Concerns about droughts and the water supply have generally spurred higher prices of live cattle futures – sending the stocks of some top global meat producers into a downturn. So, then, why have shares of several fast-food companies been on a climb – especially amid higher consumer meat costs and more expensive menu items? Is a Big Mac Slider in order? Find out what’s steering the live cattle markets, and what to watch out for, as Sean McGovern, vice president of research at McAlinden Research Partners, and IBKR’s Jeff Praissman, join host Steven Levine in our ongoing agricultural commodities series….

Note: Any performance figures mentioned in this podcast are as of the date of recording (June 21, 2023).

Summary – IBKR Podcasts Ep. 88

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steven Levine

Hello, and welcome to IBKR Podcasts. I’m Steven Levine, senior market analyst at Interactive Brokers. I’m your host for today’s program. Sean McGovern, vice president of research at McAlinden Research Partners, joins us again for our ongoing series on agricultural commodities. McAlinden Research Partners is a highly informative, independent investment strategy group. It focuses on identifying alpha-generating investment themes, and they’ve got a lot of great commentary on our Traders’ Insight platform. Very fortunate to have Sean here with us again. So, welcome back, Sean!

Sean McGovern

Always a pleasure. Glad to be here.

Steven Levine

Thanks so much. Thanks so much. And we’re also lucky to be joined again by Jeff Praissman. He’s our senior trading education specialist here at IBKR. Jeff’s been using our Trader Workstation platform and tools, along with his own research, which has provided us with some really terrific insights into the performance of futures prices, as well as related company stocks and options: from coffee to wheat to corn and cocoa. You can check out our past podcasts for some great information there, and he’ll be helping us out today on the live cattle market. So, excited to be talking about that topic today.

In a way, it seems the live cattle market is a little similar to corn – at least given the wide array of products that are produced. Corn produces a great number of products I had no idea about when we did that, but the live cattle market, too: It’s not only responsible for beef – like hamburgers and steaks and so on – but also by-products like oleo oil, and that’s made from beef fat. It’s used in margarine, for example. Then there’s beef hide. It gets used to make leather goods, and even the bones and horns and hooves are used to produce things like piano keys and buttons and certain glues and … marshmallows, I had no idea. So, there’s a very long list of uses, especially for these by-products. They can go into everything from insulin to dish soap to candles, crayons, car wax, nail polish remover, and deodorants to dog food. It’s an incredibly long list, and an incredibly large global industry that’s responsible for millions of jobs. So, like corn, as we did with those futures, we’ll limit the scope of this discussion to what we, or people who elect to consume meat, might include in their dietary habits. This might be anything from steak and eggs to a bacon cheeseburger to a Whopper or Big Mac. It seems like there’s a lot of people who are interested in that, and we’ll be talking about meat processors and fast-food restaurants, as we take a look at live cattle futures. So, let’s start there.

Sean, I see there are different types of cattle futures. There’s live cattle, there’s feeder cattle – not sure what the difference is between these. What do commodities traders and investors actually get when they purchase a live cattle contract?

Live Cattle Futures – Contract, Prices, and Catalysts

Sean McGovern

Assuming we’re talking about the CME’s contract for live cattle, you’re getting 40,000 pounds of cow. So, that’s about 18 metric tons – that is, if you’re taking delivery. But I have a feeling that some of our listeners … it’s going to be a little bit out of their reach to do that. So, they better make sure they’re keeping track of the expiration. Despite the fact you’re signing up for 40,000 pounds, the contract is usually going to be quoted on a per pound basis, or 100 pounds – either way works the same way. Those contracts will be listed for six months of the year: February, April, June, August, October, and December. Right now, the front month is still the June contract, since the trading continues all the way through the contract month and doesn’t actually terminate until the last business day of each respective month for whichever month you’re trading. That’s live cattle. But you also mentioned feeder cattle, which is a little more interesting, I think. Live cattle – that’s going to be older, more mature cows that have achieved a certain weight of well over 1,000 pounds. That makes them ready for harvest and slaughter. Feeder cattle are more recently weaned calves that are just being sent to the feedlot to get fattened up. So, that’s going to be an even bigger commitment of 50,000 pounds, or 23 tons. The contract is only financially settled, so there’s no physical delivery of the cattle associated with this. They’re just going to be too small for slaughter, so there’s not really any point of delivering them. In simple terms, you can think of the feeder cattle as eventually becoming the live cattle that will be harvested, but they’re just not there yet. They’re in the pipeline. Settlement frequencies also more common – occurring in eight months rather than just six, and since there’s no June contract in that mix, August is the current front month for that one.

