증권사 고객 마크업

자동화된 비용 청구, 유연한 수수료 마크업과 이자 마크업 및 마크다운은 증권사/딜러 및 소개 증권사를 위한 턴키 솔루션입니다.

수수료 마크업

증권사는 각 자산 클래스 (e.g. 주식, 옵션 등) 거래소 및 통화에 대한 거래당 수수료 단위 (fee-per-trade unit)를 기반으로 제공되는 서비스에 대해 고객에게 비용을 청구할 수 있습니다. The trade unit is determined by the unit Interactive Brokers uses for its commissions charges and can be on a per share, per contract, or % of trade value basis.

계정 관리 탭에서 고객 비용 페이지에서 수수료 마크업을 자세히 확인하세요.

고객 비용 템플릿

고객 수수료 스케줄은 계좌에 각각 적용할 수 있으며, 템플렛에도 저장 가능합니다. As a broker, you can configure fees for one or more client accounts, or set up client fee schedules in templates, then assign the templates to client accounts. 템플릿의 사용은 여러 고객 계정의 다양한 비용 일정을 쉽게 관리할 수 있게 도와줍니다.

새로운 브로커인 경우 (예: IBKR 계정을 바로 개설한 경우), 공백의 기본 고객 수수료 템플릿에 본인의 수수료 일정을 구성할 수 있습니다. 기존 브로커인 경우, 이전 글로벌 수수료 일정이 이제는 기본 고객 수수료 템플릿입니다. 기본 템플릿을 수정할 수 있지만 삭제할 수는 없습니다.

브로커 고객 비용 규정

다음의 일반적인 규정은 브로커 고객 수수료 일정에 적용됩니다:

- 브로커가 개인 계정에 대한 수수료 스케줄을 표시하지 않은 경우, 기본 고객 수수료 템플릿이 해당 계정에 자동으로 적용 됩니다.

- 브로커가 고객 수수료 템플릿 또는 개인 계정에 대한 수수료 일정과 같은 수수료 일정을 전혀 표시하지 않은 경우 Interactive Brokers의 표준 수수료는 브로커에 대한 마크업 없이 청구됩니다.

- 증권사 고객 마크업은 일반적으로 Interactive Brokers 표준 수수료의 15배로 제한됩니다.

- 고객이 거래를 마감하기 위해 IBKR에 전화하는 경우 거래당 수수료가 적용되지 않습니다.

- 증권사는 특정 상품 및 거래소에 대한 거래당 수수료를 지정할 수도 있습니다.

- Fees and markups owed to fully disclosed and non-disclosed brokers are sent to the master account and then swept to the broker's Proprietary Account for Broker-Dealers every night.

- 자동 청산 거래에는 가격 인상이 적용되지 않습니다.

증권사 고객 마크업 유형

각 자산 클래스/통화에 대해 증권사는 아래 나열된 거래당 수수료를 고객 마크업 유형 중 하나를 선택할 수 있습니다:

증권사는 거래당 청구할 최소 금액을 지정할 수 있습니다. 최소 금액은 다음 한도를 초과할 수 없습니다:

| 통화 | USD | EUR | CHF | GBP | CAD | JPY | HKD | SEK | MXN | KRW | AUD |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 거래당 최소 수수료 한도 | 25 | 20 | 30 | 15 | 30 | 2500 | 160 | 175 | 250 | 20000 | 30 |

거래당 최소 금액과 티켓 비용을 둘 다 입력할 수 없음을 참고하세요. 둘 중에 하나만 입력할 수 있습니다.

