Market bulls were seeking to finish August with a bang but ran into heavy selling pressure near all-time highs, similar to yesterday's rally experiencing unexpected afternoon turbulence. Meanwhile, optimism regarding the Fed’s upcoming easing cycle is growing after this morning’s PCE data and Consumer Sentiment report reflected dwindling price pressures and downwardly revised inflation expectations. Still, stocks, which are now tanking, have generally made lower highs and have been unable to conquer former peaks ahead of what's historically been the worst month for equities.

Consumers Didn’t Avoid Cash Registers in July

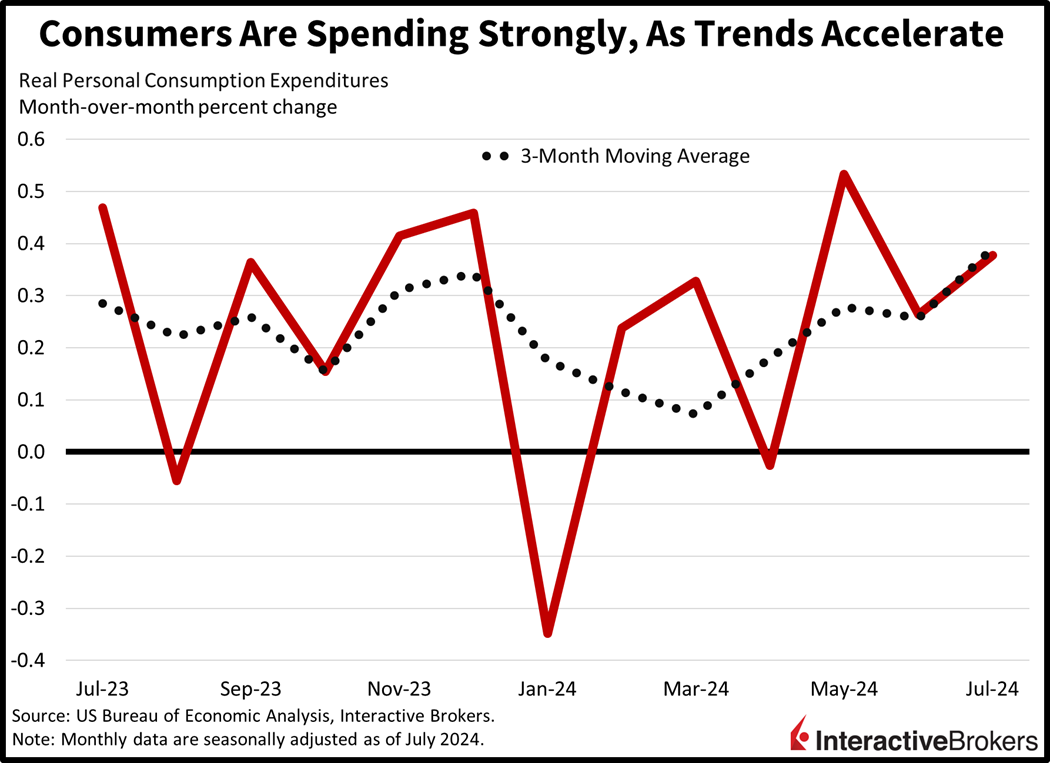

Optimism about a potential soft landing gained another tailwind this morning with the Personal Income & Outlays report from the Bureau of Economic Analysis showing consumer spending is still robust and price pressures are continuing to recede. July outlays were dominated by durable goods, which expanded 1.7% m/m in real terms, while non-durables and services both grew just 0.2%. Overall spending progressed strongly, expanding 0.5% month over month (m/m) and meeting expectations. Consumption also rose above June’s 0.3% clip. Incomes only advanced 0.3%, however, but surpassed the median projection of 0.2%, which would have matched June’s pace. Unfortunately, the rising gap between compensation and outlays pulled the personal savings rate down from 3.1% to 2.9% m/m.