Steven Levine

So, feeder cattle is a little bit like future live cattle futures.

Sean McGovern

That’s exactly right.

Steven Levine

Okay, got it. Got it. And, so, Jeff, looking at the Trader Workstation, how are these live cattle futures performing? What trends do you see there?

Jeff Praissman

Over the past year, the cattle futures have gained in price, generally rising steadily and then taking a few steps back every few months. However, they popped around mid- to late May and now they’ve slightly retreated again over the past few weeks.

Steven Levine

They’ve retreated, okay, but they’re still pretty high, aren’t they?

Jeff Praissman

Last time I looked, it was around 170 or so. I think they hit a high of 175 prior to that.

Steven Levine

Sean, how do you account for this performance? What are some of the economic drivers, or other catalysts affecting prices? I’m imagining the weather. I saw Texas as being something like 117 … 120 degrees or something to that effect. It’s crazy what’s going on out there.

Sean McGovern

First off, demand has remained relatively inelastic for beef, so consumers’ desire to continue buying beef has not waned in spite of constant price increases that we’ve seen and varying other economic conditions over the past few years. As we have discussed in the past, come rain or shine, recession or boom, people need to eat, and they appear to have decided beef is one of those things that they’re just not willing to go without, at least not yet.

Things are pretty simple on the supply side right now, as well. The U.S. cattle herd right now is as thin as it’s been in eight years – going back to 2015 – and they’ve been wiped out by persistent drought conditions throughout the Southwest. It’s been particularly bad in regions like Texas and Oklahoma, and I don’t think anybody would be surprised to learn that those are the two largest cattle-producing states in the nation. That’s where the droughts have maybe had the most significant and ongoing impact, but it’s really been the entire Midwest that’s been affected … really struggling with several waves of drought since 2020. We’re talking Nebraska, Missouri, Kansas … all up along the Great Plains. There’s been no relief lately, and when there’s a lack of water, that’s when culling begins. The pace of the slaughter might be expedited. Ranchers are going to look for ways to shrink the herd. As recently as March, the U.S. Drought Monitor described more than 80 percent of Texas as abnormally dry or worse, with nearly one-fifth of the state falling into the ‘extreme’ drought category. The worst has passed for most of the state, with less than 2 percent of the state now experiencing extreme drought, but the majority of Texas’s land remains at least abnormally dry. East Texas, which is a pretty big cattle farming region, is mostly drought free. But the leading beef-producing counties up in the northern High Plains, up by the Oklahoma Panhandle – those remain some of the most heavily impacted by ongoing drought. And, speaking of Oklahoma, two-thirds of that state is considered abnormally dry or worse, and that’s the highest level in three months.

Steven Levine

Has this never happened before? Have we not experienced these kinds of drought conditions, where culling of cattle was not needed to this extent, and these states were able to weather these kinds of extreme conditions?

Sean McGovern

Believe it or not, it was worse last year. On the national level, things were worse last year. The culling really began back in 2020, because what you had was a closing down of the slaughterhouses and meat packing plants in the wake of COVID-19. And, so, when those reopened, there was a huge, almost like a glut of cattle. The prices actually fell in response to the initial lockdowns, because of the perceived economic impact that that would have. So, when they did open back up, you had a glut of cows and low prices already. And, so, the culling became very aggressive, and the droughts have only made the culling even more aggressive. Even though I think a lot of ranchers don’t want to cull anymore, they’re running out of options because of the water situation.

Global Market Size, Top Producers, and Exporters

Steven Levine

So, how big exactly Is this live cattle market, globally?

