Order Types and Algos

IBKR Pro Clients have access to over 100 Order Types, Algos and Tools

IBKR Order Types, Algos and Tools

IBKR Pro traders use our order types, algos and tools to implement trading strategies and help limit risks, speed execution, support price improvement, provide privacy, time the market and simplify the trading process.

Use the filters below and select a tile to learn more about how an order type, algo or tool can help you trade.

No results found. Please adjust your filter selections.

Algo

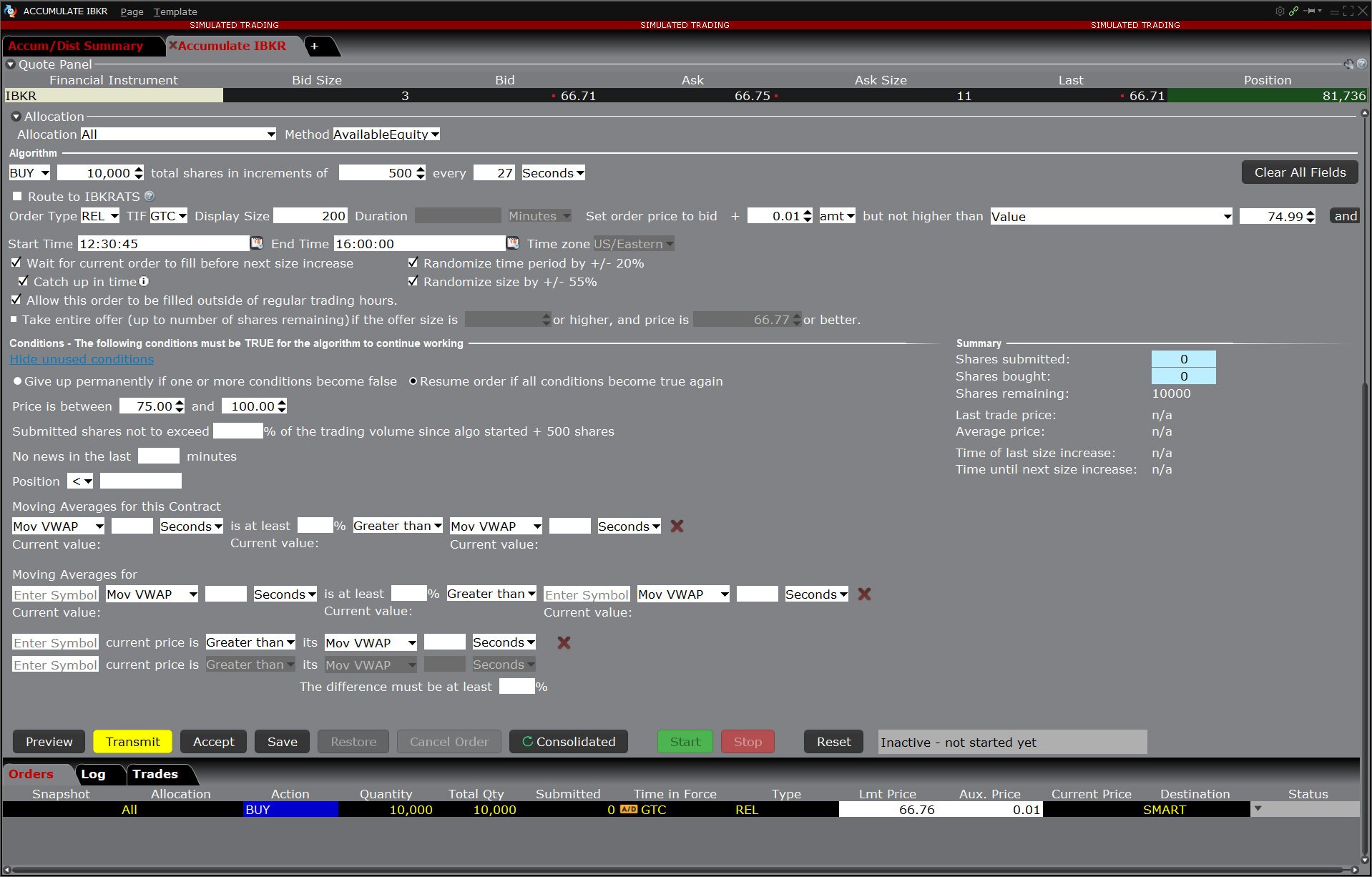

Accumulate / Distribute

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed, IBKR ATS

Video Lesson

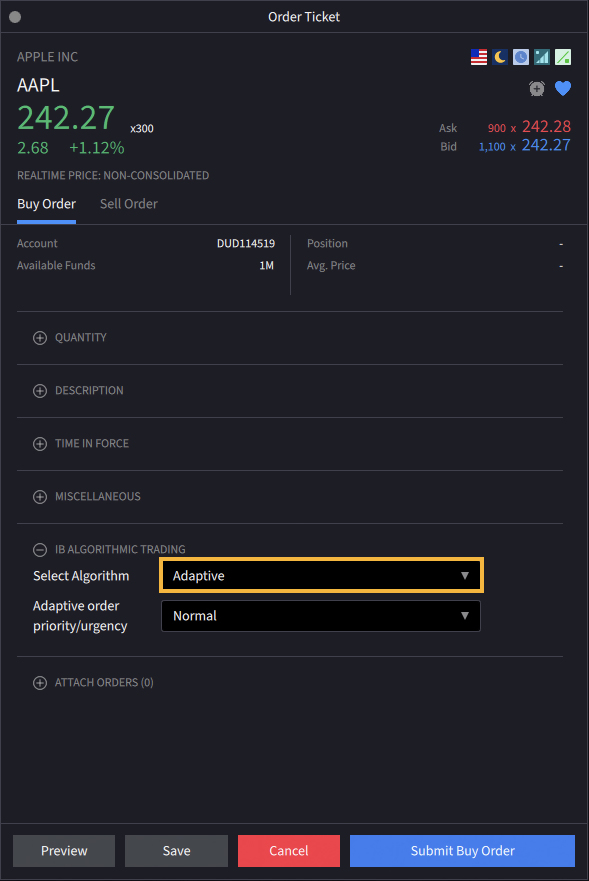

Algo

Adaptive Algo

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

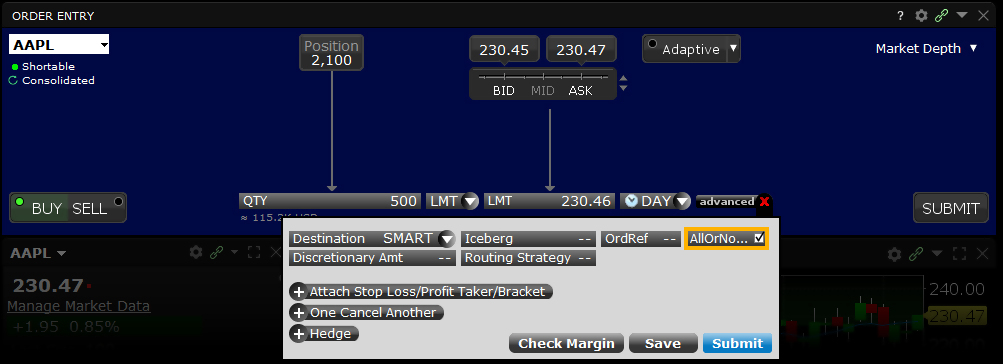

Order Type

All or None

Platforms: All

Regions: US Only

Routing: Smart

Video Lesson

Algo

Arrival Price

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

Order Type

At Auction

Platforms: TWS Only

Regions: Non-US Only

Routing: Directed

Order Type

Auction

Platforms: TWS Only

Regions: US Only

Routing: Directed

Order Type

Auto Combo Limit

Platforms: TWS Only

Regions: US & Non-US

Routing: Directed

Order Type

Auto Combo Market

Platforms: TWS Only

Regions: US & Non-US

Routing: Directed

Algo

Balance Impact and Risk

Platforms: TWS Only

Regions: US Only

Routing: IB Algo

Video Lesson

Tool

Basket

Platforms: TWS Only

Regions: US Only

Routing: Directed

Video Lesson

Attached Order

Beta Hedge

Platforms: TWS Only

Regions: US & Non-US

Routing: Directed

Tool

Block

Platforms: TWS only

Regions: US Only

Routing: Directed

Order Type

Box Top

Platforms: TWS Only

Regions: US Only

Routing: Directed

Order Type

Bracket

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

Algo

Close Price

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

Tool

Conditional

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

Tool

Currency Conversion

Platforms: Select

Regions: US & Non-US

Algo

Dark Ice

Platforms: Select

Regions: US Only

Routing: IB Algo

Video Lesson

Attached Order

Delta Hedge

Platforms: TWS Only

Regions: US Only

Routing: Directed

Order Type

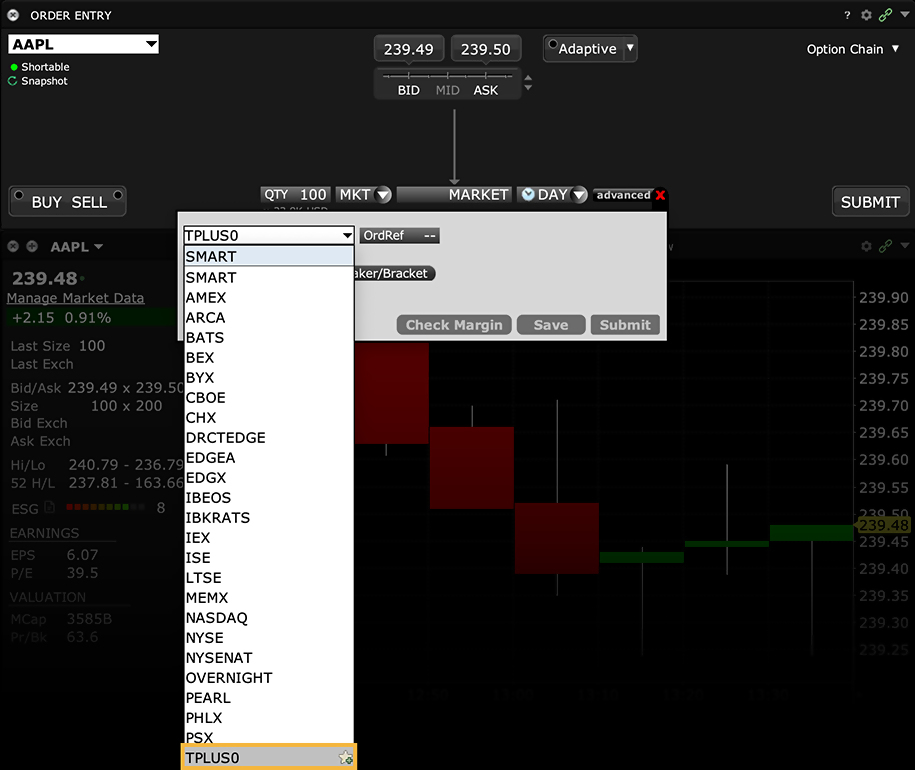

Direct Routing

Platforms: All

Regions: US & Non-US

Routing: Directed

Video Lesson

Order Type

Discretionary

Platforms: TWS Only

Regions: US Only

Routing: Smart

Order Type

Fill or Kill

Platforms: Select

Regions: US Only

Routing: Smart, Directed

Order Type

Fractional Shares

Platforms: All

Regions: US & Non-US

Routing: Smart

Video Lesson

Order Type

Funari

Platforms: TWS Only

Regions: Non-US Only

Routing: Directed

Attached Order

FX Order

Platforms: TWS Only

Regions: Non-US Only

Routing: Directed

Video Lesson

Order Type

Good After Time/Date (GAT)

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Order Type

Good Til Canceled (GTC)

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

Order Type

Good Til Date/Time (GTD)

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed

Order Type

Hidden

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

Order Type

IBKR ATS

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

Order Type

IBKR ATS Pegged to Best

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

Order Type

IBKR ATS Pegged to Midpoint

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

Order Type

IBKR ATS Reroute to SMART

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

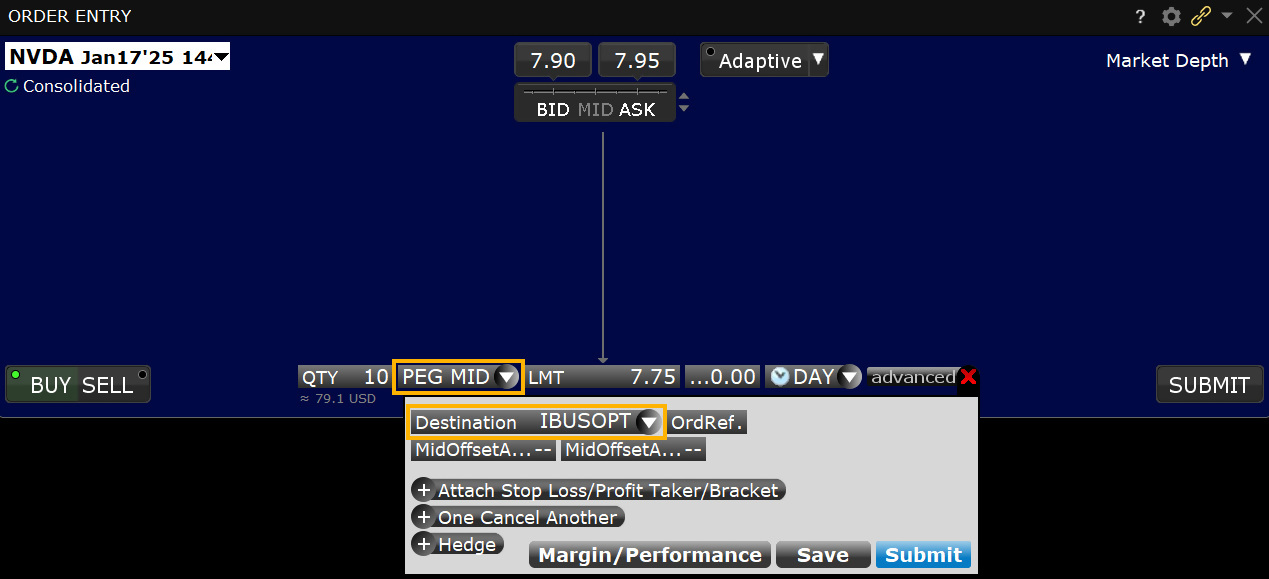

Order Type

IBUSOPT Destination

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

Order Type

IBUSOPT Pegged to Best

Platforms: TWS Only

Regions: US Only

Routing: Directed

Video Lesson

Order Type

IBUSOPT Pegged to Midpoint

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

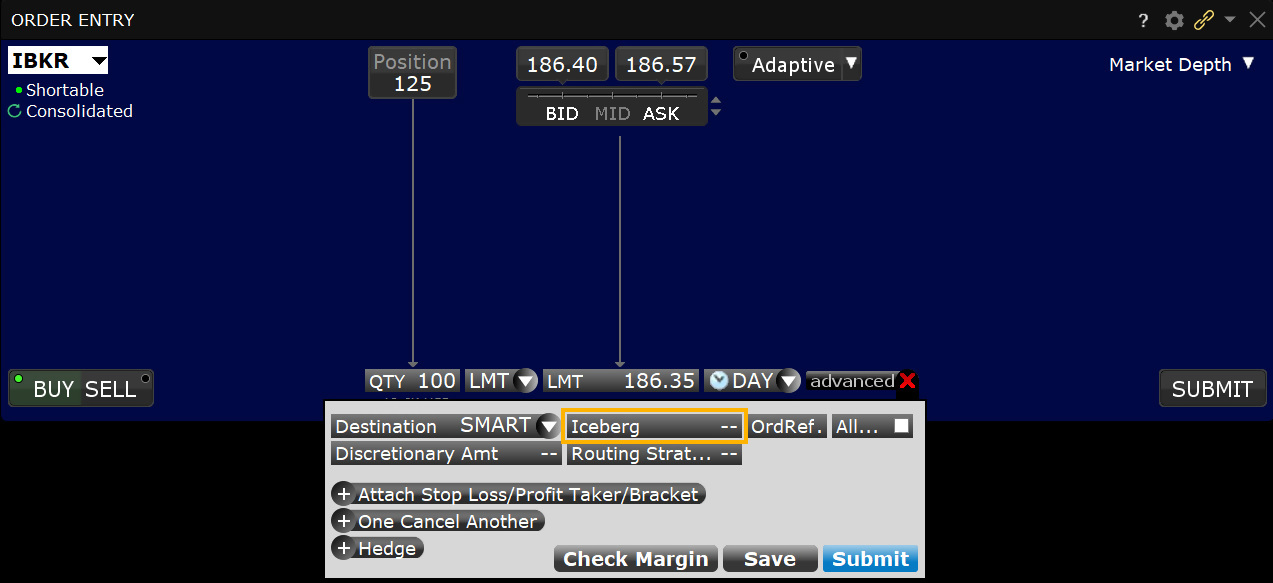

Order Type

Iceberg / Reserve

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

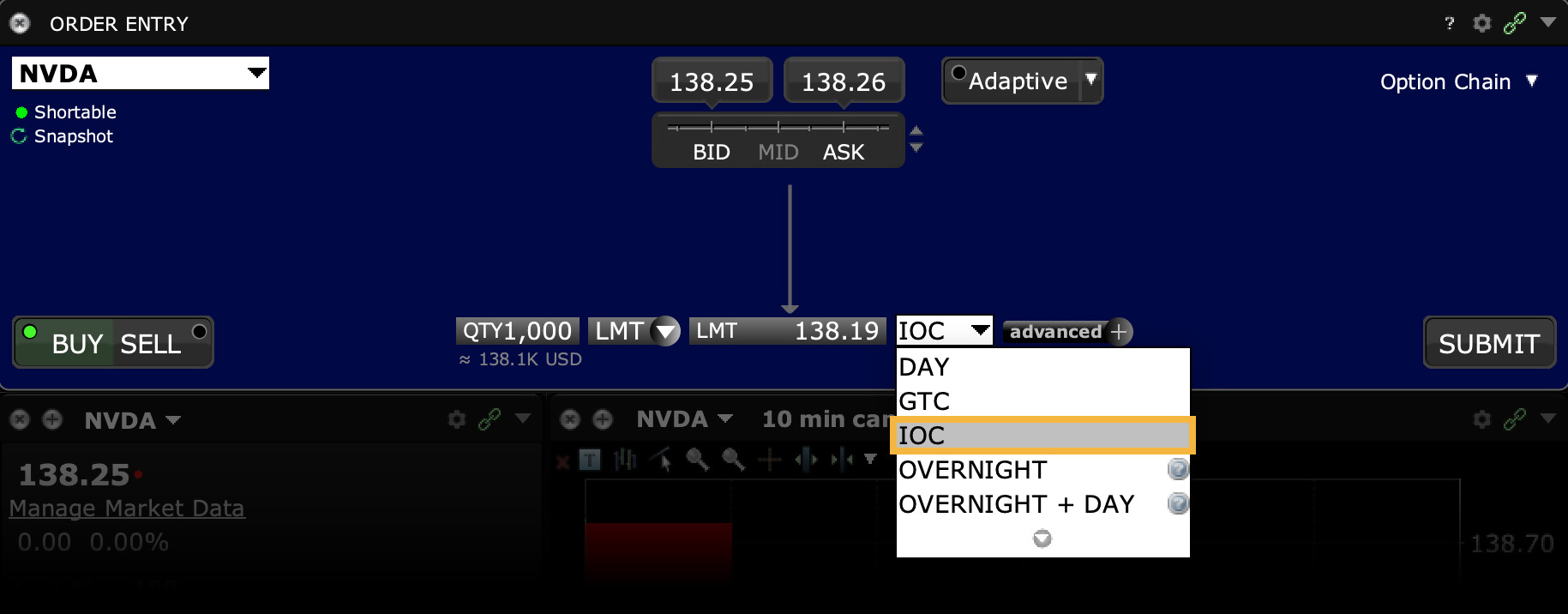

Order Type

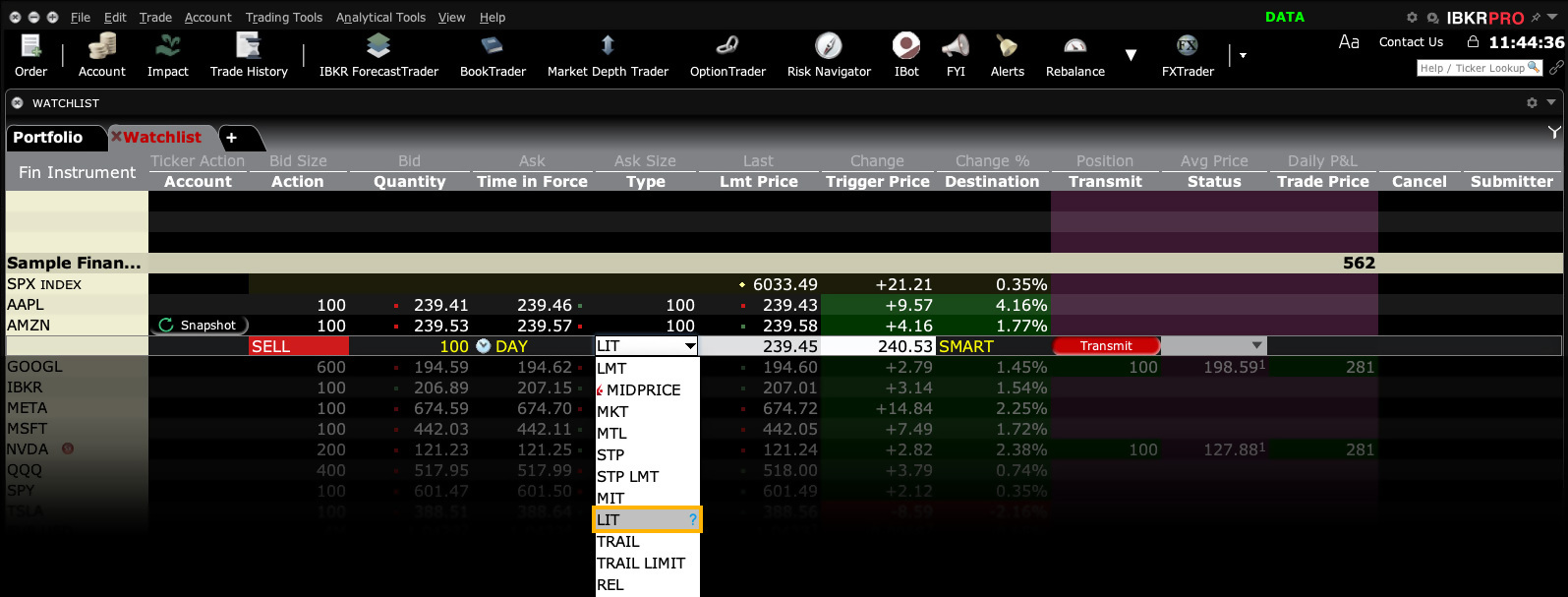

Immediate or Cancel (IOC)

