The bonds that held market expectations and central bank policies closely together during the COVID-era are starting to break. BlackRock’s quant bond experts discuss the latest developments in inflation dynamics, liquidity in the financial system, and changes in China’s policy reaction.

Key points

01 Inflation raises central bank uncertainty

Inflation looks like it will “stick” around into 2022—leaving the near-term outlook for central bank policy highly uncertain and inflation-adjusted yields on fixed income firmly negative.

02 When the liquidity spigot shuts off

Markets are witnessing an unwinding in the historic amounts of liquidity pumped into the financial system—adding risk to the prolonged period of reach-for-yield behavior.

03 A sea change in China’s policy reaction

China may be shifting its “lather, rinse, repeat” pattern of policy accommodation—creating a potential drag on global growth.

For the past two years, a set of shared assumptions between market participants and policy makers helped create a somewhat benign investment environment. Inflation would be “transitory,” allowing for a prolonged period of accommodative low rates and stable rate expectations. Ample monetary liquidity would be supplied providing a tailwind for markets to continue to climb. China would answer any domestic slowdown with stimulus, helping to keep global growth on track.

Now, these key assumptions and relationships are in question. The final destination of transitory inflation remains in flux, casting central bank policy into tightening mode in some geographies and uncertainty in the U.S. and Europe. Unprecedented amounts of liquidity are starting to slowly drain from the financial system, creating risks for market participants that have been reaching for yield. China’s reluctance to inject stimulus into its flagging economy may create waves in global growth projections.

Heading into 2022, core fixed income is already on track to post negative yearly returns for only the fourth time since 1976.1 The weakening of these key relationships is creating new challenges for an already challenged asset class.

Inflation raises central bank uncertainty

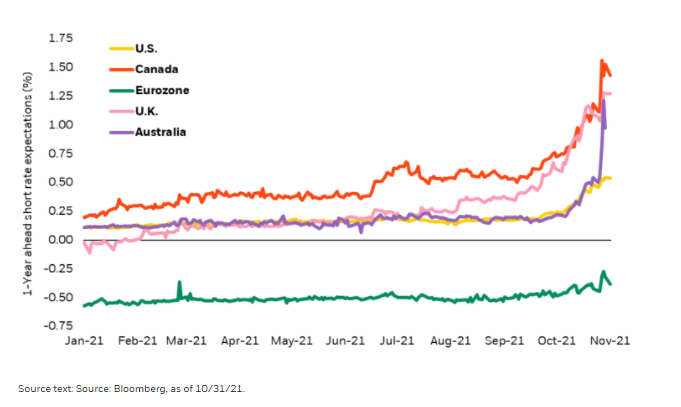

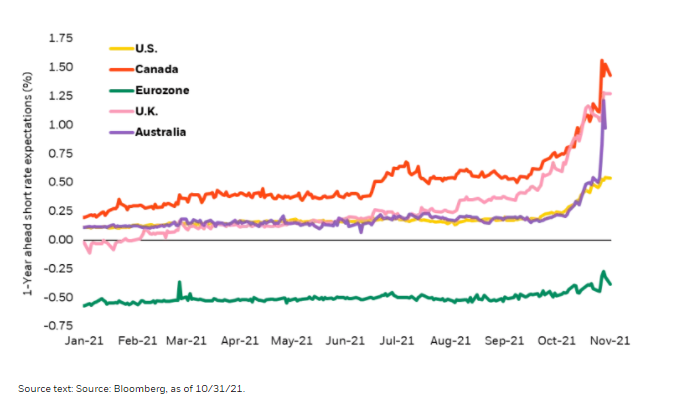

The market’s trust in a patient pace of rate normalization by central banks has been upended by increasing evidence of “sticky” inflation. A surge in front-end rate expectations reflects that many are reevaluating the thesis that inflation pressures are “transitory” (Figure 1).

Figure 1: Breaking bonds,1-year forward rate expectations

Our previous commentary, Tempting FAIT, described the risk of moving from a “demand-pull” inflationary environment to a “cost-push” environment. Demand-pull inflation is typically short-lived as the supply side catches up and demand eventually normalizes. Cost-push, on the other hand, can result in more sticky inflation when high goods and services costs result in workers demanding higher wages, and with higher wages feeding back to higher input costs.

As global economies reopened in the beginning of the year, inflation reflected the combined forces of a surge in demand with a significant disruption in supply. The most recent inflation reports highlight spreading inflation pressures into key areas associated with sticky rather than transitory inflation in rent, wages, and passthrough sale price increases from higher input costs. Trimmed measures of inflation, which look at broad measures and discount outlier spikes in a single category, no longer look contained. Inflation is broadening and has surged well past 2%, leading to more concerns over a cost-push inflation cycle.

Adding pressure to this issue, the recent spike in global energy prices results in more purchasing power getting siphoned off into energy consumption. When rising inflation outstrips consumers nominal earnings growth, the real value of income falls. So, despite having seen strong consumption contribution to growth so far, a more persistent inflation that erodes the purchasing power of the consumer can undermine the outlook for real growth.

Going into the end of 2022, the outlook for prolonged energy costs may hinge on the forecast for the weather. An exceptionally cold winter in the northern hemisphere could bring natural gas prices even further beyond the stratospheric increases already seen—with knock-on effects for consumers and producers across the global economy.

Click here to read the full post

—

Originally Posted on November 12, 2021 – Breaking Bonds

© 2021 BlackRock, Inc. All rights reserved.

1. Source: Bloomberg, as measured by the backfilled history of the Bloomberg Barclays U.S. Aggregate Bond Index. Year-to-date 2021 returns as of 10/31/21.

This material is prepared by BlackRock and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of November 2021 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, BlackRock funds or any investment strategy nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Stock and bond values fluctuate in price so the value of your investment can go down depending upon market conditions. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage- or asset-backed securities may be prepaid at any time, which will reduce the yield and market value of these securities. Obligations of US Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US Government. Investments in non-investment-grade debt securities (“high-yield bonds” or “junk bonds”) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax.

Index performance is shown for illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index.

Investing involves risk, including possible loss of principal.

Prepared by BlackRock Investments, LLC, member FINRA.

©2021 BlackRock, Inc. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH1121U/S-1902376

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!