Inflation Continues to Moderate

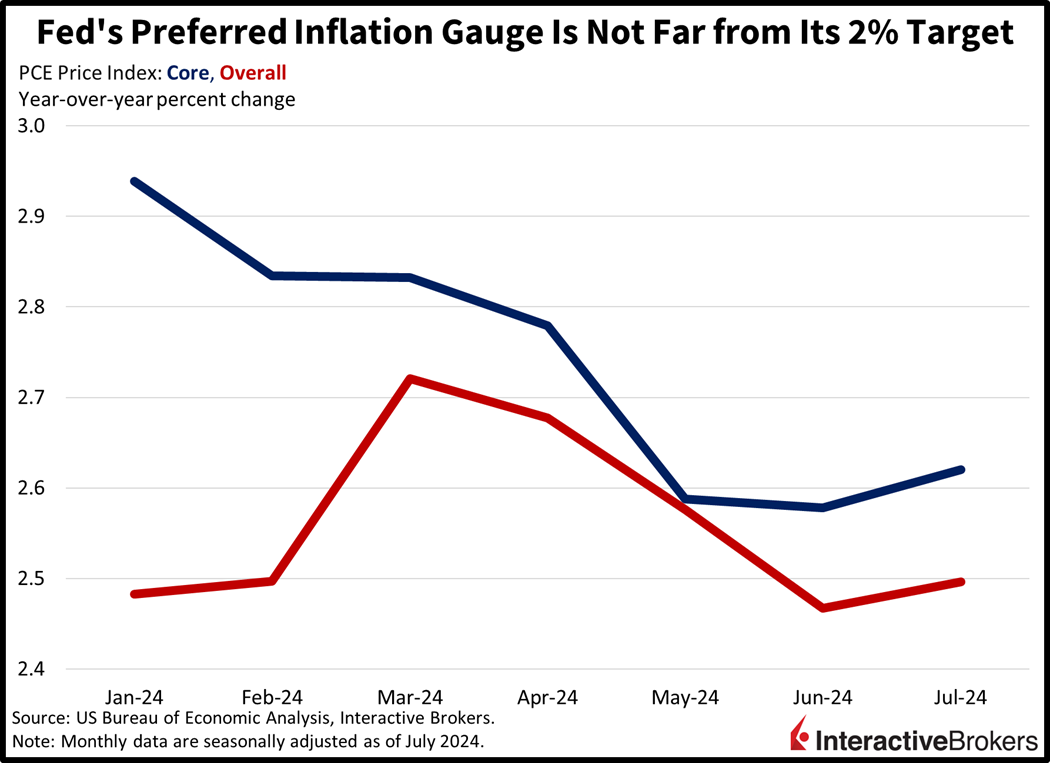

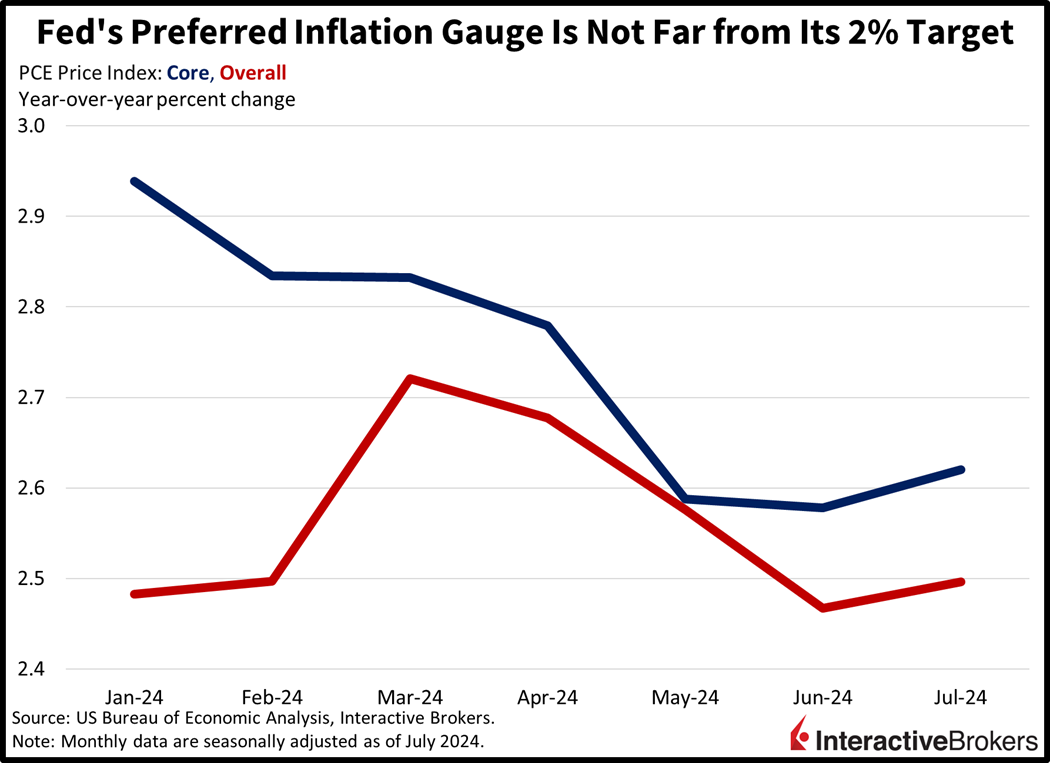

Price pressures were mixed with the Personal Consumption Expenditures (PCE) index depicting m/m services and nondurables cost increases of 0.2% and 0.1%, but durable goods prices declined 0.3%. Both the headline and the index without fuel and food, or the core benchmark, climbed 0.2% m/m, exactly as expected. This compares to the prior month’s 0.2% for core and 0.1% for headline. On a year-over-year (y/y) basis, the headline PCE and core advanced 2.5% and while the core climbed 2.6% respectively, matching June and arriving 10 basis points (bps) lighter than median estimates.

Consumer Sentiment Revised Modestly

Consumer sentiment was revised modestly from its first estimate released earlier this month. The headline University of Michigan's index figure was upgraded from 67.8 to 67.9 while one-year inflation expectations ticked from 2.9% to 2.8%.

AI Demand Extends to Servers and Application Providers

Demand for artificial intelligence (AI) products is extending beyond chip makers, with Dell Technology and MongoDB reporting that the trend supported second-quarter sales. In the retail sector, however, results for Lululemon and Gap were mixed. Those are a few highlights from the following earnings reports:

- Dell Technology (DELL) earnings and revenue exceeded analyst consensus expectations with the latter metric climbing 9% y/y, a result of growing demand for servers that facilitate AI. During the second quarter, AI server orders increased from $2.6 billion to $3.2 billion y/y and the backlog of orders totaled $3.8 billion. In a statement, Chief Operating Officer Jeff Clarke said the company’s pipeline of deals for AI servers is several multiples of its order backlog. While some industry