IBKR OMS

IBKR OMS

The IBKR OMS is a powerful, comprehensive execution and order management solution for buy-side and sell-side firms.

Whether you want to replace multiple vendors and systems with a comprehensive OMS/EMS solution, or are looking to add a powerful, stand-alone OMS to your existing environment, Interactive Brokers' offering will fit your needs at $100 minimum commissions per month per terminal. Minimum 25 terminals.

Comprehensive OMS/EMS Solution

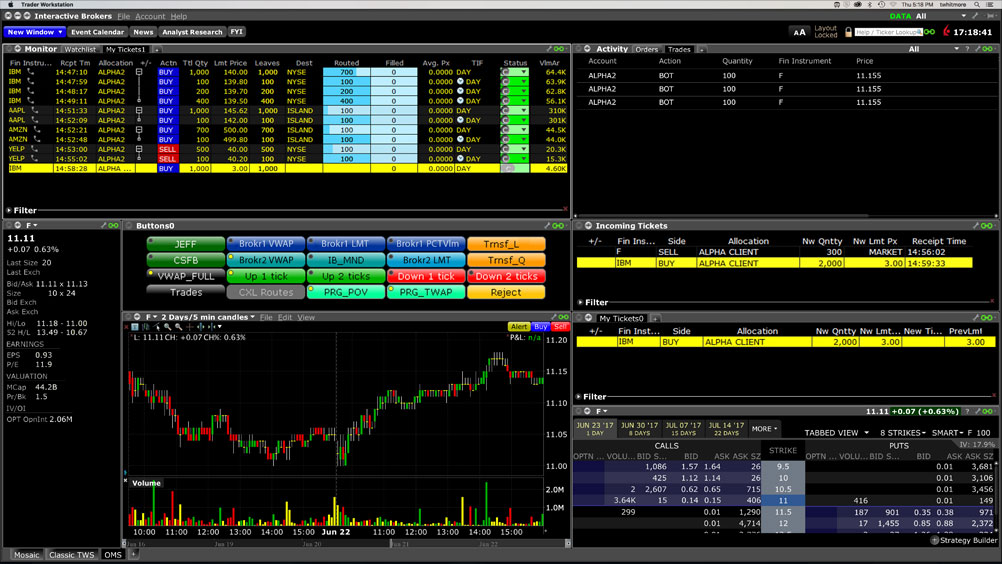

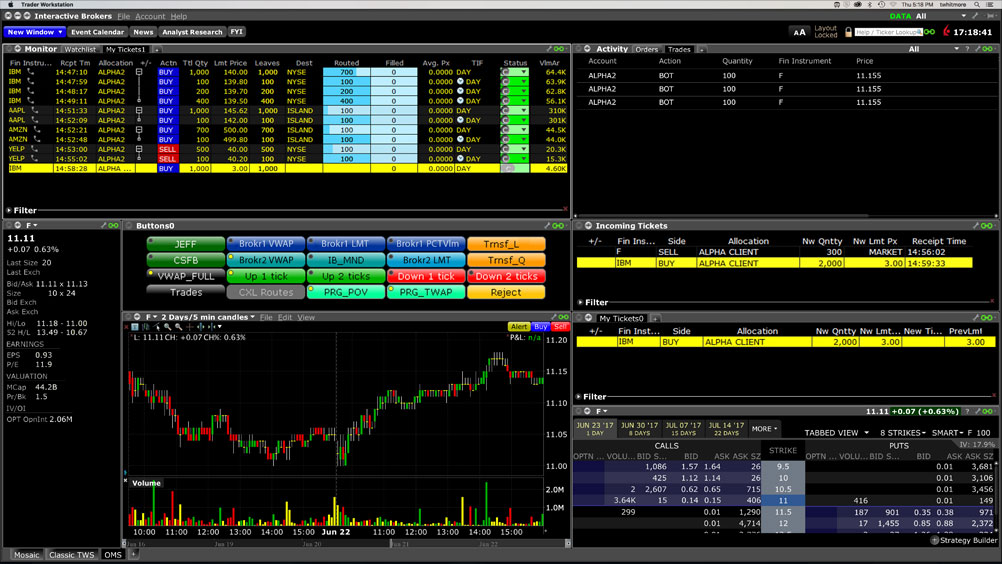

Our OMS software integrates with our award-winning EMS, the Trader Workstation (TWS).

This one-stop solution is perfect for institutions looking to reduce costs and improve productivity with a fully integrated OMS/EMS setup.Order management, trading, research and risk management, operations, reporting, compliance tools, clearing and execution – all are available as part of our complete platform.

Stand-Alone OMS

The IBKR OMS offers a robust and customizable order management platform that you can use within your current multi-broker setup.

Route orders to your existing execution providers, and allocate pre- or post-trade to multiple custodians using the IBKR OMS platform.

With over 40 years of industry experience, we can easily configure our robust technology to fit the complex needs of your business.

