Investors are piling into risk assets as this morning’s news of lighter-than-expected wholesale inflation has rate watchers screaming 50 in September. Traders are certainly hoping that continued economic growth paired with decelerating price pressures will allow the Fed to engineer a soft landing while corporate earnings projections remain healthy. Indeed, the fed funds futures market is now favoring twice the normal reduction next month, with the probability of a half percent cut up to 54%. But our brand new IBKR Forecast Trader reflects hawkishly tilted ForecastEx fanatics, with our participants placing the odds of the central bank cutting at double the normal reduction at just 34%− a whopping 20% lower than the fed funds future market suggests. Uncertainties are quite elevated against the backdrop, considering concerns regarding the durability of consumer finances, volatile geopolitical tensions and a presidential election that is looking like a dead heat, all of which are opening up arbitrage opportunities across ForecastEx and alternative markets.

ForecastEx Players At Odds With Fed Funds Futures

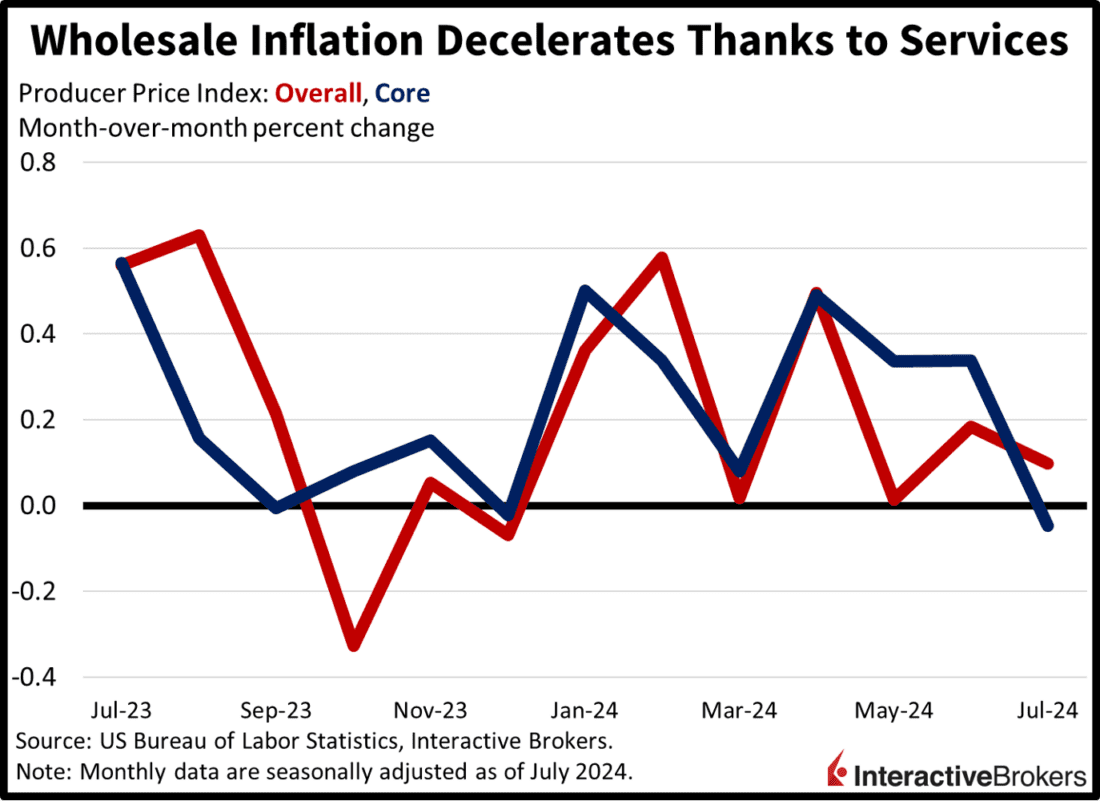

Investors that hold a “No contract” for the question, “Will the US Fed Funds Target Rate be set above 4.875% at the end of the FOMC meeting ending September 18, 2024?” are taking things in stride today as this morning’s Producer Price Index (PPI) came in beneath anticipations, bolstering the case for a 50-basis point trim down to a 4.875% midpoint next month. July’s PPI increased just 0.1% month over month (m/m) and 2.2% year over year (y/y), 10 basis points (bps) lighter than the median estimates. And while the No contract holders are quite sanguine that data is coming their way, ForecastEx enthusiasts aren’t as collectively dovish. Surely, our question regarding the Fed’s September meeting and the potential 4.875% rate currently has the highest Yes and No bids at 64% and 34%, hawkish perspectives relative to fed funds futures.

