The relationship between crude oil and pipelines exhibits the qualities of a copula distribution. This was suggested to us last week by a highly numerate financial advisor, commenting on the tendency of the midstream energy infrastructure sector to have its biggest falls when oil is also collapsing.

It is an unfortunate historical truth that a sharp drop in economic activity, such as at the onset of the pandemic, can depress both the price of oil and expectations for volumes of hydrocarbons passing through America’s pipelines. At such times investors recall being told it’s a toll model largely indifferent to commodity prices. This is true, but when commodities fall far enough it can signal a drop in volumes.

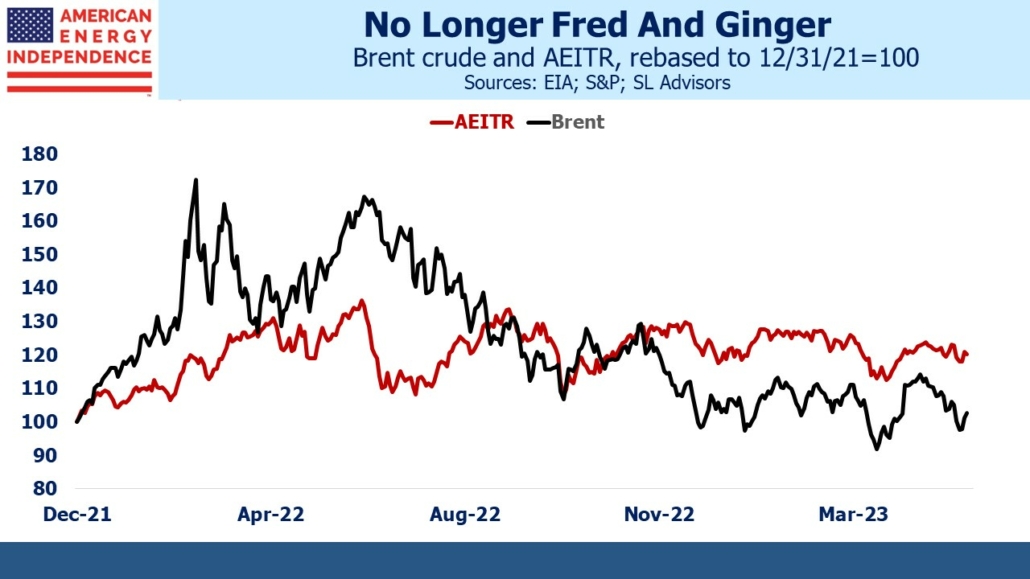

This is why the weakening relationship between the two is so welcome. Since mid-April Brent crude has shed $10 per barrel, while the American Energy Independence Index (AEITR) is close to unchanged. America’s regional banking crisis is one of the causes. Signs of the credit crunch are few, but a bank whose regulator is checking on their liquidity is likely to be trimming its risk appetite.

Construction loans would seem especially vulnerable. 350 California Street in San Francisco is expected to sell at an upcoming auction for 80% less than its $300 million 2019 appraised value. This will provide a useful benchmark for commercial real estate. Hybrid work has hit the Bay area office market especially hard. But the city also shows how much wreckage unchecked liberal policies can inflict. City leaders are considering a slave reparations bill that would award $5million to every eligible black adult, to be funded by the other 94% of the city’s population. A commensurate population shift will likely follow. California is contemplating something similar, at a cost of up to $800BN.

The decoupling of pipelines from crude oil relies in part on stronger balance sheets. The median Debt:EBITDA for investment grade companies is 3.5X. Ten years ago 4-4.5X was common. Most businesses are on a trajectory towards further reduced leverage next year, driven by increasing EBITDA.

Since the beginning of last year, daily returns of oil and the AEITR have a correlation of 0.45. They move together more often than not, but it’s a weak relationship. Following Russia’s invasion of Ukraine crude oil gyrated wildly while pipelines trended up. Crude was up over 50% by midyear, while the AEITR was +13%. During the second half of last year crude fell over 30% while the AEITR was +7%. So far this year they are down 5% and flat respectively.

The AEITR has also been helped by 1Q23 earnings, which followed a familiar pattern whereby companies generally beat expectations by a few percent. Cheniere is usually the exception, once again reporting a huge beat with 1Q23 EBITDA of $3.6BN (versus $2.5BN expected). They also raised full year guidance from $8-8.5BN to $8.2-8.7BN.

The energy sector is sitting on a growing pile of cash. This also acts to shield companies from movements in oil and gas prices. Exxon Mobil finished the quarter with almost $33BN cash on hand. Six big global oil companies have almost $160BN in cash.

Midstream companies tend not to accumulate cash to the same degree but are returning it to stockholders with dividend hikes and buybacks. Capex is creeping up in a few cases, but for the most part financial discipline remains.

The other day an investor asked me why riskless treasury bills yielding 5% weren’t better than energy infrastructure yielding 6% but with equity volatility. The answer is that treasury bills won’t always yield 5%, and interest rate futures imply they’ll be at 3% by the end of next year. Ample dividend coverage with the continued prospect of increases will lead more investors to this sector once the Fed starts cutting rates. Two publications from the Fed on Monday showed that they’re starting to appreciate the risk of regional banks adopting a more cautious attitude towards new exposure.

Bill Gross told Bloomberg TV that he has 30% of his personal portfolio in MLPs. He referred to Energy Transfer as an ETF (he was appearing on ETF IQ) and likes the tax deferred yields. His comments are at the 15 minute mark.

A fixed income investor likes the yield on pipeline stocks. Ten year treasuries at 3.5% are an improvement on the past few years but still inadequate to prevailing inflation.

It’s also interesting to see that NextEra, the most valuable power company in America and a leader in renewables, is planning to invest $20BN in hydrogen. The tax credits in the Inflation Reduction Act (IRA) are an important driver. But solar and wind projects are facing increasing challenges. Danish company Orsted, Spain’s Iberdrola and a JV including Shell are all developing offshore wind projects in New England and have requested a regulatory review of contracts because of sharply higher costs.

Weather-dependent power that requires enormous space and long-distance transmission lines is a miserable future. Hydrogen is expensive, although less so under the IRA. But like natural gas it’s energy dense and dispatchable, meaning it’s there when needed not just when it’s sunny or windy. And it can move by pipeline. Midstream energy infrastructure companies will be ready.

—

Originally Posted May 10, 2023 – Oil And Pipelines Less In Sync

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.