Multi-Asset Global Trading from a Single Platform

Seamless integration with our TWS trading tools provides benefits to both buy-side and sell-side firms:

- Route to multiple brokers, and allocate to multiple custodians before or after the trade

- Same-day and next-day settlement for US stock is available for execution venues that support it

- Support for pair trades

- Trade on over 160 market centers in 36 countries with direct market access to stocks, options, futures, forex, bonds, and ETFs all from a single account

- Use our more than 90 order types, in-house algos and opening/closing auctions, with real-time market data and depth

- Advanced trading tools for managing and working orders that can help traders to achieve the best price and minimize market detection

Customizable Tools for Limitless Possibilities

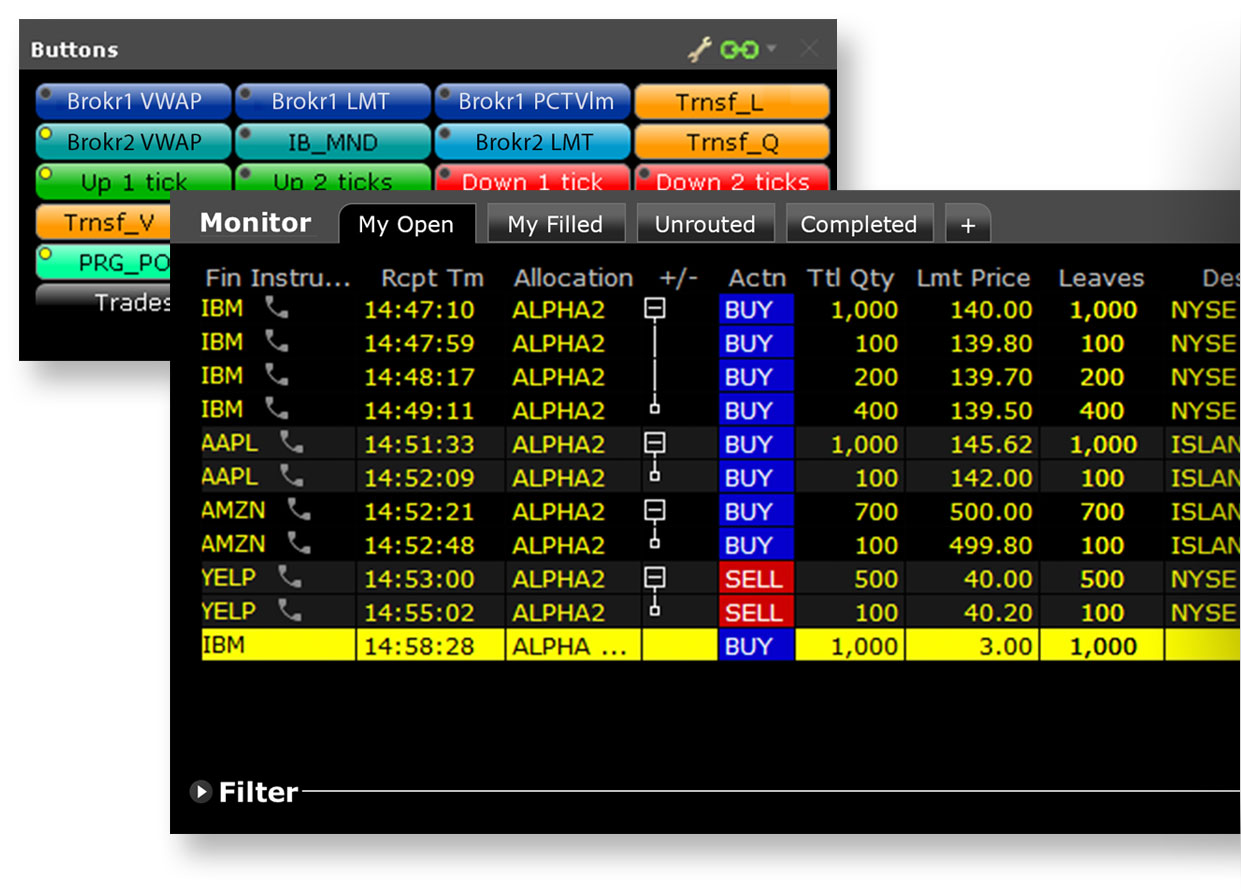

Create and arrange a custom workspace to accommodate your needs and workflow. Every window provides flexible filters, and lets you add, remove and rearrange data and tiles.

- Create multiple tabs on your blotter for different order and workgroup views

- Configure buttons and hot keys for specific order routing and order management actions and access to account information plus data, tools, and ticket transfers

- Configure fat finger precautionary settings and alerts at the user level to be in line with individual preferences

Gain Efficiency and Transparency within Your Organization

Interactive Brokers gives its institutional customers the ability to create and customize user permissions and access through granular User Access Rights setup so your employees have access to only the systems they need.

- Access to real-time trade data and allocations ensuring a seamless clearing and reconciliation process

- Access to user audit trails

- Web-based post trade allocation interface (WebPTA) that allows for allocation processing, trade summaries, commission specification and more, by either trading or operations staff

- Access to our robust reporting database with its library of report templates to create reusable custom reports in a variety of file formats

- OATS OSO reporting capabilities

Benefits for Both Buy- and Sell-Side Institutions

No matter whether you are a buy-side or sell-side trader, our IBKR OMS offering provides you with the features you need.

- Initiate funds and positions movements

- Create and customize pre-trade compliance checks and rules to safeguard your firm and clients, and ensure non-compliant orders and brokers are blocked or sent to your Compliance Officer for override/approval

- Integration of third-party credit compliance reporting services

- Route or transfer order tickets between traders within your firm, or directly to traders at a sell-side broker

- Facilitate pre-arranged crossing orders between client accounts (registered broker/dealers only)

- Electronic order tickets can be set to trigger automatically based on user defined rules, handled quickly with customizable button shortcuts ("low touch") or managed with TWS rich functionality ("high touch")

- Accept and route orders from and to other OMS/EMS systems via FIX

- Full Omgeo OASYS® and ALERT® support

Competitive Pricing

Our IBKR OMS provides incredible value by providing a wide breadth of functionality at extremely competitive costs

Monthly Minimum IBKR Commissions

$2,500/month

+ $100/month for each linked executing broker

Includes 25 terminals

+ $100/month for each additional terminal

No term commitment

No installation fees

All orders routed through IBKR incur a regular commission charge. This charge is then applied against the required monthly minimum.