By: Rick Rieder, Russell Brownback, Trevor Slaven, & Navin Saigal

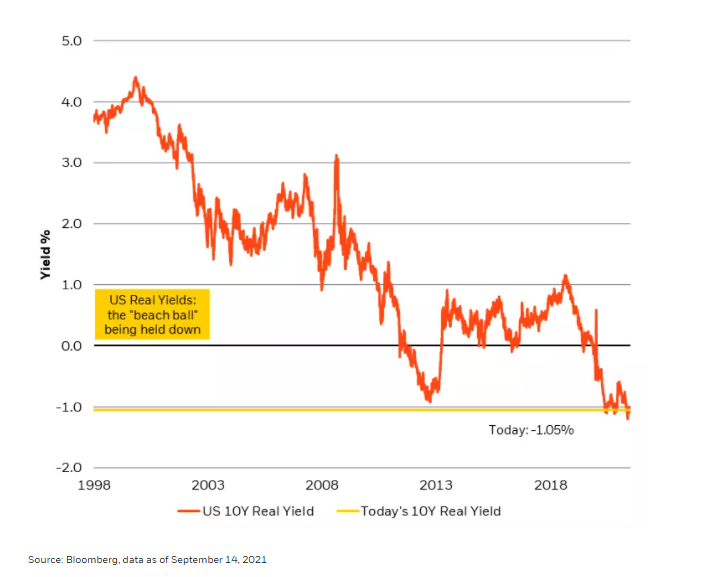

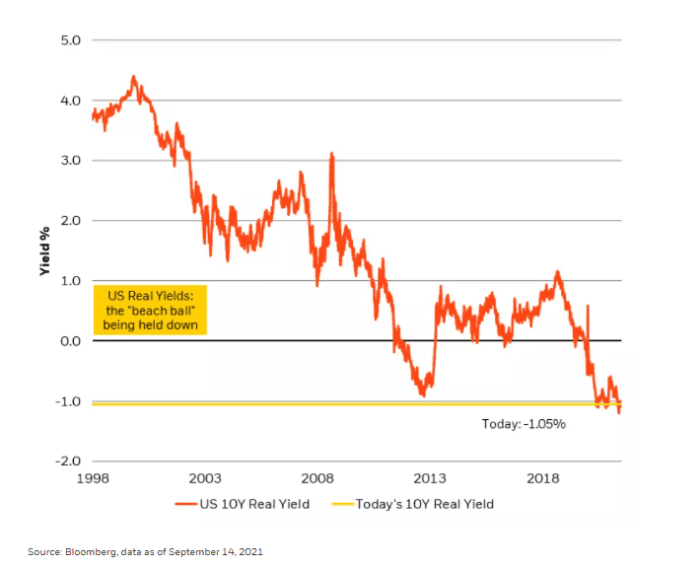

Had the modern beach ball existed in ancient Greece, many at that time may have had difficulty in understanding why it took so much effort to push it underwater, and why, upon being released underwater, it would jump dramatically from the water before floating in equilibrium at the surface. That is, until Greek mathematician and polymath Archimedes discovered the principle of buoyancy around the year 212 B.C. In some respects, a negative real yield resembles a beach ball being held underwater, in the sense that they are both below their equilibrium levels. Historically, real yields have been correlated with real economic growth, but in 2021 real growth is on track to post its highest reading since World War II, while real yields are at their lowest point in history (see Figure 1).

In our analogy, this would create the equivalent of a massive buoyant force on a fully submerged beach ball. In the world of physics, Archimedes’ Principle would allow us to calculate this exact buoyant force, based on factors like the size of the ball and the extent to which it has been submerged, but it is a little more complicated in the world of real yields and portfolios. The financial markets today are huge (certainly much bigger than at any time in history), and the hands pushing real yields down (the Federal Reserve and the European Central Bank) are extremely strong.

Figure 1: U.S. Real Yields are Near Historically Low Levels, Like a Beach Ball Being Held Underwater

Two Decades of Dramatic Market Change

Interestingly, while real yields are at record lows, the supply of financial assets is at record highs, suggesting a robust demand for income. In the month of September alone, $625 billion of new supply is expected across U.S. Treasury, credit and equity markets, which is considerably greater than the $400 billion monthly average in recent years, according to BlackRock Capital Markets data, as of September 12, 2021. That fact certainly places a potential $15 billion-a-month Fed asset purchase taper into perspective (as it would represent a mere 2% of September’s supply) and it illustrates that quantitative easing (QE) in general is perhaps needlessly competing with organic demand for fixed income assets to keep yields at unsustainably low levels.

Central banks’ intent to hold the “real rate beach ball” underwater belies some of the changes that our economy has undergone in just the last two decades. As we remembered the 20-year anniversary of 9/11 this past month, we are awestruck by some of the changes to markets since that time. Some of those changes include, the evolving nature of e-commerce, the way we interact with each other on social media (spending three hours and 43 minutes each day on our devices, on average) and the huge role China now plays in the global economy. In fact, China has grown its GDP 17x since entering the WTO in 2001, which should perhaps outweigh the Fed taper discussion in terms of long-term investment implications, in our view.

Still, arguably the most significant change in financial markets over the last two decades has been one of the most subtle: the onset of the “Liquidity Era” (as we wrote about in The Policy Liquidity Monopoly). Pre-9/11, the real economy was the independent variable that drove financial economy outcomes. However, today it’s the financial economy that is the independent variable driving real economy outcomes. Indeed, liquidity provision has become the primary tool of global monetary policy (rather than interest rate manipulation), through channels like wealth effects, as evidenced by the more than doubling in size of global financial markets relative to world GDP over the last 20 years. It is in this context that we face a liquidity cliff today: having injected nearly $1.5 trillion year-to-date through August, the U.S. Treasury will likely make large liquidity withdrawals before year-end, which could actually transcend ongoing Fed asset purchases. Thus, the flow of liquidity is set to wane demonstrably at a time when real rates are priced through fair value.

Click here to read the full article

Rick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Global Fixed Income and is Head of the Global Allocation Investment Team.

Russell Brownback, Managing Director, is Head of Global Macro positioning for Fixed Income.

Trevor Slaven, Managing Director, is a portfolio manager on BlackRock’s Global Fixed Income team and is also the Head of Macro Research for Fundamental Fixed Income.

Navin Saigal, Director, is a portfolio manager and research analyst in the Office of the CIO of Global Fixed Income, and he serves as Chief Macro Content Officer.

—

Originally Posted on September 30, 2021 – There’s More Than Just an Underwater Beach Ball in Today’s Investment Pool

© 2021 BlackRock, Inc. All rights reserved.

Investing involves risks, including possible loss of principal. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks may be heightened for investments in emerging markets.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 22, 2021 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Prepared by BlackRock Investments, LLC, member FINRA.

© 2021 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

USRRMH0921U/S-1846870-1/12

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.