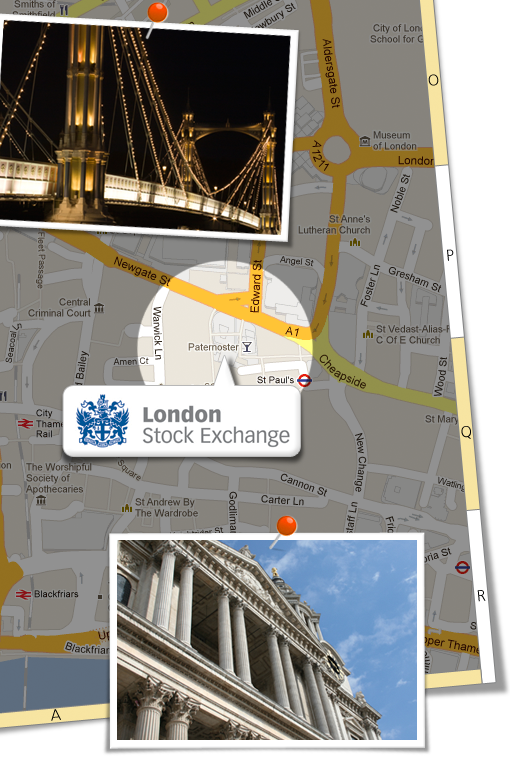

London Stock Exchange

The London Stock Exchange (LSE) merged with Borsa Italiana in October of 2007 to form the London Stock Exchange Group (LSEG). LSEG companies, which include the LSE, Borsa Italiana, MillenniumIT, and Turquoise Trading Limited among others, provide trading and listing services, information and technology services and post trade services to the global financial community.

The London Stock Exchange (LSE) is one of the world's oldest stock exchanges, with a history that dates back more than 300 years. The exchange provides listing services to connect companies with investment capital. Large, established and international companies list on the LSE's Main Market, while the LSE's AIM market is home to smaller, growing businesses that may be early stage or venture capital-backed and are seeking access to growth capital. The exchange also operates a Professional Securities Market for companies seeking to raise capital through specialist securities issuances to professional investors, and a Specialist Fund Market for specialist investment funds geared toward institutions and professional investors.

The LSE offers fully electronic, order-driven trading platforms for liquid U.K. and international securities, and quote-driven, market-maker supported platforms for less liquid securities. The exchange's trading services are designed to maximize liquidity. Trading is conducted on Millennium Exchange, MillenniumIT's multi-asset class trading platform, which operates on a price time priority basis.

The LSE’s flagship electronic order book, Stock Exchange Electronic Trading Service (SETS), combines electronic order-driven trading and integrated market-maker liquidity to guarantee two-way prices. Stock Exchange Electronic Trading Service – quotes and crosses (SETSqx), is the LSE's trading service for securities less liquid than those traded on SETS. SETSqx blends a periodic electronic auction book with standalone non-electronic quote-driven market making. AIM securities and Fixed Interest market securities not traded on SETS or SETSqx trade on SEAQ, the LSE's non-electronically executable quotation service.The International Order Book (IOB) provides market participants with direct access to securities via depository receipts from countries around the world in a single electronic order book. Order functionality on the IOB is similar to that of SETS.

Turquoise Derivatives (TQ Derivatives) is the international equity derivatives business of the LSE. The TQ Derivatives platform offers trading of single stock, index and dividend derivatives based on Pan-European and IOB equities.