KEY TAKEAWAYS

- ChatGPT is a potentially transformative artificial intelligence (AI) breakthrough, crossing one million users within five days of launch.1

- ChatGPT is an advanced form of generative AI, which can have human-like conversations, create content, images and audio.

- Generative AI could have significant implications for different areas of the economy ranging from displacing web-based search tools to automating various services industries.

Note: The below section titled “How might ChatGPT impact investors” was written by ChatGPT when we entered the prompt, “How might ChatGPT impact investors?”

WHAT IS ChatGPT?

ChatGPT (Generative Pre-Trained Transformer) is an advanced form of an artificial intelligence (AI) chatbot that can understand and create human-like conversation. ChatGPT was released by OpenAI, a company focused on artificial intelligence. It uses a transformer algorithm, which is based on a neural network: a computer program that mimics the way the human brain works.2 ChatGPT was trained using a massive amount of data from the internet, including books, Wikipedia, articles, and other pieces of writing, amounting to 300 billion words!3 The model uses its knowledge to predict what the next word should be in a sentence. ChatGPT is continuously learning, so as it processes more text it can become better at predicting what words should come next, generating increasingly realistic outputs.

While OpenAI is not a public company, investors have taken notice of the potentially transformative nature of artificial intelligence. After underperforming the S&P 500 through the first 11 months of 2022, the NYSE FactSet Global Robotics and Artificial Intelligence Index has returned 17.3% since the launch of ChatGPT on November 30th, 2022, outperforming the S&P 500 by 14.2%.4

IMPLICATIONS OF ChatGPT AND AI ON THE BROADER ECONOMY

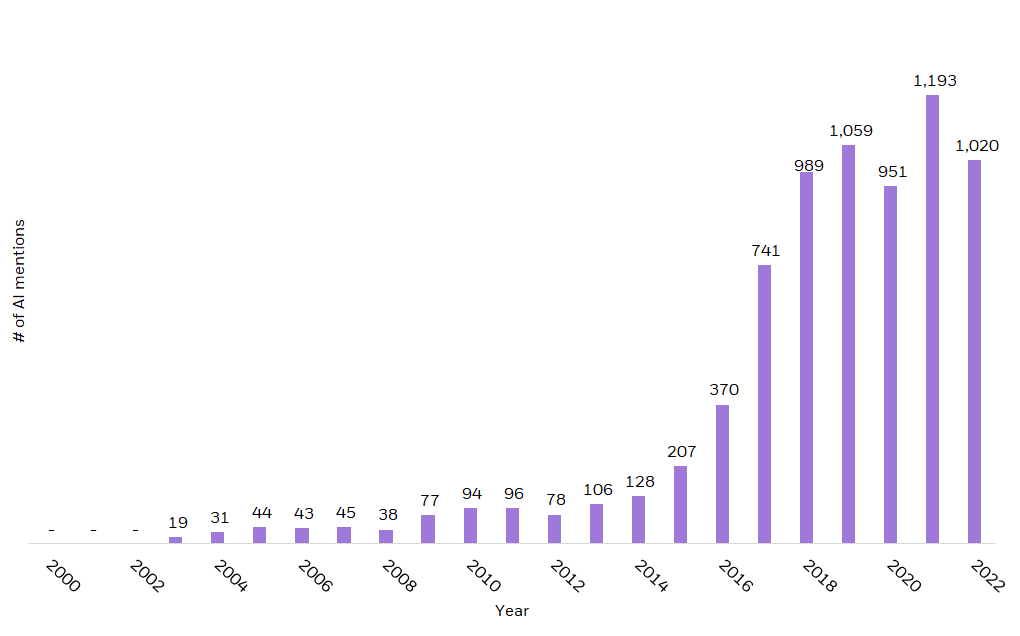

While companies have significantly increased investments and use of artificial intelligence over the past 20 years, breakthroughs like ChatGPT have the potential to disrupt a variety of industries and create opportunities for investors. In fact, the global AI market is expected to double between 2022 and 2026, reaching $900 billion.5

Mentions of “Artificial Intelligence” in S&P 500 Transcripts

Source: FactSet. Accessed on 1/27/23. Transcripts reflect company commentary on earnings calls and investor day presentations.

Chart Description: Bar chart reflects mentions of “artificial intelligence” in transcripts for S&P 500 companies dating back to 2000.

While still in its infancy, we envision two ways generative AI could revolutionize the world.

- Search: Generative AI could upend the search engine model, which has been the dominant form of digital information gathering since the 1990s. Today, search engines rely upon digital advertising spending that allows companies to promote products in response to specific search queries (e.g., “what should I visit on my vacation in Barcelona?”). Digital advertising is a $681 billion market6 which could be disrupted if there is less reason for people to click on advertising links; that is, if generative AI can eliminate the requirement for a search engine intermediary and deliver information directly to consumers.

