Excerpt

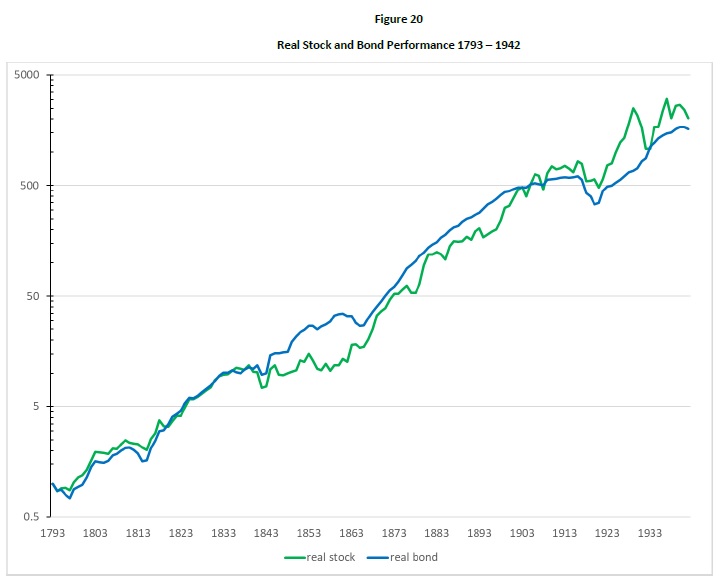

There are very few observations of the attributes of financial markets that are considered by most of the investors as nearly permanent facts. One of the most often cited examples is that over the long interval stocks outperform bonds. But is it really such truth? Over how long interval? 10 years, 20 years, 30 years? As the new and better historical data are becoming available for analysis, they show interesting findings. Let’s show one example. There exist one very long interval during which the return of stocks was nearly equal to bonds. What do you think is the length of such an interval in the case of the US? It’s 150 years! Yes, that’s correct, there was a one-and-half-century long period in the history of the United States when the performance of stocks and bonds was nearly identical. We do not imply that it will be the case in the 21st century. But an important research paper written by Edward McQuarrie shows that investors must prepare for even the most unexpected possibilities when they are making their asset allocation decisions.

Author: McQuarrie

Title: The US Bond Market before 1926: Investor Total Return from 1793, Comparing Federal, Municipal and Corporate Bonds Part II: 1857 to 1926

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3269683

Notable quotations from the academic research paper:

“Today’s investors believe themselves to possess a 200-year history of bond market returns, courtesy of Siegel (1992a – The Equity Premium: Stock and Bond Returns Since 1802). That history purports to show bond returns over the long-term to be decisively inferior to those provided by stocks. The empirically demonstrated inferiority of bonds jibes with standard finance theory that investment returns should line up with market risk assumed. Under this theory, bonds, the risk-less asset, cannot out-perform stocks, a risk asset, over long intervals.

However, few investors have probed deeply into Siegel’s sources, especially those pertaining to the distant past. I found important mistakes in Homer (1963), a crucial data source for Siegel. I will also highlight the limitations of the bond data available to Siegel and other prior compilers, while introducing new bond price data not heretofore available. Net of the new and corrected data, 19th century bond returns appear to be much stronger than Siegel in his famous book “Stocks for the Long Run” understood.

The goal of the paper is to capture the returns that an investor would have earned by owning an index fund tracking long-term, investment-grade bonds, had such a thing existed in the 19th century US. This investor does not seek to own the single best or most secure bond, but to maximize risk-adjusted returns by holding a portfolio of investment-grade bonds, whose yields vary but all of which promise at least good security. The new data indicate that in fact, long bonds in the United States did out-perform stocks over several multi-decade periods following 1793.

Visit Quantpedia to read the full article:

https://quantpedia.com/stocks-not-for-the-long-run/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.