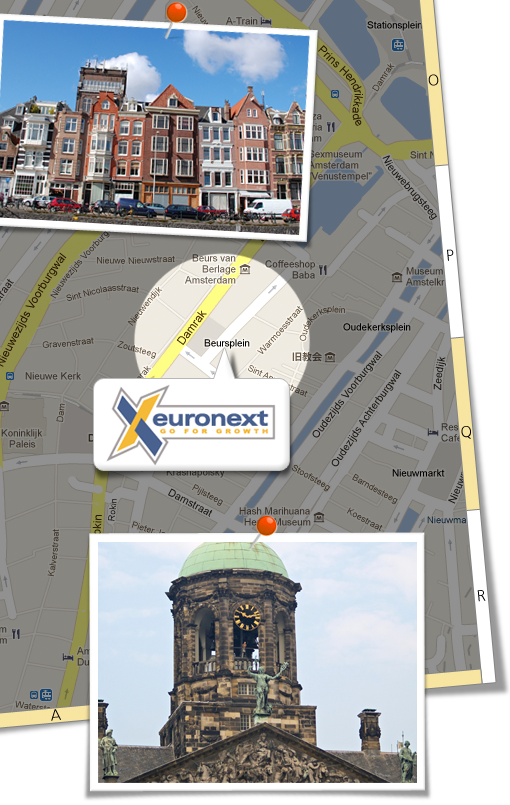

NYSE Euronext

NYSE Euronext, the holding company created by the combination of NYSE Group, Inc. and Euronext N.V. in 2007, operates exchanges in Europe and the United States, providing market infrastructure and trading technology for equities, futures, options, fixed-income and exchange-traded products (ETPs). In 2012, NYSE Euronext was purchased by IntercontinentalExchange (ICE) for $8.2 billion.

NYSE Euronext offers customers a single pan-European market for its stock market products, including equities, closed-end funds, bonds, ETFs, warrants and certificates. All securities listed on NYSE Euronext's European-regulated markets trade in one centralized order book (the Central Order Book). The exchange’s Universal Trading Platform (UTP), powered by NYSE Euronext trading systems and technologies, facilitates trading across its markets and products.

The exchange operates the largest and most liquid cash equities market in Europe, with five separate cash marketplaces in Amsterdam, Brussels, Lisbon, London and Paris. The regulated market, as defined by the Markets in Financial Instruments Directive (MiFID), is the first transnational exchange in Europe.

NYSE Alternext

NYSE Alternext is a pan-European market that lists small- and mid-sized companies. The NYSE Alternext market model merges trading on the Central Order Book for the most liquid equities, with the support of Liquidity Providers (LPs) for equities which require additional liquidity. Less liquid equities are traded via daily auction, with buy and sell orders centrally matched to set an auction price. NYSE Alternext is regulated by NYSE Euronext.

Free Markets

The two Free Markets of NYSE Euronext are the Free Market of Brussels and the Marche Libré Paris. The Free Markets are venues for trading securities of companies that are too small or too young to be listed on one of NYSE Euronext’s regulated markets. Transactions on the Free Markets are executed through a single auction per session. Trades are carried out by the trading system of NYSE Euronext and are cash settled; clearing and settlement are handled through LCH. Clearnet SA, the Caisse Interprofesionnelle de Dépôts et de Virements de Titres (CIK) and/or Euroclear Bank.

NYSE Arca Europe

NYSE Arca Europe is a pan-European Multilateral Trading Facility (MTF) operated by NYSE Euronext. The platform broadens the range of Euronext's regulated markets by providing a venue for trading blue-chip stocks from thirteen European countries and the United States.

NYSE Arca Europe is fully integrated with the NYSE Euronext systems and powered by the Universal Trading Platform (UTP), providing a central limit order book for trading liquid stocks from Austria, Czech Republic, Denmark, Finland, Germany, Hungary, Ireland, Italy, Norway, Spain, Sweden, Switzerland, United Kingdom and the United States. NYSE Arca Europe clearing and settlement is managed by EuroCCP.