TWS Option Strategy Lab Webinar Notes

Overview

TWS Option Strategy Lab lets you evaluate multiple complex option strategies tailored to your forecast for an underlying. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. You can analyze each potential strategy to find one with the lowest price, highest risk/reward ratio, largest maximum gain or smallest maximum loss.

Option Strategy Lab for Complex Orders

There are numerous options strategies available for traders. TWS Option Strategy Lab will help you evaluate multiple complex option strategies tailored to your forecast for an underlying. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies to consider.

This innovative feature with integrated performance tables and graphs allows you to quickly and efficiently compare and analyze the different option strategies by their expected profit/loss or probability of making any profit. You can adjust your forecast date, price or volatility settings to find those strategies that can either reduce the risk or increase the return based on your specific forecast point.

Access Option Strategy Lab

- From the Mosaic, open the Option Strategy Lab from the New Window dropdown.

- On Advanced Order Spreadsheet, from Trading Tools menu, find Option Strategy Lab.

Strategy Lab Components

When you have a forecast on a particular equity:

- You could either buy or sell the asset;

- If you are a slightly more sophisticated investor, you could buy a call option or sell a put;

- If you are an experienced trader, you may also do a combination of option trades designed to more efficiently profit from the forecast.

You can use strategies to either try to reduce the risk, or increase the return at the specific forecast point.

Strategy Scanner

Enter your forecast for the underlying stock and specify your forecast date. Then determine how you want the results organized, by Price or Volatility, and whether you expect that value to rise or drop, stay range bound, or move a certain percentage.

You can optionally add filter(s) for Premium type (debit/credit only), a specific range for Delta, or choose to filter by strikes or expiries from the drop downs.

Once you’ve plugged in your forecast, Click DONE. TWS will return a variety of both simple and complex option strategies tailored to that forecast. You can then click through the returned strategies to view the probability of profit and evaluate each strategy’s potential risk.

Scanner columns display these fields for each strategy returned:

- Price – positive price indicates a Debit / negative price indicates a Credit.

- Delta – ratio comparing the change in cost of the underlying with the corresponding change in price of the derivative.

- Return/Reward ratio – max profit divided by max loss.

- Market Implied probability of any gain.

- Maximum Return and Maximum Loss columns:

- Max potential gain/loss of the strategy.

- Max % return – shows the max potential gain/loss as a % of investment.

- ProbMaxProfit/Loss – probability of achieving the max potential gain/loss.

- Break Even point(s).

Note this window updates every 60 seconds.

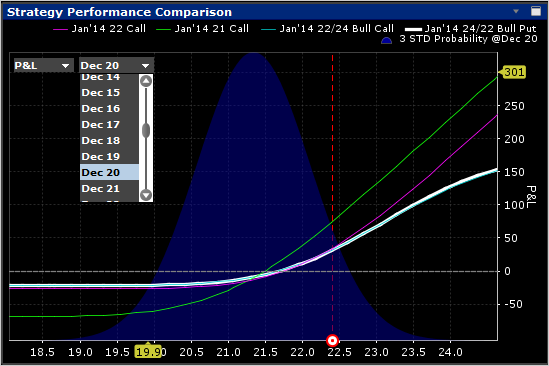

You’ll see four strategies selected with different color check marks – the colors correspond to that strategy line in each of the graphs – Price Target, Strategy Performance Comparison and the Strategy Performance Detail.

- Click on any strategy row to highlight that strategy in each of the Strategy Lab graphs.

- Up to four colored strategy lines display in the Performance Strategy Comparison. When you highlight a non-colored strategy, a fifth White line is added to the graphs. That fifth strategy line migrates to the selected strategy.

- See an alternate strategy you like? Click in the scanner checkbox, and the selected strategy will change to one of the four line colors, then displayed in the graphs on the embedded windows for comparison.

Let’s take a clockwise look at these windows:

Price Target

Price Target graph shows the price history and the forecasted price target, and graphs a one standard deviation move from today’s price. Solid line shows P&L as of today’s date, the dotted line represents your forecast date. Target icon indicates where your target price falls. (Current underlying price is highlighted in yellow, and the target price based on your forecast in displays in red.

You can drag these lines in the chart, and the corresponding performance detail window changes the respective “as of” dates. So, based on where the price has been and the one standard deviation move, you can evaluate how reasonable your forecast is.

Strategy Performance Detail

Shows the highlighted strategy in two performance detail graphs where you can compare P&L, Delta, Gamma Vega, Theta, & Rho. Because the P&L curve changes for an option strategy over time, two lines are displayed, the solid line displays selected risk as of today and the dotted line as of the expiration. Use the drop down menu selections to change the risk comparison.

Strategy Performance Comparison

This graph displays a three standard deviation move with each of the selected strategies from the scanner (line color corresponds to the colored checks in the Scanner table.) A fifth, white line can be added for comparing performance by clicking in the row of any non-checked strategy. Clicking in a checkbox will assign a colored line to that strategy.

Select a risk factor from the drop down and all strategy lines will update. Choose a date from the drop down, to view the selected strategies at any chosen date between now and your forecast point.

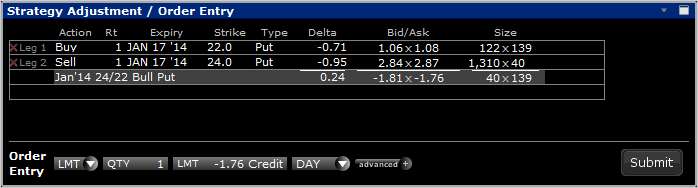

Strategy Adjustment and Order Entry

The Strategy Adjustment window displays detail of the currently selected strategy.

You can adjust the strategy by modifying inputs in the Strategy Builder section. Changing any of the fields (order actions, expiry, strike, etc.) will spawn a new strategy row in the Scanner table, indented underneath the strategy you are analyzing.

You can analyze your forecast-based strategy using any of the Strategy Lab graphs. To remove any of the additional strategies you create, click the red “X” that appears just to the right of the checkbox in the scanner table.

When you determine a strategy that suits your risk tolerance, you can submit orders directly from the Strategy Lab. Edit any of the order entry fields right in the Strategy Lab and transmit. Use the Advanced + button to add a stock leg or make the spread delta neutral.