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed

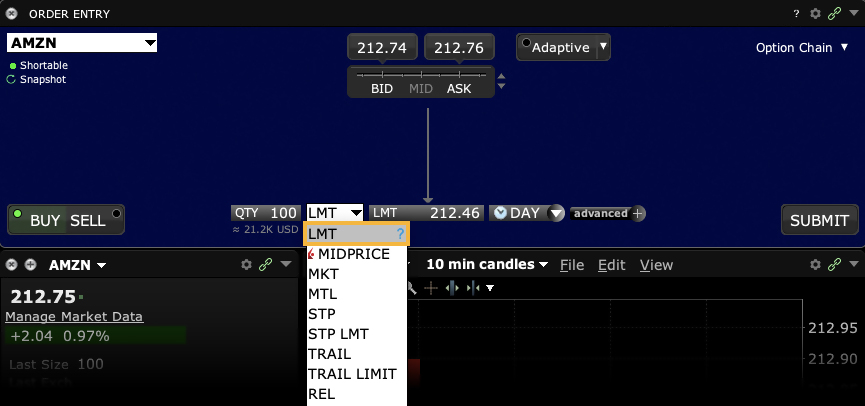

Order Type

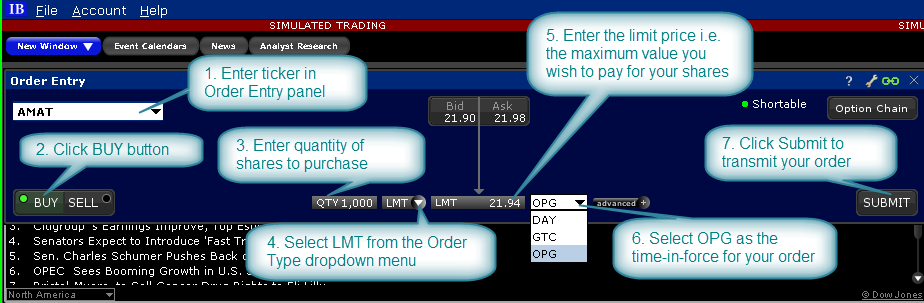

Limit

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed, Lite

Video Lesson

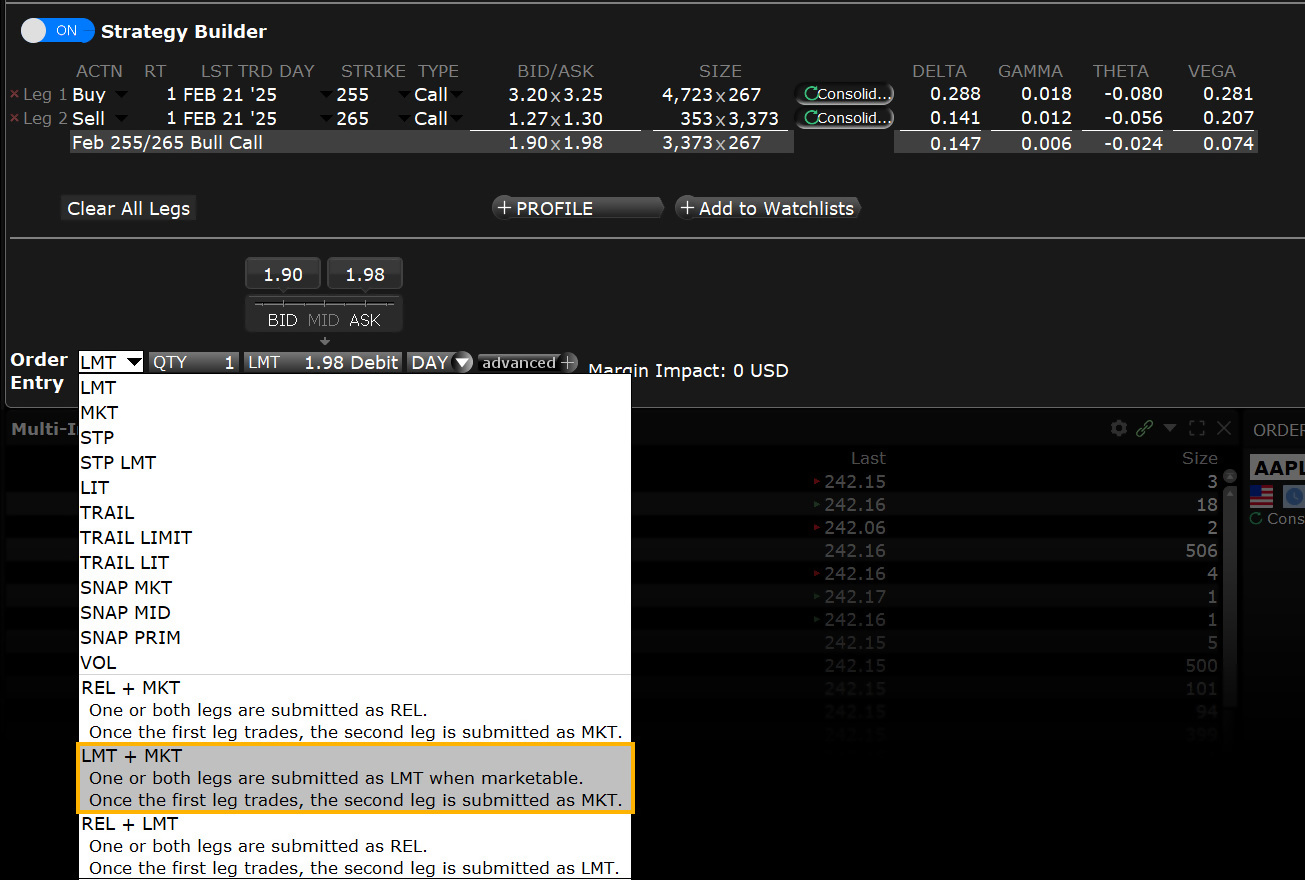

Order Type

Limit + Market

Platforms: Select

Regions: US & Non-US

Routing: Smart

Order Type

Limit if Touched

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed, Lite

Order Type

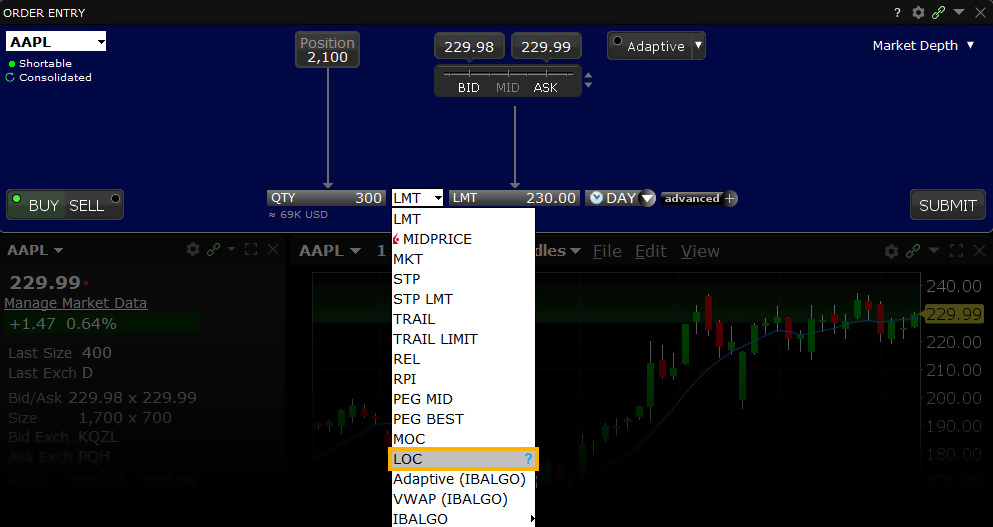

Limit on Close

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed, Lite

Order Type

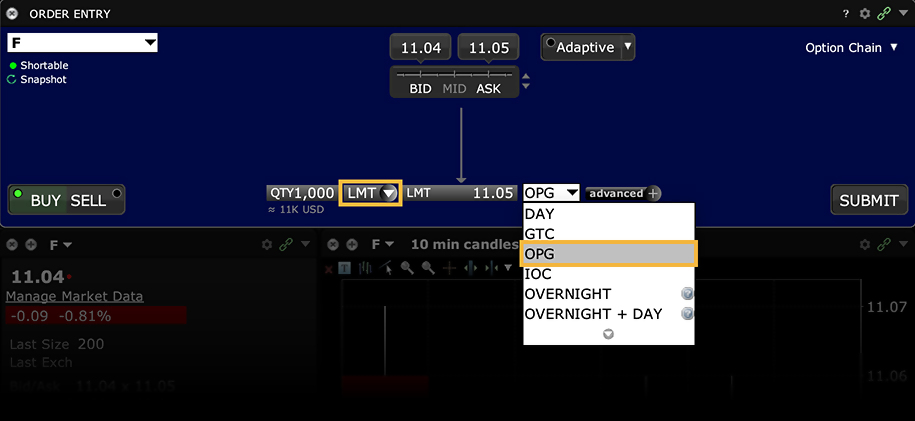

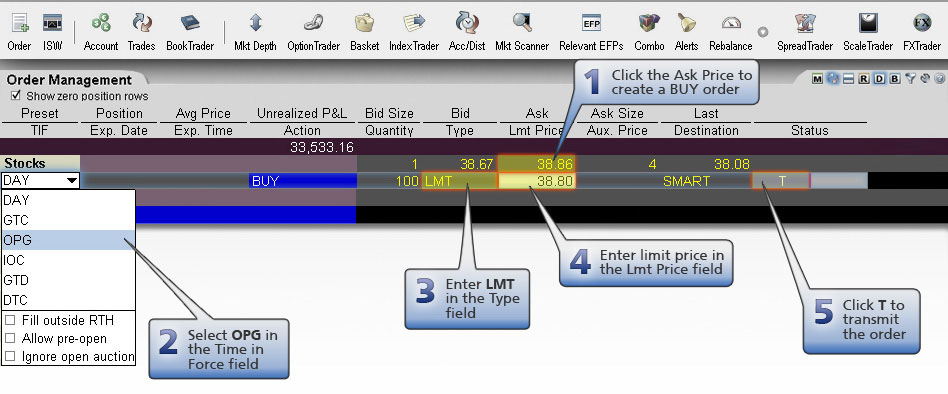

Limit on Open

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed, Lite

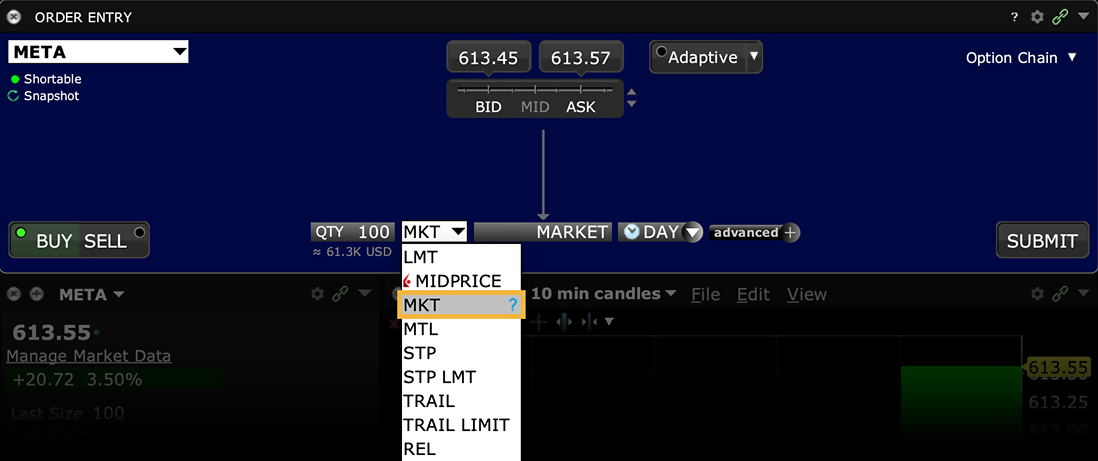

Order Type

Market

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed, Lite

Video Lesson

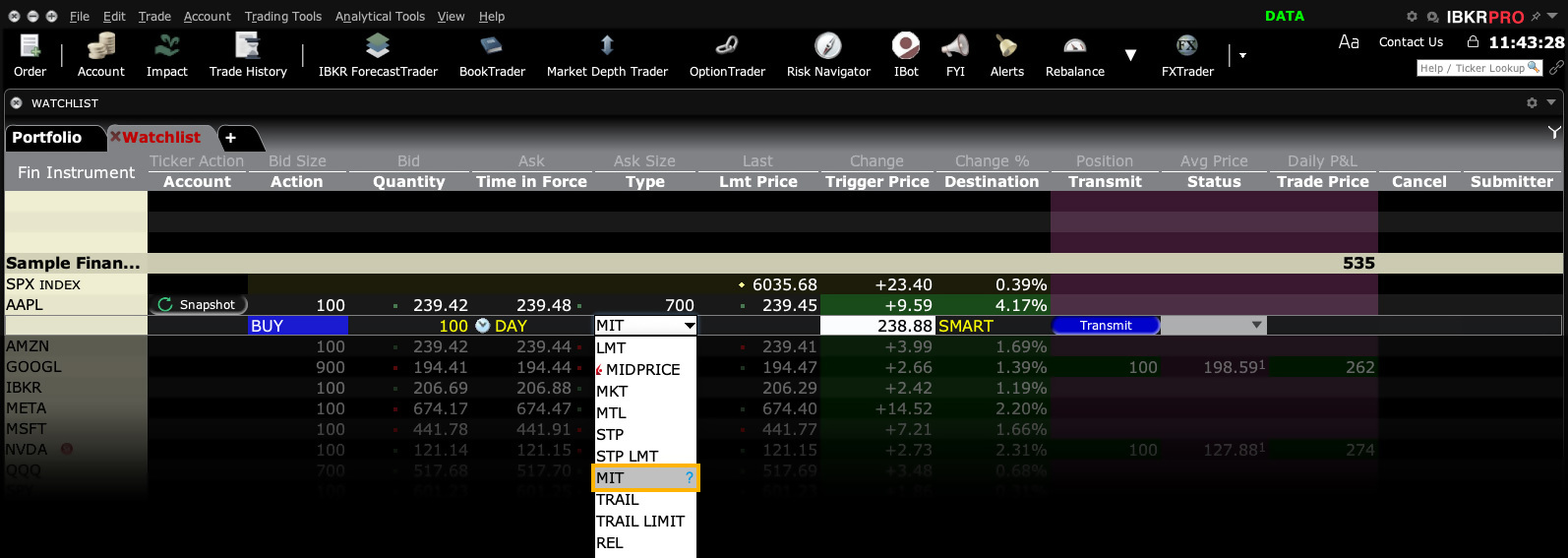

Order Type

Market if Touched

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed, Lite

Order Type

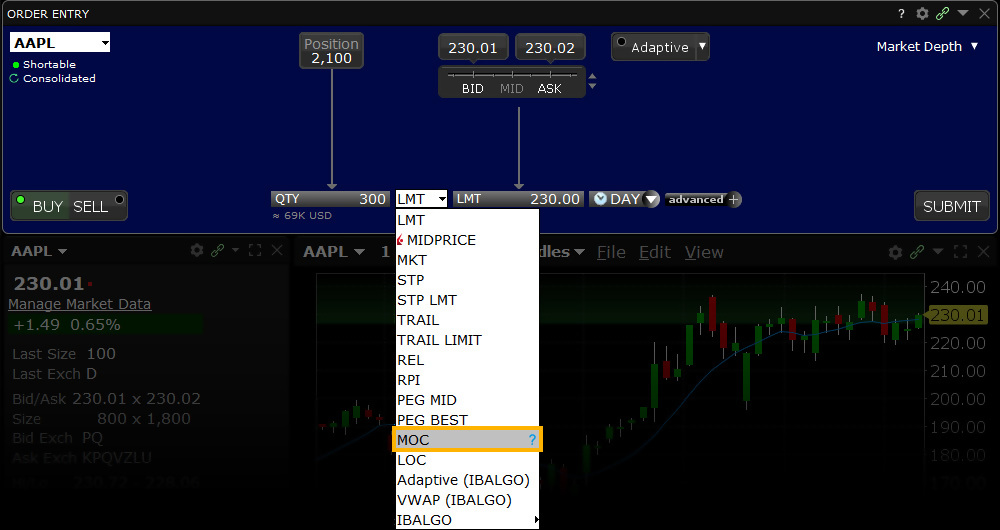

Market on Close

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed, Lite

Video Lesson

Order Type

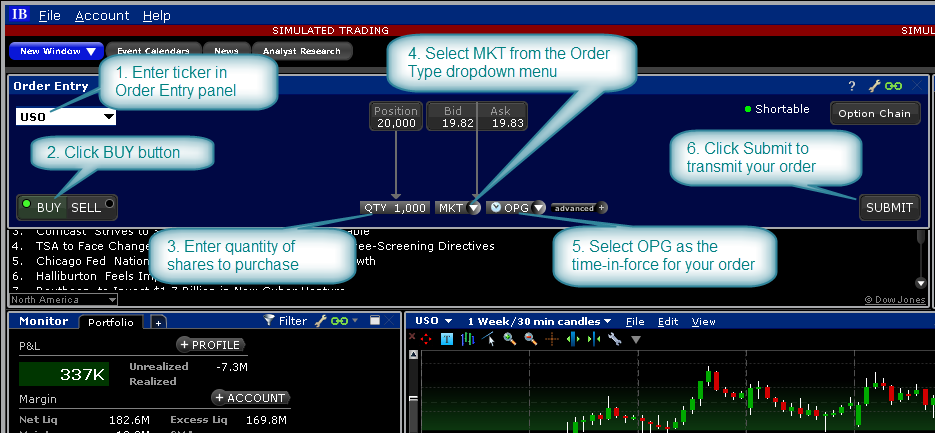

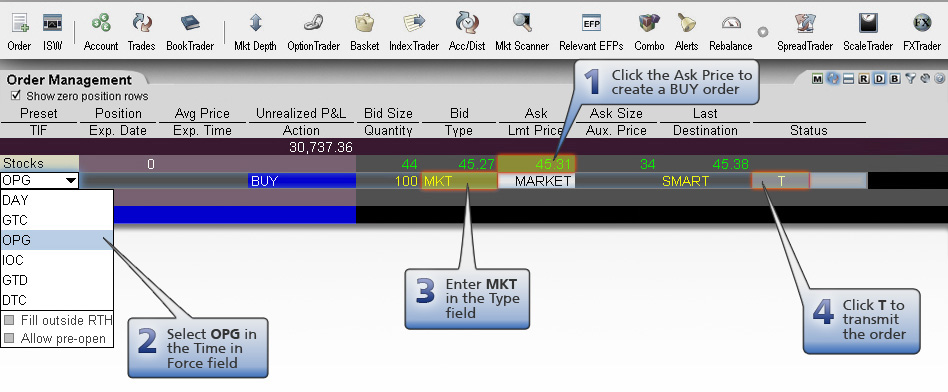

Market on Open

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed, Lite

Order Type

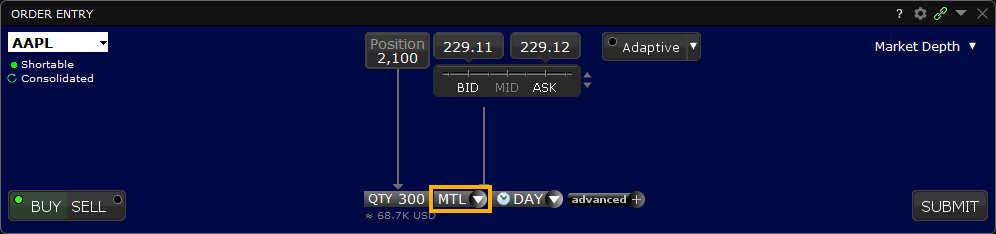

Market to Limit

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed

Order Type

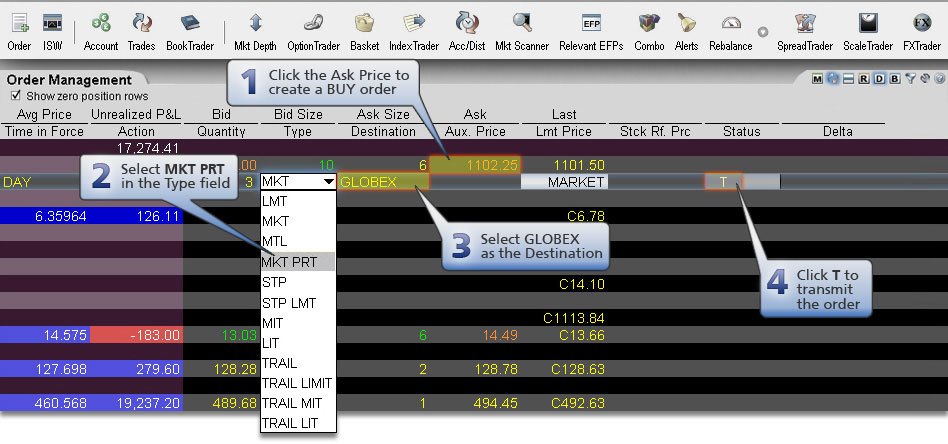

Market with Protection

Platforms: Select

Regions: US, Globex

Routing: Directed

Order Type

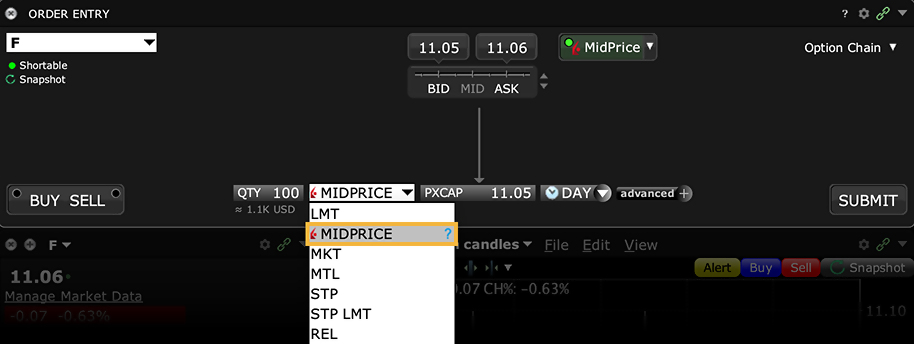

MidPrice

Platforms: All

Regions: US Only

Routing: Smart

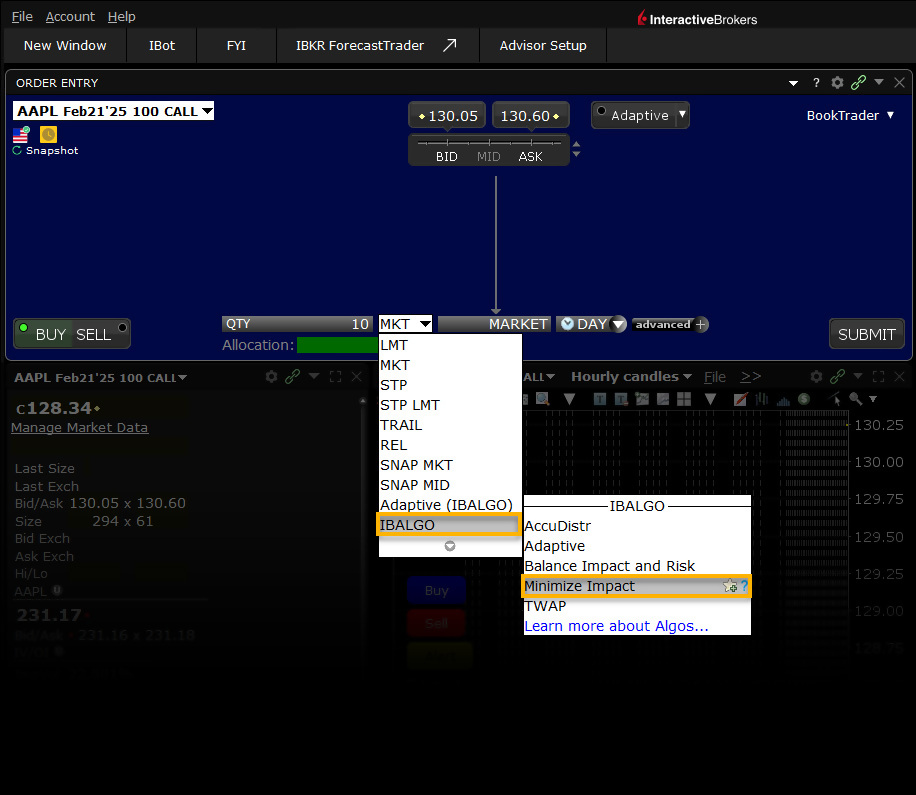

Algo

Minimize Impact

Platforms: TWS Only

Regions: US Only

Routing: IB Algo

Order Type

NYSE Closing Auction D-Quote

Platforms: Select

Regions: US Only

Routing: NYSEFLOOR

Order Type

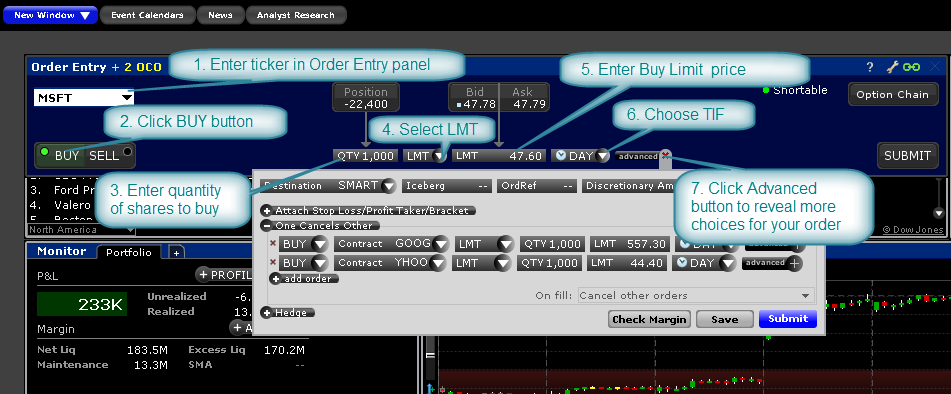

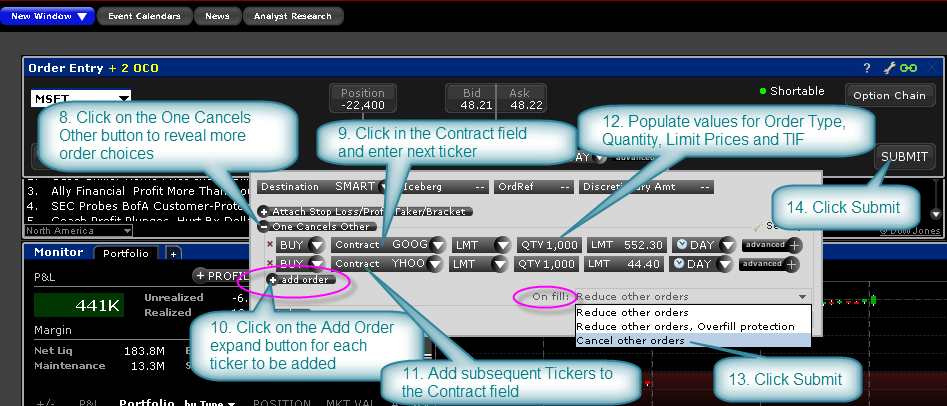

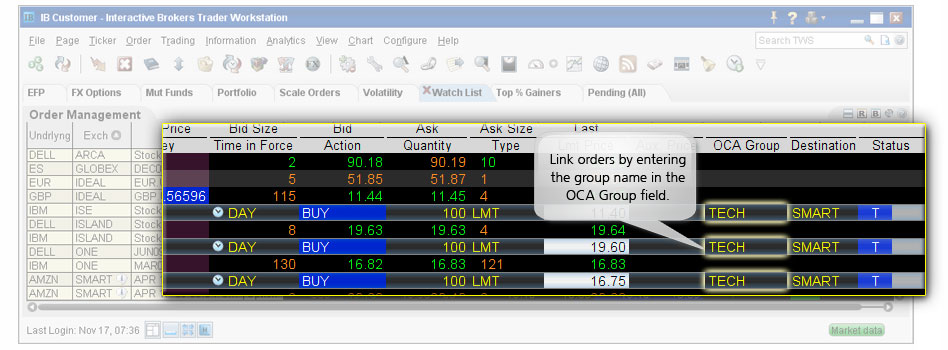

One Cancels All (OCA)

