Streaming media giant Netflix’s (NASDAQ: NFLX) latest earnings release Tuesday surprised investors with higher-than-expected top and bottom-line earnings results, as well as with a massive wave of new memberships.

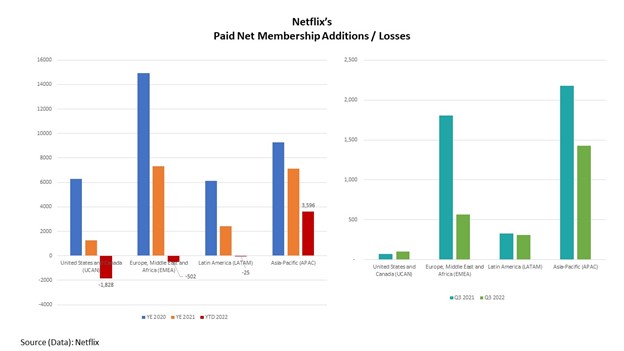

Holders of Netflix’s stock were handsomely rewarded after the company attracted 2.41 million additional subscribers to its platform in the third-quarter of 2022, trouncing its own expectations of around one million in the prior three-month period.

Overall, the Los Gatos, California-based online entertainer earned US$3.10 per share (EPS) in its latest quarter, a 45.7% rise above most analysts’ estimates, with revenue totaling US$7.93 billion, a year-over-year increase of close to 6.0% and higher than the US$7.84 billion many expected.

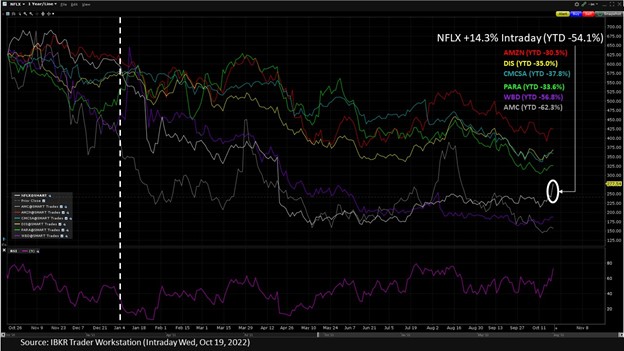

Following the release of its figures, the company’s shares skyrocketed and were last trading over 14% intraday Wednesday to around US$274.5, according to the IBKR Trader Workstation.

The results also provided some solace among those market participants who had witnessed the firm shed a string of subscribers earlier in 2022. In fact, the Asia-Pacific (APAC) region was the only geographical segment where Netflix had retained paid net membership additions at the end of the nine-month period to September 2022.

International Operative

Meanwhile, as streaming media services have been generally facing fewer new subscribers in developed economic markets such as the U.S. and Europe, Netflix, along with rivals such as Amazon Prime, appear to be focusing more intently on APAC.

Dave Novosel, a senior analyst at corporate bond research service firm Gimme Credit, recently observed that U.S. subscriber growth has been slowing at Netflix, but international growth “has been superlative and should continue expanding nicely.”

Novosel continued that higher pricing has “enhanced overall revenue growth”, and given the company’s “massive spending on content, particularly as the company moves to more original programming,” it continues to “burn through significant amounts of cash each year.” He added that while its debt burden has been rising accordingly, its improvement in EBITDA has led to lower leverage.

In the latest quarter, Netflix’s operating activities generated US$557 million in net cash, a rise of US$475 million from the prior year period, and free cash flow (FCF) amounted to US$472 million, compared with -US$106 million over the same timeframe.

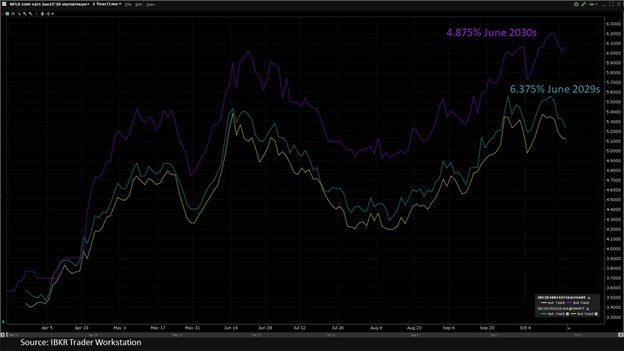

Against this backdrop, the company’s 6.375% notes due June 2029 were trading up around 0.38% intraday Wednesday at a premium of US$101.10, while its 4.875% notes due June 2030 were last priced at around US$91.50, according to the IBKR Trader Workstation.

Netflix contends with US$14 billion worth of gross debt at the end of the third-quarter, within management’s US$10-$15 billion target range, with net debt amounting to US$7.9 billion, or 1.2x LTM.

Suffering from Special FX

Netflix also said it continues to expect positive FCF of around US$1 billion for the full year 2022, as well as “substantial growth” in FCF in 2023, barring further material strengthening of the U.S. dollar, which seems to have been impinging on the firm’s margins.

