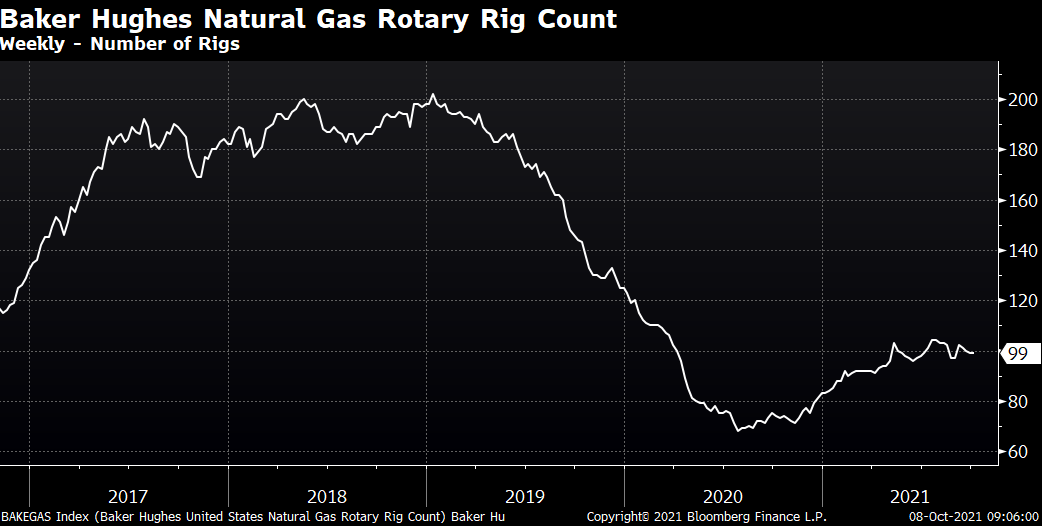

Clearly, the hottest commodity market has been natural gas, with prices more than doubling between June and October. This was led by a shortage in Europe from strong air conditioner use, persistent setbacks in wind production, and the lack of a significant recovery in global production. The weekly rig operating count has shown only a modest increase from its steep decline in 2019 and 2020.

A more recent catalyst for the rally has been the shortage of coal in China, which combined with the increase in prices in Europe adds to the bullish environment in the petroleum complex, as more is needed for generating electricity.

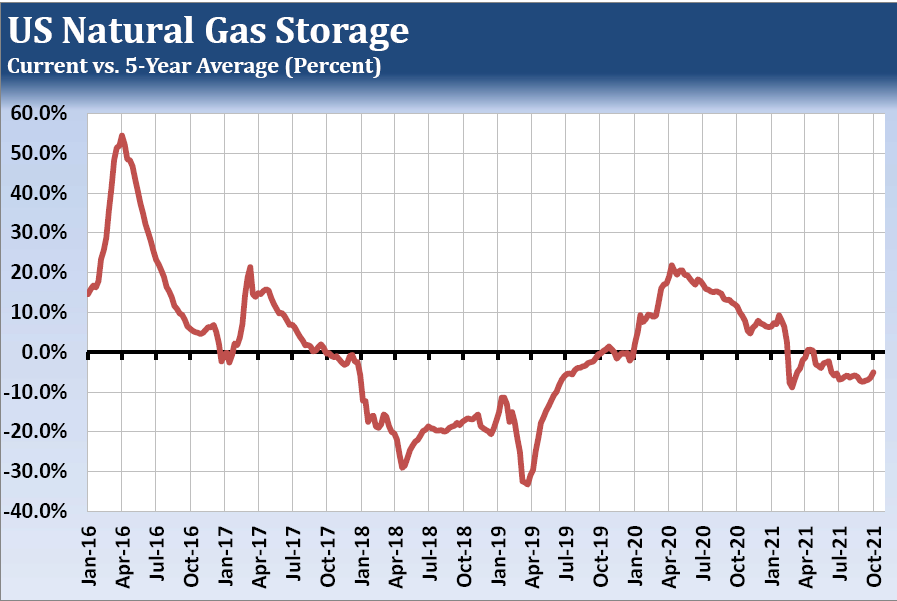

In the early stages of the rally the trade focused on expectations of significant tightness into the northern hemisphere heating season, with US storage running at 5-8% below the 5-year average levels. That deficit has narrowed considerably over the past six weeks, which is to be expected given the decline in demand during the shoulder season between summer cooling and winter heating. We expect large injections to continue into the beginning of November, which could result in pullback in natural gas prices. We suspect China will be able to increase its coal deliveries, which could also create a temporary drop in demand for natural gas.

Source: Baker Hughes & Bloomberg.

Regardless, there is still a worldwide shortage of liquified natural gas (LNG), and recent high prices could encourage some hoarding. Surging prices should also facilitate further expansion of US LNG exports, which could temper injections into domestic storage. Speculators hold a significant net short position, which should limit selling and stoke short covering if prices regain key technical levels after a selloff. We suggest traders look for a large break in the coming weeks to reposition themselves for a resumption of a bull trend next month.

Source: EIA

—

Originally Published on October 8, 2021

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.