Sean McGovern

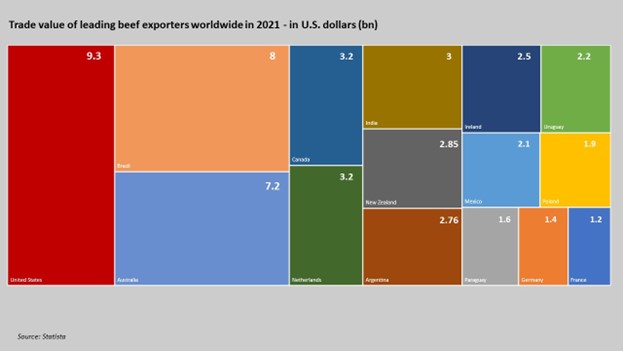

The global cattle population is going to be be anywhere from 900 million to 1 billion heads, and a head just represents one cow – that’s kind of the terminology of the industry. Like we’ve seen in the U.S., the population has actually diminished over the past several years. If we go back to 2013, and before, we saw several years where the population surpassed one billion. But more recently we’re seeing levels below 950 million. If we want to quantify the global industry in terms of beef production, you’re talking about hundreds of billions of pounds of meat annually, just the top ten beef producing nations put out well over 100 billion pounds last year.

Steven Levine

And who are they? That’s the U.S. It’s certainly, I’m sure, among those top ten, but who are some of the bigger producers in the world?

Sean McGovern

Yeah, we’re talking a lot about the United States already, and it’s important to make sure we do put a lot of focus there, since the U.S. is responsible for about 22 percent of the world’s beef production in 2022. That’s the largest share of any single nation, and whatever happens with the cattle population in the U.S., that’s going to reverberate throughout the prices around the globe. Weighing that number out, U.S. beef production was equivalent to almost 28-and-a-half billion pounds last year. If we look more closely at the data out of the USDA [United States Department of Agriculture] and their Foreign Agricultural Service, more specifically, we see Brazil is not that far behind us at this point. They’re at 17.4 percent of that market. They’re also the largest exporter of beef, making up 23.5 percent of exports. The second largest exporter, despite not really being one of the top five largest producers, is Australia. They’re only responsible for less than 3.5 percent of total global output, but they represent almost 14 percent of all exports.

Steven Levine

Wow.

Sean McGovern

The cattle herds and beef output from these two countries has been stable to strong recently, and there was a report out of Rabobank that noted these two countries may be able to offset the declines in U.S. production and steady global beef supplies throughout the next 12 months. I haven’t seen anything particularly concerning in regard to water supplies in either Brazil or Australia. Brazil is definitely drier than Australia, which appears to be enjoying plenty of rain, but below average temperatures have actually been of greater concern for Brazilian ranchers, as several thousand cattle have actually been killed by the cull recently. Now, that alone, is not really going to have a material impact on Brazil’s total output in the grand scheme of things, but any kind of inclement weather is always something to watch out for in commodity markets. It’s always something to take away from that.

Steven Levine

I remember the wildfires that Australia had, and I’m sure that that remains a risk.

Sean McGovern

Well, one of the biggest impacts you saw from those wildfires was actually the smoke — kind of what we’re seeing with the smoke coming down from Canada with the wildfires in Quebec — that smoke and those conditions … that went off of Australia and up into Asia and other parts of the globe and negatively impacted some of the some of the crop growing out in different parts of the world.

Global Meat Processors – Stocks & ADRs Depressed

Steven Levine

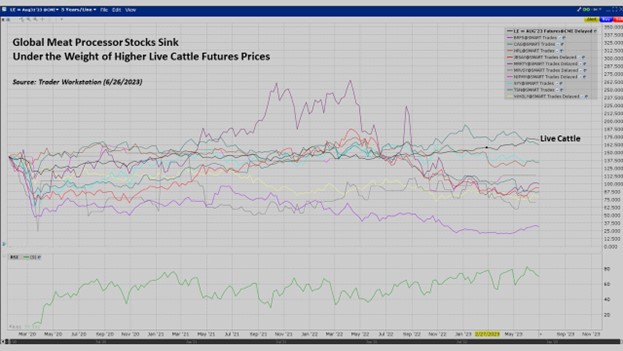

It’s amazing what kind of effects or consequences these have that you don’t consider when you think of the local damage or local catastrophes. We’ll get to the outlook on the market a bit later, but since Interactive Brokers is a global company, I thought we’d take a look at some of the global meat processors – these are among the largest in the world, I understand – the stocks of those that are publicly traded – companies like BRF, JBS, and Minerva Foods in Brazil; ConAgra, Hormel, Cisco, and Tyson, here in the U.S. Also, Japan’s NH Foods…. These all seem to be on fairly depressed levels versus their recent highs. So, Jeff, what do you make of the activity there?