- Services Industries: Generative AI can perform a wide variety of tasks that are currently done by humans. It can do everything from developing complex lines of code to language transcription and translation to making wardrobe suggestions for a particular occasion. Impacted sectors include technology, education, and retail, though it’s not difficult to imagine other areas of the economy, such as healthcare, being impacted as well. (No more waiting several days for a doctor to call you back and explain an MRI result!) In fact, Buzzfeed recently announced they plan to use AI powered by ChatGPT to help generate content such as quizzes and articles.7 With the U.S. still facing a labor shortage of 4 million workers8, and ageing populations around the globe threatening future labor supply, companies able to create AI tools that could enhance productivity and efficiency may benefit.

HOW MIGHT ChatGPT IMPACT INVESTORS?

ChatGPT, as a language model, has the potential to impact investors in a variety of ways. It can be used for natural language processing, which can help with tasks such as sentiment analysis and news summarization. This can potentially aid investors in making more informed decisions by providing them with a better understanding of the overall sentiment and key information related to a particular stock or market. Additionally, ChatGPT can also be used for content generation, such as creating financial reports or earnings call transcripts. This can potentially save investors time and resources in analyzing financial information. Overall, ChatGPT could help investors make more informed decisions and increase efficiency in their analysis of financial information.

Note: This does not constitute investment advice. The above section titled “How might ChatGPT impact investors” was written by ChatGPT when we entered the prompt, “How might ChatGPT impact investors?”

LOOKING AHEAD FOR GENERATIVE AI AND BROADER AI BREAKTHROUGHS

ChatGPT is not the only generative AI offering making headlines. DALL-E creates digital images based on user descriptions. Check out the painting below, which was created by DALL-E after being asked to “paint us a picture of your favorite futurist inventor”.

Technology like DALL-E has major implications for creative areas of the economy, such as the arts and entertainment, which previously had been thought of as immune to the forces of AI.9

Character.AI is another generative AI service which allows people to chat with a facsimile of anyone alive or dead, real or imagined.10 We see these new use cases for AI technology appearing with increased frequency, reflecting the fast-flowing nature of the space.

Ultimately, the goal of AI researchers is to achieve multi-modal AI; an application that can learn from and engage via text like ChatGPT, also learn via and generate images like Dall-E and extend to understanding and learning from audio, time-based and spatial data too. By combining all of these “types of intelligence” AI can become exponentially more useful and multi-faceted.

HOW TO INVEST IN THE AI THEME

Investors looking to access AI companies may want to consider ETFs that hold pure-play firms across the full value-chain of artificial intelligence, targeting both the AI developers as well as the AI enablers.

- AI Developers: Companies that develop various forms of artificial intelligence such as natural language processing, generative AI, pattern recognition or predictive analytics.

- AI Enablers: Companies that produce various forms of technology such as cloud services or AI-oriented chips which enable the development of AI.

CONCLUSION

66 years after the birth of artificial intelligence at the Dartmouth workshop of 1956,11 ChatGPT might be the most impressive AI tool yet. While new use cases are still being discovered, we believe that ChatGPT and other forms of AI could continue to impact wide swaths of the economy. People looking to invest in AI may want to consider ETFs that provide exposure to pure-play stocks across the theme’s value chain.

—

Originally Posted February 8, 2023 – How ChatGPT and AI might impact investors

© 2023 BlackRock, Inc. All rights reserved.

1 Yahoo, Steve Mollman, 12/9/22

2 IBM, “What is a neural network?”

3 Sciencefocus.com, “ChatGPT: Everything you need to know about OpenAI’s GPT-3 tool”

4 Morningstar, returns from 11/30/22 through 1/27/23

5 International Data Corporation, 7/29/22, “IDC forecasts 18.6% compound annual growth for the artificial intelligence market in 2022-2026”

6 Shopify, Digital Ad Spend 2021-2026

7 CBS News, 1/26/26 Megan Cerullo

8 U.S. Chamber of Commerce, Understanding America’s Labor Shortage

9 Oxford, “Art for Our Sake: Artists Cannot be Replaced by Machines”, May 2022

10 NYT, “A.I. is Becoming More Conversational, But is it More Honest?”, 1/10/23

11 Dartmouth.edu, “Artificial Intelligence Coined at Dartmouth”

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Technology companies may be subject to severe competition and product obsolescence.

Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0223U/S-2711386

Disclosure: iShares by BlackRock

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from iShares by BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or iShares by BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.