observers believe that businesses and consumers have started to replace personal computers purchased during the Covid-19 pandemic, Dell’s sales of those items declined in the low-single digits. Within that category, sales of consumer-focused computers dropped 22% y/y. Dell shares bounced6.4% in premarket trading.

- MongoDB (MDB), a provider of database software, reported a 13% y/y increase in revenue for the three-month period ended July 31 and a net loss that fell from $0.74 to $0.53 a share. Both metrics exceeded analyst consensus expectations. CEO Dev Ittycheria maintains that the company is “incredibly well positioned to help customers incorporate generative AI into their business and modernize their legacy application estate.” MongoDB’s guidance for the current quarter exceeded analysts’ expectations and the company increased its full fiscal-year forecast, which is now strongerWall Street’s outlook. Shares of MongoDB jumped more than 16% last night in extended trading.

- Lululemon Athletica (LULU) earnings surpassed the analyst consensus, but revenue missed expectations, a result of the company terminating sales of its recently launched Breezethrough leggings and other issues. Breezethrough sales were halted after women complained that the leggings’ fitting was unflattering. Lululemon has also struggled with stocking the right merchandise. Overall cash register totals were up7% y/y, but comparable sales, which don’t include newer stores, grew only 2%. In the Americas, the latter metric declined 3%. The company also lowered its full-year outlook. It previously provided revenue guidance ranging from $10.7 billion to $10.8 billion, but it is now anticipating that sales will range from $10.38 billion and $10.48 billion. Shares of Lululemon gained 2% in after-market trading after initially declining.

