A ski mountain looks very different whether you’re at the bottom, the middle, or the top. The same can be said for markets. As an avid skier, though one who has never been to Jackson Hole, I believe that the analogy nonetheless applies. The lifts may be closed now, but we can once again call on Fed Chair Powell to be our mountain guide when he speaks tomorrow. He might let us know whether we should continue to ride the chairlift higher, and if not, whether the route will be gentle or steep.

We have been voicing concerns ahead of tomorrow’s speech for a few reasons. For starters, the S&P 500’s track record after the past few Jackson Hole conferences has been uninspiring:

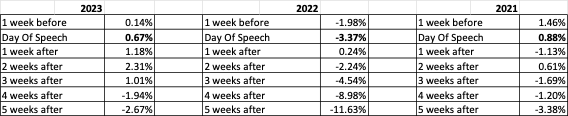

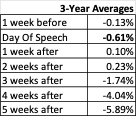

S&P 500 Performance Before and After Powell’s Recent Jackson Hole Speeches

Source: Interactive Brokers

Of course, three annual observations is hardly a robust sample size, but it is worth noting that the S&P 500 (SPX) was down four and five weeks after each of the last occurrences. That may be attributable as much to September seasonality as it is to the speeches themselves, but those speeches indeed played a role in setting the tone for the weeks that follow.

A further concern arises from whether investors have put too much faith in a conflicting set of expectations. It is clear that the basic economic scenario is for a soft landing. Even though historical sightings of a soft landing are about as common as credible sightings of a Yeti, earnings estimates for the coming year are solidly higher – something that implies that we will avoid a recession.

Yet that basic scenario also implies that we should expect Fed Funds to be a full percentage point lower by the end of the year, implying that at least one of the remaining three FOMC meetings will offer a 50bp cut. CME futures imply a 93% probability of Fed Funds being 1% lower after the December meeting, though the IBKR ForecastTrader shows a 34% chance that the rate will be above 4.625% at that point. (Seems like a potentially tradeable divergence, no?)

Now ask yourself whether those expectations might be mutually exclusive. It seems quite possible. To be fair, we began the year with an impossible conundrum – expectations for a solid economy AND six or seven rate cuts – but we’ve done just fine because the economy delivered and the cuts weren’t needed. Now, when we’re faced with the prospect of a slowing economy – even though the current Atlanta Fed GDPNow projects 2% growth this quarter – we are quite hopeful that aggressive Fed cuts will benefit investors instead.

And so we will find out if Chair Powell is willing to accommodate investors’ hopes for those cuts, the cuts that many believe are necessary to forestall economic woes. It is fair to expect that a 25-basis point cut will arrive next month, since Powell and other Fed officials have implied that is in the cards. But what if he simply reiterates data dependence and a tendency towards rate cutting caution. That doesn’t seem to fit with investors’ expectations. Will we then need to root for lousy jobs numbers in two weeks to justify the need for cuts?

Jackson Hole has a reputation for being among the most challenging ski areas in the world. Will Powell guide us towards a pleasant scenic ride, or perch us at the top of a treacherous couloir and leave us to our own devices?

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Unless the economy is deteriorating at a rapid pace, there is no need for rate cuts. The Fed got the markets hooked on rock-bottom interest rates. It now has a duty to ween market participants off this drug.

Hi Steve;

From my perspective you have been solid for a long time. I have been around for a while, My badge was zen. Folks should pay attention to your good thoughts.

We appreciate your positive feedback!

POWELL really said little today other than it was time to cut, but he really didn’t justify it as usual with explicit recent data other than that unemployment was rising but not at a fearful rate. I agree with others that there is no economic reason for a cut but a danger of reigniting inflation.

EXCEPT, and I am sure IBKR doesn’t like me saying this since it’s image is to be politically, not necessarily correct, but not insulting: Powell had promised Biden a rate cut(s) at the appropriate time upon his reappointment and this seems to be the appropriate time. This is a well-accepted fact in D C but is not shouted from the rooftops.

It is very silly to keep citing what FED FUNDS predict especially when it is never stated that that prediction source has been consistently wrong for over 25yrs and as evidenced by it’s call earlier in the year. Sure someday it might get it right.