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

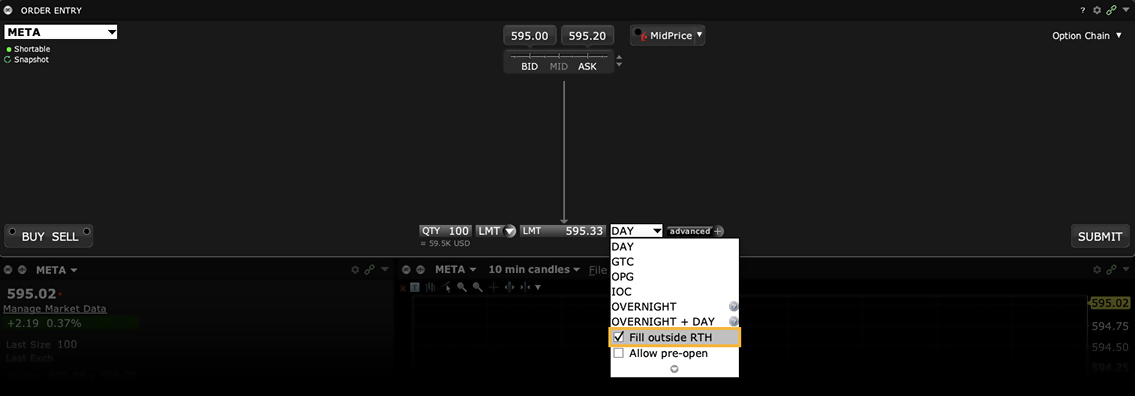

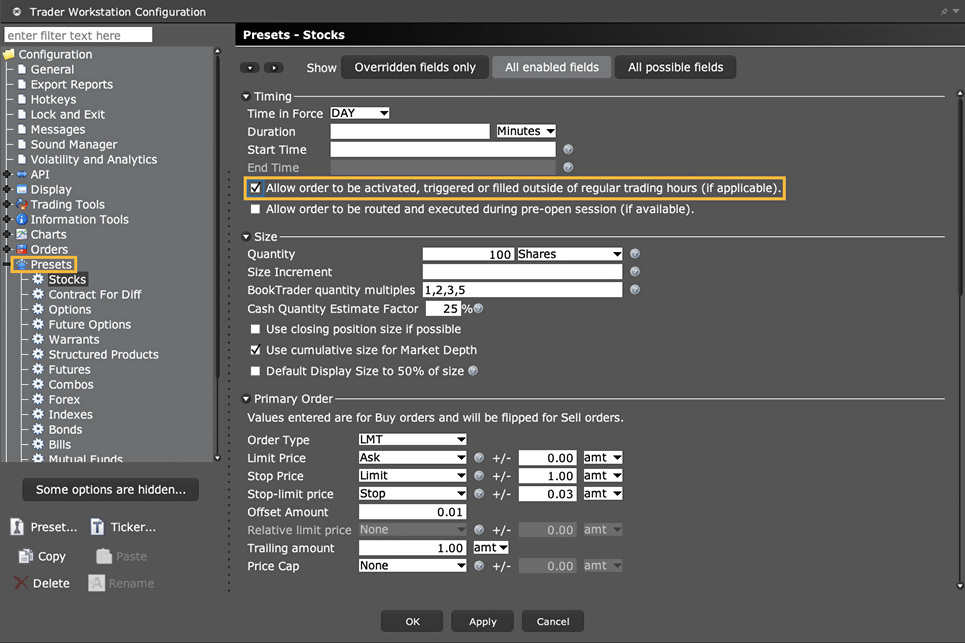

Order Type

Outside RTH

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

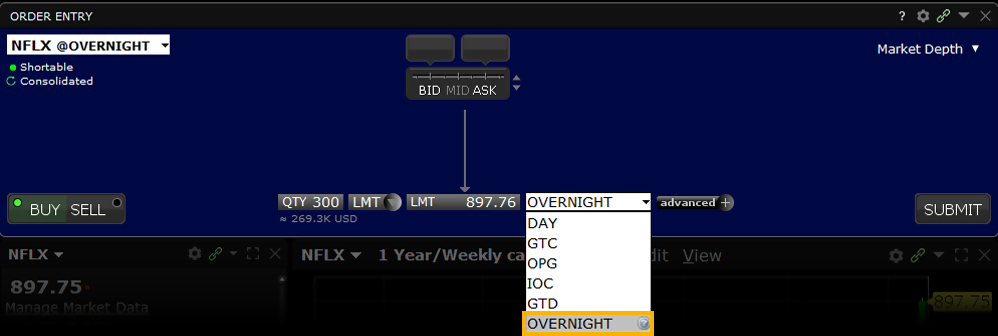

Order Type

Overnight Trading

Platforms: All

Regions: US Only

Routing: Directed

Video Lesson

Order Type

Overnight + SMART

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart

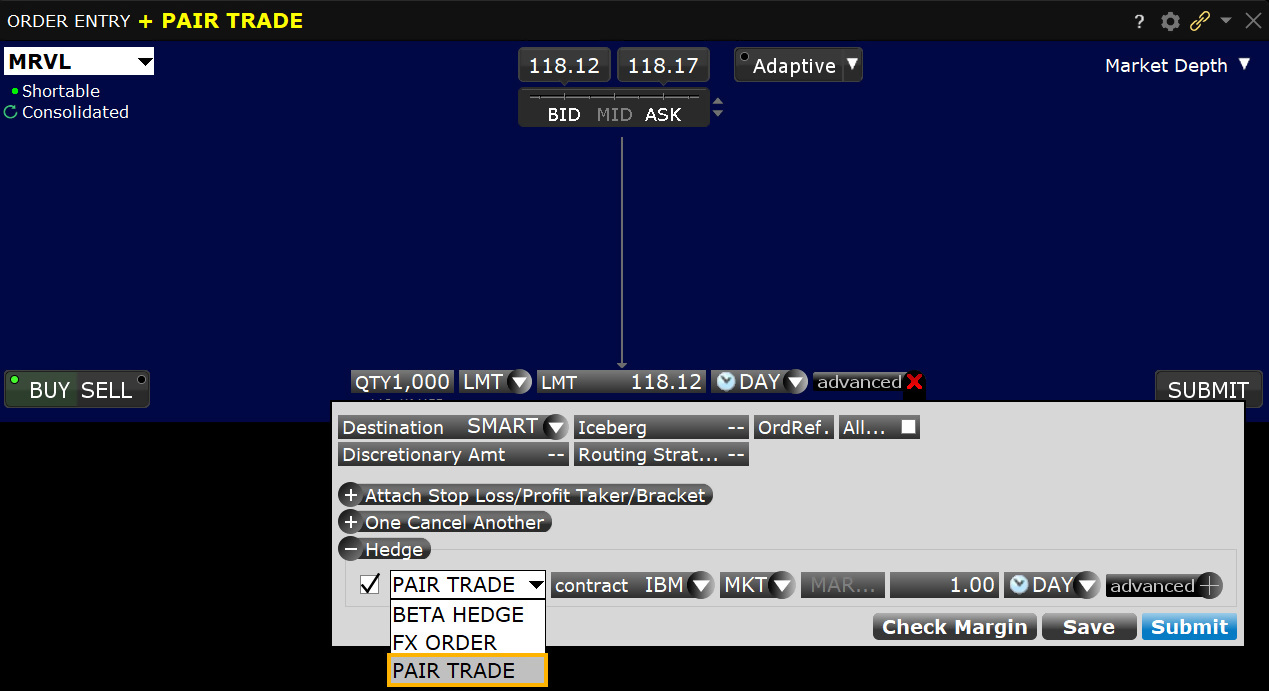

Attached Order

Pair Trade

Platforms: TWS Only

Regions: US & Non-US

Routing: Directed

Order Type

Passive Relative

Platforms: TWS Only

Regions: US Only

Routing: Directed

Order Type

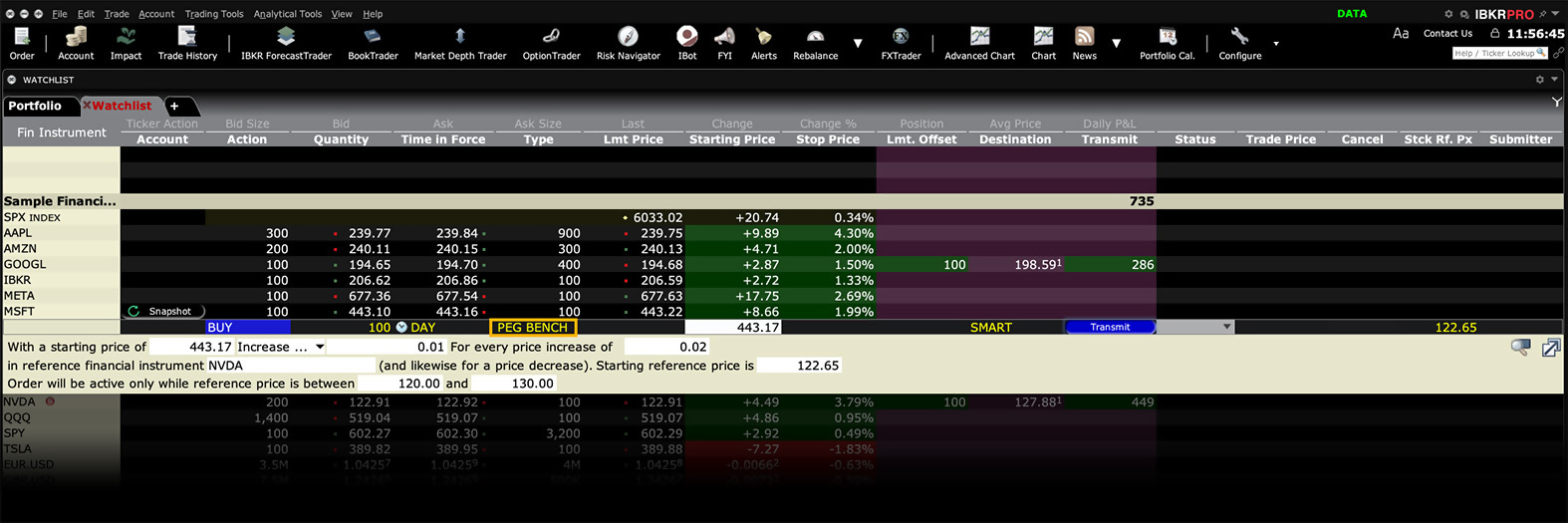

Pegged to Benchmark

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Order Type

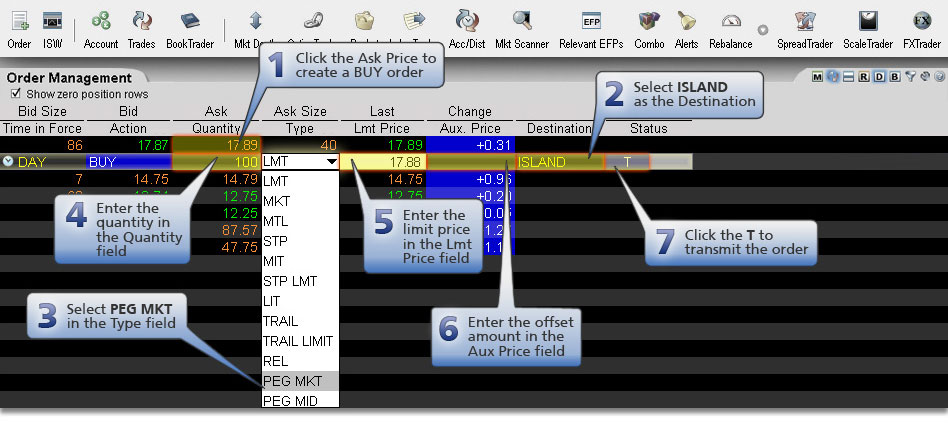

Pegged to Market

Platforms: TWS Only

Regions: US Only

Routing: Directed, Island Only

Order Type

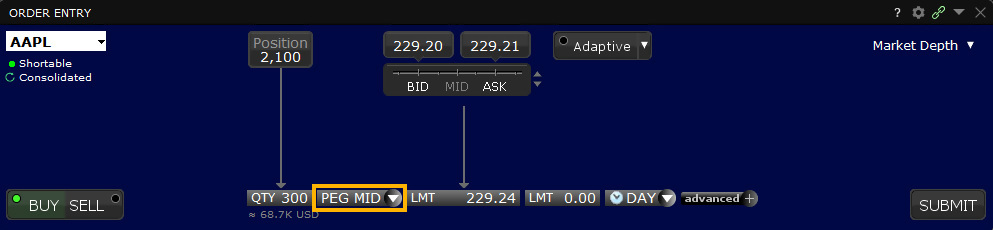

Pegged to Midpoint

Platforms: Select

Regions: US & Non-US

Routing: Directed, IBKR ATS

Order Type

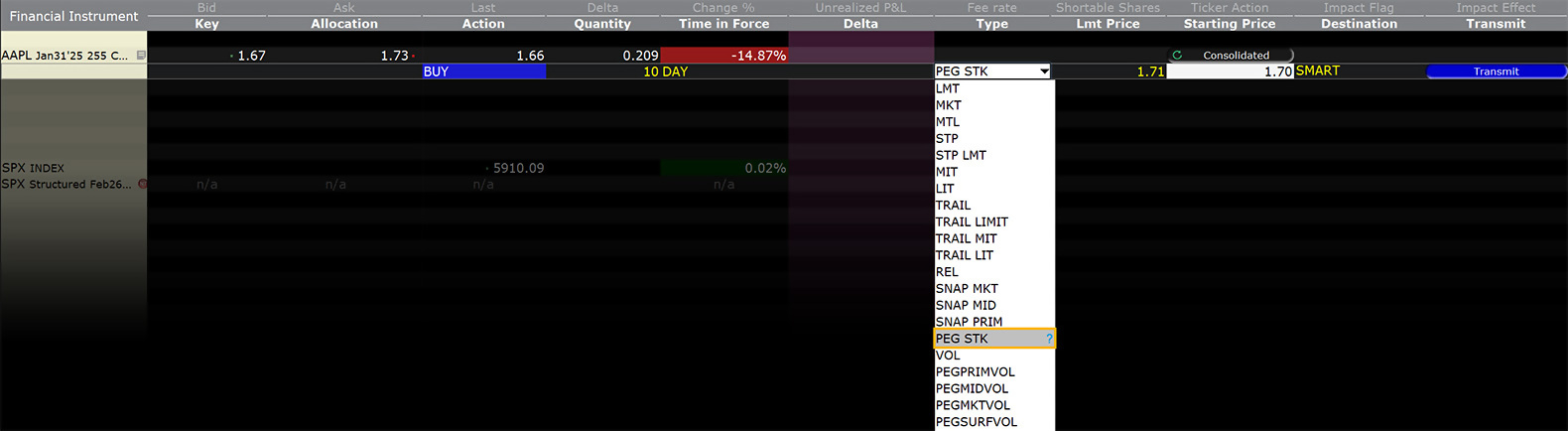

Pegged to Stock

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

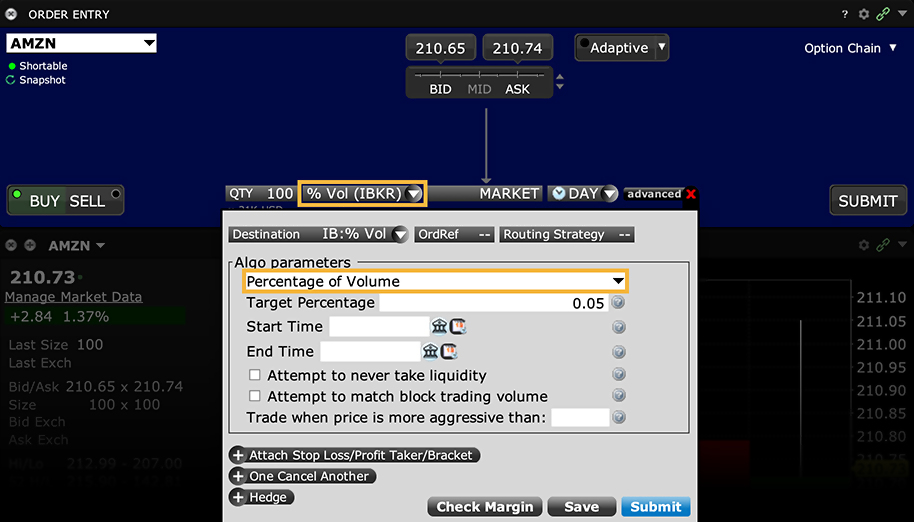

Algo

Percent of Volume

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

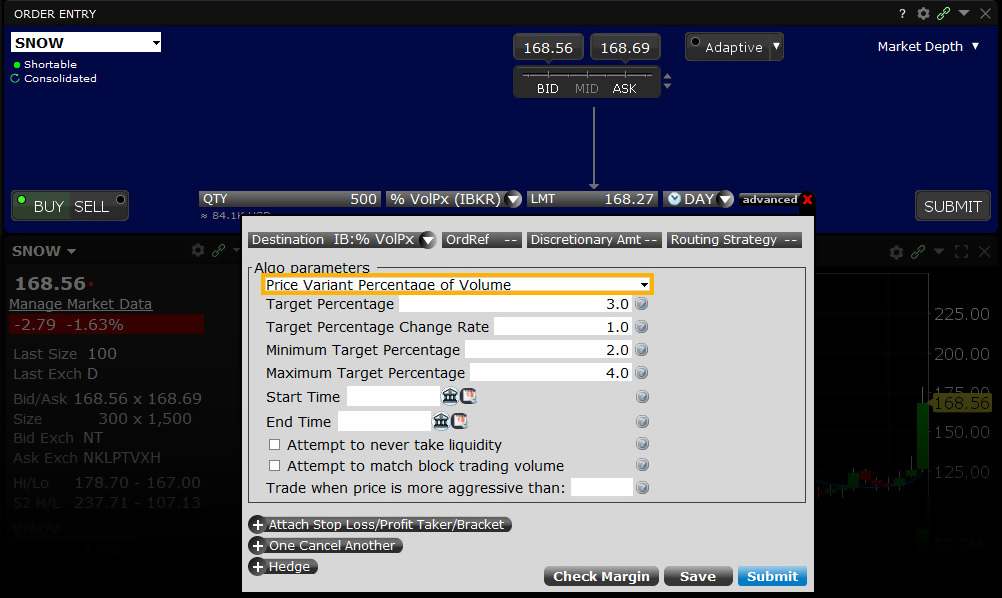

Algo

Price Variant Percent of Volume

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

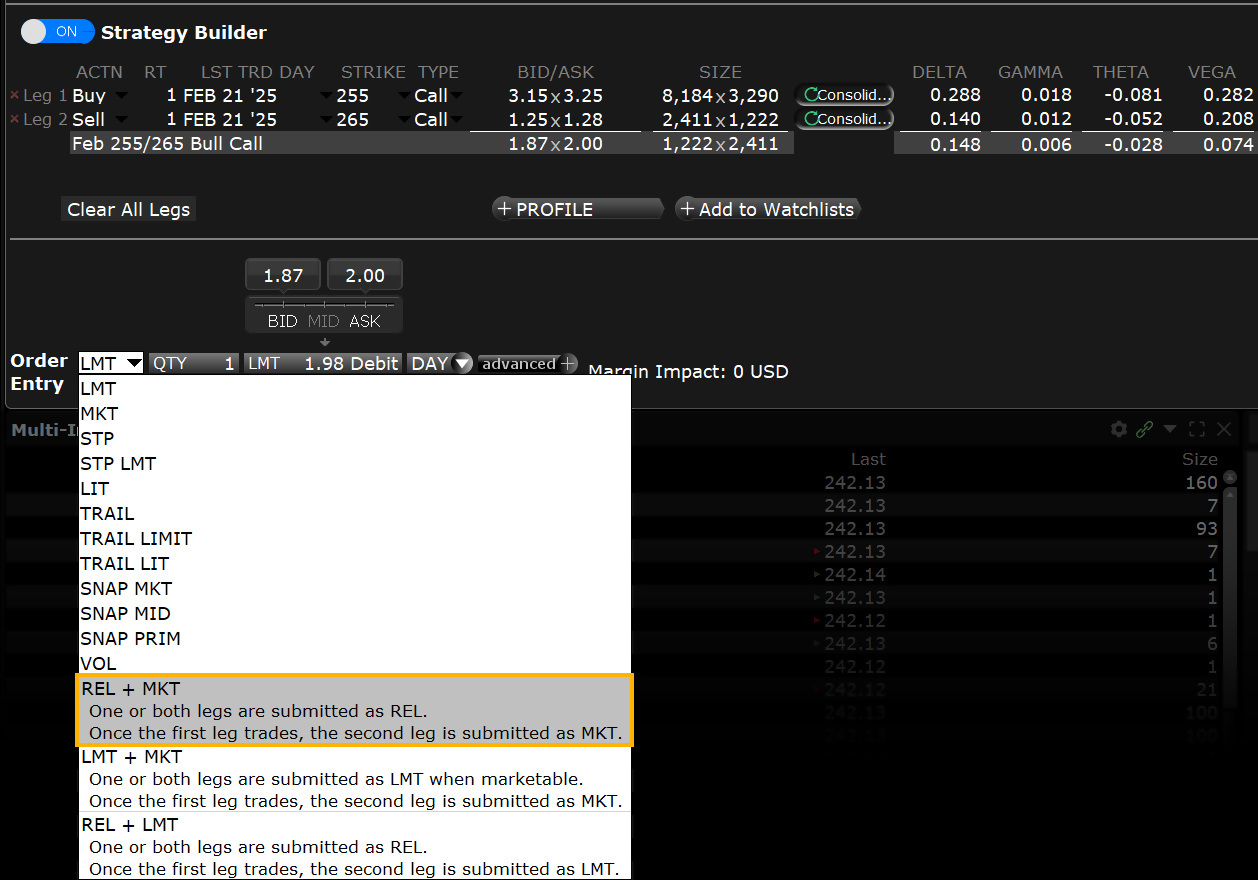

Order Type

Relative + Market

Platforms: TWS, IBKR Desktop

Regions: US Only

Routing: Smart

Order Type

Relative/Pegged to Primary

Platforms: Select

Regions: US & Non-US

Routing: Smart, Directed, IBKR ATS

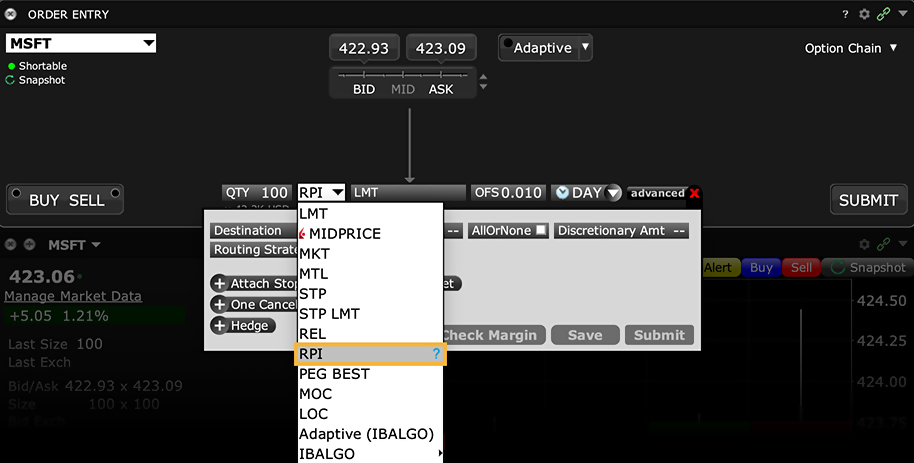

Order Type

Retail Price Improvement

Platforms: Select

Regions: US Only

Routing: Smart

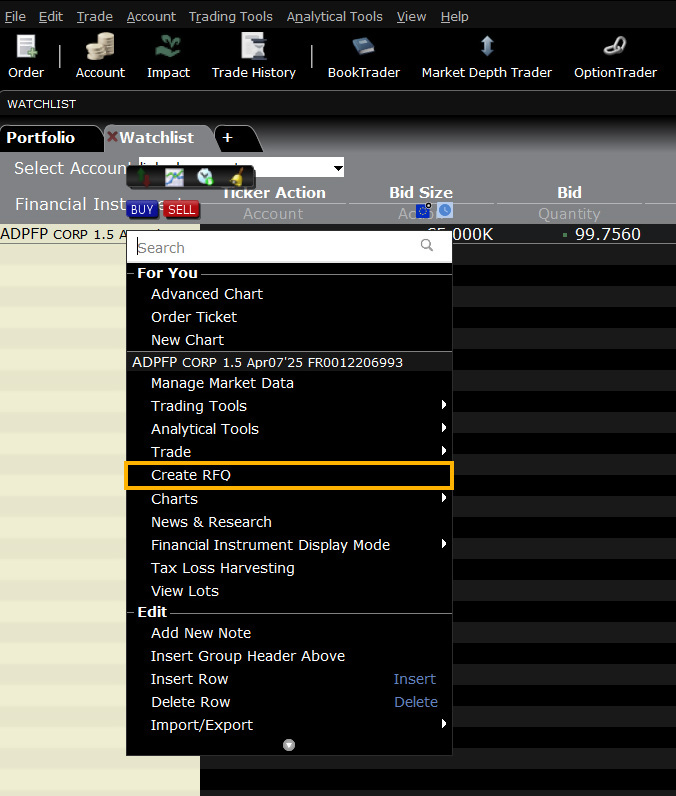

Order Type

Request for Quote (RFQ)