- Gap (GAP) earnings and revenue exceeded analyst median forecasts with the company’s largest brand, Old Navy, posting better-than-expected results. Sales were 5% higher than during the year-ago-period while comparable sales advanced 3%. In a CNBC interview, CEO Richard Dickson said the quarterly results benefited from the company reinvigorating its brands, which also include Banana Republic, Old Navy, Athleta and its namesake retailer. Gap also raised its full-year outlook, with operating income expected to strengthen 50% y/y compared to previous guidance of a 40% increase. Shares of Gap advanced 2% prior to trading being halted due to the company “inadvertently” posting its quarterly results prematurely.

Bulls Hit with Mid-Day Lethargy

This morning’s stock rally is fading in a similar fashion to the last one, with most major equity indices shifting from green to red. The Russell 2000, Dow Jones Industrial and S&P 500 benchmarks are well off their highs and they’re losing 0.5%, 0.4% and 0.1% while the Nasdaq Composite tries desperately to hang on. Sectoral breadth is now deeply negative with all sectors lower being led by energy, health care and communication services which are off by 0.7%, 0.3% and 0.3%. Rates are near the flatline with the 2- and 10-year Treasury maturities changing hands at 3.91% and 3.87%. The Dollar Index is higher by 22 bps as the greenback has appreciated relative to most of its major counterparts, including the euro, pound sterling, franc, yen and Aussie and Canadian dollars. It is depreciating relative to the yuan though. Commodities are mostly bearish as crude oil, silver, gold, lumber and copper lose 2.9%, 1.8%, 0.7%, 0.4% and 0.1%. WTI is trading at $73.85 per barrel as OPEC+ is looking to boost supply in October in an effort to defend market share amidst a still uncertain demand outlook.

The Fickle Nature of Inflation

This morning's Personal Income & Outlays report reminded us that inflation has been a terrific story, with price pressures softening despite economic and employment growth remaining buoyant. Still, the road ahead may offer complications, similar to recent periods this cycle when we thought elevated costs were conquered, only to see them rebound again.