예시:

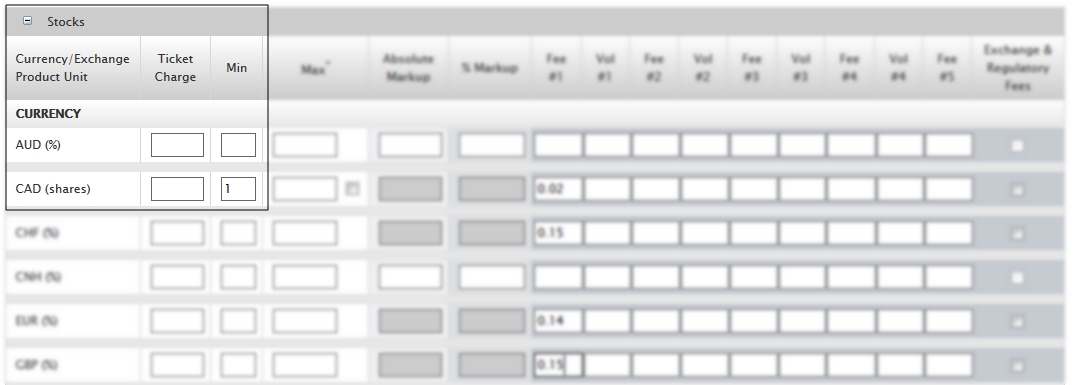

For example, a broker enters 1 in the Min column for Stocks/CAD for an individual client account. 이 고객에 대한 최소 브로커 고객 수수료는 CAD 1.00입니다. A broker would typically set the Minimum Amount in conjunction with other types of client markups for a specific asset class/currency.

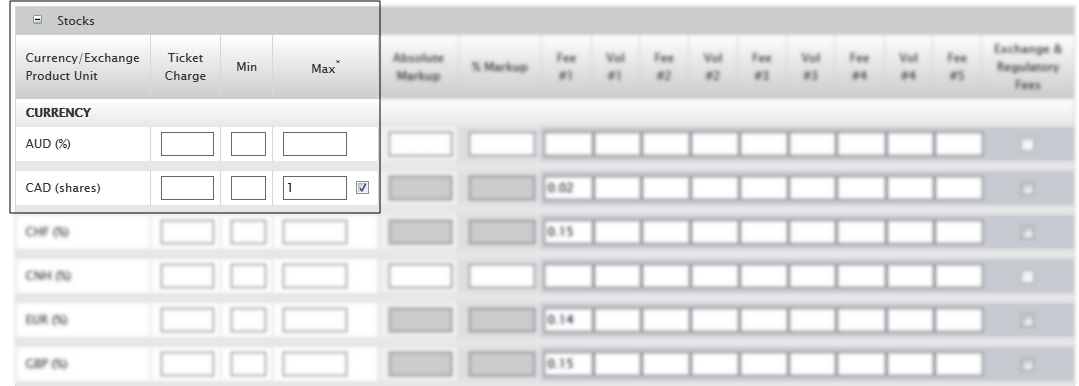

Brokers can specify a maximum amount to charge per trade. They can also configure the Maximum Amount as a percent of trade value for stocks in USD and CAD by clicking the check box below the Max entry field on the Client Fees page in Account Management.

예시:

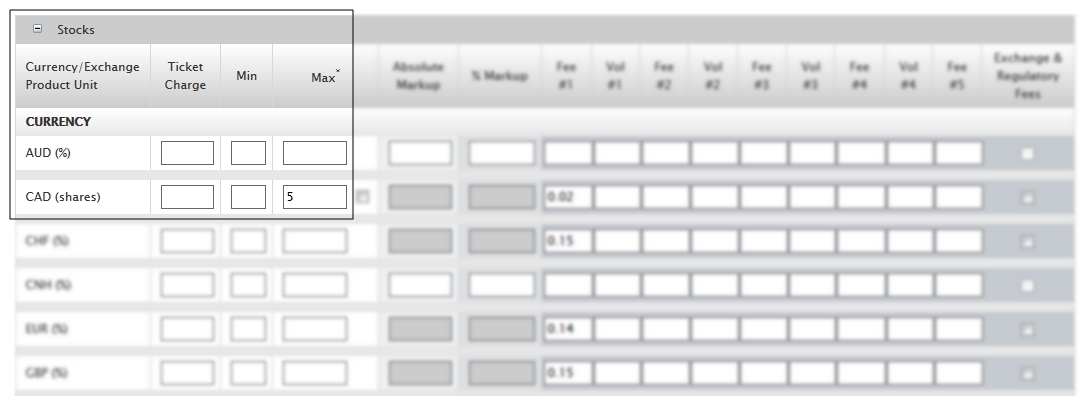

For example, a broker enters 5 in the Max column for Stocks/CAD for an individual client account. The maximum broker client fee for a stock trade in CAD for that client will be 5.00. A broker would typically set the Maximum Amount in conjunction with other types of client markups for a specific asset class/currency.