Platforms: TWS Only

Regions: US & Non-US

Video Lesson

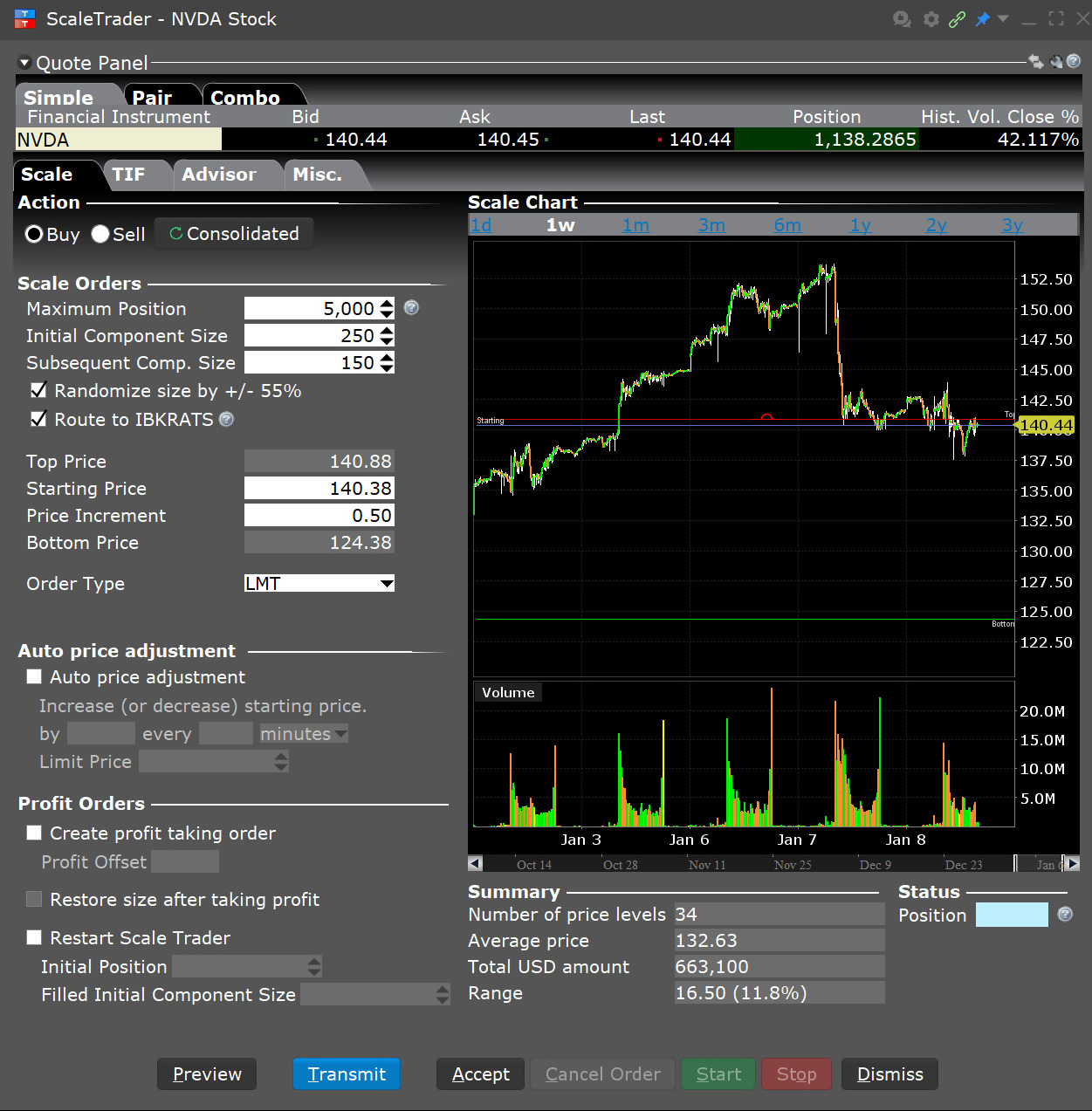

Tool

ScaleTrader

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

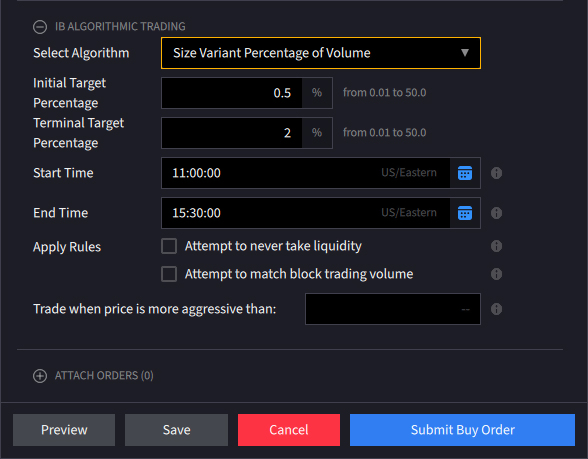

Algo

Size Variant Percent of Volume

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

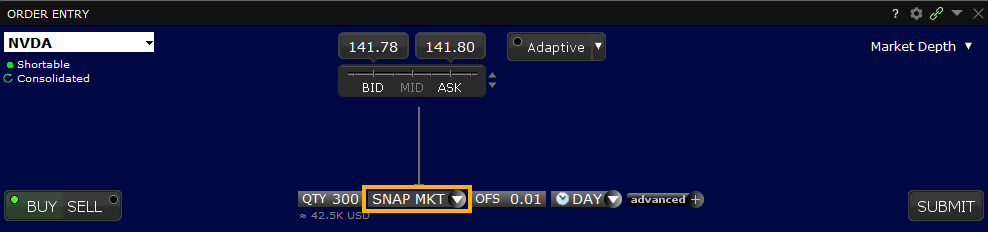

Order Type

Snap to Market

Platforms: Select

Regions: US Only

Routing: Smart, Directed

Video Lesson

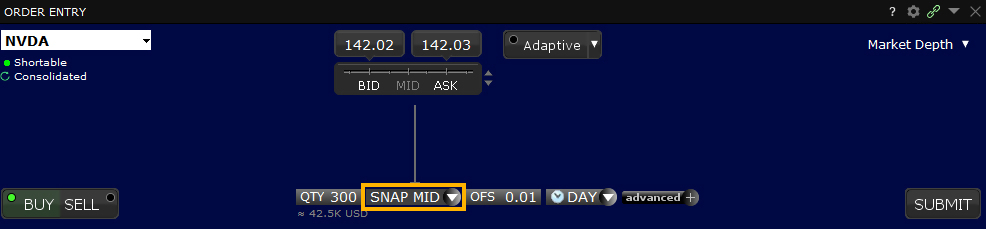

Order Type

Snap to Midpoint

Platforms: Select

Regions: US Only

Routing: Smart, Directed

Video Lesson

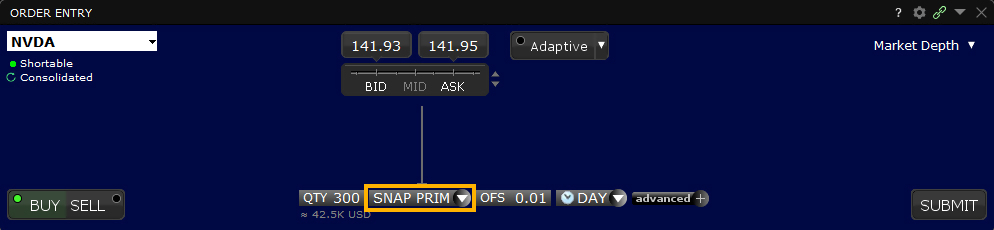

Order Type

Snap to Primary

Platforms: Select

Regions: US Only

Routing: Directed

Video Lesson

Order Type

Spreads

Platforms: TWS Only

Regions: US Only

Routing: Smart, Directed

Order Type

Stop

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed, Lite

Video Lesson

Order Type

Adjustable Stop

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed

Order Type

Stop Limit

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed, Lite

Video Lesson

Order Type

Stop with Protection

Platforms: TWS Only

Regions: US Only

Routing: Directed

Order Type

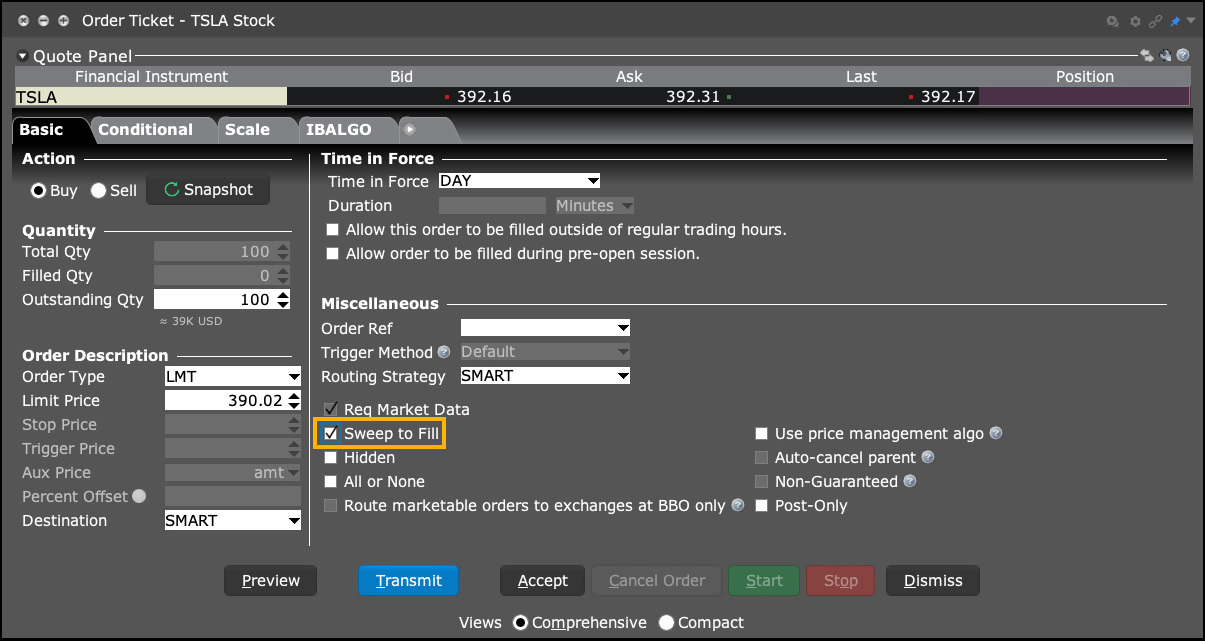

Sweep to Fill

Platforms: TWS Only

Regions: US Only

Routing: Smart

Order Type

T + 0 Stock Settlement

Platforms: TWS Only

Regions: US Only

Routing: Smart

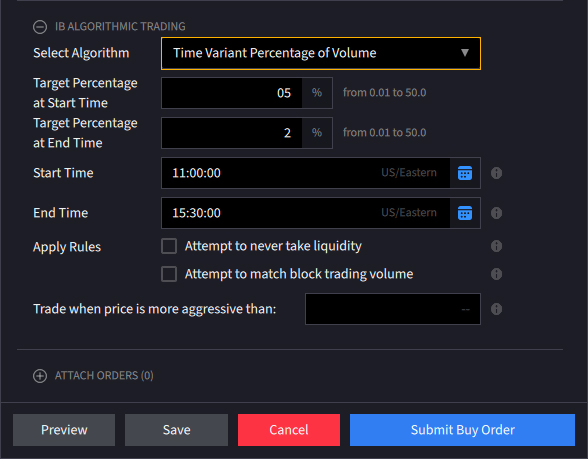

Algo

Time Variant Percent of Volume

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

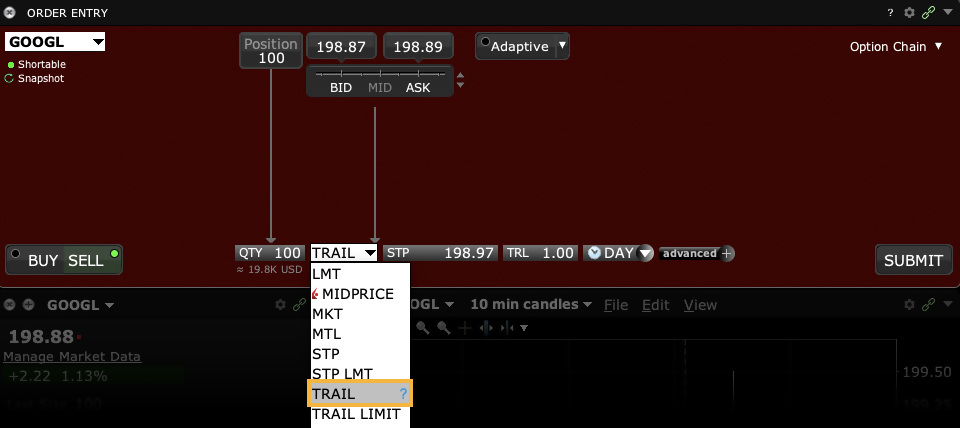

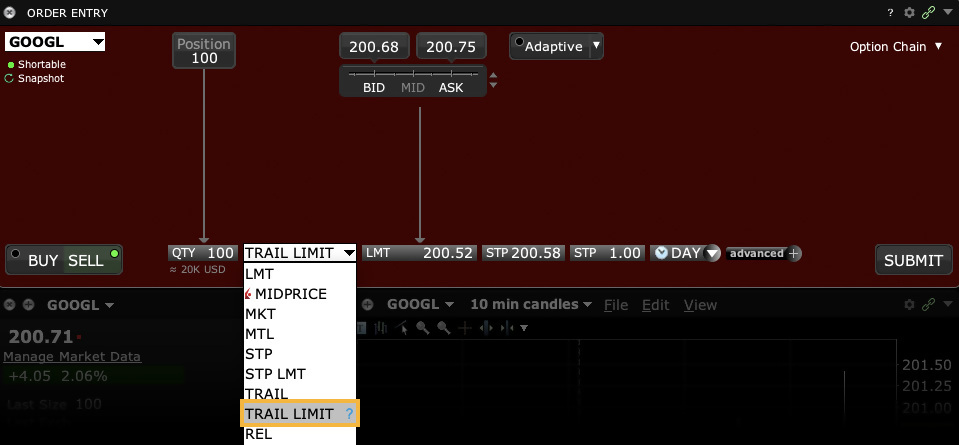

Order Type

Trailing

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed

Order Type

Trailing Limit

Platforms: All

Regions: US & Non-US

Routing: Smart, Directed

Video Lesson

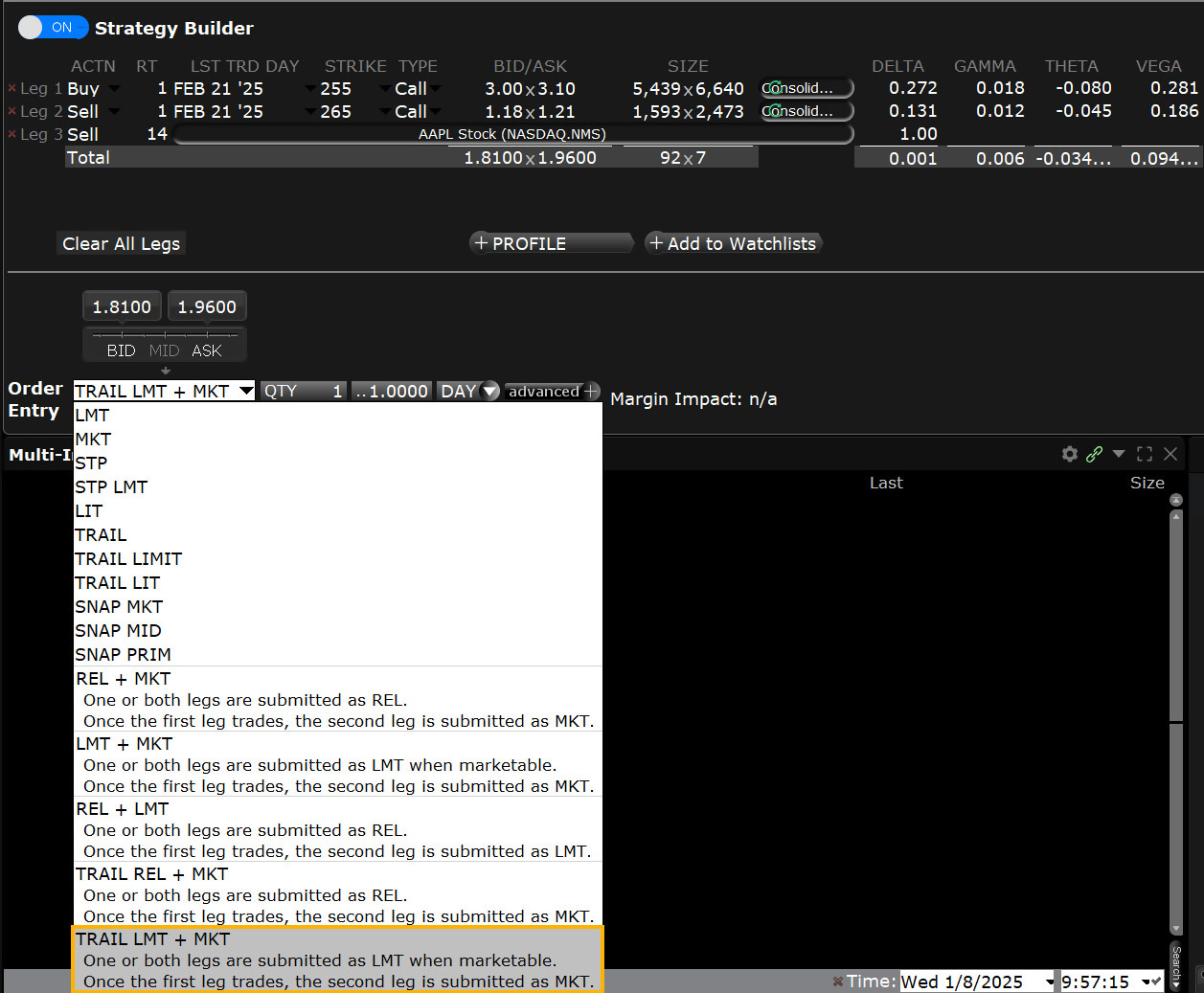

Order Type

Trailing Limit + Market

Platforms: Select

Regions: US & Non-US

Routing: Smart

Order Type

Trailing Limit if Touched

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

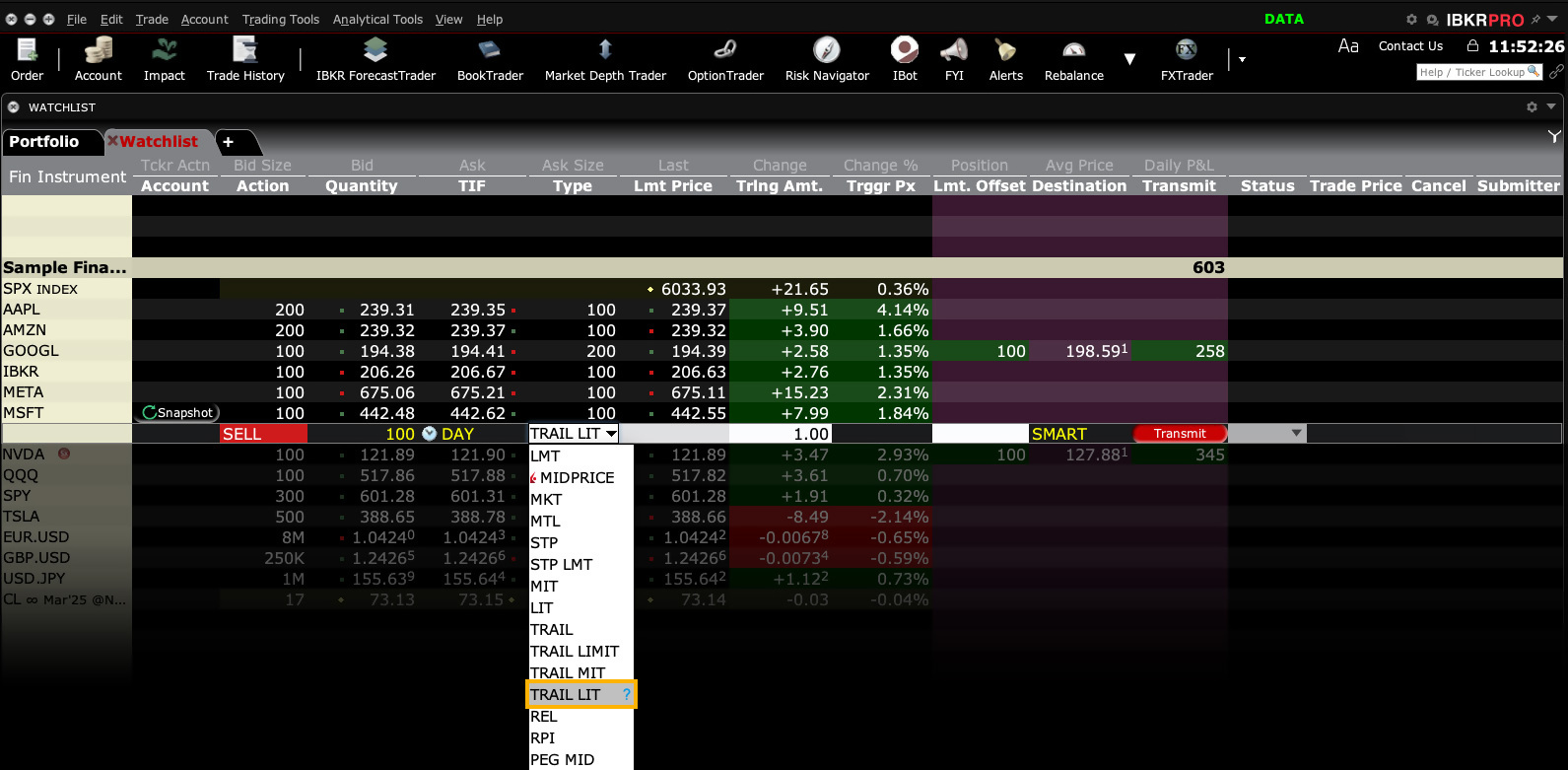

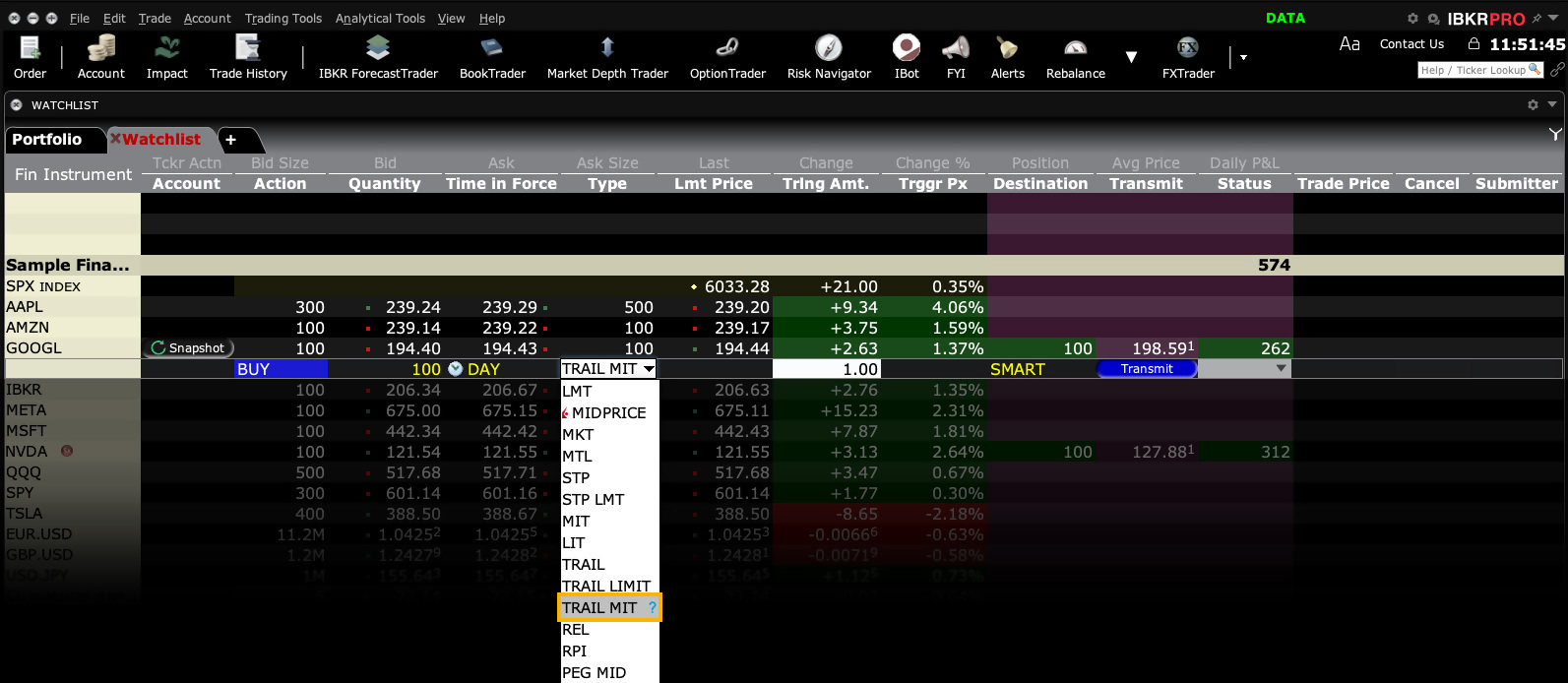

Order Type

Trailing Market if Touched

Platforms: TWS Only

Regions: US & Non-US

Routing: Smart, Directed

Order Type

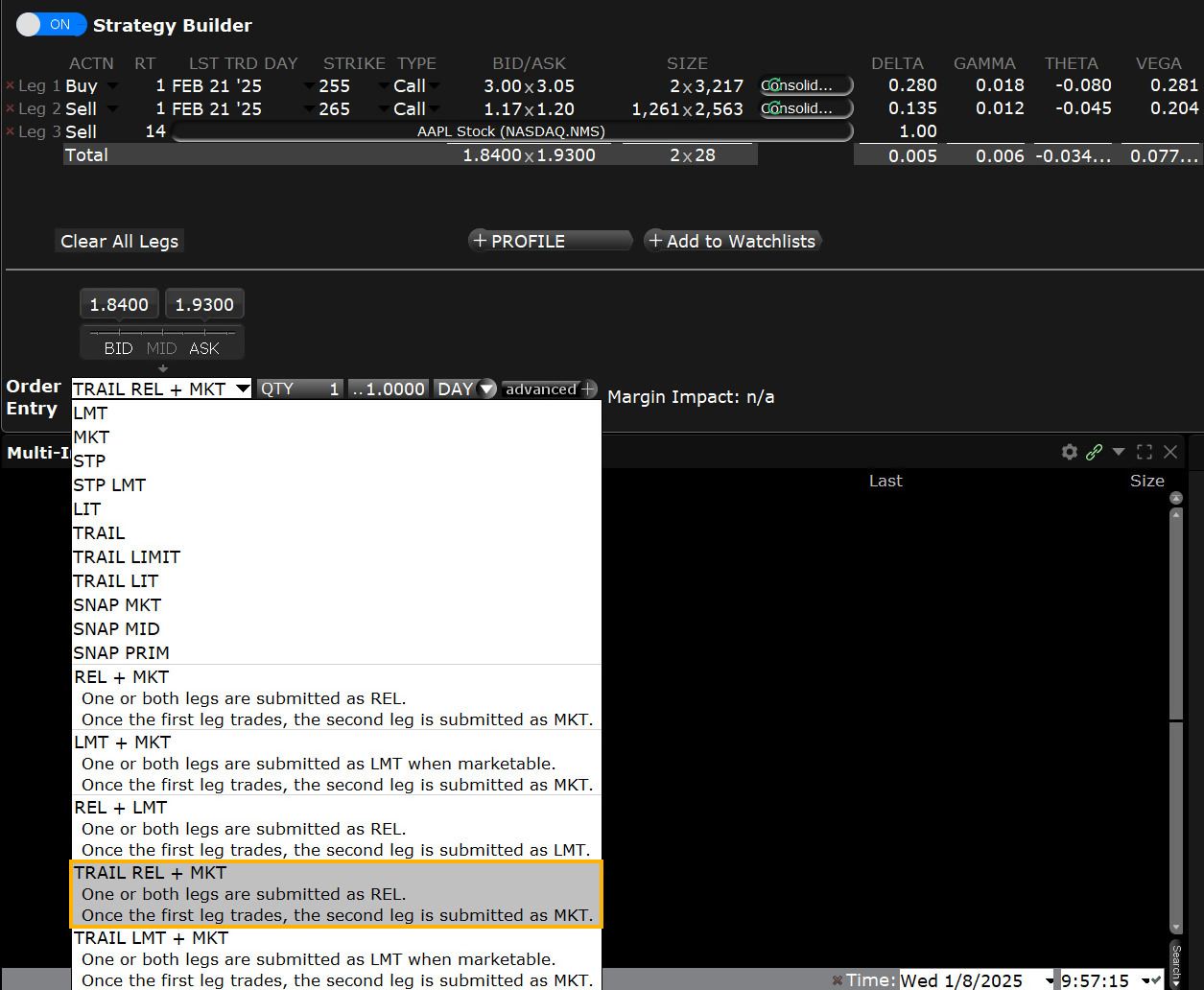

Trailing Relative + Market

Platforms: Select

Regions: US Only

Routing: Smart

Algo

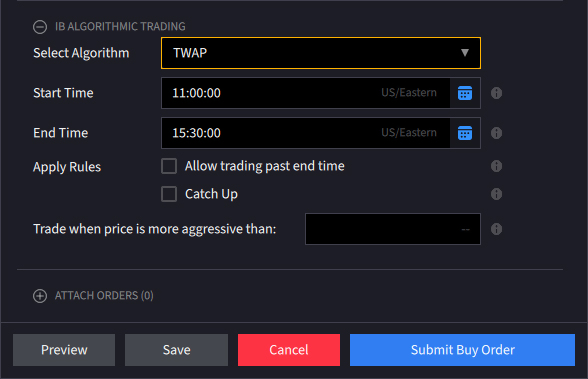

TWAP

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Video Lesson

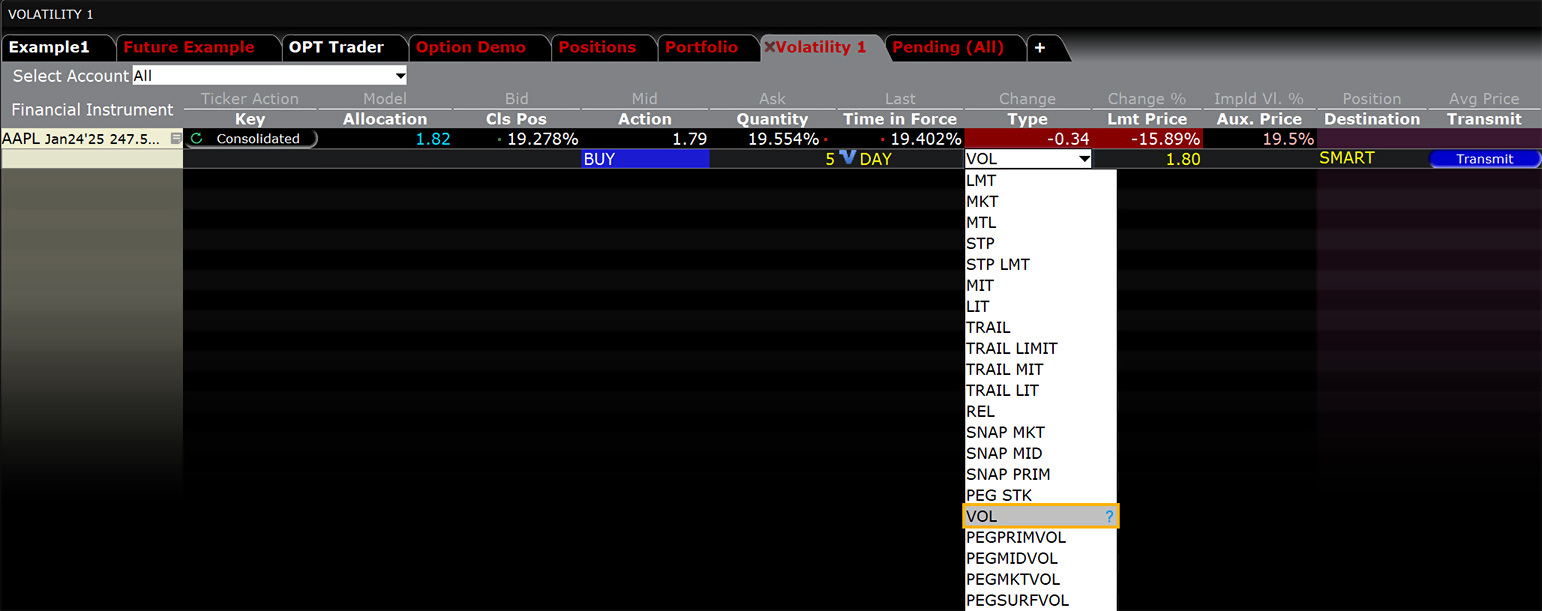

Order Type

Volatility

Platforms: TWS Only

Regions: US Only

Routing: Smart

Order Type

Pegged Volatility Orders

Platforms: TWS Only

Regions: US Only

Routing: Smart

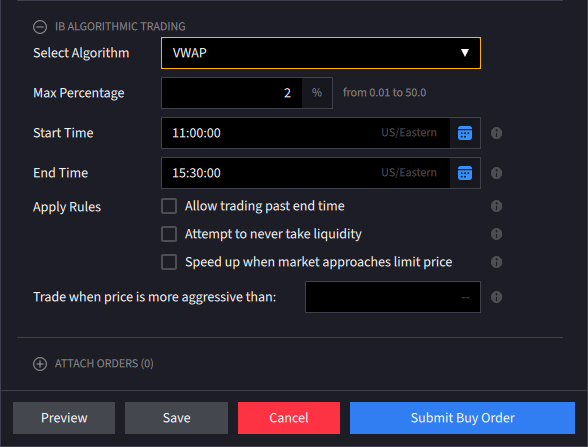

Algo

VWAP (Best-Efforts)