Core Items Pull Down PPI Results

The downside miss on PPI was driven by core categories, with the indicator excluding food and energy coming in unchanged m/m and up only 2.4% y/y, 20 and 30 bps softer than forecasts. Services as a whole declined 0.2% m/m, helped by the trade subcomponent, which experienced prices slipping 1.3%. But services related to transportation/warehousing and other activities experienced inflation of 0.4% and 0.3% during the period. Goods also saw price pressures grow, with the category’s costs rising 0.6% driven by 1.9% and 0.6% increases in energy and food. Meanwhile, core goods rose just 0.2%.

Home Building Material Sales Are Likely to Sag Further

This Thursday’s NAHB Housing Market Index report and Friday’s release of construction permits and housing starts data will provide insight into the real estate market after cautious comments from Home Depot (HD) that were echoed by James Hardie (JHX), a national provider of exterior building materials. Home Depot’s earnings per share (EPS) and revenue exceeded analyst consensus expectations. Overall sales climbed 0.6% y/y, with results supported by the company’s acquisition of building supplier SRS Distribution. On a comparable sales basis, which excludes the impact of new store openings, closures and other one-time events, revenue fell 3.3%. Chief Financial Officer Richard McPhail told CNBC that customers continue to defer home buying and renovations because of high finance costs. In the recent quarter, however, shoppers became more cautious with overall spending due to increased uncertainty about the economy. The company now expects full-year comparable sales to drop as much as 4% relative to 2023. It previously provided guidance for a 1% drop. Home Depot shares initially fell 4% following the earnings release. James Hardie’s EPS beat the consensus forecast for its fiscal first quarter ended June 30, but revenue underperformed expectations despite net sales climbing 5% y/y. The increase resulted from higher average net prices and a small increase in unit volume sales. James Hardie CEO Aaron Erter said the current quarter and the final quarter of this year are likely to be challenging. With the market for exterior housing products declining in the low-to-mid single digits during the company’s current fiscal year. James Hardie, however, maintained its previous guidance.

PPI Energizes Market Bulls

Bulls are charging aggressively and picking up stocks and bonds as they progress forward. All major US equity indices are gaining on the session led by the Nasdaq Composite, S&P 500, Russell 2000 and Dow Jones Industrial benchmarks which are travelling north by 1.7%, 1%, 0.7% and 0.5%. Sectoral participation is broad with nine out of eleven segments higher on the session. Piloting the upside are technology, consumer discretionary and communication services, which are gaining 2.3%, 1.4% and 0.9%. Energy and consumer staples are missing the party; they’re losing 1.2% and 0.2%. Treasurys are catching a bid with the 2- and 10-year maturities seeing their yields lower by 6 and 5 bps as the instruments change hands at 3.96% and 3.86%. The dollar is being hampered by wagers pointing to a friendlier Fed and the greenback is depreciating relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. The US currency benchmark is off by 22 bps. In commodity land, price action is softer with crude oil, silver, and copper down 1.2%, 1% and 0.5% but lumber and gold near the flatline. WTI crude is journeying south following a five-day winning streak. It’s trading at $78.80 per barrel mainly because an expected Middle Eastern escalation hasn’t materialized and to a lesser degree from OPEC+ lowering its demand outlook.

Don’t Forget CPI Tomorrow

Today’s equity market celebration may lead some participants to forget about lurking risks around the corner, but ForecastEx players are standing off on tomorrow’s largely awaited Consumer Price Index (CPI) for July. And while some of our other contracts are ripe for arbitrage, we are looking at a stalemate for tomorrow’s CPI, ladies and gentlemen. Anchored by the Wall Street economist consensus at 2.9% y/y, the Yes crowd is being met forcefully by the No crew, with the highest bids for yes and no at 49% on each side. It’s a toss-up folks, and we’ll all be watching impatiently on the edge of our seats at 8:29 am Eastern Time for the CPI results. While it’s a close call, I am favoring the Yes crowd here, with my in-house model pointing to 3% y/y. Good luck!

To learn more about ForecastEx, view our Traders’ Academy video here.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

If the Fed cuts rate by 50 basis points. It will spook the market into a massive sell off. A 50 basis point cut indicates strong counter measures and things are not well. The yen carry trade valued at $4T usd will be the first to dump hard to avoid being last out the door and eating losses and margin calls. With the M2 money supply currently at $20T. The liquidity required by the carry yen trade will eat up 20% of the M2 money supply. That leaves $16T for everyone else trying to get out of the market, a market valued at $100T. Even if 5% of the market sells off that would require $5T in liquidity. If this minor scenario and the yen carry trade unwinds. That would leave the M2 money supply with $11T. This would create a massive liquidity and credit crunch that will bring the economy to a screeching halt and the biggest recession we have every seen. Stocks could drop to worthless levels. Just look at all these billion dollar tech companies carrying debt to assets of 3-1. In a lot of cases spending 2 dollars to make 1.