Jeff Praissman

Yes, especially compared to when you look at the live cattle futures that are, sort of, almost trading near the yearly high as well. So, the food processors seem to be trading lower than higher right now.

Steven Levine

So, the more that these live cattle futures are on the climb, it seems the relationship is … the more depressed these meat processors stocks become.

Jeff Praissman

Yes, which makes sense, because obviously the supply is getting more expensive for these meat processors. And the input is becoming more expensive for the output, where they have to send it off to restaurants or supermarkets or anyone else that is buying the supply of beef once they’ve processed it.

Sean McGovern

One thing I’ll point out with the processors is that U.S. cattle prices are particularly high compared to their international counterparts, and for companies that consume a lot of U.S. cattle, that may be causing issues. As an example, my most recent check shows Minerva Food’s shares are only down about 12 percent over the last year, whereas JBS shares are down three times as much – at a 36 percent decline. Now, both of those are Brazilian firms, like you mentioned, but JBS has a lot of plants in the U.S., whereas Minerva doesn’t. Lots of processors are struggling with high cattle costs and maybe having issues passing those on to restaurants, or whoever’s buying in the wholesale market. But I think the cattle pricing in the U.S. certainly has been a larger detriment.

Fast-Food Companies – Stocks Climb

Steven Levine

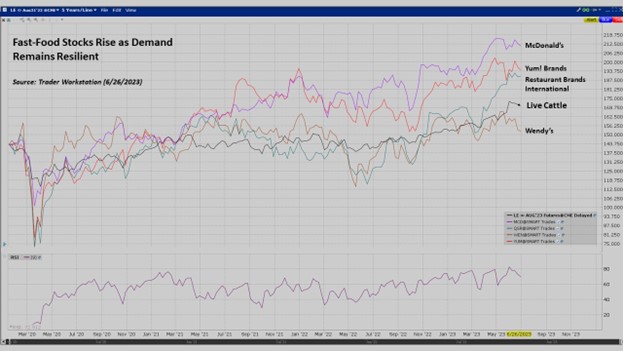

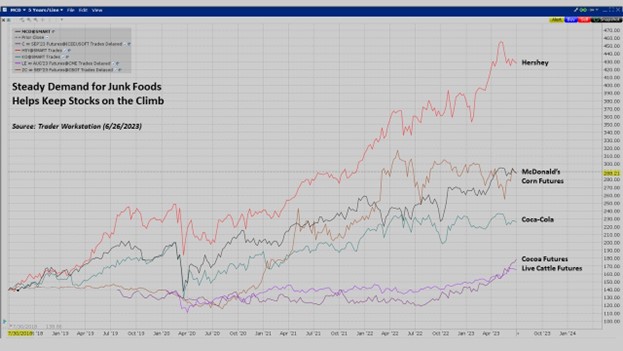

it’s very interesting to me because these costs don’t seem to be affecting certain fast-food companies. Some popular fast-food companies are seeing their shares go higher recently, right – McDonald’s, Wendy’s, Restaurant Brands International – they operate Burger King, among others, like Tim Hortons, and Popeyes; Yum! Brands, which has Taco Bell and Habit Burger Grill. There are others as well. So, the processing companies appear to be suffering, while fast-food is benefiting. And I was looking at the U.S. CPI … and I know you mentioned this in your report, Sean – the Consumer Price index – that the average price per pound of ground beef rose to a new record high in May, up 3.6 percent over the prior month, and a little more than 25 percent since the start of 2021. So, that’s even bigger than the 17.7 percent increase over that same period for all meats, poultry, fish, and eggs category in that report. So, how can we explain this? How can we explain that on the back of this inflation, on the back of higher live cattle food prices, at least from say McDonald’s – they’ve pretty recently raised the prices on certain of their menu items and their global comparable sales were up over 12-and-a-half percent in the first quarter. It’s like Coca-Cola, Hershey, which we talked about in previous podcasts…. It seems that demand is still there. So, same questions for Jeff: What are we seeing with these fast-food stocks? And those relationships with the meat processors that we talked about? What conditions are driving the fast-food sector prices outside of demand? I mean, the cost must be higher for them.