In another example, a broker enters 1 in the Max column for Stocks/CAD for an individual client account, and selects the check box below the Max field, indicating that this Maximum Amount will be calculated as a percentage of trade value of Stocks/CAD. The maximum broker client fee for a stock trade in CAD for the client will be 1% of the stock trade value.

Brokers can specify a ticket charge per trade. A ticket charge is simply an additional flat fee. You cannot specify both a minimum amount AND a ticket charge for a single asset class/currency.

예시:

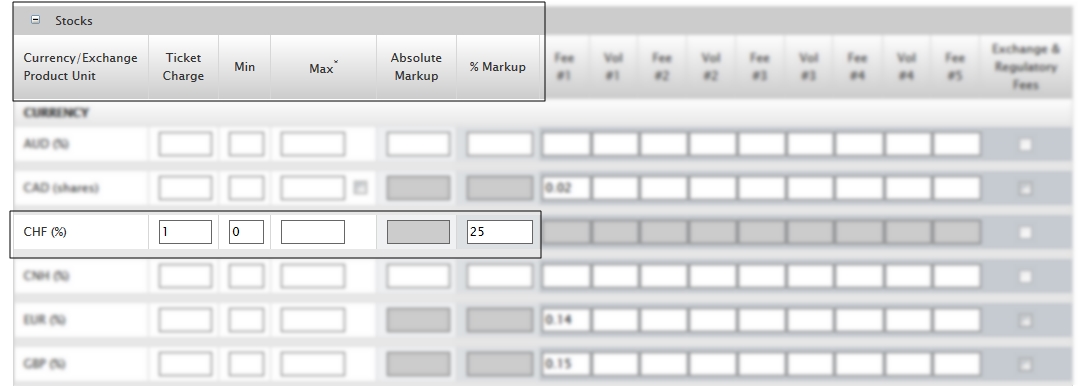

For example, a broker enters 25 in the % Markup column for Stocks/CHF and then enters 1 in the Ticket Charge column for an individual client. The broker markup for a stock trade in Swiss Francs for this client will be 25% of the Interactive Brokers commission + 1CFH.