Platforms: Select

Regions: US & Non-US

Routing: IB Algo

Third Party Algo

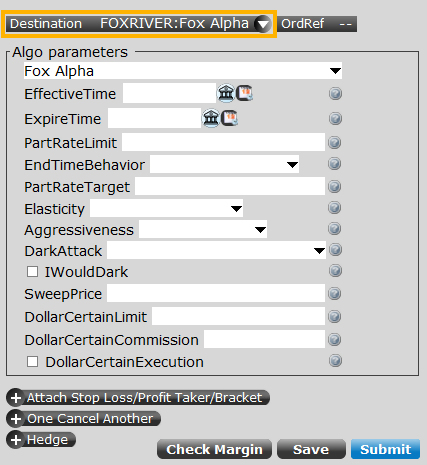

Fox Alpha

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

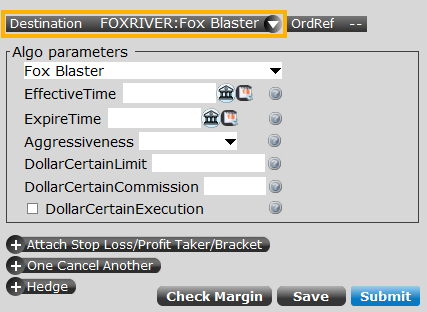

Fox Blaster™

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

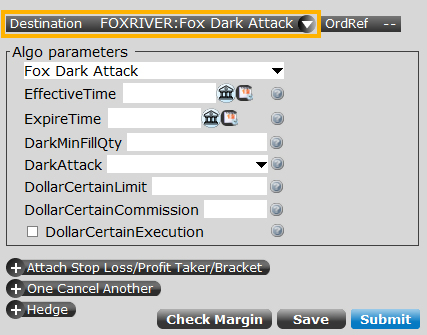

Fox Dark Attack™

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

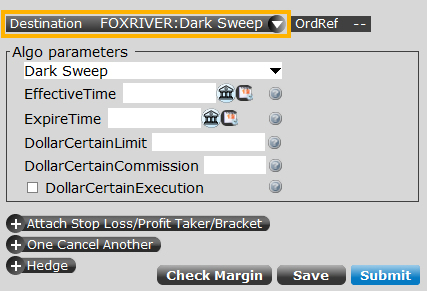

Fox Dark Sweep

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

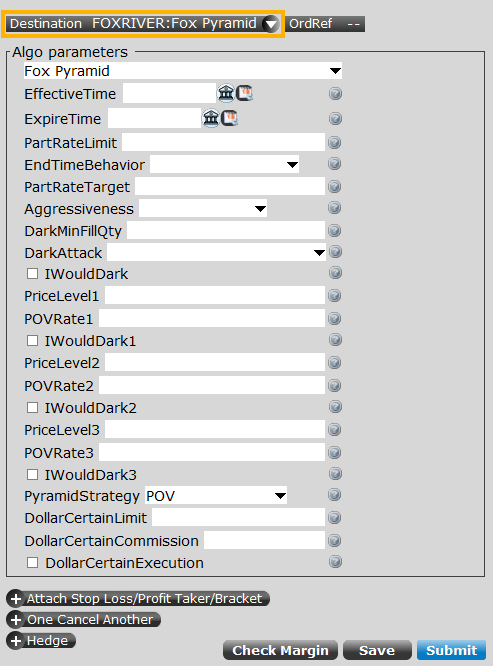

Fox River Pyramid™

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

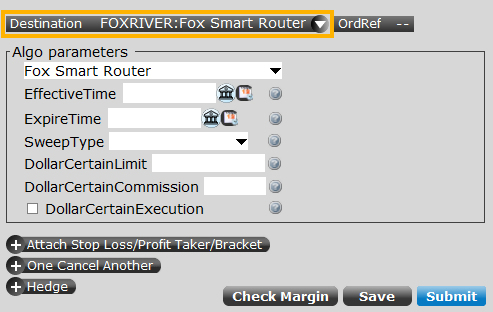

Fox Smart Order Router™

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

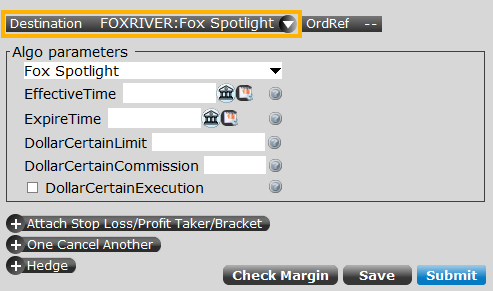

Fox Spotlight™

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

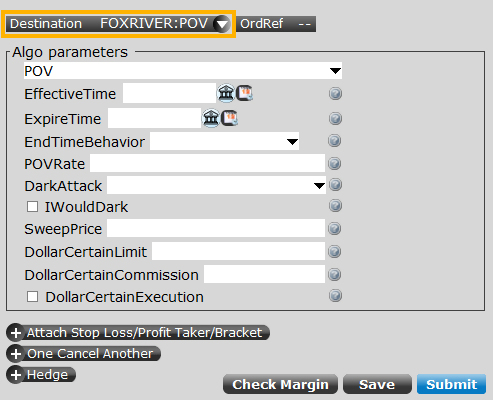

Fox Percent of Volume™

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

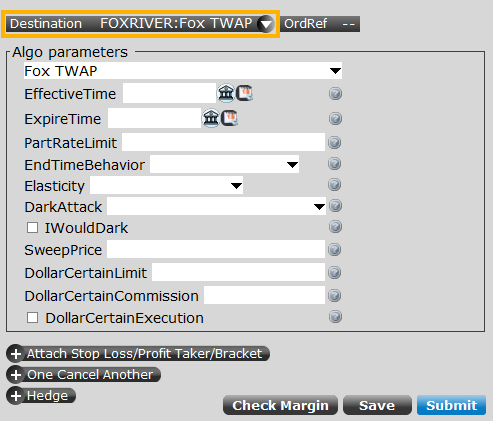

Fox Alpha TWAP

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

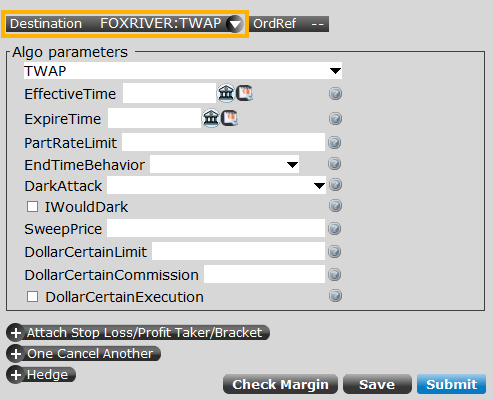

Fox Standard TWAP

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

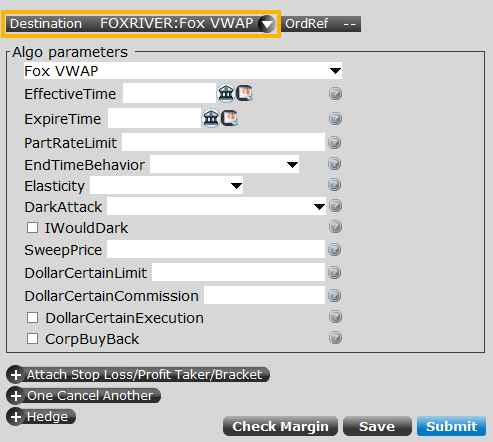

Fox Alpha VWAP

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

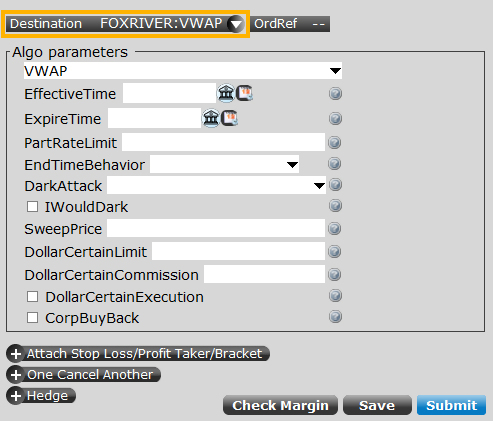

Fox Standard VWAP

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

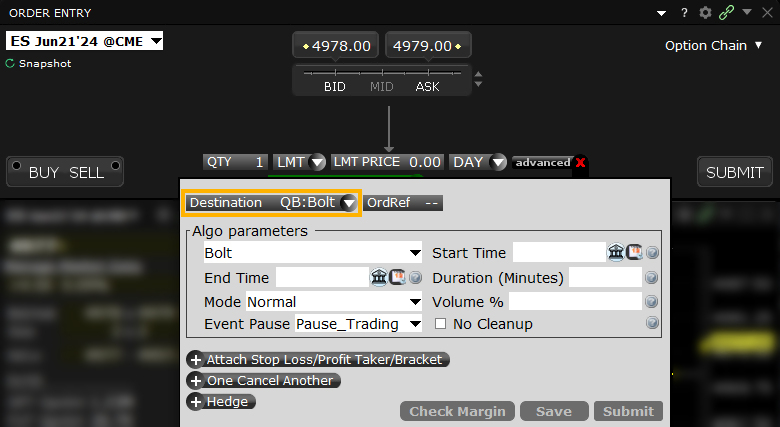

QB Bolt

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

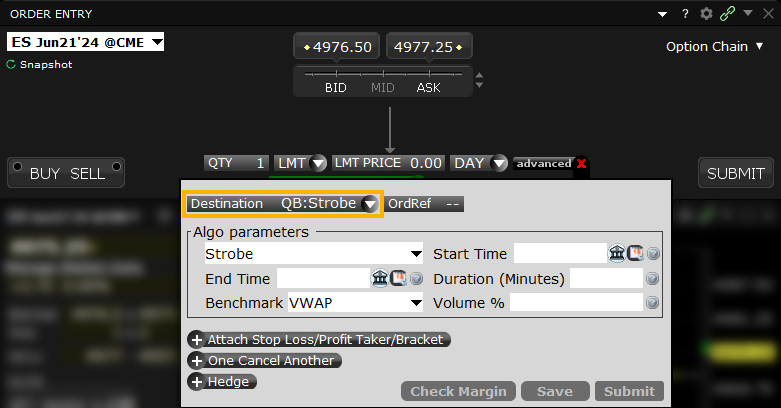

QB Strobe

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

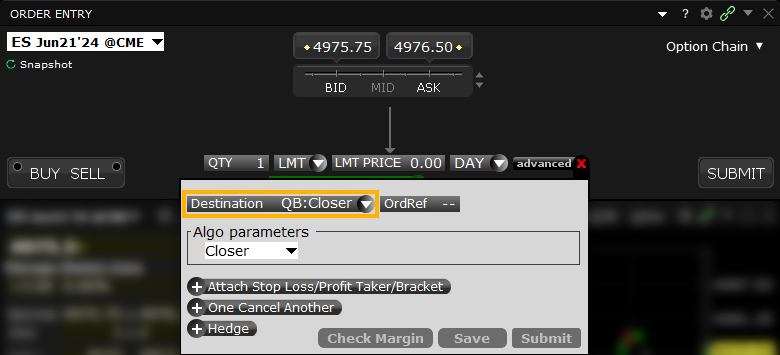

QB Closer

Platforms: TWS Only

Regions: US Only

Routing: Directed

Third Party Algo

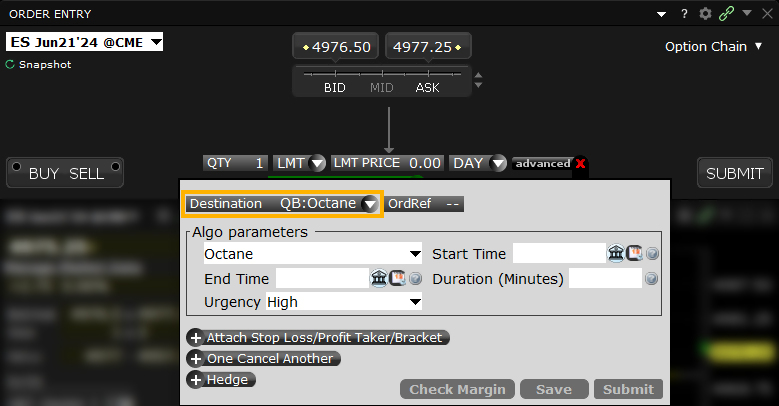

QB Octane

Platforms: TWS Only

Regions: US Only

Routing: Directed

Important Information

The broker simulates certain order types (for example, stop or conditional orders). To provide clients with a consistent trading experience, simulated order types may be used in cases where an exchange does not offer an order type. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges.

Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. Unsatisfactory (non)executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters (example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders); [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions.

Clients should understand the sensitivity of simulated orders and consider this in their trading decisions.

Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Exchanges also apply their own filters and limits to orders they receive.

These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. Filters may also result in any order being canceled or rejected. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange.

The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange.

Please note that GTC orders are not supported for IBAlgos.

Algo Accumulate / Distribute

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Bonds, Warrants |

Platforms: |

TWS Only |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed, IBKR ATS |

The Accumulate/Distribute algo can help you to achieve the best price for a large volume order without being noticed in the market, and can be set up for high frequency trading. By slicing your order into smaller randomly-sized order increments that are released at random time intervals within a user-defined time period, the algo allows the trading of large blocks of stock and other instruments without being detected in the market. The algo allows limit, market, and relative order types.

Algo Adaptive Algo

Products: |

Stocks, ETFs, Options, Futures |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile |

Regions: |

US and Non-US Products |

Routing: |

IB Algo |

The Adaptive algo order type combines IBKR's smart routing capabilities with user-defined priority settings in an effort to achieve a fast fill at the best all-in price. It can be used as either a market or limit order.

The Adaptive Algo is designed to ensure that both market and aggressive limit orders trade between the bid and ask prices. On average, using the Adaptive algo leads to better fill prices than using regular market or limit orders. This algo order type is most useful to an investor when the spread is wide, but can also be helpful when the spread is only one tick.

Order Type All or None

Products: |

Stocks, ETFs, Options, Bonds, EFPs |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile, Client Portal |

Regions: |

US Products Only |

Routing: |

Smart |

For orders using the All or None (AON) attribute, IBKR will typically route to the native exchange, or hold the order if the AON order type is not supported by the primary exchange. When held, IBKR will attempt to simulate the order as follows:

- For US stock orders: The NBBO must qualify limit price AND the NBBO size must be equal to (or greater than) the order size + 1000 shares.

- For US options orders: The NBBO must qualify limit price AND the NBBO size must be equal to (or greater than) the order size + 10 contracts.

For example, an AON order to buy 1500 shares of ABC at $10.00/share will be held until the NBO qualifies (is less than or equal to $10.00) and the NBO size is equal to or greater than 2500 shares.

The order will remain active until it either executes or is canceled. The AON attribute can be used in conjunction with the basic order types and all times in force.

Mosaic Example

- Select desired option

- Choose LMT

- Enter Quantity

- Enter price limit (LMT) field

- Choose Time-in-Force

- Click Advanced button and check All-or-None box

- Click Submit to transmit your order

In this Mosaic example, the client wishes to sell or write more options in Ticker BAC than are currently on display. Note the size shown on the Bid quantity of 124 contracts is less than the 150 order to be submitted. In order to prevent a partial fill, the client uses an All-or-None order type, which can also be used for stock orders.

Having populated the Option Order Entry panel with the desired call option, select LMT from the Order Type dropdown menu and enter the desired Quantity. Select the price you wish to limit your sell order to and select a desirable time-in-force from the TIF dropdown menu. By clicking on the Advanced tab you will expand the order entry options. Locate the All-or-None field and check the box. This ensures that when your order is transmitted, certain volume-related conditions must be met before the order will attempt to fill. You are now ready to transmit your order by clicking either Submit button in the Advanced field or in the Order Entry panel.

| Assumptions | |

|---|---|

| Action | SELL |

| Qty | 150 |

| Order Type | LMT |

| Limit Price | 0.21 |

| Order Attribute | All or None |

| Market Price | 0.21 |

Classic TWS Example

- Use Customize Layout > Order Columns to display the All or None Order Attribute column

- Click the Ask Price to create a BUY order

- Enter 10 in the Qty field

- Select LMT from the Type field

- Enter your desired Limit price

- Click the T to transmit the order

- Click the All or None check box to make this an All or None order

Order Type In Depth - All-or-None Buy Order

Step 1 – Enter a Limit Order and Apply the All-or-None Order Attribute

You want to place an order to buy 10 Jan11 140 calls of XYZ, but you do not want the order to execute unless the entire order quantity is available. Before you place the order, make sure the All or None column is displayed on the trading screen. Click the check box in the All or None field to tag the order as All-or-None. If the entire quantity becomes available at the specified price or better, the order will be filled. Otherwise, it continues to work until it is canceled.

Step 2 – Order for 10 Options Contracts Transmitted

You've transmitted your order for 10 Jan11 140 calls of XYZ. At this point, the contracts are nether available at your limit price nor for the entire quantity. If the entire quantity becomes available at your Limit Price or better, the order will be filled. Otherwise, it continues to work until it is canceled.

Step 3 – Market Price Falls, Partial Quantity is Available

The price of the XYZ options contracts falls to 3.95, which is your Limit Price. However, only four contracts are available at that price. Because this is an All or None order, your order cannot be filled until the entire quantity becomes available at your desired price.

Step 4 – Entire Quantity is Now Available

Finally, the entire quantity of 10 options contracts becomes available at your limit price, so the order is filled.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 10 |

| Order Type | LMT |

| Limit Price | 3.95 |

| Order Attribute | All or None |

| Market Price | 4.00 |

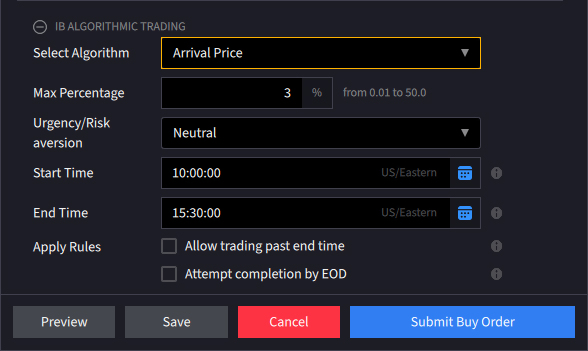

Algo Arrival Price

Products: |

Stocks, ETFs, Currencies |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile |

Regions: |

US and Non-US Products |

Routing: |

IB Algo |

This algorithmic order type will attempt to achieve, over the course of the order, the bid/ask midpoint at the time the order is submitted. The Arrival Price algo is designed to keep hidden orders that will impact a high percentage of the average daily volume. The pace of execution is determined by the user-assigned level of risk aversion and the user-defined target percent of average daily volume. How quickly the order is submitted during the day is determined by the level of urgency – higher urgency executes the order faster, but exposes it to greater market impact. Market impact can be lessened by assigning lesser urgency, which is likely to lengthen the duration of the order. The user can set the max percent of ADV from 1 to 50%. The order entry screen allows the user to determine when the order will start and end regardless of whether or not the full amount of the order has been filled. By checking the box marked Allow trading past end time the algo will continue to work past the specified end time in an effort to fill the remaining portion of the order.

Order Type At Auction

Products: |

Stocks, ETFs, Futures |

Platforms: |

TWS Only |

Regions: |

Non-US Products Only |

Routing: |

Directed |

An auction order is entered into the electronic trading system during the pre-market opening period for execution at the Calculated Opening Price (COP). If your order is not filled on the open, the order is re-submitted as a limit order with the limit price set to the COP or the best bid/ask after the market opens.

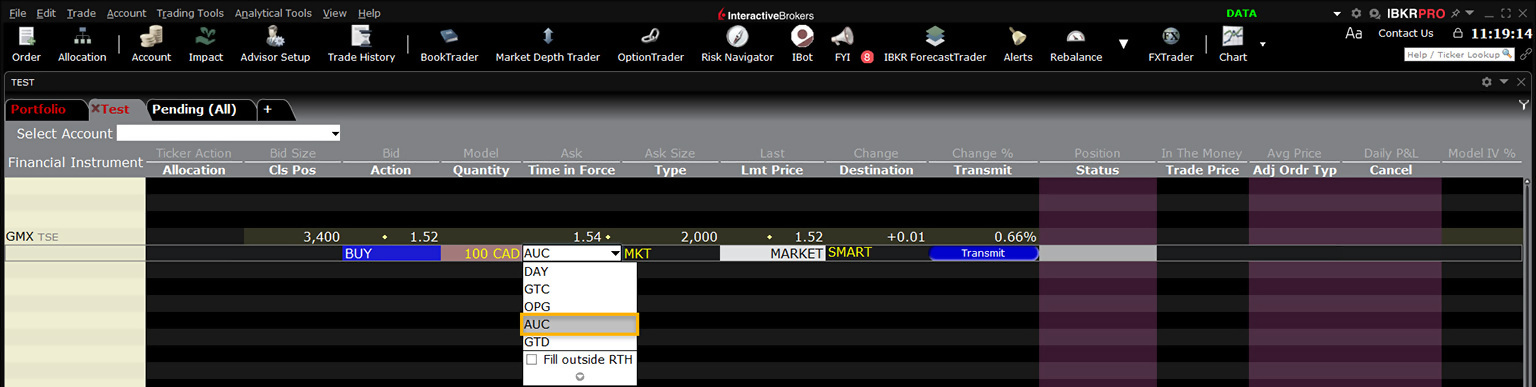

Example

- Select AUC from the Time in Force field.

You want to buy 10 XYZ futures contracts as an auction order at the calculated opening price, which you think will be the best price of the day. Create a buy order row, and selected MTL as the Type and AUC as the time in force. The market to limit order type with the AUC time in force define your order as an auction order. The order will be converted to a limit order at the Calculated Opening Price if it is not filled during the pre-market opening period.

Order Type Price Improvement Auction Orders

Products: |

Options Only |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

Directed |

For option orders routed to the Boston Options Exchange (BOX) you may elect to participate in the BOX's price improvement auction in pennies. All BOX-directed price improvement orders are immediately sent from Interactive Brokers to the BOX order book, and when the terms allow, IBKR will evaluate it for inclusion in a price improvement auction based on price and volume priority. In the auction, your order will have priority over broker-dealer price improvement orders at the same price.

Enter your order price in penny increments, and it will be rounded to the nearest listed increment in favor of the order (bids and offers will continue to be listed in increments of $0.05 or $.10) until the start of the auction. Should an auction start, your improvement amount will be the absolute difference of your order price in pennies and your rounded listed price.

Interactive Brokers' customers submitting Smart marketable options orders will have their orders routed to BOX when BOX is at the NBBO, and Interactive Brokers has information that there is an NBBO improvement order on the opposite side of the trade, in which case your order will be exposed to a price improvement auction.

Example

To enter a limit order, select limit order in the Type field and enter a limit price. As an example, if the market was $2-2.10 and you wanted to enter a buy limit order at $1.97 you would enter:

| Order Type: | Limit | |

| Limit Price: | 1.97 | |

| Aux Price: | N/A | |

If the bid on BOX moves to $1.95, and if an auction were to start, you would immediately bid $1.97 in the auction.

To enter a relative order, select Relative in the Type field and enter an offset. For example, if the market was $2-2.10 and you wanted to enter a sell relative order with a $.04 offset, you would enter:

| Order Type: | Relative |

| Limit Price: | N/A (Optional) |

| Aux Price: | .04 (Offset) |

If the listed offer moved to $2.05, and if an auction were to start and the first auction offer was $2.04, your auction offer would then be $2.03. Your auction price would continue to improve the auction by $.01 until you reached $2.01.

To enter a Pegged-to-Stock order, select Pegged in the Type field and enter a starting price, then enter a stock reference price (optional), and a stock range (optional). For example if the market was $2-2.10 and you wanted to enter a buy pegged-to-Stock call with a starting price of $2.05, a delta of .5, a stock reference price of $100, and a stock range of $98-$102, you would enter:

| Order Type: | Pegged-to-Stock |

| Limit Price: | N/A |

| Aux Price: | 2.05 (Starting Price) |

| Delta: | .5 |

| Stock Reference: | 100 |

| Stock Range (Low): | 98 |

| Stock Range (High): | 102 |

Your bid would be entered at $2.05. If the NBBO midpoint price of the stock went to $100.05 your bid would be $2.06, and would continue to move up until you reached $2.07 (the .5 delta times $.05 stock move rounded down to the nearest increment). If the NBBO midpoint price of the stock were to go above $102 or below $98, the order would be cancelled.

Order Type Auto Combo Limit

Products: |

Stocks, ETFs |

Platforms: |

TWS Only |

Regions: |

US and Non-US Products |

Routing: |

Directed |

Attach an opposite-side limit order to a complex multi-leg combination order. The limit price is determined using the Combo Order Preset values for the "Target Order." The attached order is a child order and will be linked to the parent order automatically with the OCA (one-cancels-other) tag. This order will be auto-submitted when the parent order fills.

