At a time when crystal balls are dusted off and market prognosticators are making their predictions for the coming year, there is as much economic uncertainty as we have seen in a long time. Forecasts for 2023 are all over the board and I sense a bit less conviction in many of the market and economic predictions.

I tend to shy away from making specific targets for the markets because it can be seen as influencing how we manage portfolios (i.e. Brian is bullish so they must be loading up on equities). Dynamic Risk Hedging has proven a very effective strategy for allocating across multiple asset classes based on each holdings risk contribution. Controlling what we can control is the focus in the portfolios we manage so my personal “forecast” of where the markets will trade has little impact on how our portfolios are allocated.

That said, any student of the markets will have opinions on what the current data is telling us and what we expect will happen in the coming year. I believe 2023 will be a Tale of Two Halves as the title of this research suggests. The first half of 2023 is likely to see a breach of the 2022 market lows as the economy tilts on the verge of contraction. The formula I see playing out over the first six months of 2023 is:

Downward Earnings Revisions + Tight Credit Conditions + Negative Wealth Effect = 20% or greater drop in Equities

You could add exogenous factors like economic crisis in China, natural gas crisis in Europe, escalations with Russia, N. Korea, etc., but the main reasons why I believe stocks will be lower through June is represented by the formula.

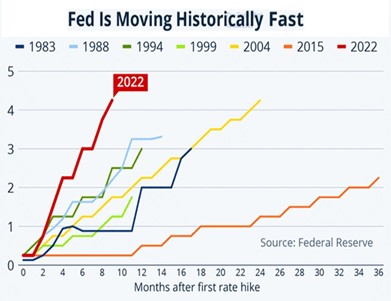

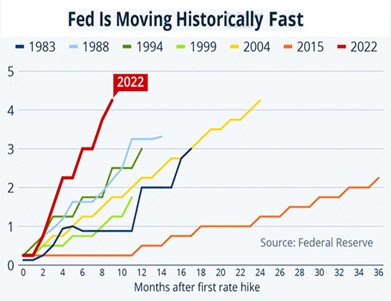

In my opinion, earnings are going to fall dramatically. While some analysts are still forecasting $220 in EPS on the S&P 500, I believe the number will be closer to $196. I think the Fed is also going to continue to hike rates through Q1 towards approximately 500 basis points of tightening. Lending standards are more restrictive and demand for debt is falling given the elevated rates. Tight credit conditions historically lead to corrections in equities. The Negative Wealth Effect impacts consumer spending as people feel less confident about the economy when their major assets: homes and 401k’s, decline. Consumer spending has held up to this point but I expect to see that rollover in the first half of 2023.

Virtually every macroeconomic data point, with the exception of consumer spending, suggests the economy is currently contracting and a recession likely. Composite PMI, one of the best leading indicators, is a 45 and heading lower suggesting contraction in the manufacturing sector. Services PMI is also in contraction territory and the Leading Economic Indicators published by the Conference Board is dismal. A deeply inverted yield curve negatively impacts earnings of financials that compromise 12% of the S&P 500. Higher corporate borrowing costs combined with recent tax hikes are strong headwinds for earnings.

The situation might not be as dire as the data suggests when forecasting market performance in 2023 as there are positive signs on the horizon. First, it is likely the Fed will be done with rate hikes at the end of Q1 and markets are pricing in Fed rate cuts by the summer. Enough damage will likely have been done to the economy and labor markets that inflation will be under control. The Fed should also come to the conclusion that inflation has become a necessary evil. Higher interest rates raise the cost of corporate borrowing and reduce corporate profits resulting in lower tax receipts by the government. Fed tightening also hurts the markets and tax revenues from capital gains are being slashed. Prolonged high interest rates drive up the cost of servicing government debt and ultimately reduce the revenues of the government. The combination could result in a rapidly depreciating dollar and bigger inflation problem.

I expect the markets to bottom from this cycle during the summer and rebound strongly in Q3 and Q4. Energy and healthcare should continue to lead sectors during the first half of the year, but leadership will likely shift to information technology, financials and consumer durables in the 2nd half of 2023. If Rip Van Winkle took a nap on January 1 and did not wake until December 31st, he would likely look at the markets and yawn thinking, “nothing to see here.” For investors who are awake during that period, the volatility and stomach churning might be much greater.

—

Originally Posted January 2023 – A Tale of Two Halves

Disclosure: Peak Capital Management

Peak Capital Management, LLC, is a fee-based SEC Registered Investment Advisory firm with its principal place of business in Colorado providing investment management services. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request. Advisory services are only offered to clients or prospective clients where our firm and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Peak Capital Management, LLC unless a client service agreement is in place. Nothing herein should be construed as a solicitation to purchase or sell securities or an attempt to render personalized investment advice. To receive a GIPS compliance presentation and/or our firm’s list of composite descriptions, please email your request to [email protected]. Peak Capital Management claims compliance with the Global Investment Standards (GIPS). GIPS is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Peak Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Peak Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.