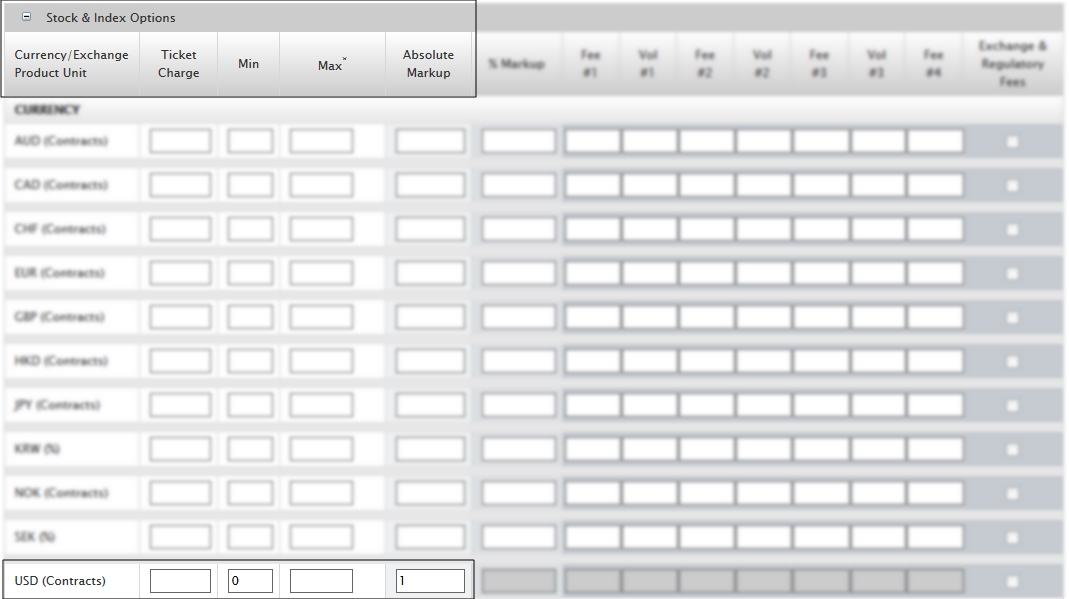

절대 마크업

브로커는 거래당 Absolute Markup을 청구할 수 있습니다. Absolute Markup은 Interactive Brokers 수수료에 첨가되는 특정한 수수료 금액입니다. Brokers enter an Absolute Markup in the currency or exchange of the asset class. On the Client Fees page in Account Management, the units listed in the Currency/Exchange/Product Unit column indicate if the absolute markup gets applied to shares, contracts, or % of notional value. 절대 마크업 금액은 소수점 세자리까지 포함 가능합니다.

예시:

For example, a broker enters 1 as the Absolute Markup for USD Stock and Index Options. 그 후에, 하나의 IBKR Smart 옵션 계약은 실행됩니다. The client will be charged $2 ($1 IBKR commission + $1 Absolute Markup).

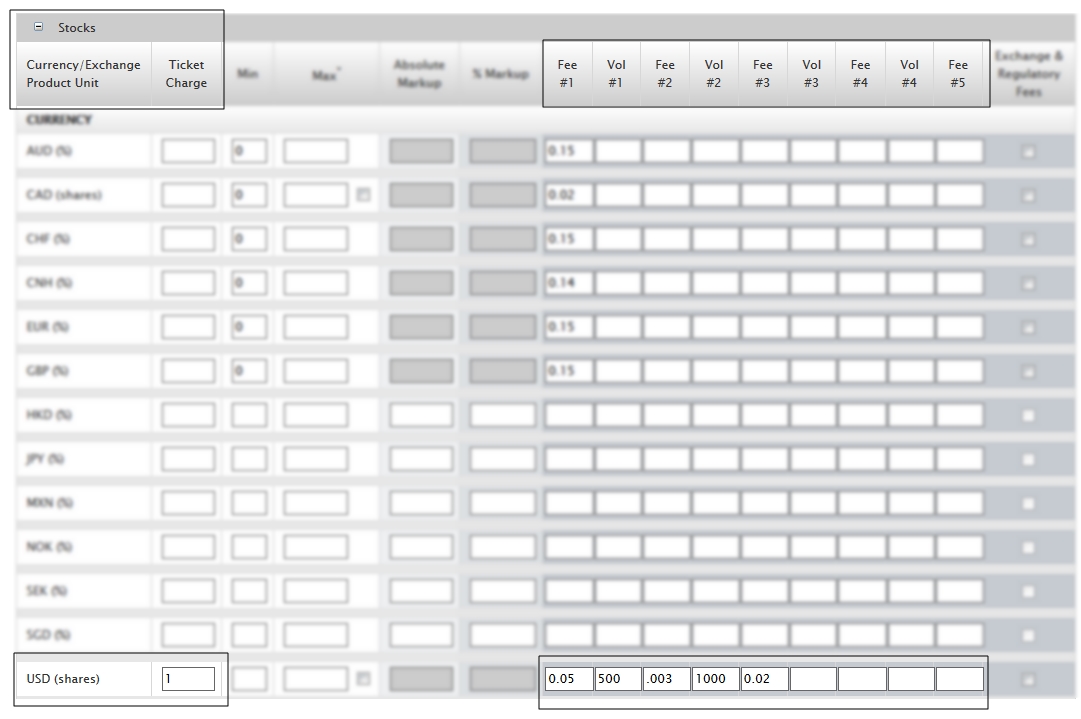

Tiered Absolute Amount

Brokers can charge an Absolute Amount from which Interactive Brokers' commission is subtracted. You can set up to three tiers for Absolute Amount based on volume breaks. Brokers should monitor their clients commissions as it is possible for Interactive Brokers to charge more than the client fee.