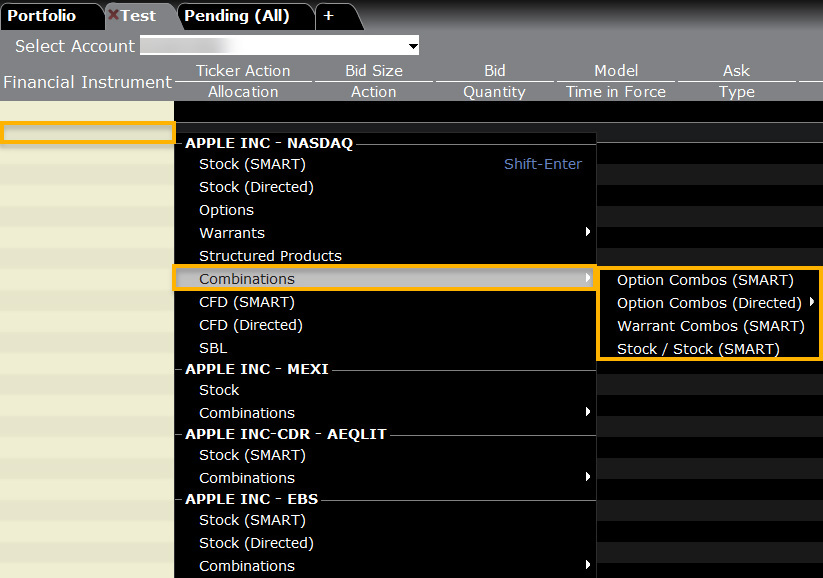

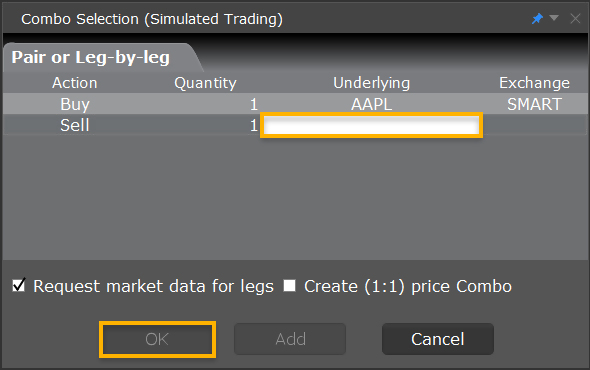

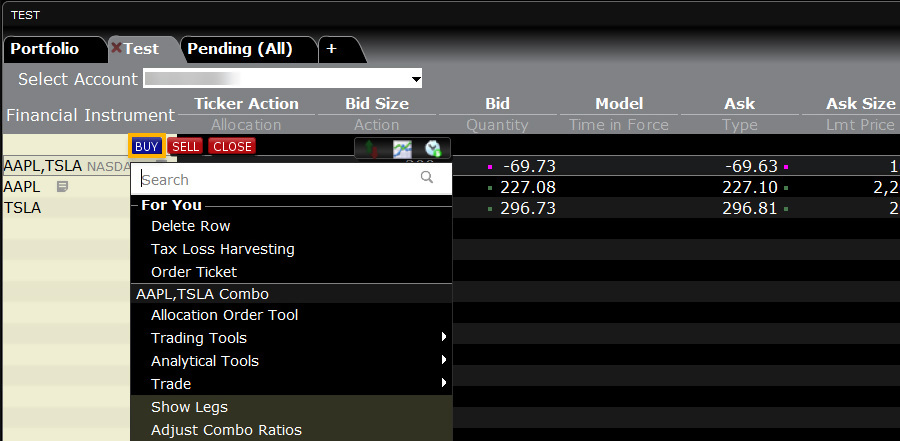

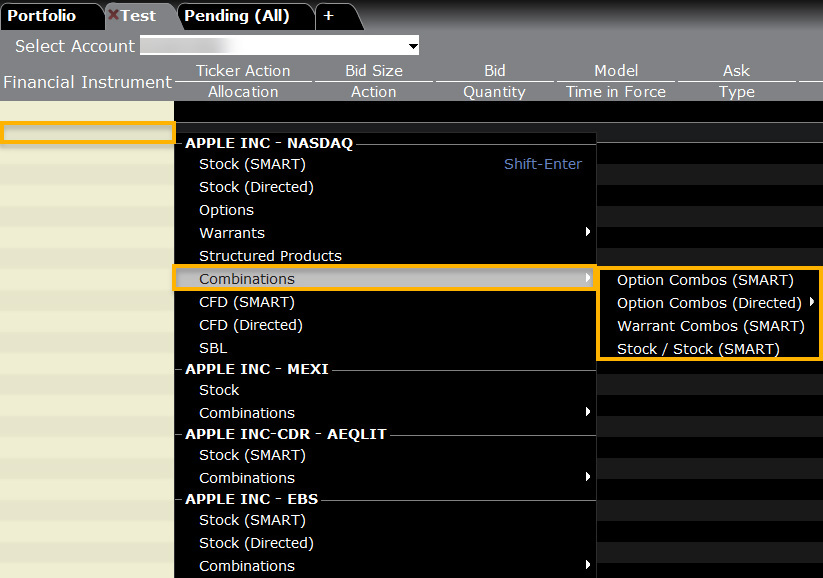

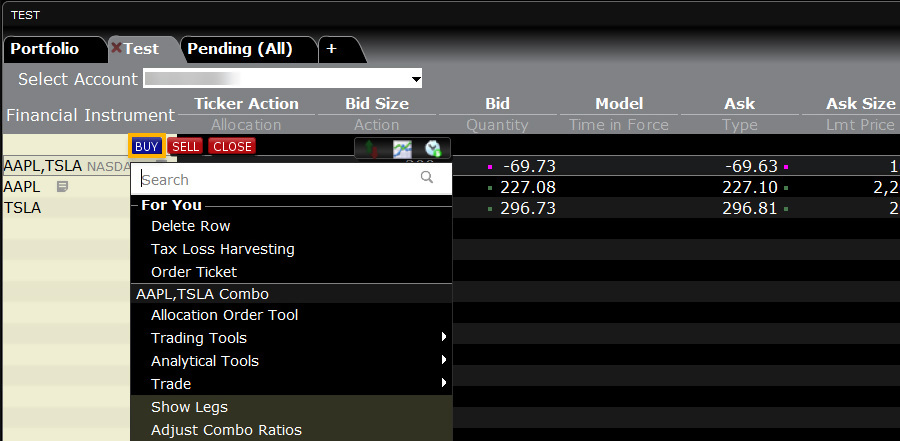

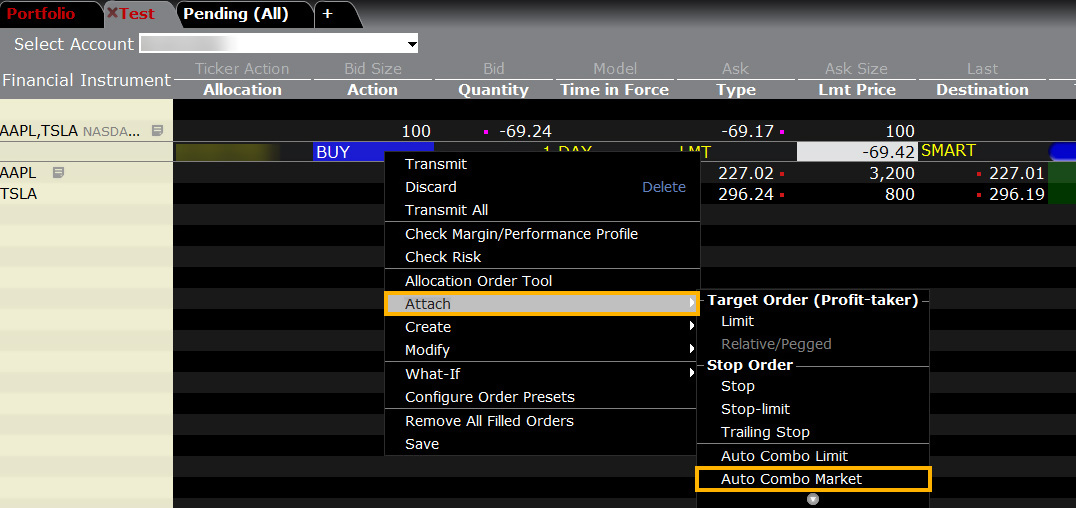

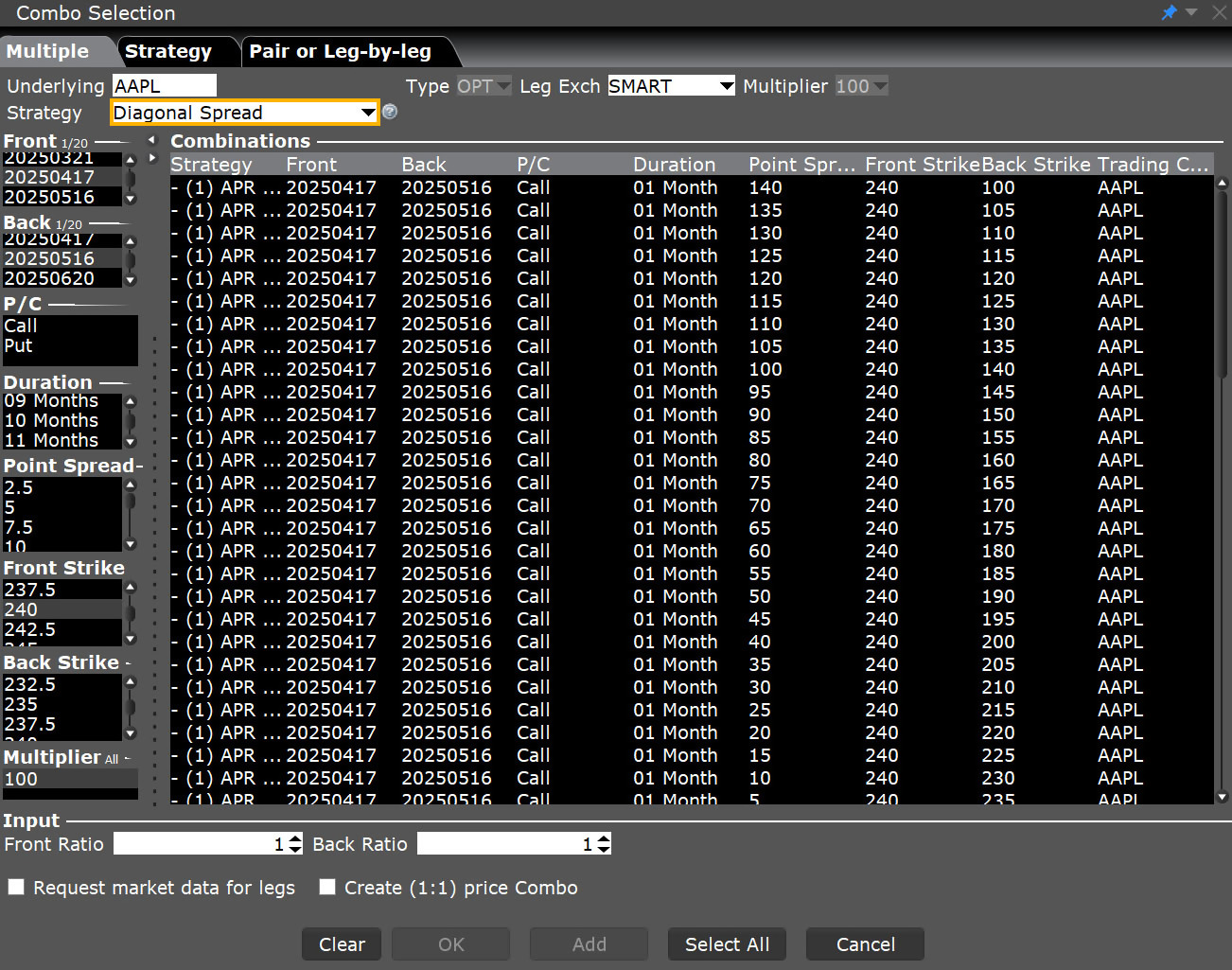

First you will need to create a combination order in TWS. To do so, add a product into a watchlist (such as AAPL), select “Combinations” and choose one of the following options. For this example, we have selected Stock / Stock.

Example

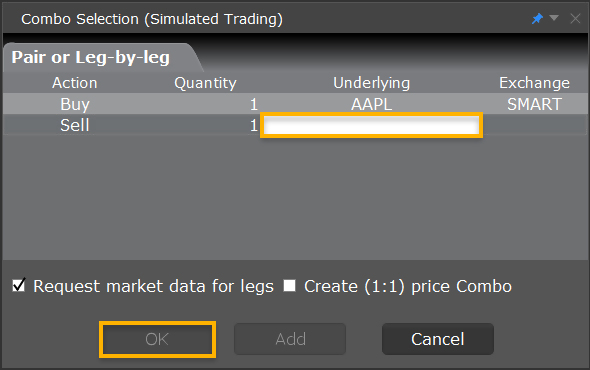

Once the selection has been made, a pop-up will appear on your screen. Add the additional asset to this combo order and Press OK.

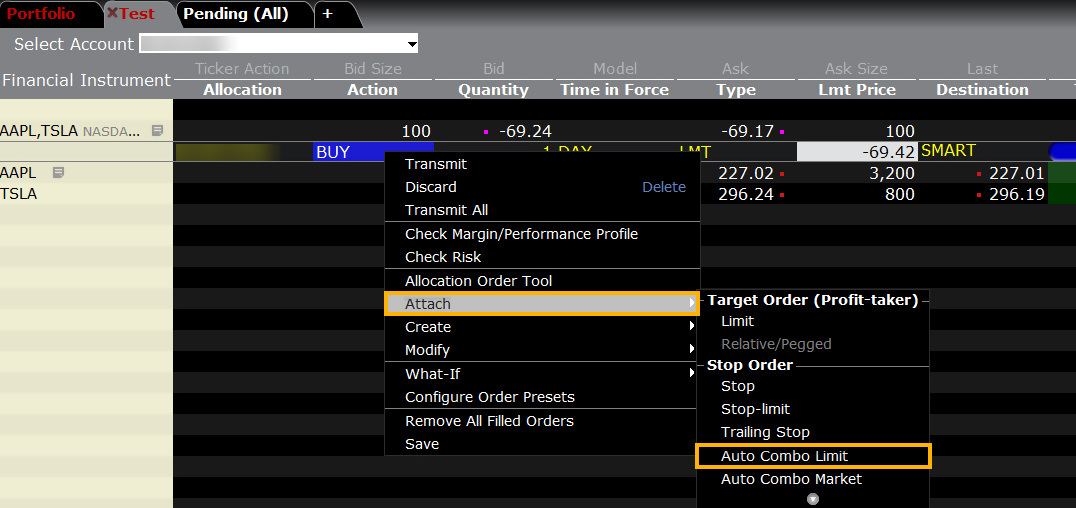

Next, you will be navigated back to the watchlist with the combo order populating. Right-click on the combo order and select “Buy”.

An order line will populate below the combo. Right-click on this order line and select “Attach” followed by "Auto Combo Limit Order."

Order Type Auto Combo Market

Products: |

Stocks, ETFs |

Platforms: |

TWS Only |

Regions: |

US and Non-US Products |

Routing: |

Directed |

Attach an opposite-side limit order to a complex multi-leg combination order. The limit price is determined using the Combo Order Preset values for the "Target Order." The attached order is a child order and will be linked to the parent order automatically with the OCA (one-cancels-other) tag. This order will be auto-submitted when the parent order fills.

First you will need to create a combination order in TWS. To do so, add a product into a watchlist (such as AAPL), select “Combinations” and choose one of the following options. For this example, we have selected Stock / Stock.

Example

Once the selection has been made, a pop-up will appear on your screen. Add the additional asset to this combo order and Press OK.

Next, you will be navigated back to the watchlist with the combo order populating. Right-click on the combo order and select “Buy”.

An order line will populate below the combo. Right-click on this order line and select “Attach” followed by "Auto Combo Market Order."

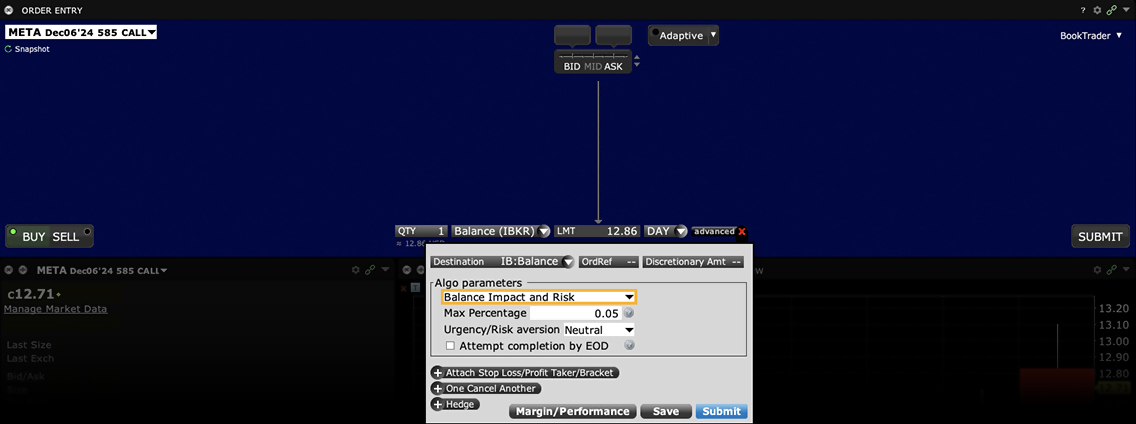

Algo Balance Impact and Risk

Products: |

Options Only |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

IB Algo |

Objective

To balance the market impact of trading the option with the risk of price change over the time horizon of the order. This strategy considers the user-assigned level of risk aversion to define the pace of the execution, along with the user-defined target percent of volume.

User Inputs

- Max Percentage of Average Daily Volume

- Urgency/Risk Aversion Level

- Get Done

- Aggressive

- Neutral

- Passive

- Attempt Completion by EOD checkbox

Important Points

- The max percent you define is the percent of the total daily options volume for the entire options market in the underlying.

- The level of trade urgency determines the pace at which the order is submitted over the day.

- A higher urgency executes the order more quickly, opening it to greater market impact; a lower urgency allows the order to fill over time and incur less market impact.

- Note that the algo uses a randomization feature to keep the algo hidden, and by default always attempts to execute quickly. The Urgency/Risk Aversion selections are driven by the size of the order; it is designed for orders that will impact a high percent of the Average Daily Volume and its mechanism may be insignificant for smaller orders.

- If Attempt Completion by End of Day is checked, we will try to complete the order today. Please note that we may leave a portion of the order unexecuted if the risk of the price changing overnight is less than the extra cost of executing the whole order today.

- Available for US Equity and Index Options.

Tool Basket

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Bonds, Funds, Warrants |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

Directed |

TWS BasketTrader can be used to manage baskets of securities or other asset classes. Portfolio managers and investors can build a spreadsheet of tickers for import to TWS or simply add directly to a TWS page and save as a basket. Order size, type and price can be built before saving the entire group as a Basket for execution at a later time, and these values can be modified when you're ready to trade the basket. Because BasketTrader is flexible and configurable, investors can quickly access an established portfolio, rebalance, and manage baskets before submitting orders.

Example

You want to place a group of orders for a number of different instruments at one time. Before you can select and transmit your basket order, you must create and save the basket file:

First, create orders to include in the basket file. Modify the order parameters and define the order attributes as required. Next, on the Trade menu, select Save Orders as Basket. In the dialog box, review or rename the file using a .csv extension (for example, stocks.csv) then click OK. The system uses the Trading page name as the default basket name. Now cancel the orders you created by selecting Cancel Page from the Trade menu.

Next, place your basket order using the BasketTrader. On the Trading Tools menu, select BasketTrader, or click the Basket icon on the trading toolbar. In the Basket File field, select a basket file from the list or click the Browse button to find a basket file that doesn't appear in the list. Modify the Multiplier if necessary. This value multiplies the quantity of each order in the basket. Modify the order parameters if necessary, then submit the entire basket order. You can submit individual orders within the basket using the market data lines on the Orders tab.

A single Basket order can contain multiple order types on various products, and include any supported time in force or order attribute. The image below shows a limited sample of a basket order file that has been opened in MS Excel.

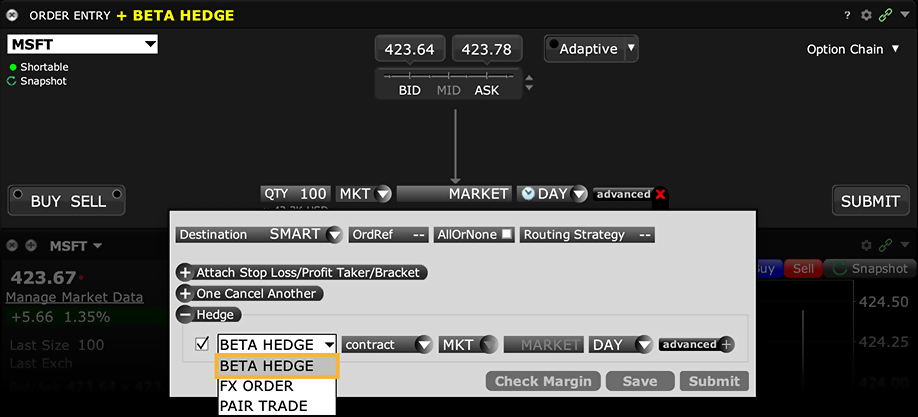

Attached Order Beta Hedge

Products: |

Stocks, ETFs |

Platforms: |

TWS Only |

Regions: |

US and Non-US Products |

Routing: |

Directed |

Attached hedge order to a stock with an ETF. Used to reduce risk systematically by purchasing stock with offsetting betas.

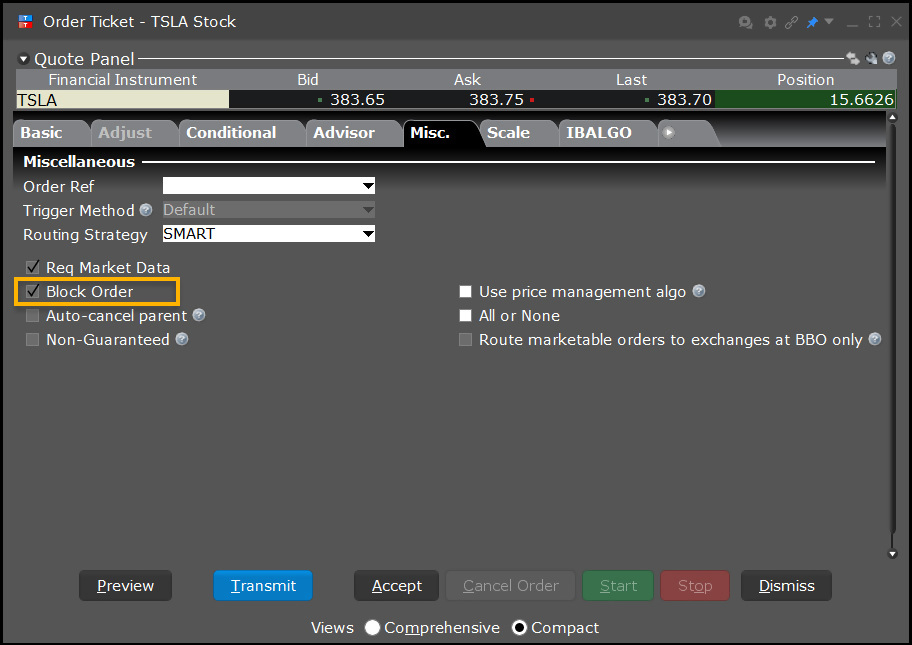

Tool Block

Products: |

Options Only |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

Directed |

The Block attribute is used for large volume option orders on ISE that consist of at least 50 contracts. To execute large-volume orders over time without moving the market, use the TWS Accumulate/Distribute trading tool.

Example

- Select the checkbox in the Block Order field.

You want to buy 10,000 XYZ option contracts for the best possible price. You select the XYZ option ticker line, then open the Order Ticket. In the Exchange field, you select ISE, then in the Price field you enter a limit price. Next you click the Miscellaneous tab and click the Block Order checkbox. This ensures that your order is made public and may result in a price improvement. You click Transmit to submit your order, or Accept to display the order on the trading screen before you submit it.

Order Type Box Top

Products: |

Options Only |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

Directed |

A Box Top order executes as a market order at the current best price. If the order is only partially filled, the remainder is submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed.

Example

- Click the Ask Price to create a BUY order

- Enter 3 in the Qty field

- Select BOX from the Destination field

- Select BOX TOP from the Type field

- Click the T to transmit the order

Order Type In Depth - Box Top Buy Order

Step 1 – Enter a Box Top Order

The JAN11 130 XYZ call is currently trading at $6.00 - $6.05. You create a market order to buy three contracts, select BOX as the Destination and BOX TOP in the Type field. The word MARKET appears in the Lmt Price field to indicate that you are willing to buy at the current market price. You transmit the order.

A Box Top order executes as a market order at the current best price. If the order is only partially filled, the remainder is submitted as a Limit order with the Limit Price equal to the price at which the filled portion of the order executed.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 3 |

| Order Type | BOX TOP |

| Destination | BOX |

| Market Price | 6.00 – 6.05 |

| Limit Price | MARKET (Current Market Price) |

Step 2 – Order Transmitted and Partially Filled as a Market Order

You've transmitted your Box Top order, and the order is partially filled as a Market order; you buy two contracts at $6.05, the best market price. The remainder of the order, one contract, is canceled and immediately re-submitted as a limit order with the Limit Price automatically set to $6.05. The Limit Price is the price at which the filled portion of the order executed.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 3 |

| Order Type | BOX TOP > LMT |

| Market Price | 6.05 |

| Limit Price | 6.05 |

Step 3 – The Remainder of the Order is Submitted as a Limit Order

The canceled portion of your order, a single contract for a JAN11 130 XYZ call, has been resubmitted as a Limit order with the Limit Price set to $6.05, which is the price at which the market order portion of the order was filled. The contract becomes available at the Limit Price, and the order is filled at that price, completing your entire order for three contracts.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1 (2 already filled) |

| Order Type | LMT |

| Market Price | 6.05 |

| Limit Price | 6.05 |

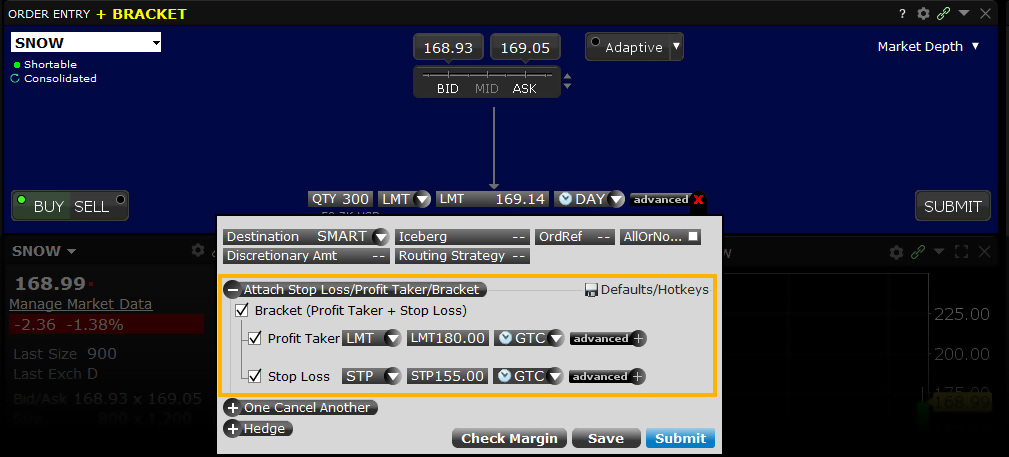

Order Type Bracket

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Warrants, EFPs, Combos |

Platforms: |

TWS, IBKR Desktop, and IBKR Mobile |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed |

Bracket orders are designed to help limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order.

The order quantity for the high and low side bracket orders matches the original order quantity. By default, the bracket order is offset from the current price by 1.0. This offset amount can be changed on the order line for a specific order, or modified at the default level for an instrument, contract or strategy using the Order Presets feature in Global Configuration.

Mosaic Example

In this example, we wish to buy 1,000 shares in ticker TSLA at a price of no more than $219.50. However, at the same time we want to determine a Stop Loss order to sell the shares should the price drop to $218.00. We also wish to place a Profit Taking order in the event that TSLA rises to $221.00 during the session. Enter the desired ticker and click the Buy button, which causes the background to turn blue. Sell orders create a red background. Enter the number of shares to be purchased and select LMT from the Order Type dropdown menu. Next set your limit price at which you are prepared to buy shares. Change the TIF field if required. Users may select the Time-in-Force field to select a Good-til-Cancelled duration for the trade. In this example, we are using a Day order.

Assumptions

| Limit Buy Order | |

| Action | BUY |

| Qty | 1,000 |

| Order Type | LMT |

| Market Price | 219.60 |

| Limit Price | 219.50 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 1,000 |

| Order Type | LMT |

| Market Price | 219.60 |

| Limit Price | 221.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 1,000 |

| Order Type | STP |

| Market Price | 219.60 |

| Limit Price | 218.00 |

Next, click on the Advanced button to the right of the TIF field to display more order entry options. Click on the Attach button to the right to reveal Bracket functionality. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked. Enter the desired values for the Profit Taker Limit order. And enter the desired Stop Limit sell order price. Once again, users may change the TIF if necessary before clicking the Submit button to enter the completed order.

Classic TWS Example

Order Type In Depth - Bracket Order

Step 1 – Enter a Limit Buy Order

Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. In this example, you want to buy 100 shares of XYZ stock, which has a current Ask price of 30.00. You expect the price to fall to 25.00, then rise to 30.00. By attaching a bracket order, you do not have to return to reevaluate and manage the risk of a position if the Limit order to buy at 25.00 per share is executed.

You click the Ask price of XYZ stock to create a Buy order, then enter the quantity and order type, then enter 25.00 as your Limit price. You do not transmit the order yet because you want to attach a Bracket order.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 30.00 |

| Limit Price | 25.00 |

Step 2 – Attach a Bracket Order

To attach a Bracket order to your Limit Buy order, right click the order row, then select Attach > Bracket Order. A Limit Sell and a Stop Sell order now bracket your original order. You enter 30.00 as the Limit price for the attached Limit Sell order, then you enter 20.00 in the Aux. Price field as the trigger price for the attached Stop Sell order. You transmit the order.

| Assumptions | |

|---|---|

| Market Price | 30.00 |

| Limit Buy Order | |

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 25.00 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 30.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | STP |

| Trigger Price | 20.00 |

Step 3 – Bracket Order Transmitted

You've transmitted your Bracket order. The diagram above illustrates the Market Price, the Limit Prices for your original Limit Buy order and the attached Limit Sell order and the Trigger Price for the attached Stop Sell order.

| Assumptions | |

|---|---|

| Market Price | 30.00 |

| Limit Buy Order | |

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 25.00 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 30.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | STP |

| Trigger Price | 20.00 |

Step 4 – Market Price Falls, Original Limit Buy Order Fills

As you expected, the price of XYZ shares falls to 25.00, which is the Limit Price for your original Limit Buy order. The order for 100 shares fills at that price. Your two Sell orders now enter the market.

| Assumptions | |

|---|---|

| Market Price | 25.00 |

| Limit Buy Order | |

| Limit Price | 25.00 |

| Limit Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | LMT |

| Limit Price | 30.00 |

| Stop Sell Order | |

| Action | SELL |

| Qty | 100 |

| Order Type | STP |

| Trigger Price | 20.00 |

Step 5A – Market Price Rises, Limit Sell Order Fills

In one possible scenario, the price of XYZ rises to 30.00, which is the Limit Price of your attached Limit Sell order. The order fills at that price and you make $500.00 profit. The other attached order, the Stop Sell order, is canceled.

| Assumptions | |

|---|---|

| Market Price | 30.00 |

| Limit Buy Order | |

| Filled at | 25.00 |

| Limit Sell Order | |

| Limit Price | 30.00 |

| Stop Sell Order is canceled | |

Step 5B – Alternate Scenario: Market Price Falls, Stop Sell Order Fills

In an alternate scenario, the price of XYZ falls to 20.00, which is the Trigger Price of your attached Stop Sell order. A Market order executes at that price and you lose $500.00. The other attached order, the Limit Sell order, is canceled.

| Assumptions | |

|---|---|

| Market Price | 20.00 |

| Limit Buy Order | |

| Filled at | 25.00 |

| Stop Sell Order | |

| Trigger Price | 20.00 |

| Limit Sell Order is canceled | |

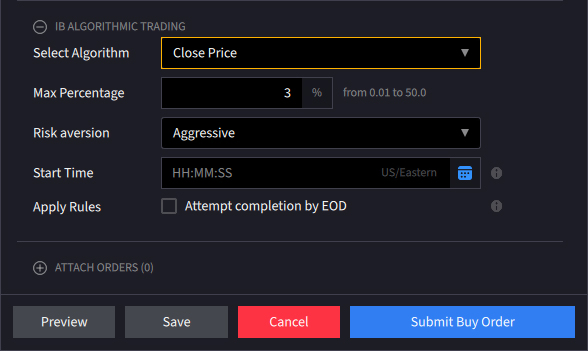

Algo Close Price

Products: |

Stocks, ETFs, Options |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile |

Regions: |

US and Non-US Products |

Routing: |

IB Algo |

Investors submitting market or limit orders into the closing auction may adversely affect the closing price, especially when the size of the order is large relative to the average close auction volume. In order to help investors attempting to execute towards the end of the trading session we have developed the Closing Price Strategy. This algo breaks down large order amounts and determines the timing of order entry so that it will continuously execute in order to minimize slippage. The start and pace of execution are determined by the user who assigns a level of market risk and specifies the target percentage of volume, while the algo considers the prior volatility of the stock.