Jeff Praissman

So, first of all, you’re right, the fast-food stocks are trading at or near their 52-week highs. It seems, at least for the time being, they’ve been able to successfully pass off the increased cost to either the consumer and continue to thrive … but, also, remember that many of these fast-food restaurants are franchised. So, corporate may also be able to pass off some of those costs to the franchisees through their product. And, also, I think a lot of these restaurants might become an affordable alternative for people who may be trading down their restaurant choices. So, in other words, maybe people who might be going down to a sit-down restaurant with their kids are maybe now instead going to a McDonald’s or a Wendy’s. Because while it’s more expensive than it used to be for what those families are used to, it’s actually a cheaper alternative than their prior dining experience.

Market Outlook + Food Inflation

Steven Levine

Sean, do you think it’s going to keep going in this direction? What’s your outlook for the live cattle futures … the live cattle markets? Do you do you foresee that these conditions, where culling is continually needed, that the thin supply on the ground, is going to continue?

Sean McGovern

Our focus is really going to be on the water supply, and the water supply is not only thinking about drinking, you’re thinking about also, ‘What are the conditions on the range like’? What are the conditions on the pasture like?’ And in the United States, range conditions were horrible last year, as I already mentioned, and we just got the first national look from the USDA in May … to kind of give us what to expect throughout the summer as far as range and pastures look. It’s a little bit better, but only 33 percent of pastures are rated ‘good’ to ‘excellent’, while a larger 37 percent is ‘poor’ to ‘very poor’. That’s national. And, as we mentioned earlier, not all states are equal in their cattle production. If we go back to Texas, for instance, we’re at 26 percent of pasture land rated ‘good’ to ‘excellent’ – that’s up from 15 percent a year ago, but it’s still below average – and conditions have actually deteriorated significantly in most of the other big cattle states like Oklahoma, Missouri, Kansas, Nebraska…. All of those are experiencing double-digit percentage declines in ‘good’ to ‘excellent’ conditions. There is a little bit of consolation in there that the Western United States – specifically, Arizona, Utah, Nevada, California – they’re seeing really solid improvements in pasture quality, but their combined output, all four of those states, it’s only 1.7 million cows, or so, which is equivalent to maybe just one of the top five powerhouse states like Nebraska.

And so, given the smaller U.S. herd, it’s not surprising that the slaughter rates have been trailing 2022 levels through May already. The USDA sees beef production at 27 billion pounds in 2023, while next year’s beef production is likely to be 24.8 billion. That’s a year-over-year reduction of almost 2.3 billion pounds. Each of those figures is also a significant decline from record U.S. beef production in 2021, which was well over 28 billion pounds.

The real question at this point is how much of these supply-side issues are already priced into the contract? You know, the drought conditions are not a surprise anymore. We know traders will be looking at the longevity of the dryness – whether they’re getting better or worse – and we’ve seen that prices have already come off of the record highs throughout the past week. But there could be more upside if the water supplies, and other weather dependent conditions, take a turn for the worse throughout the summer.

And I’ll just add when it comes to the fast-food guys, if we talk about that, I think it comes back to the inelasticity of demand we mentioned with beef in general, and an improvement in the outlook for economic growth that’s kind of been boosting stocks across the board recently. It’s just a really positive macro factor. But I do think that both of them are finite, and stocks can’t continue to rise, or hope to outperform, the benchmarks if that’s what’s driving them. McDonald’s, you mentioned – it’s a really interesting example since it wasn’t until last quarter they finally saw some pushback to their price hikes, and the company explained that primarily as items purchased per transaction – that metric was beginning to fall off by just low single-digit percentages. And an interesting trend we might begin to see is a shift back to eating at home as those prices continue to mitigate. You mentioned the CPI, and it should be noted that the index’s ‘food at home’ component – that’s been rising by double-digits until pretty recently, outpacing the ‘restaurant, other prepared food’ prices. It was only up 5.8 percent in May, whereas data showed ‘food away fr om home’ was still up 8.3 percent. And if we see more resistance to restaurant food inflation, I think that could be tied to the smaller price increases that we’ve seen for ‘food made at home’.