To set an Absolute Amount, enter one to three fees (Fee#1, Fee#2, Fee#3), and enter volume breaks (Vol#1, Vol#2) on a per trade basis on the Client Fees page in Account Management. The units listed in the Currency/Exchange/Product Unit column indicate if the absolute markup gets applied to shares, contracts, or %. Absolute Amounts can include up to three decimal places.

예시:

For example, a broker wants to charge 0.05 USD for up to 500 shares of stock, 0.03 USD for up to 1,000 shares, and 0.002 USD above 1,000 shares, along with a ticket charge of 1 USD.

Client Absolute Tiered Commissions are mutually exclusive from Interactive Brokers Tiered Commissions. They can be combined with IBKR Tiered Commissions, or one client absolute rate can be used with IBKR Tiered Commissions.

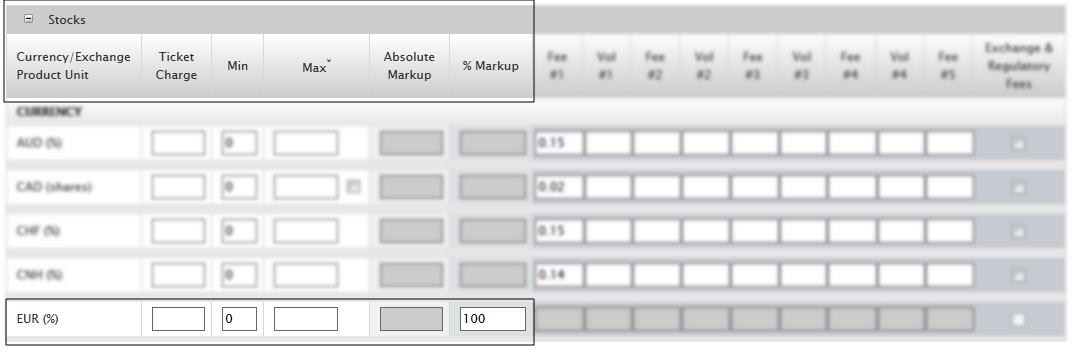

Brokers can specify a percentage of Interactive Brokers' standard commission to charge per trade. Enter % Markup as a percentage without the decimal point.

예시:

For example, a broker enters 100 in the % Markup column for Stocks/EUR for an individual client, indicating that stock trades for this client will carry a broker markup of 100% of IBKR's commission. If IBKR charges 10 EUR for a stock trade, the % Markup will be 10 EUR (100% * 20 EUR). The client will be charged a total of 20 EUR for a stock trade (10 EUR IBKR Commission + 10 EUR % Markup).