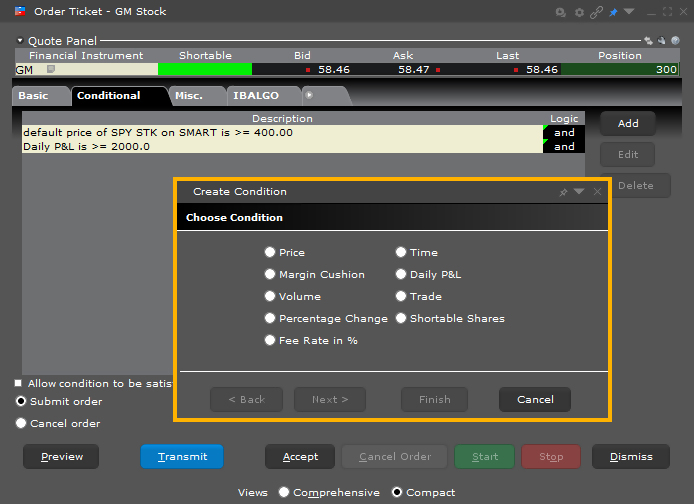

Tool Conditional

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Warrants |

Platforms: |

TWS and IBKR Mobile |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed |

Conditional orders allow the user to attach one or more stipulations that must be true before the order can be submitted. This might allow an investor to only buy/sell an option if its underlying is trading above or below a specified level. Alternatively, the condition might cause the order to become active only when an index is trading above or below a specific range. The Conditional order type may draw together multiple stipulations that might make it harder for the trade to execute, yet which would safeguard the investor from trading outside of circumstances under which he would prefer not to trade.

The trader can choose from and combine logical conditions from Price, Time and Volume variables using operators of equal to, greater or less than. Other conditions include Margin Cushion, Trade and Percentage Change. Clients could enter an order to buy 10 call options on MSFT with a specified limit price of 85-cents, but only when its share price ≤ $46.45 and Volume >25mm and the S&P 500 index was ≤ 2,000.

For Good-til-Canceled (GTC) conditional orders, unless the order is executed on the same day as the condition trigger, the condition has to be retriggered again on the following day(s) for the order to become active.

Example

Order Type In Depth - Conditional Buy Order

Step 1 – Create a Limit Buy Order

The JAN11 490 XYZ call is currently trading at $30.20 - 31.00. You want to buy 1 contract, but only if the Ask price of the underlying stock falls to 464.00 per share. You enter a Limit Buy order for 1 contract, then right-click the order line and select Modify > Condition from the menu.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1 |

| Order Type | LMT |

| Market Price | 30.20 - 31.00 |

| Limit Price | 30.95 |

Step 2 – Add Condition to the Order

On the Conditional tab in the Order Ticket, you add a new condition by clicking the Add button and following the steps shown above. You want to buy 1 contract if the price of the underlying stock falls to 464.00 per share so you select Price as the condition, then enter the underlying symbol, trigger method, operator and trigger price.

In this example, we are using the Default trigger method, which for US options is the double bid/ask method, where two consecutive ask price (bid price) values must be less than (greater than) or equal to the trigger price, and the second bid or ask must have greater size if it is at the same price level as the first bid or ask.

You click Transmit to submit the order.

Step 3 – Place Conditional Order for 1 XYZ Option Contract

You've transmitted your Conditional order. When the price of the underlying stock falls to 464.00 per share, your Limit order to buy 1 option contract will be submitted.

Step 4 – Market Price of Underlying Falls, Condition Satisfied

The market price of the underlying XYZ stock falls to 464.00, which is the trigger price for the condition. The condition having been satisfied, a Limit order for 1 XYZ option contract is submitted with a Limit price of 30.95.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1 |

| Order Type | LMT |

| Market Price | 30.20 - 31.00 |

| Limit Price | 30.95 |

| Conditional Settings | |

| Condition | Price |

| Underlying | XYZ |

| Method | Default |

| Operator | <= |

| Price | 464.00 |

Step 5 – Market Price of Option Contract Falls, Limit Order Filled

The market price of the underlying XYZ stock falls to 464.00, which is the trigger price for the condition. The condition having been satisfied, a Limit order for 1 XYZ option contract is submitted with a Limit price of 30.95.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1 |

| Order Type | LMT |

| Market Price | 30.95 |

| Limit Price | 30.95 |

Tool Currency Conversion

Products: |

Stocks, Options, Futures, FOPs, Currencies, Warrants |

Platforms: |

IBKR Mobile, Client Portal |

Regions: |

US and Non-US Products |

Easily convert cash from one currency to another using the Currency Conversion tool. Simply pick a currency you have, then enter the amount of the currency you want. The system sets up the market order for the conversion. Just preview your order, and submit!

Expand the accordion items below to learn how to use the Currency Conversion tool on different IBKR platforms.

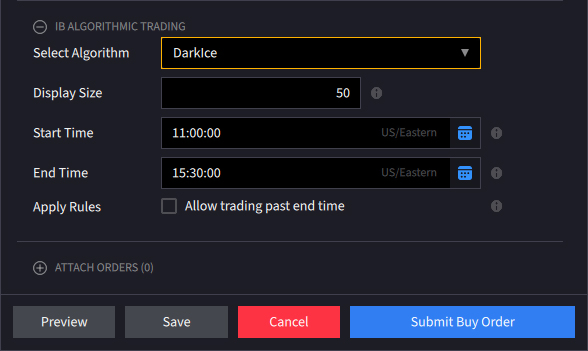

Algo Dark Ice

Products: |

Stocks, ETFs, Futures, Currencies |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile |

Regions: |

US Products Only |

Routing: |

IB Algo |

The Dark Ice order type develops the concept of privacy adopted by orders such as Iceberg or Reserve, using a proprietary algorithm to further hide the volume displayed to the market by the order. Clients can determine the timeframe an order remains live and have the option to allow trading past end time in the event it is unfilled by the stated end time. In order to minimize market impact in the event of large orders, users can specify a display size to be shown to the market different from the actual order size. Additionally, the Dark Ice algo randomizes the display size +/- 50% based upon the probability of the price moving favorably. Further, using calculated probabilities, the algo decides whether to place the order at the limit price or one tick lower than the current offer for buy orders and one tick higher than the current bid for sell orders.

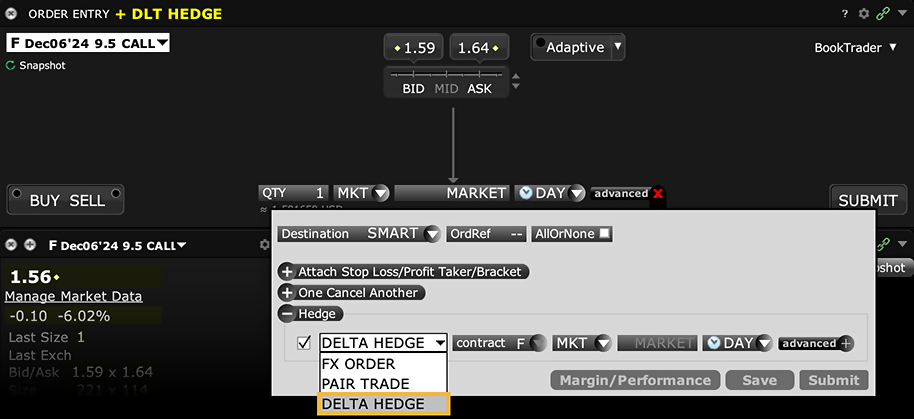

Attached Order Delta Hedge

Products: |

Options Only |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

Directed |

Attach a delta hedge order to an options order, and as an alternative to setting a hedge order attribute in the original Volatility order line.

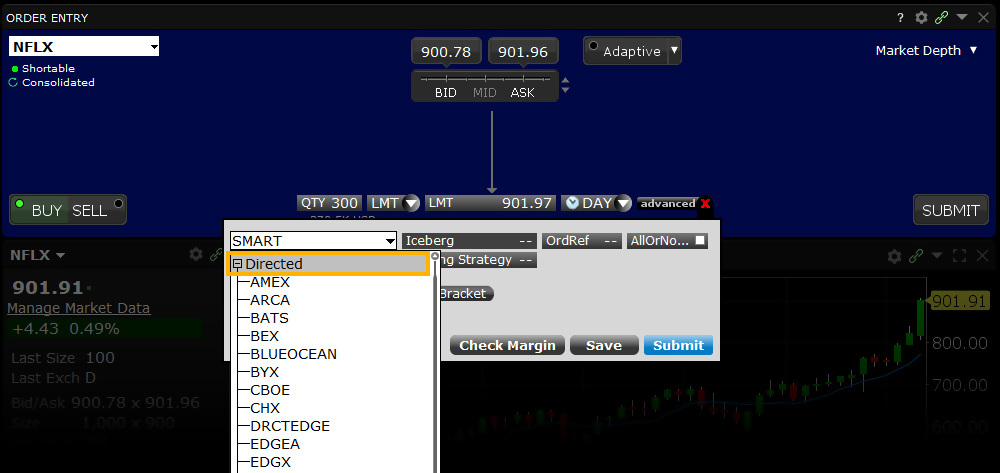

Order Type Direct Routing

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Bonds, Funds, Warrants, EFPs, Combos |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile, Client Portal |

Regions: |

US and Non-US Products |

Routing: |

Directed |

Customers can give specific instructions for an order to be routed to a particular exchange or venue for execution instead of using IBKR's SmartRouting technology. Note that the specified exchange may have exchange fees/rebates.

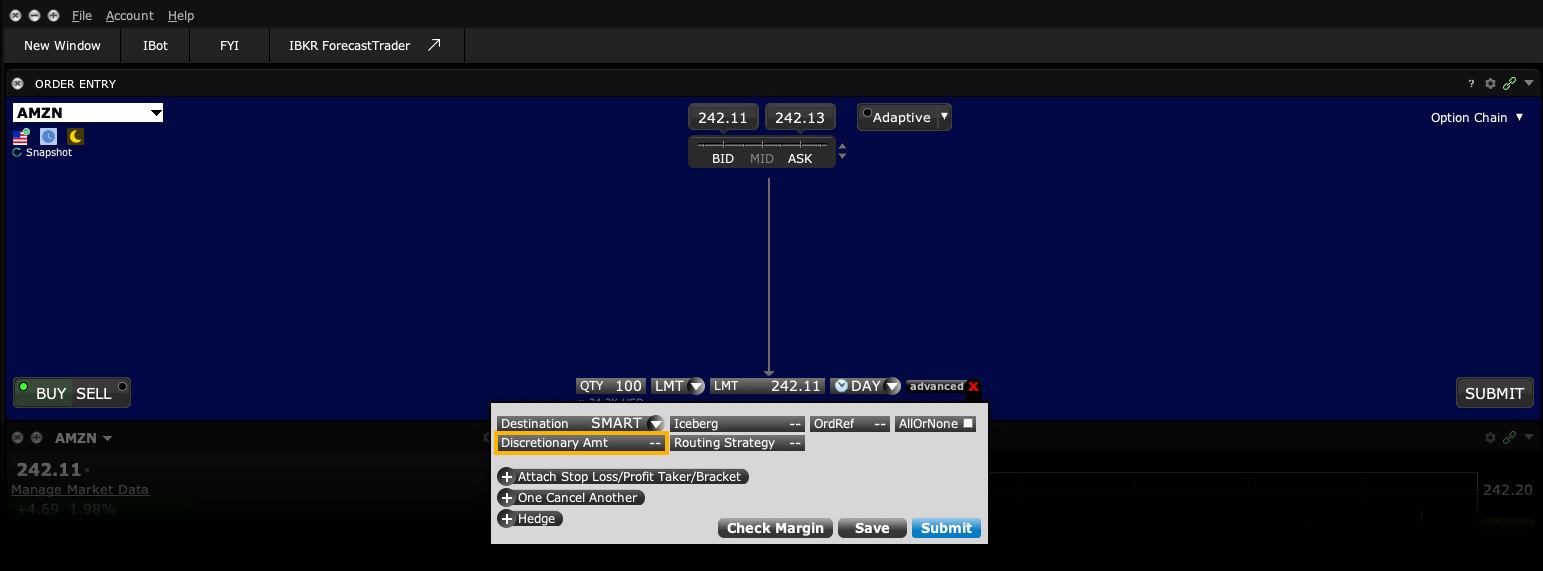

Order Type Discretionary

Products: |

Stocks, ETFs |

Platforms: |

TWS Only |

Regions: |

US Products Only |

Routing: |

Smart |

A Discretionary order is an order type offered by certain exchanges. This order is a limit order submitted with a hidden, specified 'discretionary' amount off the limit price which may be used to increase the price range over which the limit order is eligible to execute. The market sees only the limit price.

For information about special handling for discretionary orders for US options and Penny Pilot Program US options, please see the Discretionary Order Handling page.

Mosaic Example

Markets or specific stock prices often move quickly resulting in wider-than-usual spreads. In some cases quotes on some stocks are higher and therefore accommodate a wide spread. In an effort to increase the chances of execution in a stock where a spread exists, clients may use a discretionary order type to add to a limit bid price or subtract from a limit ask price without exposing the price improvement to the market. In this example, the user wishes to purchase 1,000 shares in ticker TSLA at 3-cents more than the National Best Bid (NBB) displayed in the market quote. However, the user's bid size is only displayed at the NBB although the discretionary amount increases the buyer's chance of the trade executing. In addition the buyer wishes to limit the price he is willing to pay to no higher than $218.79.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1,000 |

| Order Type | LMT |

| Market Price | 218.82 |

| Limit Price | 218.79 |

| Discretionary Amount | 0.03 |

Enter the ticker symbol in the Order Entry field and click on the Buy button. This causes the background to turn blue. Sell orders create a red background. Enter the desired purchase value in the Quantity field and select LMT for the Order Type. Change the TIF if desired. In this example we are using a Day order. Clicking the Advanced button displays more parameters for the order. Click on the Discretionary Amount field, which allows the user to enter the desired amount in dollars and pennies over and above the Bid price we are willing to pay. With the NBB of $218.76 and a 3-cent Discretionary amount added to this order, the order might execute in the event the market price of TSLA falls to $218.79. Note that if the NBB rose to $218.77 the order would not fill should the market price decline to $218.80 on account of the limit price of $218.79 in place. With these values entered on the screen, you are ready to click the Submit button to transmit your order.

Classic TWS Example

- Use Customize Layout > Order Columns to display the Discretionary Amt column

- Click the Ask Price to create a BUY order

- Enter LMT in the Type field

- Enter your Limit Price in the Limit Price field

- Enter the Discretionary Amount in the Discretionary Amt field

- Click the T to transmit the order

Order Type In Depth - Discretionary Buy Order

Step 1 – Enter a Discretionary Buy Order

In a fast-moving market, you want to place a limit order to buy 100 shares of XYZ, which is trading at 64.25 per share. To improve the chances of getting filled, you decide to add a discretionary amount to the Limit Price. You click the Ask Price to create a buy order and select LMT as the order type. Then you enter a Limit Price of 64.10 and enter a discretionary amount of 0.10 in the Discretionary Amt field. This is the amount added to the limit price to increase the price range over which the order is eligible to execute.Note that this amount is hidden from the market, which sees only the limit price of 64.10.

Step 2 – Order Transmitted

You've transmitted your limit order with a discretionary amount of 0.10. If the price of XYZ shares falls to within 0.10 of your limit price of 64.10, your order for 100 shares will be filled.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 64.25 |

| Limit Price | 64.10 |

| Discretionary Amt | 0.10 |

Step 3 – Market Price Falls, Order Filled

The market price of XYZ falls to 64.19, which is within the range specified by your discretionary amount. Your limit order for 100 shares is filled at 64.19.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 64.19 |

| Limit Price | 64.10 |

| Discretionary Amt | 0.10 |

Order Type Fill or Kill

Products: |

Options Only |

Platforms: |

TWS, IBKR Desktop |

Regions: |

US Products Only |

Routing: |

Smart, Directed |

Setting FOK as the time in force dictates that the entire order must execute immediately or be canceled. A trader might see a short-lived opportunity to buy or sell an option that would suit a strategy or fit within a portfolio. However, the time opportunity might be subject to buying or selling a minimum number contracts. The fill-or-kill order type is designed to ensure that the investor does not receive a partial fill that would not suit his current appetite. Failure to fill the entire order upon immediate submission to the market causes the system to cancel the order in its entirety.

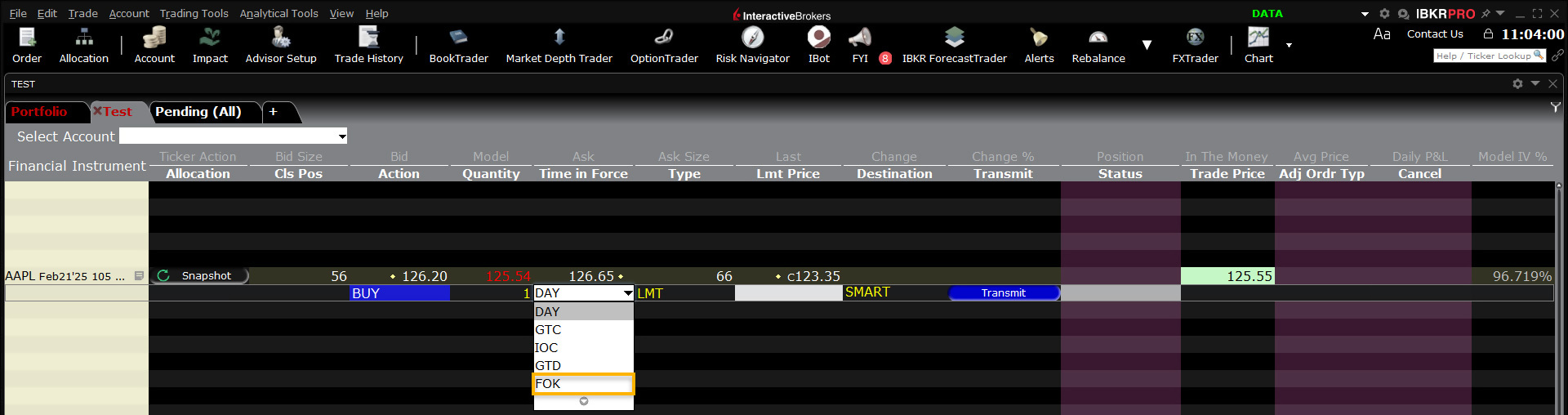

Example

- Click the Ask Price to create a BUY order

- Select the FOK in the Time in Force field

- Click the T to transmit the order

Order Type In Depth - Fill or Kill Buy Order

Step 1 – Enter a Fill or Kill Buy Order

At 10:00 AM Tuesday, you want to place an order to 1000 contracts of XYZ option. You want the entire order to fill right away, otherwise you don't want it. Create the buy order, select an order type from the Type field (in this example, we've chosen a limit order), and select FOK as the time in force. If the entire order does not fill immediately once it is accepted by the market, the entire order is canceled.

Step 2 – Buy Order for 1000 Contracts Transmitted

You've transmitted your limit order with the time in force set to Fill or Kill. If the entire order does not fill immediately once it is accepted by the market, the entire order will be canceled.

Step 3 – Order is Filled Immediately

Your limit price and the market price of XYZ are the same, 13.50, when you transmit the order. Your entire order is immediately filled.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1000 |

| Order Type | LMT |

| Market Price | 13.50 |

| Limit Price | 13.50 |

| Time in Force | FOK |

Alternate Scenario – Market Price Moves Away from Limit Price, Order Cannot Be Filled Immediately

In this alternate scenario, the market price of XYZ rises to 13.51, away from your limit price of 13.50. Your entire order cannot be immediately filled so it is canceled.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 1000 |

| Order Type | LMT |

| Market Price | 13.51 |

| Limit Price | 13.50 |

| Time in Force | FOK |

Order Type Fractional Shares

Products: |

Stocks, ETFs |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile, Client Portal |

Regions: |

US and Non-US Products |

Routing: |

Smart |

Fractional shares allow IBKR clients to build their portfolio components based on dollar amount, not shares. IBKR clients can pick any eligible US, Canadian or European stock (or ETF, where available) and decide how much they want to invest - it's that easy. If the purchase price doesn't result in a whole number of shares, IBKR will buy or sell fractional shares.

To specify a dollar amount for an order, use the size wand in the Quantity field to toggle from "shares" to currency.

Fractional shares allow IBKR clients to divide their investments among more stocks to achieve a more diversified portfolio and put small cash balances to work quickly to maximize potential returns.

| Pick Your Stock | Pick Your $ Amount | Share Price1 | Number of Shares |

|---|---|---|---|

| NFLX | $25 | $644.50 | 0.0388 |

| TSLA | $25 | $173.79 | 0.1439 |

| GOOG | $25 | $176.03 | 0.1420 |

| AMZN | $25 | $184.69 | 0.1354 |

| $100 | Stock Portfolio |

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

[1] Share prices as of June 11, 2024.

Order Type Funari

Products: |

Stocks, ETFs |

Platforms: |

TWS Only |

Regions: |

Non-US Products |

Routing: |

Directed |

A Funari order is submitted as a limit order at the user-specified limit price, with any unfilled quantity resubmitted as a Market-On-Close order at the end of the trading session. Market-On-Close orders execute as close to the closing price as possible.

Example

- Select FUNARI from the Order Type field

- Order must be directed to TSEJ

Disclosure

IB may simulate market orders on exchanges. For details, see market order handling using simulated orders.

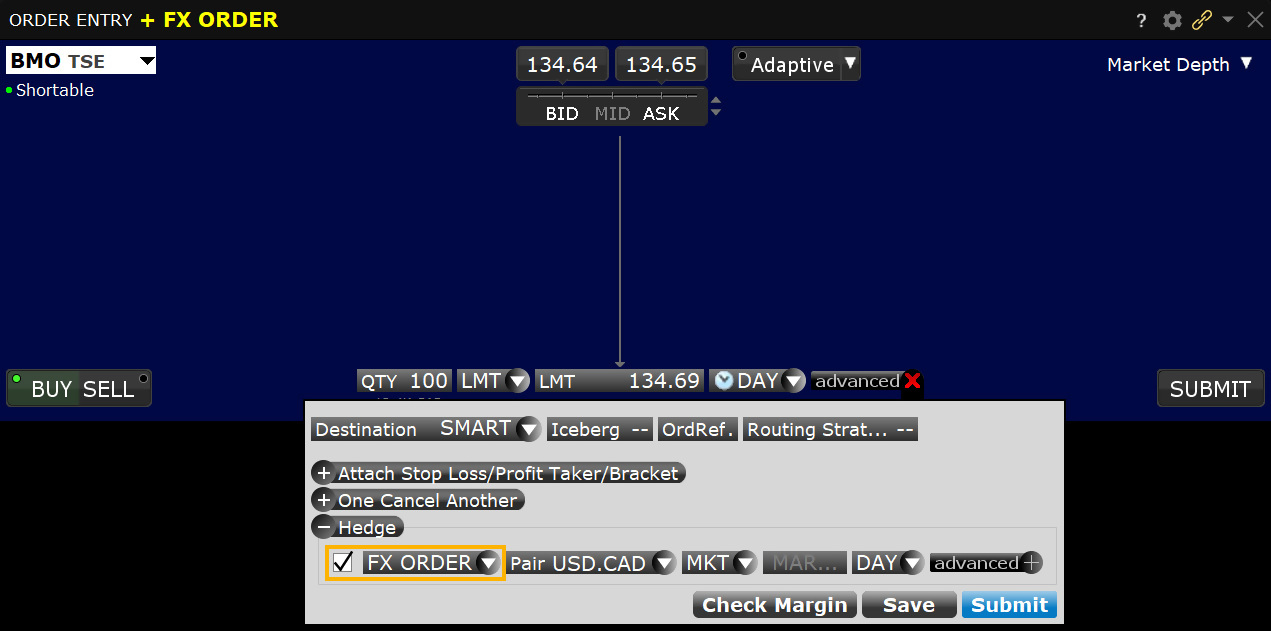

Attached Order FX Order

Products: |

Stocks, ETFs, Options |

Platforms: |

TWS Only |

Regions: |

Non-US Products Only |

Routing: |

Directed |

You can elect to attach an FX Order in cases where you are buying a contract in a currency other than your base, and want to convert base currency to the currency of the contract to cover the cost of the trade.

Order Type Good After Time/Date (GAT)

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Bonds, Warrants, , Crypto |

Platforms: |

TWS Only |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed |

An order that uses the good after time/date field is held in the IBKR system and submitted to the market on the date and time you specify.* You must display the Good After Time field to use this time in force.

Example

- Use Customize Layout > Order Columns to display the Start Time column

- Click the Ask Price to create a BUY order

- Select MKT in the Type field

- Enter the quantity in the Qty field

- Click in the Start Time field, click the Calendar icon, select a date and time, and click OK

Order Type In Depth - Good After Time/Date Order

The example below applies to Limit orders as well as Market orders.

Step 1 – Enter a Good After Time/Date Buy Order

You're in Honolulu and want to buy 500 shares of XYZ stock on the NYSE. You expect volatility and wide markets at the open but you need to fill this order and you're 6 hours behind. You use a Good After Time/Date market order to ensure that your order is not submitted until a specific date and time.

First use the Customize Layout feature to add the Start Time column to the trading screen. Then create a market order for 500 shares of XYZ and use the Calendar icon in the Start Time field to select July 22, 10:00 am Eastern Time. You transmit the order. The submitted order is held in the IBKR system until the specified time and date, and is then submitted to the market.

Step 2 – Order for 500 Shares Transmitted

You've transmitted your limit order, which will be held in the IBKR system until the specified time and date.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 500 |

| Order Type | MKT |

| Market Price | 16.61 |

| Start Time | July 22, 20XX, 10:00 AM EST |

Step 3 – Order is Held Until the Specified Date and Time

On July 22, 20XX at 10:00 AM Eastern Time, your market order is submitted and filled at the market price of 16.60.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 500 |

| Order Type | MKT |

| Market Price | 16.60 |

| Start Time | July 22, 20XX, 10:00 AM EST |

Crypto Notes:

Available in Desktop TWS only and for SELL orders only.

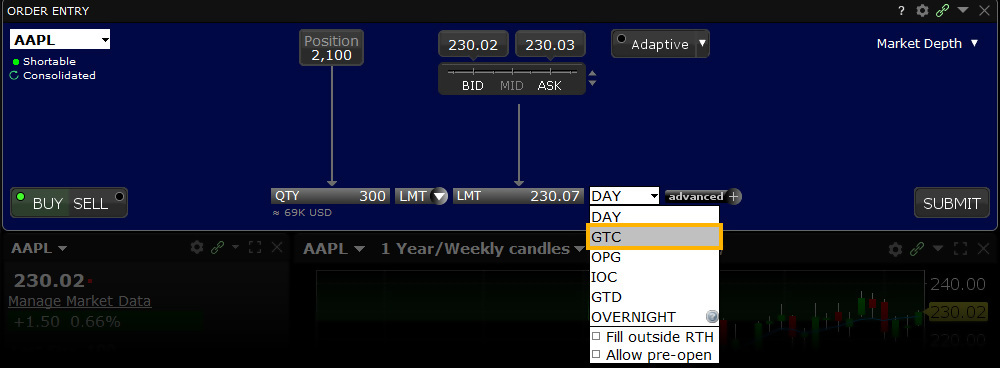

Order Type Good Til Canceled (GTC)

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Bonds, Warrants, EFPs, Crypto |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile, Client Portal |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed |

An order that uses the Good-Til-Canceled (GTC) time in force will continue to work until the order fills or is canceled 1. The ability to enter a bid well below the prevailing trading price for most asset classes, or an offer higher than its current level, allows an investor to place a resting order for days, weeks or months in advance without having to repeat the process each day.

The GTC order type allows traders to pinpoint in advance levels at which they would like to enter or exit the market. GTC orders will generally 2 be canceled automatically under the following conditions:

- If a corporate action on a security results in a stock split (forward or reverse), exchange for shares, or distribution of shares.

- If the company issues a dividend where the rate exceeds 3% of the prior day's closing price or if the dividend is an extra/special dividend, regardless of the payment amount.