Steven Levine

Not only do you have to maybe spend a little bit more at the grocery store for these products, but you also have to make it yourself, and that’s just like an added cost in some ways, I suppose. But, maybe also you could think about shrinkage in terms of the menu items that places like McDonald’s sells? And, so, maybe instead of a Big Mac they’ll have like a Little Mac…or?

Sean McGovern

Medium Mac.

Steven Levine

Yeah, something like that. They’ll have it in different sizes. They have Chicken Nuggets, right? So maybe they’ll have, like, you know, Big Mac Nuggets.

Sean McGovern

Big Mac Nuggets….

Steven Levine

Big Mac sliders. I think that would probably work.

Okay, so, it doesn’t look like such a bright outlook for the live cattle futures market in the sense that It’s going to cost meat processors more, and at the end of the day, it sounds like it’s just going to continually feed inflation in the way that we’ve been seeing, which also is not such a great sign, I would say.

Cocoa Futures PostScript: Heavy Metal Chocolate

Steven Levine (Cont.)

But let’s switch gears a bit, because we did have a listener, who wrote in about our ‘Cuckoo’ for Cocoa Futures podcast. It’s not cattle-related – it’s a sort of postscript, or an addendum, to our discussion about that podcast. And we had a comment from a listener:

‘Listening to your cast on cocoa markets and wanted to point you in the direction of the 800 pound gorilla in the cocoa room – heavy metals found in the cocoa supply.’

So, for this listener, and others who may be concerned about this topic, I thought we’d do them a disservice if we didn’t address it. So, I did some research, and I found that Consumer Reports had a few pieces, actually, one as early as December of last year, and it found that certain brands had high levels of cadmium, such as Lindt’s Excellence Dark Chocolate, 70% Cocoa – and I do look for a benchmark of like 70 percent cocoa – that’s one that had it. It is a maker of chocolate bars I like. Dove’s Promises Deeper Dark Chocolate, also 70% Cocoa … Tony’s Chocolonely Dark Chocolate, 70% Cocoa; Godiva’s Signature Dark Chocolate, 72% Cacao, which, I remember, you talked about, Sean; Hu’s Organic Simple Dark Chocolate, 70% Cacao; and Hershey’s Special Dark Mildly Sweet Chocolate, among others … these were all very high in lead content…. I was shocked.

So, I want to hear from you, Sean, about this particular risk to cocoa. To what extent does this impact the cocoa market? Does it have any bearing on the fundamentals, say, on the cocoa economics? There are other questions. Is it something that’s been deterring consumers in any significant way? I’m looking at the earnings from, say, Hershey. I haven’t seen it. But maybe it would have been more. Maybe there would have been more organic sales. I don’t know. Maybe the figures would have been even higher without this concern. So, what are your thoughts on this, Sean? Heavy metals in the cocoa supply. I’d like to hear from you too, Jeff.

Sean McGovern

Well, I guess it’s something I’m going to have to think about a little bit, but that’s on a personal level. As far as the market goes for the commodity itself, I’m not sure it really impacts it all that much. You know, a lot of foods have some amount of heavy toxic metals in them, and toxicity is really – it’s on a spectrum, right? Obviously, just because something’s toxic doesn’t mean consuming it is necessarily going to cause damage to you, right? It really comes down to moderation. I honestly feel that the sheer amount of calories in the chocolate that that you would need to consume to really harm your health with the cadmium – that would probably be just as big of a threat to your health as the cadmium itself. You know what I mean? So, cadmium is a carcinogen, but ironically enough, a lot of nutritional organizations out there consider red meats like beef, which we’re just talking about, to be a carcinogen as well. Fish – they contain lead…. Even our own bodies – they contain some amount of lead, particularly in your teeth and bones. And now I’m not any authority on nutrition beyond counting my own calories, but the reality is, so many foods expose us to certain chemicals, and there are FDA [U.S. Food & Drug Administration] regulations that broadly cover these exposures in the food supply. So, I would say personal moderation is really the big thing there, and I can’t imagine that it’s going to be impacting the cocoa market all that much, insofar as what we’re talking about with commodities.

Steven Levine

That makes a lot of sense. I’m worried about Jeff now, though, because he eats bags and bags of Halloween candy. So, I’d love to hear about his take on it. If you saw this in the Consumer Reports piece, Jeff, I think that you also would probably be a little bit concerned, I’m sure.