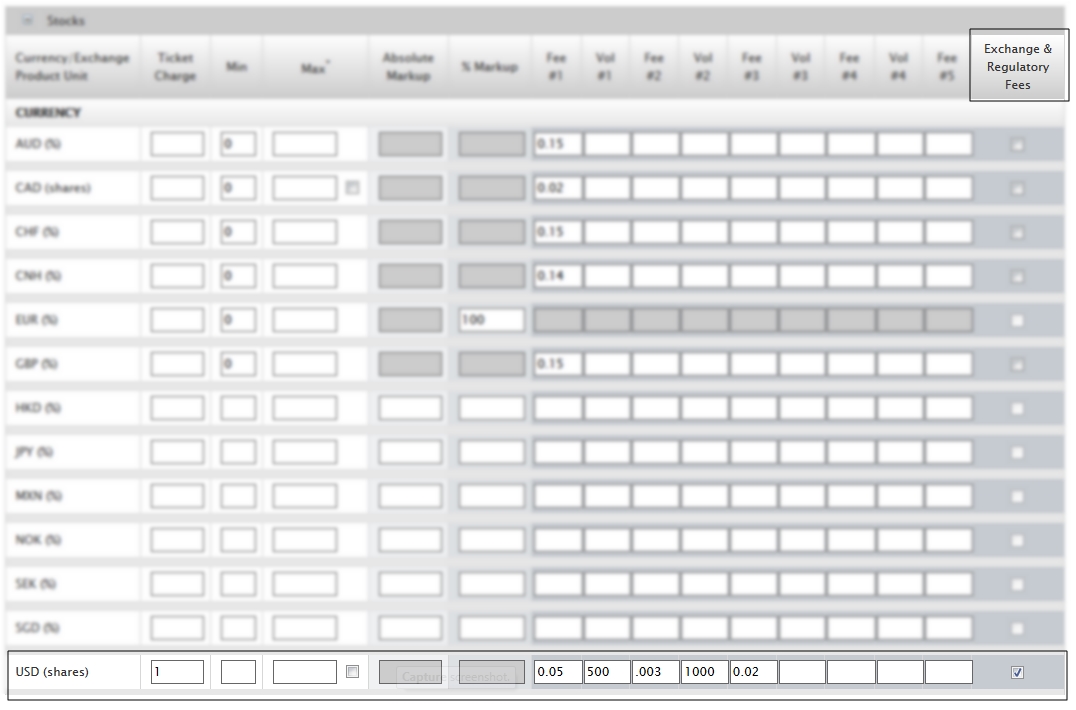

In addition to (or on top of) an absolute fee, a broker can pass any exchange or regulatory fees through to the customer by selecting the Exchange & Regulatory Fees option. Absolute Amounts가 정해지면 위 수수료를 입력할 수 있습니다. Brokers can also specify a tiered commission schedule and Exchange & Regulatory Fees for specific products and specific exchanges.

예시:

예를 들어, 1,000 shares @ $.05 per share + Exchange Fee of $.003 per share = (1,000 * .05) + (1,000 * $.003) = Total Fee charged of $53.00.

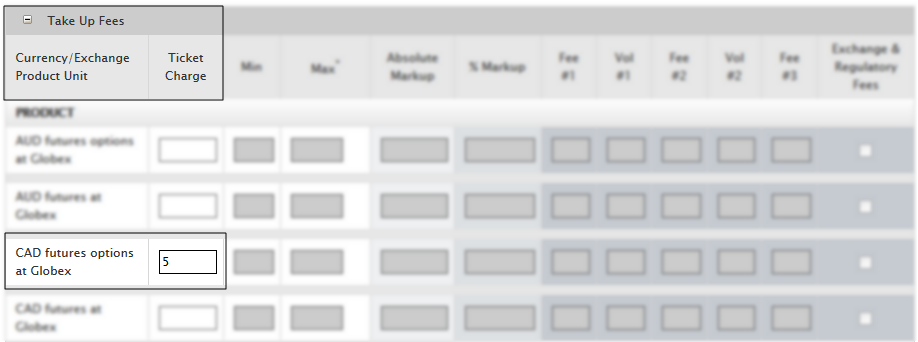

Brokers can charge markups on prime trades of certain currency/product units. This section only appears for brokers who have at least one client who subscribes to our IBKR Prime institutional service.

예시:

For example, a broker enters 5 in the Ticket Charge column for CAD futures options in the Take Up Fees section for an individual client who is subscribes to our IBKR Prime service. The broker markup for a futures options trade in Canadian dollars for this client will be $5.00 per trade.

마크업 (Markup) 요약

Brokers can view all commission markup schedules for their client accounts on the Markup Summary page in Account Management. The Markup Summary sorts information by fee schedule, and displays client accounts that use the global markup schedule together.

거래 할당 최소 수수료

We charge a minimum fee for US stock trades allocated by Brokers to their clients. Brokers can choose to charge the allocation minimum fee to their master account or to the client account. By default, the allocation minimum is charged to the client account unless there is a specific rate arrangement between the client and the Broker.

The minimum amount charged per trade allocation is as follows:

- Fixed Rate Pricing Minimum: 최소 (거래 가치 * 0.0005, USD 1)

- Tiered Pricing Minimum: 최소 (거래 가치 * 0.0005, USD 0.35)

이자 마크업과 마크다운

Brokers can mark down credit and short proceeds credit interest and mark up debit interest. Markups and markdowns are entered as % with the following fields available for input:

- Pay Client No Credit Interest - If this box is checked all credit and short proceeds credit interest will be paid to the broker and the client will not receive any revenue.