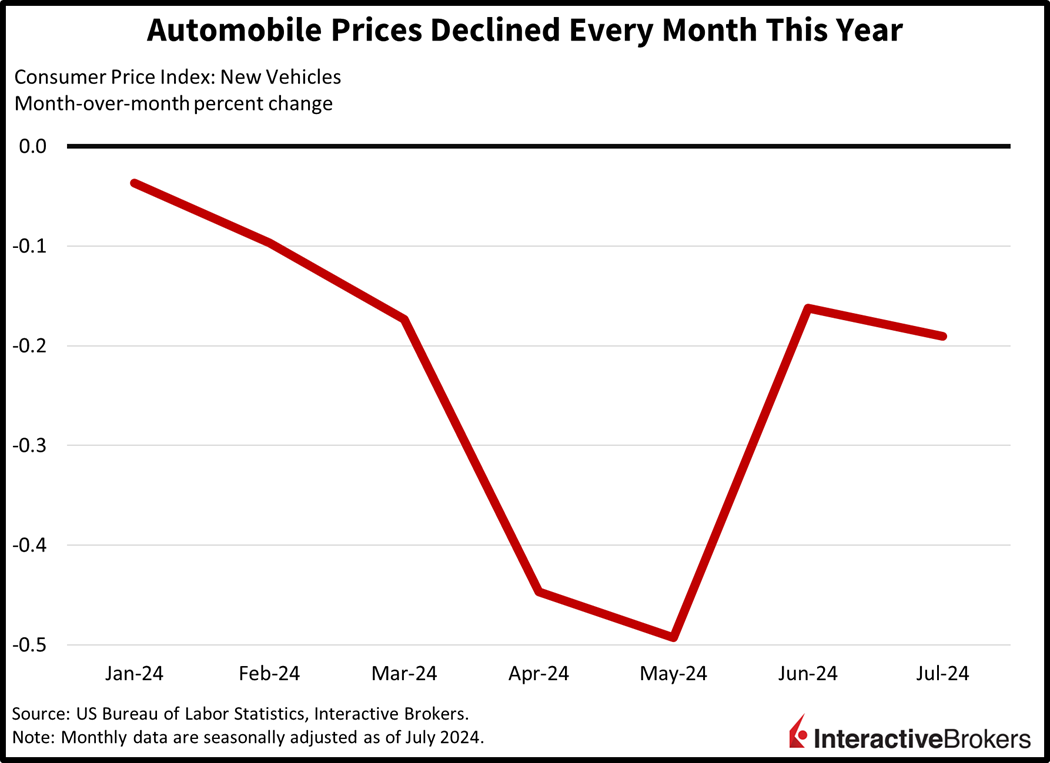

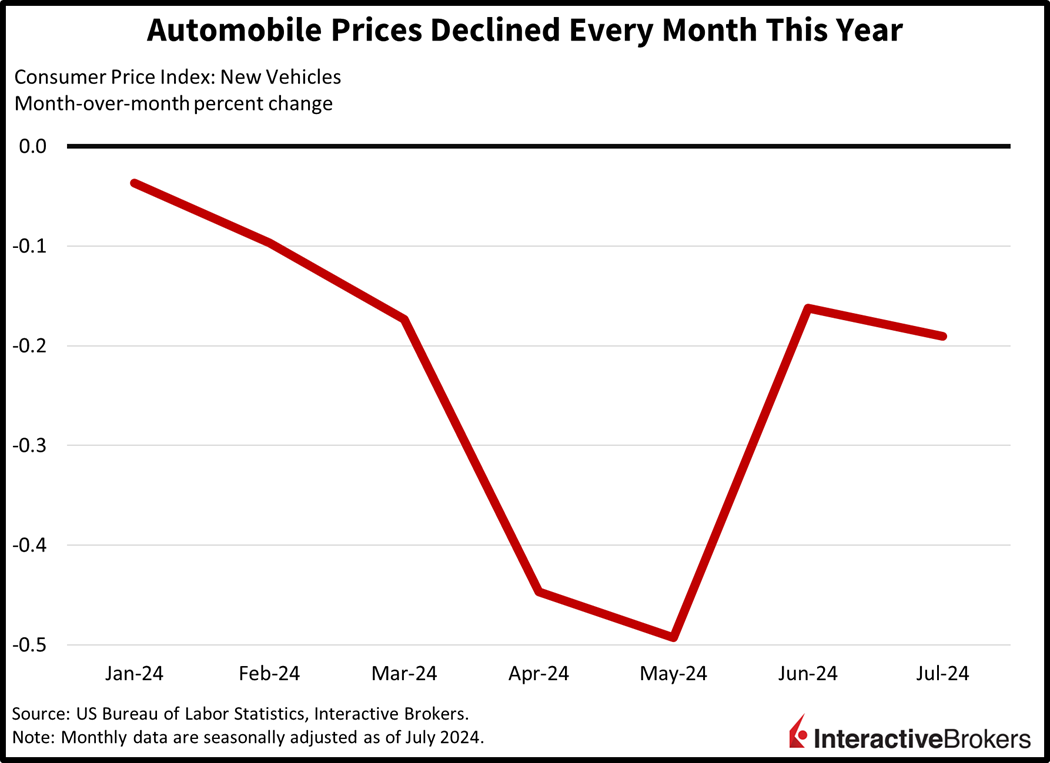

Inflationary relief has been led by goods and commodities while services continue to be a challenge. Emblematic of this point are crude oil and automobiles. Despite mounting geopolitical tensions, the critical liquid is declined 5.4% during the past 4 weeks while automobile stickers have receded for seven consecutive months. Meanwhile, services charges have been just as volatile as consumer spending, with firms compelled to trim margins as folks manage their budgets like light switches in efforts to manage the burdens of tall prices, elevated financing costs, reduced credit availability and job uncertainty. Also, housing alone may deter the Fed from moving too fast, with many folks eager to get in against the backdrop of basement level inventories, substantial immigration flows and the American Dream. Despite another favorable report this morning, the central bank is likely to walk down the monetary policy stairs slowly, especially in consideration of the fierce consumption numbers we're getting in certain months. Finally, the variability of hiring and spending patterns tells me that we're in the latter innings of the cycle, but the ideal soft landing will push the game into extras amidst a few more years of economic expansion. Why not?

To learn more about Forecast Contracts, please view our recent podcast with Wall Street Veteran and ForecastEx CEO David Downey here.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

A good overview and explanation. THANKFULLY not crammed with useless option nonsense.

Hello Joe, we hope you continue to enjoy Traders’ Insight!