manufacturing added jobs as well, gaining 7,000 workers during the period.

The professional and business services category and leisure and hospitality industry each added 21,000 jobs. In comparison, ADP reported that leisure and hospitality added 232,000 jobs in June.

The professional and business services category and leisure and hospitality industry each added 21,000 jobs. In comparison, ADP reported that leisure and hospitality added 232,000 jobs in June.

Categories that contracted had minor declines in payrolls with retail surrendering 11,000 workers and transportation and warehousing giving up 7,000. Other categories, such as mining, quarrying, and oil and gas extraction; wholesale trade; information; financial activities; and other services had little or no payroll changes.

Employers Still Challenged by Tight Job Market

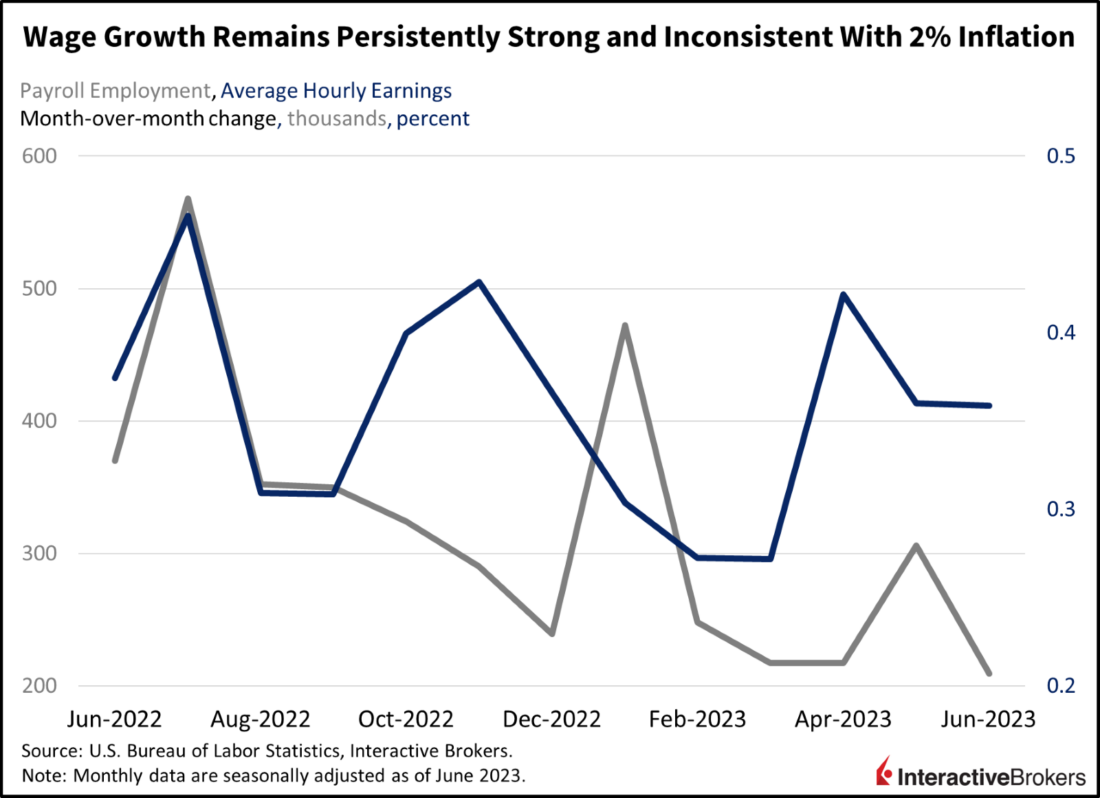

With June payroll increases trailing the monthly averages for 2022 and the first six months of this year, the data implies that the job market is weakening, but workers are still hard to find with the country’s unemployment rate dropping from 3.7% in May to 3.6% in June. Separately, the BLS recently reported that the ratio of open jobs to unemployed individuals remains at a high level of 1.6, which is down slightly from post-pandemic highs but is still above the 1.2 level that existed prior to Covid-19. The tight labor market is allowing workers to command higher wages, with average hourly earnings climbing 0.4% month-over-month (m/m), higher than expectations calling for 0.3% and in-line with May’s growth. On a year-over-year basis, average hourly earnings rose 4.4%, also higher than projections of 4.2% and equal to the same rate as the previous month.

Expectations for Monetary Policy Spark Small-Cap Rally

Markets are reacting with stocks struggling to recover yesterday’s losses driven by a drastic rise in yields on the back of hot economic data. Yields are softening across most of the curve, led by the short-end as softer economic numbers this morning alleviate concerns of an overly hawkish Fed. Hot wage data and still strong job growth overall, however, are keeping yields high on the long-end as investors factor in strong longer-term inflation expectations. The 2-year maturity is down 9 basis points (bps) to 4.92% while the 10-year is unchanged at 4.04, resulting in a bear-steepener motion. Lighter monetary policy expectations are weighing on the dollar as well, with its index down 69 bps to 102.40 as it reverses all of yesterday’s gain and then some. Lighter petroleum supply expectations on the back of firmness from Riyadh and Moscow amidst a declining dollar are supporting energy markets, with WTI crude oil up 1.1% to $72.59 per barrel. Expectations of a lighter Fed relative to yesterday morning are driving a celebration in small caps, with the Russell 2000 Index up 1.7% and outperforming all other major indices. The other major indices are nearly flat with almost all offensive sectors higher while defensive health care, utilities and consumer staples alongside cyclical real estate weigh on overall index performance.

Labor Market Pain Persists

While today’s data came in a lot cooler than yesterday’s, a lower unemployment rate, job gains in excess of 200,000 and persistently high wage growth are serving to suppress equity market sentiment. With the Fed still expected to deliver another rate hike or two this year and the central bank’s balance sheet $41 billion lower today than prior to the failure of a handful of regional banks, bullish investors are dialing back their optimism. Indeed, today and yesterday’s wage growth data point to inflationary dynamics that are well above the central bank’s 2% inflation target. A slew of earnings reports released in the next few days will provide more clues on the degree to which tighter monetary policy is affecting the bottom line and forward-looking revenue and income projections.

Visit Traders’ Academy to Learn More about Payroll Employment and Other Economic Indicators.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!