- Credit Markdown - A % amount will be subtracted from the credit interest paid and given to the broker. Clients will not be charged negative interest so if the markdown is greater than the currently available credit interest rate then no interest will be paid.

- Debit Markup - A % amount will be added to the debit interest. 마크업 최대값은 5%입니다.

- Short Credit Markdown - Operates like the Credit Markdown. A % amount will be subtracted from the short proceeds credit interest paid and given to the broker.

Borrow Fee Markups

Brokers can charge markups to their clients based on our stock borrow rates, entered as a variable or fixed percentage of our borrow rate. 두 가지 유형의 마크업을 모두 입력할 수 있으며, 당사의 시스템은 더 큰 총 금액을 생성하는 마크업 비율을 적용합니다.

- Variable borrow fee markup - This is a variable percentage of our borrow rate. The total cost to your client is calculated as follows:

Borrow Rate (1 + Variable Markup Percentage)

The range of acceptable values that you can enter is 0 - 25%. - Fixed borrow fee markup - This is a fixed percentage of our borrow rate. The total cost to your client is calculated as follows:

Borrow Rate + Fixed Markup Percentage

The range of acceptable values that you can enter is 0 - 1%.

예시:

Symbol ABC Borrow Rate = 35%

Variable Borrow Markup = 20%

Fixed Borrow Markup = 1%

Calculating the total cost to your client, we have:

Variable markup

35% (1 + 20%) = 42% total cost to your client

or

0.35 (1.2) = 0.42

고정 (Fixed) 마크업

35% + 1% = 36%

or

0.35 + 0.01 = 0.36

Our system applies the larger total amount, so in this example, we would apply the Variable Borrow Markup and the total cost to your client is 42%, which includes our borrow rate plus your borrow markup.

참고: 이자 마크업과 마크다운은 소수점 두번째 자리까지 반올림됩니다.

온라인 인보이스

Fully-disclosed brokers can configure and submit electronic invoices from the Invoicing page from the Manage Client > Fees menu in Account Management. Before you can submit fee invoices for client accounts, you must first configure Automatic Billing for Monthly/Quarterly Invoicing for the account(s) on the Invoicing page. You must specify a monthly or quarterly markup limit, then calculate the markup and submit an electronic invoice for each client account at any time, up to the specified limit. The invoice amount will be automatically transferred from the client account to the broker account. Invoices submitted prior to 5:30 (17:30) PM EST will be processed by IBKR the same day (U.S. night) and appear on that day's statements. Invoices submitted after 5:30 (17:30) PM EST will be processed by IBKR on the next business day. 한 번에 최대 10명의 고객에 대한 인보이스를 제출할 수 있지만, 고객 계정당 하루에 하나의 인보이스만 제출할 수 있습니다.

You can also upload a .csv (comma-separated values) file containing multiple client invoices. .csv 파일은 다음 사항이 필요합니다:

- 고객 계정 번호

- 금액 (고객 계정의 기본 통화로 표시)

- 메모 (이 부분은 선택사항입니다)

Invoices submitted after 5:30 (17:30) PM EST will be processed by IBKR on the next business day. 한 번에 최대 10명의 고객에 대한 인보이스를 제출할 수 있지만, 고객 계정당 하루에 하나의 인보이스만 제출할 수 있습니다.

총액 및 제한 사항

Introducing Broker client markups are limited to 15 times IBKR's highest tiered rate + external fees. In the case of US stocks, the highest tiered rate would be 0.0035 USD per share. USD-denominated bonds are subject to a separate cap on mark-ups. 미국 옵션 마크업은 거래 가치의 10%로 제한됩니다. 25% of debit interest markups over 1% will be collected by IBKR. These limits are subject to change, and specific products may have an additional limit in place. No markups will be applied if a client calls IBKR to close a position.