Interactive Brokers Home

Award Winning Platform & Services

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

#1 Best Online Broker

5 out of 5 stars

Best for

Advanced Traders

Best Online Broker

Experience Professional Pricing

- Low commissions starting at $02 with no added spreads, ticket charges, platform fees, or account minimums.

- IBKR BestXSM is a powerful suite of advanced trading technologies designed to help clients achieve best execution and maximize price improvement while minimizing market impact.

- Margin rates up to 55% lower than the industry.4

- Earn high interest rates of up to USD 3.14% on instantly available cash.5

- Earn extra income on your lendable shares

Discover a World of Opportunities

Invest globally in stocks, options, futures, currencies, bonds and funds from a single unified platform. Fund your account in multiple currencies and trade assets denominated in multiple currencies. Access market data 24 hours a day and six days a week.

160

Markets

37

Countries

28

Currencies*

Global Markets

*Available currencies vary by Interactive Brokers affiliate.

Graphic is for illustrative purposes only and should not be relied upon for investment decisions.

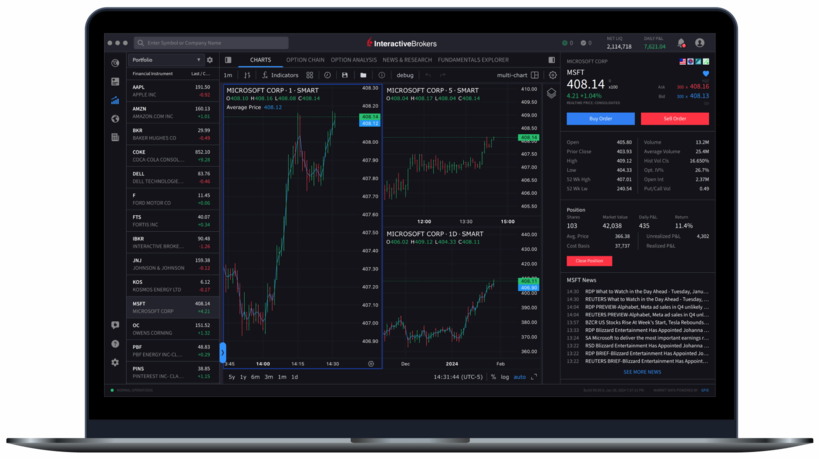

Powerful Trading Platforms To Help You Succeed

Award winning platforms for every investor from beginner to advanced on mobile, web and desktop.

Discover new investment opportunities with over 200 free and premium research and news providers.

Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

100+ order types - from limit orders to complex algorithmic trading - help you execute any trading strategy.

Real-time trade confirmations, margin specifics, transaction cost evaluation, advanced portfolio assessment and beyond.

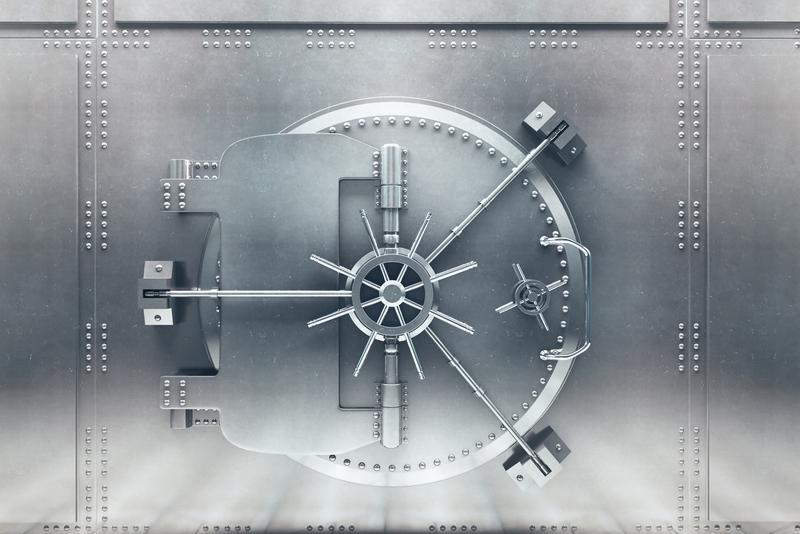

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times in the broader financial markets. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR from major market events that can threaten the stability of financial institutions.

Member of the

S&P 500

Nasdaq Listed: IBKR

$19.5B

Equity Capital*

74%

Privately Held*

$13.3B

Excess Regulatory Capital*

4.13M

Client Accounts*

3.62M

Daily Avg Revenue Trades*

IBKR Protection

*Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.

Choose the Best Account Type for You

Step 1

Complete the Application

It only takes a few minutes

Step 2

Fund Your Account

Connect your bank or

transfer an account

Step 3

Get Started Trading

Take your investing to

the next level

FINRA BrokerCheck reports for Interactive Brokers and its investment professionals are available at www.finra.org/brokercheck

- Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

- Forecast Contracts on US election results are only available to eligible US residents.

- Payments equivalent to interest in the form of an incentive coupon subject to variation with benchmark rates.

- Restrictions apply. See additional information on interest rates. Credit interest rate as of January 7, 2026.

- View our margin rates for more information.

- IBKR Lite provides commission-free trades in US exchange-listed stocks and ETFs. For complete information, see ibkr.com/commissions.

- Interactive Brokers Group and its affiliates. For additional information view our Investors Relations - Earnings Release section.

- Interactive Brokers LLC rating by Standard & Poor's. View report

- For complete information, see ibkr.com/compare.

- Available currencies vary by Interactive Brokers affiliate.

Individual Accounts

Individual Accounts Joint or Trust Accounts

Joint or Trust Accounts Retirement Accounts

Retirement Accounts Non-Professional Advisor

Non-Professional Advisor Institutional Accounts

Institutional Accounts