Jeff Praissman

I am a little bit concerned, because I basically just finished a bag of bite-sized Hershey chocolates before this podcast. So, this is actually news to me. But I agree with Sean, where a lot of this stuff is – I don’t want to discount the study – but, you know, a lot of this stuff – if it’s occurring naturally, I don’t think it’s nearly as bad as people make it out to be. Where it’s, you know, I think in my opinion, something occurring naturally in the chocolate is much different than something that’s occurring not naturally in a substance. I do agree that, you know, moderation is good, and I try to follow that. But, again, as we know from the previous podcast, me and chocolate go together pretty well.

Sean McGovern

There’s something to be said about maybe innovation – in the way that we process these foods. I know Hershey has actually made a statement about this. They’ve come out and said that they already have certain processes to remove certain amounts of cadmium and other metals from the cocoa before they put it into the chocolate. And a lot of people … I’m not sure they’re really aware of how it actually – these metals – get into the chocolate, and it’s different for both. So, cadmium – it’s in the soil, and it gets taken up into the cocoa through the roots, right? It’s just like any other way that you consume food. Your body would probably have some trace amount of it, right? Lead is a little bit different, though. When they bring the cocoa out of the ground, they put it out in the sun to dry for a few days, and what happens is that there’s all this soil getting swept around by the wind, and that lead ends up getting on the cocoa, as it’s out drying. So, both of these ways that that cocoa gets exposed to these metals is just through the same soil that it grows from. I’m not really sure you can have cocoa without having these metals, because there’s a reason it grows where it does. That’s a very specific kind of soil. It’s a very specific kind of climate, and it becomes very difficult to eliminate those factors – unless maybe you start talking about genetic editing of these plants or something, but that’s a whole other topic….

Steven Levine

Well, we should talk about that at some point, but if I knew nothing about it at all, and I looked at that Consumer Reports piece, I would be somewhat frightened just by looking at the levels. And I can understand how our listener picked up on it and wanted to address it. But I feel a little bit better listening to both of you, and I do like the point about the USDA not approving these products unless they felt as if there were some safety risks or hazards to our health that would preclude them from being sold. So, all good. And yes, I don’t eat enough chocolate probably to substantiate it, at least not anymore.

This is really great. Sean, Jeff, again, thank you both very much for taking the time to do this. It was extremely informative.

For our listeners, you can read more commentary and market analysis at IBKR Traders’ Insight at our newly launched IBKR Campus at www.interactivebrokers.com. You can keep abreast there about topics we’ve discussed today, as well as a wide range of other news critical to your investment decisions. McAlinden Research Partners has a host of articles on several themes from central banks and gold buying to issues involving cybersecurity. Please contact Rob Davis for more details at [email protected]. For a full list of financial education offerings, visit the IBKR Campus, where, as always, all of our educational material is provided to the public at no cost.

Additionally, I wanted to mention that since we’re on the topic of agricultural commodities and futures, Andrew Wilkinson, director of trading education here at IBKR, also recently spoke with Dan Basse, President of AgResource, about the corn, soybeans, and wheat markets ahead of the June 30th USDA crop report. I encourage our listeners to check that out as well.

And wherever you listen to your podcasts, please rate, and review us. We’d love to hear your feedback. And until next time, I’m Steven Levine with Interactive Brokers.

—

LEARN MORE

WHAT’S FOR BREAKFAST – PODCAST SERIES

Eyepopping Corn Prices – Fueling Food Inflation

The War on Wheat – How Much Bread Is on the Table?

IBKR TRADERS’ ACADEMY

- Courses On Futures

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

MORE FROM McALINDEN RESEARCH PARTNERS

- Wheat Prices Surge as Dam Devastation and Intense Combat Wilt Hopes for Resilient Ukrainian Harvests (6/22/23)

- Near-Record Cattle Prices Sustained by Drought Conditions, May Indicate Continued Culling Ahead (6/20/23)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Excellent podcast discussion! I haven’t been involved in cattle futures/options in the past and I wanted to get a ‘primer’ on the space. This discussion was a great intro, addressing the mechanics of the market, the catalysts that impact price action, and the related industries and equities that are additional ways to invest/trade in this space.

Thanks for a real value-add session!