Spencer Neumann, Netflix’s chief financial officer, said during the company’s earnings call, that the drag from foreign exchange (FX) “is significant”.

To date in 2022, Neumann pointed out that the firm’s margins would be in the 19% to 20% range on an “FX neutral” basis, but on a reported basis, it registered just north of 17%, equating to roughly US$1 billion of revenue drag and around US$800 million of margin drag. “And the bulk of that is being felt in the fourth quarter as it’s built up through the year,” he added.

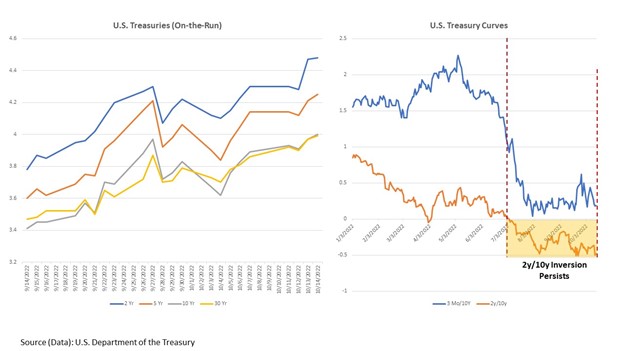

Moreover, tapping the debt market will likely be increasingly more expensive for the split-rated company, amid the Federal Reserve’s continued efforts to combat stubbornly high levels of inflation with aggressive monetary policy tightening.

Over the past month to October 14, the yield on the 10-year U.S. Treasury note has risen around 60 bps, while an inversion in the 2-year/10-year part of the yield curve has been firmly in place since at least July 6 – a potential sign of a prolonged recession.

In a Crowded Land, Content is King

Netflix’s expenditure on content appears to have materially contributed to the pure-play company’s recent success – especially in an increasingly crowded field of competitors, including behemoth media firms such as Amazon’s (NASDAQ: AMZN) Prime Video, Warner Bros. Discovery’s (NASDAQ: WBD) HBO Max, The Walt Disney Company’s (NYSE: DIS) Hulu and Disney+, and Comcast-owned (NASDAQ: CMCSA) Peacock, among others.

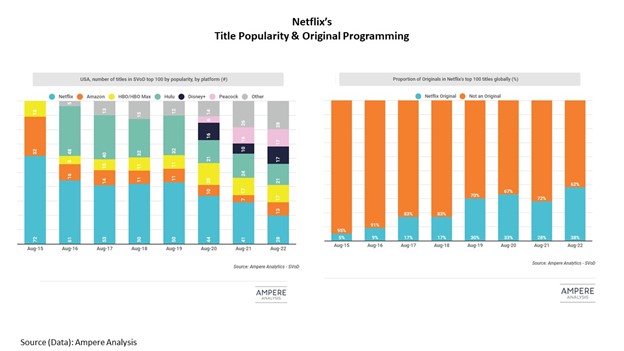

According to Ampere analyst Josh Rustage, Netflix has seen a steady decline of its share of popular U.S. streaming video on-demand (SVoD) titles – from holding a 72% share of the 100 most popular to less than 30% in the last 7 years – due mainly to the proliferation of platforms, which has created “an increasingly fragmented market”.

Across the domestic SVoD market, Netflix’s share is now within 15% of its competitors, including HBO Max (17%) and Peacock (17%), with the Disney+ Hulu bundle now the largest provider (37%).

However, Rustage noted that despite the declining proportion, “Netflix still has a higher share than any other SVoD platform and boasted five of the top ten most popular titles in August 2022,” which he partly attributed to “its focus on producing original content and acquiring high-quality exclusives.”

Rustage added that with “major studio content less readily available to license, Netflix’s aggressive investment into original content has allowed them to retain their top spot overall despite the loss of popular licensed content.”

For its part, Netflix has touted its recent releases of Stranger Things (Season 4), The Sandman, Cobra Kai (Season 5) and its limited series Monster: The Jeffrey Dahmer Story, among others, as critical to luring viewers to its platform.

Their achievement has been further underscored by the South Korean release of Squid Game, which was not only the first foreign language title to win an Emmy – but ended-up garnering six awards, including for directing, production design, and lead actor.

Sneak Previews & Fade Out

Looking forward, Netflix warned of continued U.S. dollar appreciation, and expects the fourth-quarter to generate revenue of US$7.8 billion, with the sequential decline entirely due to foreign exchange fluctuations relative to the dollar. The firm also accounts for “usual seasonality, as well as the impact of a strong content slate, counterbalanced by macroeconomic weakness which leads to less-than-normal visibility.”

The company also noted that starting with its fourth-quarter letter in January 2023, it will not provide a quarterly forecast for paid memberships, but will continue to offer guidance for revenue, operating income, operating margin, net income, EPS, and fully diluted shares outstanding.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.