- If you do not log into your IBKR account for 90 days.

- At the end of the calendar quarter following the current quarter. For example, an order placed during the third quarter of 2011 will be canceled at the end of the fourth quarter of 2011. If the last day is a non-trading day, the cancellation will occur at the close of the final trading day of that quarter. For example, if the last day of the quarter is Sunday, the orders will be cancelled on the preceding Friday.

- Orders that are modified will be assigned a new "Auto Expire" date consistent with the end of the calendar quarter following the current quarter.

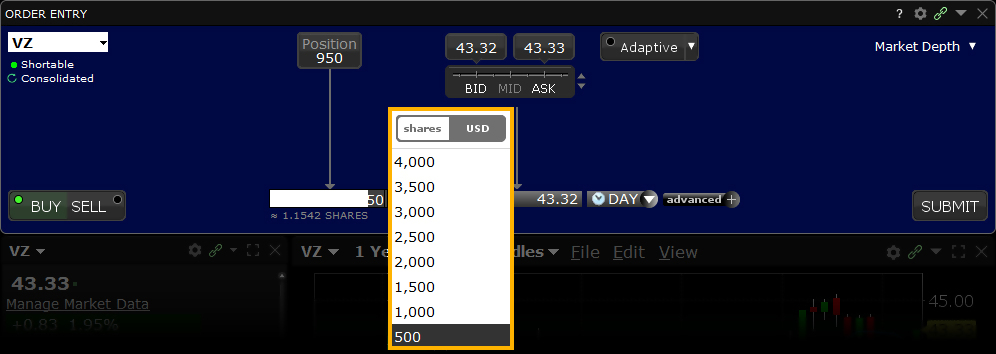

Mosaic Example

Order type In Depth – Good-Til-Canceled Order

In this example, we have an existing long position of 7,250 shares in Ticker symbol F, whose shares are quoted at 16.04/05. The investor wishes to leave a Limit order to sell the entire position at a price higher than the prevailing trading price of the stock. By modifying with a good-til-canceled attribute the investor can leave a resting order in the market in the hope his order will ultimately fill at his pre-determined level.

The advantage is that the investor does not have to place the same order day after day until his price level is achieved.

| Assumptions | |

|---|---|

| Action | SELL |

| Qty | 7,250 |

| Order Type | LMT |

| Market Price | 16.05 |

| Limit Price | 16.53 |

| Time in Force | GTC |

Chart – Entering a good-till-cancelled order on ticker symbol F

Click on the Sell button to generate an order ticket to sell shares in Ticker F. Note that the background turns red to denote an order to sell is in process. By Contrast, clicking on the Buy button would create the appearance of a blue background. When clicking on a ticker in your Portfolio window or from another linked window, the security will automatically load in the Order Entry panel. The Quantity field display will show the default value for the share amount but can be changed by clicking on the value field and selecting from the pop-up display. Alternatively users can type the required amount into the field. Enter the number of shares to be sold, or alternatively click on the Position button to sell the entire number of F shares in your portfolio. By clicking this button the Quantity field will adopt the entire position to sell. Next, from the Time-in-Force input field button select LMT as we want to enter a limit price to sell shares.

Click on the Price entry input field to change the limit price. In this example the price entered of $16.53 is significantly higher than the NBBO and above the daily trading range. In other words, it is unlikely to fill during the current session.

From the Time-in-Force selection box, choose GTC to ensure the order remains in force until filled. Note also that there are options to make the order active outside of regular trading hours (RTH) and allow it to fill in the pre-open session, which can be enabled by placing a check in the appropriate box. The GTC order to offer 7,250 shares at $16.53 each in Ticker F when reached is now ready to place. Click on the Submit button to transmit the trade, which will remain in place unless filled or cancelled by the user.

TWS Example

- Click the Ask Price to create a BUY order

- Select LMT in the Type field

- Select GTC from the Time in Force field

- Enter the quantity in the Qty field

- Enter the Limit Price in the Lmt Price field

- Click T to transmit the order

Order Type In Depth - Good-Til-Canceled Order

Step 1 – Enter a Good-Til-Canceled Limit Order

An order with a good-til-canceled (GTC) time in force keeps the order working until it executes or you cancel it. In this example, it is Monday, June 1 and you want to buy 100 shares of XYZ, which is currently at 127.38 and you want the order to keep working until it fills. You create a limit order for 100 shares with a Limit Price of 127.30 and select GTC as the Time in Force.

Step 2 – Order Transmitted

You've transmitted your limit order, which will work as a live order until it fills or until you cancel it.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 127.38 |

| Limit Price | 127.30 |

| Time in Force | GTC |

Step 3 – Order Will Work Until You Cancel It

Two days have passed. Shares of XYZ have fallen to 127.35 but not to your limit price of 127.30; your order for 100 shares of XYZ has not been filled. At this point, you decide that you no longer want to wait for the market price of XYZ to fall to your limit price, so you cancel the order instead of waiting for it to execute.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 127.35 |

| Limit Price | 127.30 |

| Time in Force | GTC |

Disclosure

- Orders submitted to IBKR that remain in force for more than one day will not be reduced for ordinary dividends. For order adjustment considerations prior to the ex-dividend date, consider using a Good-Til-Date/Time (GTD) or Good-after-Time/Date (GAT) order type, or a combination of the two.

- Stock orders with a time in force attribute set to work beyond one trading session will be flagged as Do Not Reduce (DNR). IBKR will, on a best efforts basis, cancel such GTC orders as described above; however under certain circumstances IBKR may not be able to cancel such orders on a timely basis, including but not limited to when IBKR receives information on a corporate action within 48 hours of the announced effective date, and such GTC orders may continue to remain in force and may be eligible for execution. It is the Customer's responsibility to monitor their account and to act accordingly in the event that a corporate action has been announced.

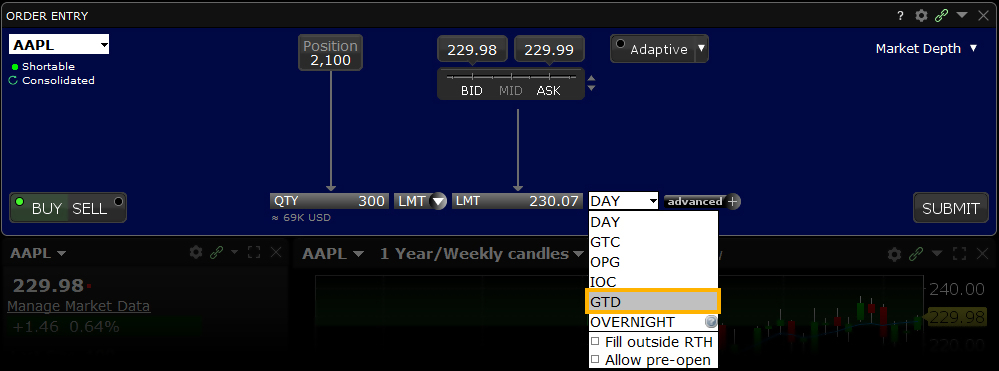

Order Type Good Til Date/Time (GTD)

Products: |

Stocks, ETFs, Options, Futures, FOPs, Currencies, Bonds, Warrants, EFPs, , Crypto |

Platforms: |

TWS, IBKR Desktop |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed |

The GTD (Good-til-Date/Time) time in force lets you select an expiration date and time up until which an order will continue to work. Setting this attribute requires both a time in force selection of GTD, a date entry in the Expiration Date field, and a time entry in the Expiration Time field if that level of detail is required. Note that if you only enter a good-till date, the unfilled order will cancel at the close of the market on the specified day.*

Example

- Use Customize Layout > Order Columns to display the Exp. Date and Exp. Time fields

- Click the Ask Price to create a BUY order

- Enter the Limit Price in the LMT Price field

Order Type In Depth - Good–Til-Date/Time Order

Step 1 – Enter a Good-Til-Date/Time Limit Order

You want to submit an order for 100 shares of XYZ which will continue to work (if necessary) until 4:00 pm ET on July 23. First you create a limit buy order by clicking the Ask price of XYZ, then you enter a limit price.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 47.56 |

| Limit Price | 47.54 |

Step 2 – Enter a Date and Time, then Transmit the Order

Next, you complete your order by selecting GTD from the time in force field, then entering a date and time In the Exp Date and Exp Time fields, you use the Calendar icons to select the desired date and time, then you transmit the order. The submitted order will work until it executes, is canceled, or until 4:00 pm ET on July 23, the specified date and time.

Step 3 – Order Transmitted

You've transmitted your good-til-date/time order, which will be held in the IBKR system until it fills, until you cancel it or until 4:00 pm ET on July 23, the specified date and time.

Step 4 – If Not Filled, Order Canceled on Specified Date and Time

At 4:00 pm ET on July 23, your limit order still has not been filled, and you have not canceled it. Because your order includes a good-til-date/time (GTD) time in force, it is therefore canceled.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 47.56 |

| Limit Price | 47.54 |

| Time in Force | GTD |

| Exp. Date | July 23, 20XX |

| Exp. Time | 4:00 PM |

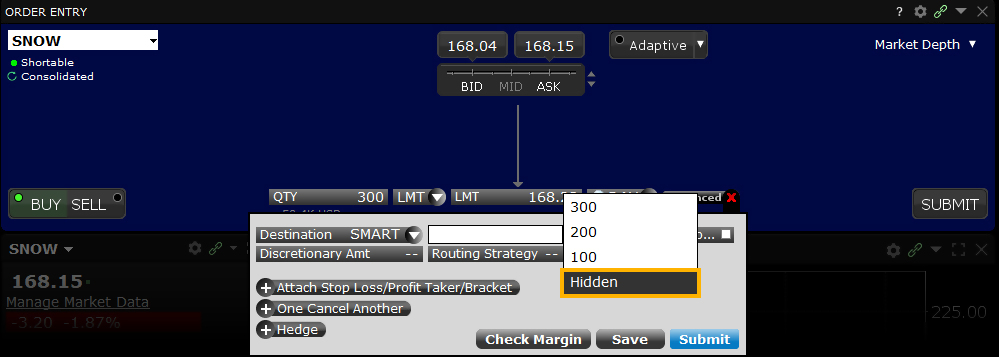

Order Type Hidden

Products: |

Stocks, ETFs, Options, Futures, FOPs, Bonds, Warrants |

Platforms: |

TWS Only |

Regions: |

US and Non-US Products |

Routing: |

Smart, Directed |

Investors wishing to hide large-size orders can do use by applying the "Hidden" attribute to a large volume order to completely hide the submitted quantity from the market. The Hidden order type is a simple solution to maintaining anonymity in the market when trying to buy or sell large amounts of stocks, options, bonds, warrants, futures or futures options. The Hidden order type is simple to add to the main trading window within TWS and requires a simple check-mark in the box in order to activate. Display the Hidden field from the Layout Manager, and check the Hidden attribute in the order line. Your order is submitted but evidence of the order is hidden from the market.

Example

You want to buy 5000 shares of XYZ but don't want your order to affect or be seen by other traders in the market. Display the Hidden field from the Layout Manager, and check the Hidden attribute in the order line. Your order is submitted but evidence of the order is hidden from the market.

Note:

IB may simulate hidden orders on exchanges. See details on hidden order handling using simulated orders.

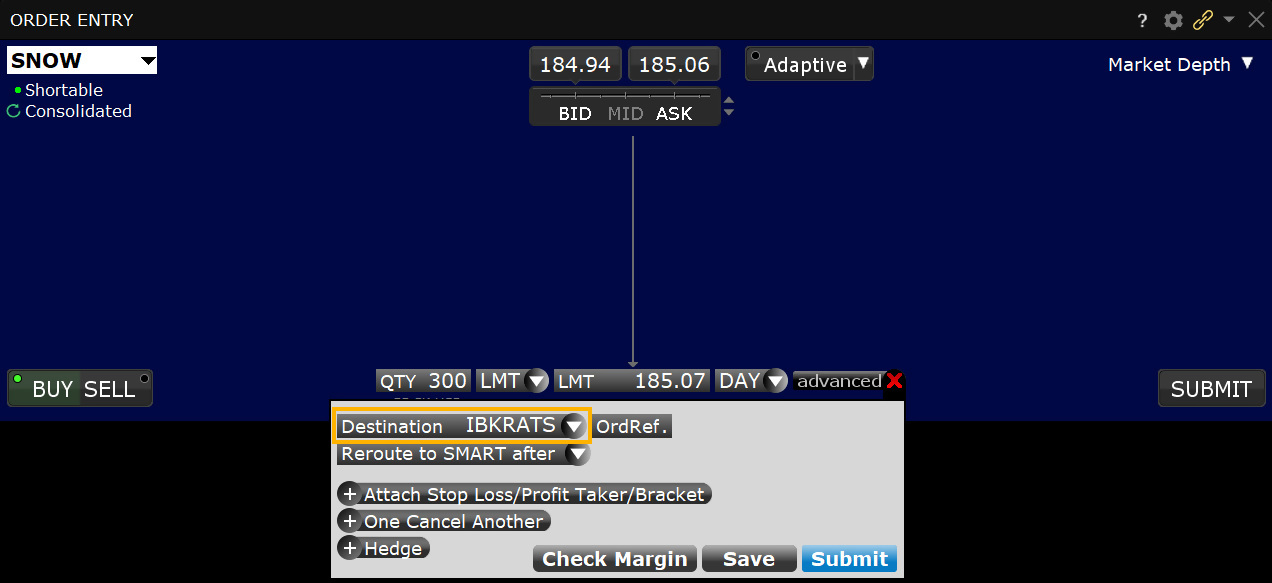

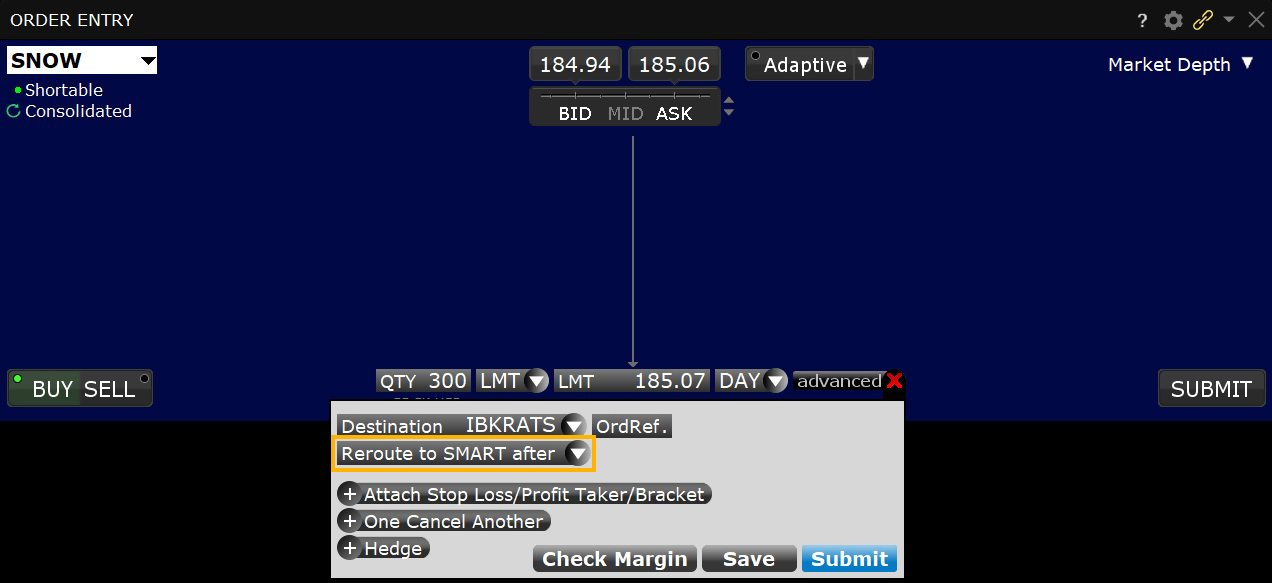

Order Type IBKR ATS

Products: |

Stocks, ETFs |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile, Client Portal |

Regions: |

US Products Only |

Routing: |

Directed |

Customers can direct U.S. stock orders to the IBKR ATS destination to add liquidity. Orders directed to IBKR ATS are automatically tagged as "not held" orders, and are posted in IBKR's order book where they are eligible to trade against incoming SmartRouted orders that are marketable against them.

A variety of order types are available for posting liquidity in IBKR ATS, including Pegged-to-Midpoint, Pegged-to-Best, Relative/Pegged-to-Primary, and Pegged-to-Market, as well as priced limit orders.

Pegged-to-Midpoint orders directed to IBKR ATS are unique in the industry as they allow for positive and negative offsets, with rounding instructions for when the effective price falls on a whole or half minimum tick increment. This allows for greater customization of your order and allows it to compete more effectively with other Pegged-to-Midpoint orders that are resting in the IBKR ATS.

Also unique in the industry, Pegged-to-Best orders allow for directed orders to IBKR ATS to compete not only with the prevailing NBBO, but also with other orders resting in the IBKR ATS, up to the NBBO midpoint.

Direct IBKR ATS routing can be used in conjunction with a number of IB ALGOS such as Accumulate/Distribute, along with the order types described above.

Directed liquidity-adding orders to IBKR ATS whose effective price would match or cross the opposite side NBBO are repriced to be 1 minimum tick increment away (less aggressive) from the opposite side, except for Pegged-to-Midpoint orders with positive offsets when the NBBO spread is one cent, in which case the order would be repriced to the NBBO midpoint.

All orders directed to the IBKR ATS can be specified to rest in IBKR ATS for a fixed period of time, after which they will be rerouted as a SMART order.

Directed orders to add liquidity to IBKR ATS may also specify a minimum quantity that indicates the minimum size contra side order that the directed order is allowed to interact with. For example, a customer may direct a liquidity-adding order for 10,000 shares with a minimum quantity of 1,000 shares. In this case, only Smart Routed orders with a size greater than or equal to 1,000 shares will be allowed to trade against the directed liquidity adding order.

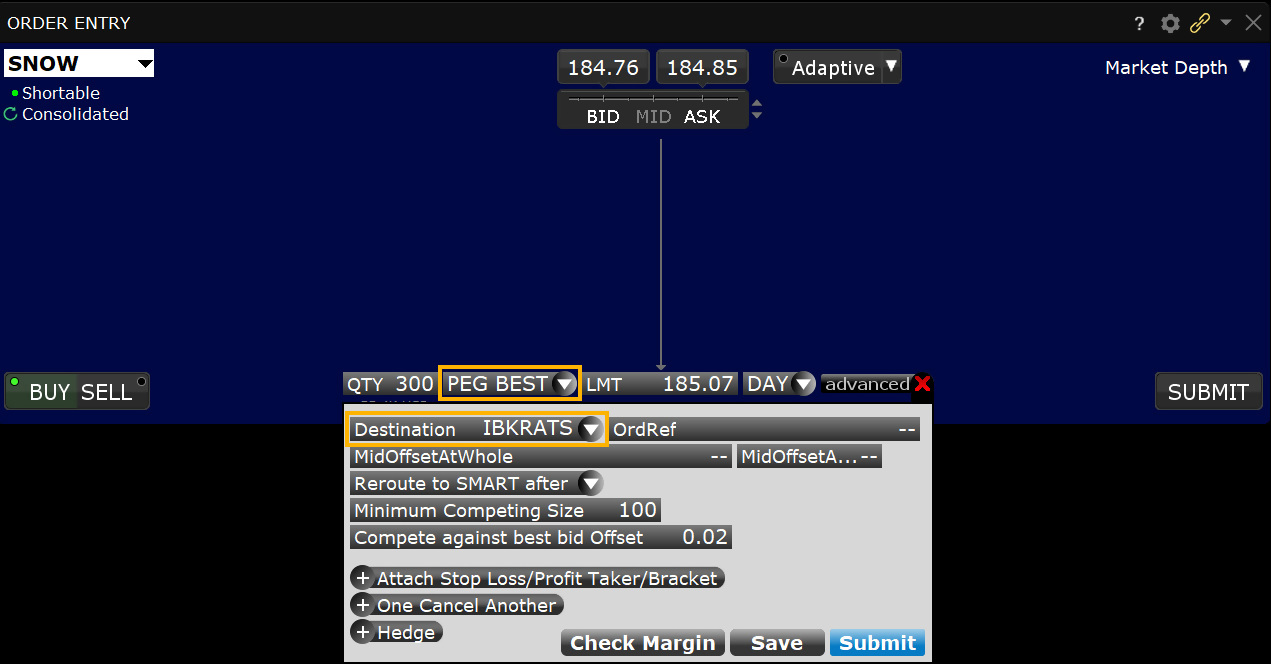

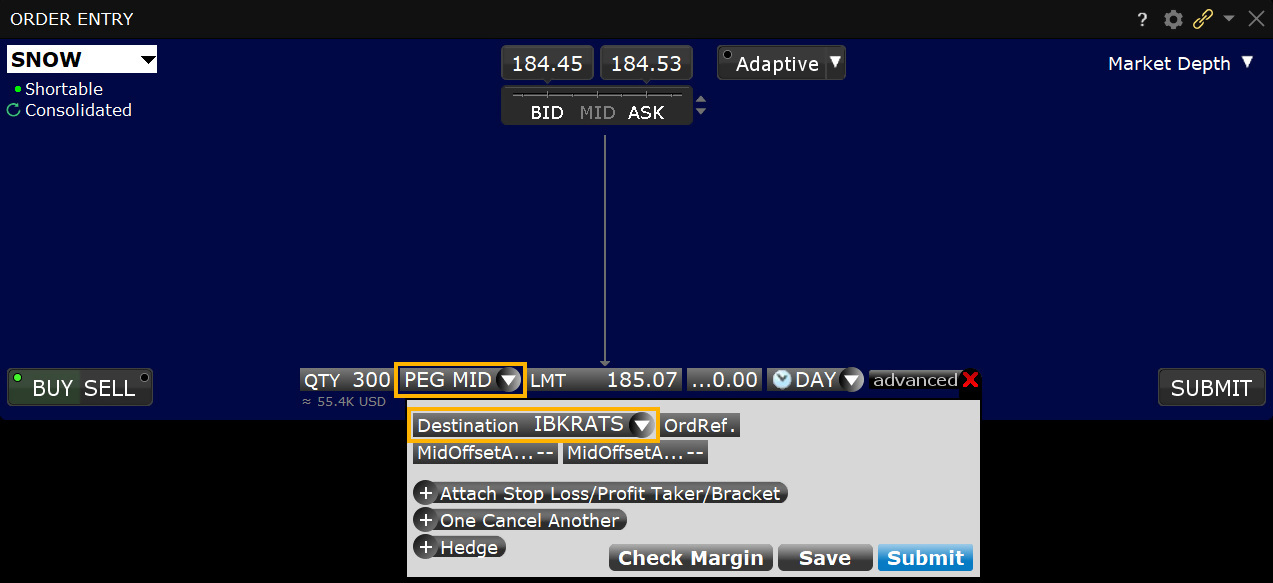

Order Type IBKR ATS Pegged to Best

Products: |

Stocks, ETFs |

Platforms: |

TWS, IBKR Desktop, IBKR Mobile, Client Portal |

Regions: |

US Products Only |

Routing: |

Directed |

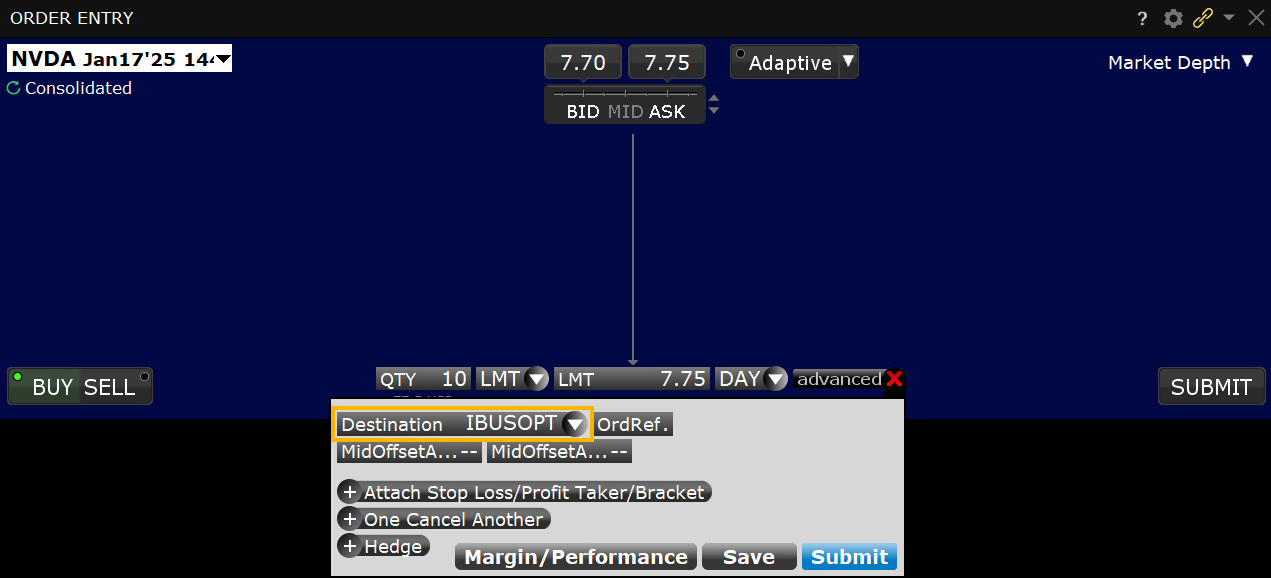

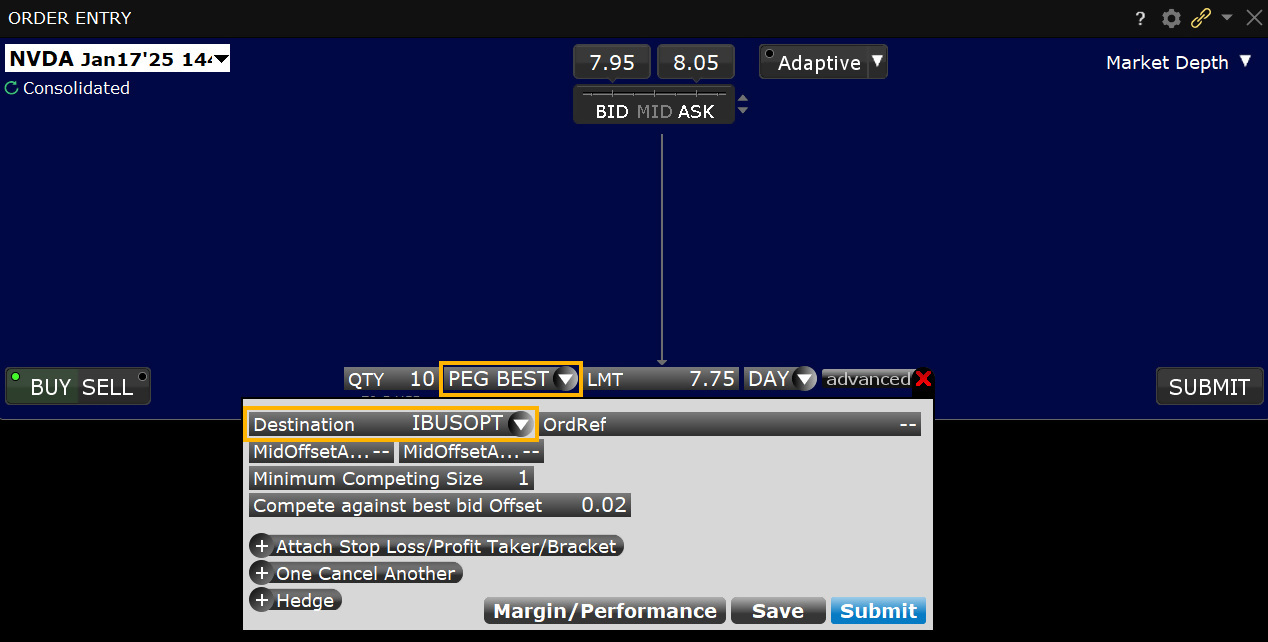

Pegged-to-Best, an order type unique to IBKR, allows clients to direct liquidity-adding orders to the IBKR ATS that compete not only with the near side NBBO, but with other same side liquidity adding orders resting in the IBKR ATS.