Tariff news is binary for equities – more tariffs, bad, less tariffs, good. Thanks to some comments from the President on Friday afternoon, implying that the “Liberation Day” tariffs, scheduled for April 2nd – a week from Wednesday – are now believed to be more targeted than originally threatened, U.S. equity traders are exuberant. It is impossible to know how the anticipated implementation might actually transpire, but markets are not waiting around to find out.

It is widely believed that the ever-shifting narrative about tariffs is a negotiating ploy, designed to bring potentially affected countries to offer concessions rather than face the full force of sanctions. The back-and-forth might be confusing to investors and corporate managements, but there could certainly be a solid rationale for the seeming confusion. We have already seen tariffs on Mexico and Canada delayed after each of those countries shifted policies to accommodate U.S. concerns, and there are reports that several other countries are in contact with the administration in the hope of blunting their impact. Thus, Friday’s news could certainly be the sort of news that investors had been craving.

That said, many of the best traders I know have a well-earned critical, if not cynical, side to their thinking. The timing could be perceived as a bit, um, convenient.

One rationale for the post-election enthusiasm was that the Trump administration would have a keener eye to markets than the prior one. (Of course, when stocks were going up ~20% per annum, as in ’23 and ‘24, it behooved them to say little.) It was demonstrable during this President’s first term, when he actively used stock markets as a barometer for his performance. Also remember the periodic vague, unsourced overnight reports that trade talks with China were proceeding well that tended to occur when stocks needed a bit of good news. Could it be that the tariff comments were well timed to precipitate a bit of a desired bounce in stocks? Maybe, and quite frankly traders don’t seem to care.

Frankly, it’s quite OK if traders don’t care about the timing, because it is a win-win for them. If the tariff news is generally good, then of course it’s a reason for optimism. And if it the adjustments turn out to be less meaningful than hoped, that can be overlooked if it means that the administration is willing to offer periodic bullish tidbits to the market. That is of course the essence of the “Trump Put”.

I offer two pieces of evidence that the “Trump Put” may have been exercised on Friday.

- Recent comments by Treasury Secretary Bessent implied that the administration would be more focused on 10-year rates than equity prices. Today we see those rates about 7bp higher. Indeed, rates are higher across the curve, which is to be expected on a “risk-on” day, but the magnitude of the move at the long end could imply that traders see a change in that focus.

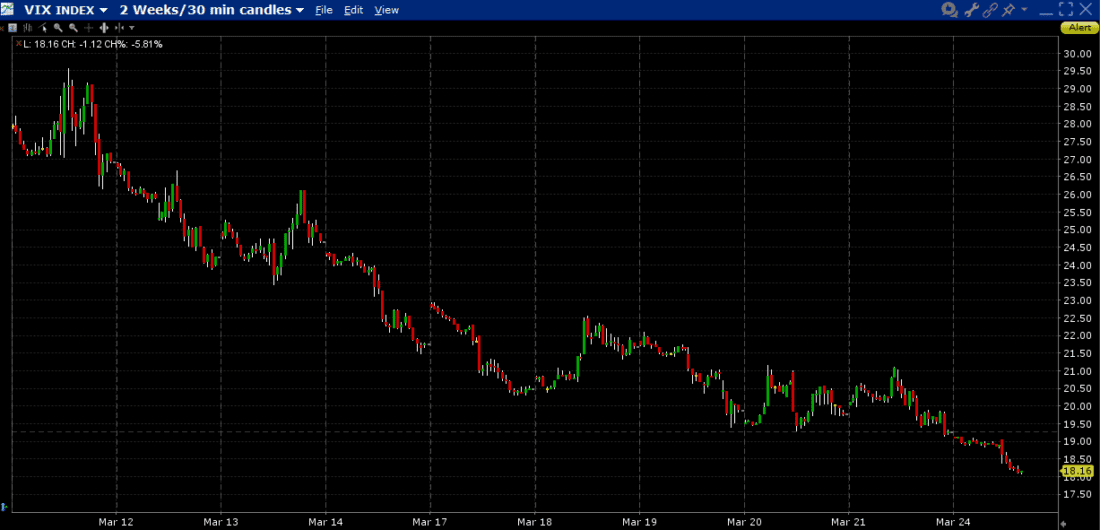

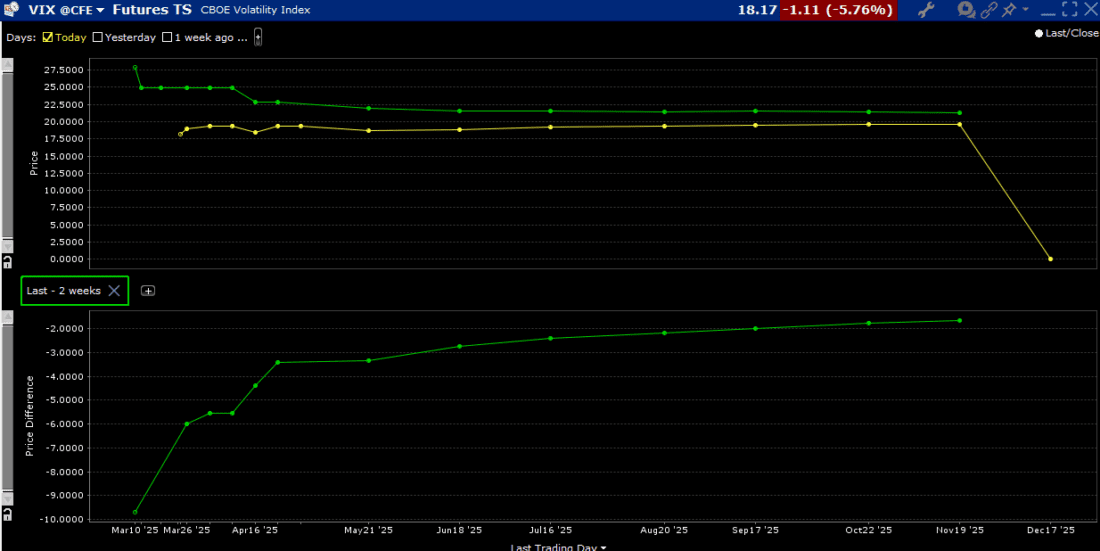

- Note that the Cboe Volatility Index (VIX) is solidly below 20 and flirting with a 17 handle as I type this. We’re not quite back to the sanguine mid-teens that prevailed earlier this year, but it is clear that there is decreased demand for hedging protection. Why should an investor pay for downside protection when the administration (or the Federal Reserve) will provide it on one’s behalf? The decline in VIX was in place even as markets plumbed new trading lows over a week ago, but it accelerated after last week’s FOMC meeting – which featured another reduction in its program of quantitative tightening – and again today. (see graphs below).

Do those items prove that the “Trump Put” was exercised? By no means. As opposed to tradeable options, however, which have defined strikes and expirations, an expectation that an external force might intervene on investors’ behalf is, by definition, nebulous. But investors have reason to be encouraged today, and thanks to a bit of FOMO, they are quite enthused right now.

Going forward, though, we need to reckon with this truism:

Most corrections do not result in bear markets. But all bear markets begin as corrections…

VIX, 6-Months, Daily Candles

Source: Interactive Brokers

VIX, 2-Weeks, Half-hour Candles

Source: Interactive Brokers

VIX Futures Term Structure, Today (yellow, top), 2-Weeks ago (green, top); Changes (bottom)

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!