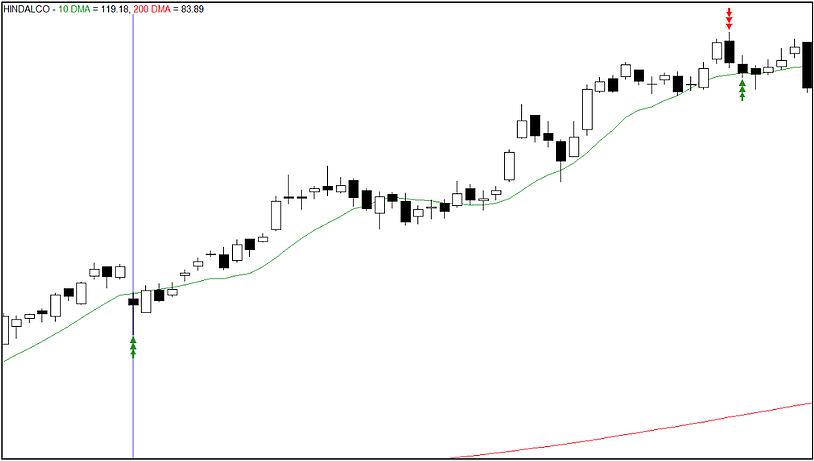

Let’s look at another strategy – the Price Pullback strategy!

Trade setup:

Fast Moving Signal – 10 Day MA Slow Moving Signal – 200 Day MA

Go Long – When,

Daily Close stays above 10 Day MA for more than 15 days

Current Close is below 10 Day MA and above 200 Day MA

Exit Long – After ‘n’ days

Do you think this could be a profit-making idea?

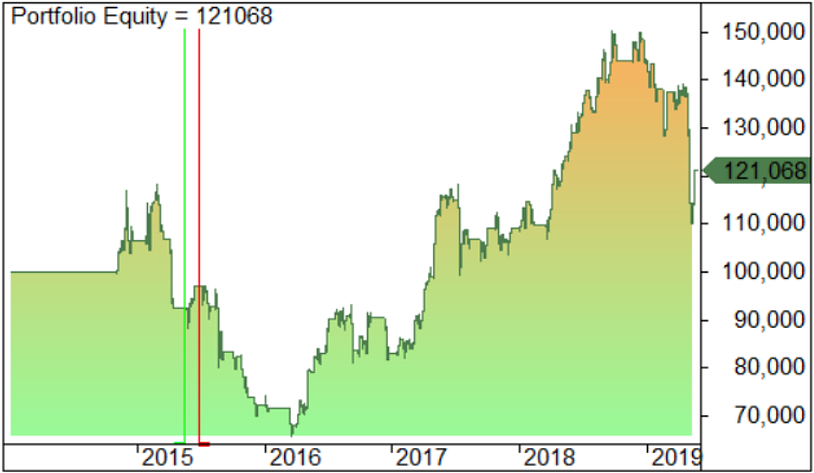

Turns out the Price Pullback strategy is a moderately profitable one. Take a look at the Equity Curve from its back-testing reports.

Still, it’s too early to give up on this strategy. Do you have any ideas that’ll help us improve it? Leave your thoughts in the comments section.

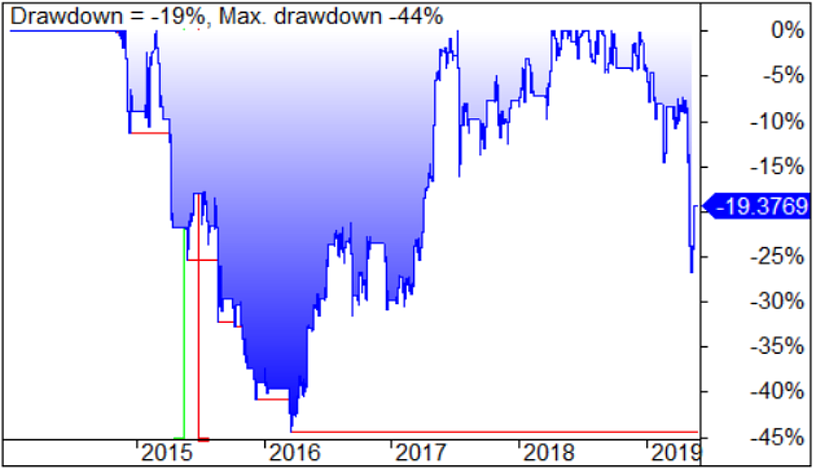

The Drawdown graph of the Price Pullback Strategy shows the other side of the coin.

We think the Equity and Drawdown Curves would give us a better picture if the value for ‘n’ was optimized. Let’s check out the back-testing reports after we do that, and see.

We next optimize the value for ‘n’ (turns out it should be 45). Check out the changes in curves after we back tested and improved the strategy!

Any thoughts on further optimizing this?

After adding a point-based target profit to our basic strategy, we’ve been able to up the game! Here are the curves from the back-test reports of our much-improved strategy.

Let’s try adding a percentage-based target profit and see what the back-testing reports have to say about that!

One look at the differences between these charts tells you that we’ve improved the strategy by a lot. Unlike adding a stop loss, optimizing values and adding a percentage-based target profit mechanism to the original strategy has helped.

With back-testing, come a number of insights that can help us in improving a strategy.

Do you also have trading ideas that you’re not sure about? Let us know if you would like our help to back test and optimize it.

Contact us via [email protected] or visit our website: www.arque.tech for more information.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Arque Tech Algo Trader and is being posted with its permission. The views expressed in this material are solely those of the author and/or Arque Tech Algo Trader and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.